Boaty and I already wrote a special report so we could not talk about the war here.

Sorry, but that’s one of my favorite bits of all time… Anyway, there’s been little reaction to America’s dropping of 14 30,000 pound (bigger and better) GBU-57 “Massive Ordnance Penetrator (MOP) Bunker Buster Bombs” which can only be deployed, two at a time, from our B-2 “Spirit” Stealth Bombers in “Operation Midnight Hammer.” We also used A LOT of Tomahawk Missiles (RTX) at $2.4M a pop!

The markets, globally, are interestingly flat. Even the Middle East Markets were flat as America’s massive show of force may have been “just right” to make a point without inviting retaliation – all kidding aside. Of course, it is possible that such a massive attack merely has “shocked” Iran and their allies and they are all being very cautious as there is no predicting what Trump will do next.

We’ll have to see how all this plays out. Israel, for their part, are still attacking Iran and their Iron Dome defenses are, for the moment, still holding up but they need to replenish their interceptors. By the way, Raytheon (RTX again) just completed their new Tamir Interceptor plant and THEN Israel attacks Iran – coincidence?

$8.7Bn was given to RTX last year and $5.2Bn this year (so far) to keep the Iron Dome supplied and it is likely Iran will run out of missiles before Israel runs out of interceptors but, if not, missiles can break through and take out the Iron Dome launchers and then there’s nothing to replenish and things go bad very fast for Israel – so you can see why they needed their supply-chain lined up before they instigated this exchange…

Anyway, we weren’t going to mention the war but it is the overhang for the week, isn’t it? As you can see, Brent Crude hit $80 before pulling back to Friday’s level and WTIC is at $73.68 this morning – LESS than it closed on Friday. This is, AT THE MOMENT, due to Iran’s lack of response and due to the fact that America did what the Oil Markets were fearing and we did not disrupt the flow of oil in doing it – though Iran still could and, frankly, they don’t have many other cards to play…

If the Fed had lowered rates last week, they’d be regretting it already as $75 oil is $10 (15%) higher than April and May and that’s another $40/month filling up America’s 284M cars so $11.36Bn a month is the direct cost to already-troubled US consumers already from this war. And, of course, oil prices cascade quickly into the Economy. In fact, Energy (including Gasoline) makes up about 7% of the headline CPI calculation so a 10% increase in Energy Costs translates into a 0.7% bump in CPI!

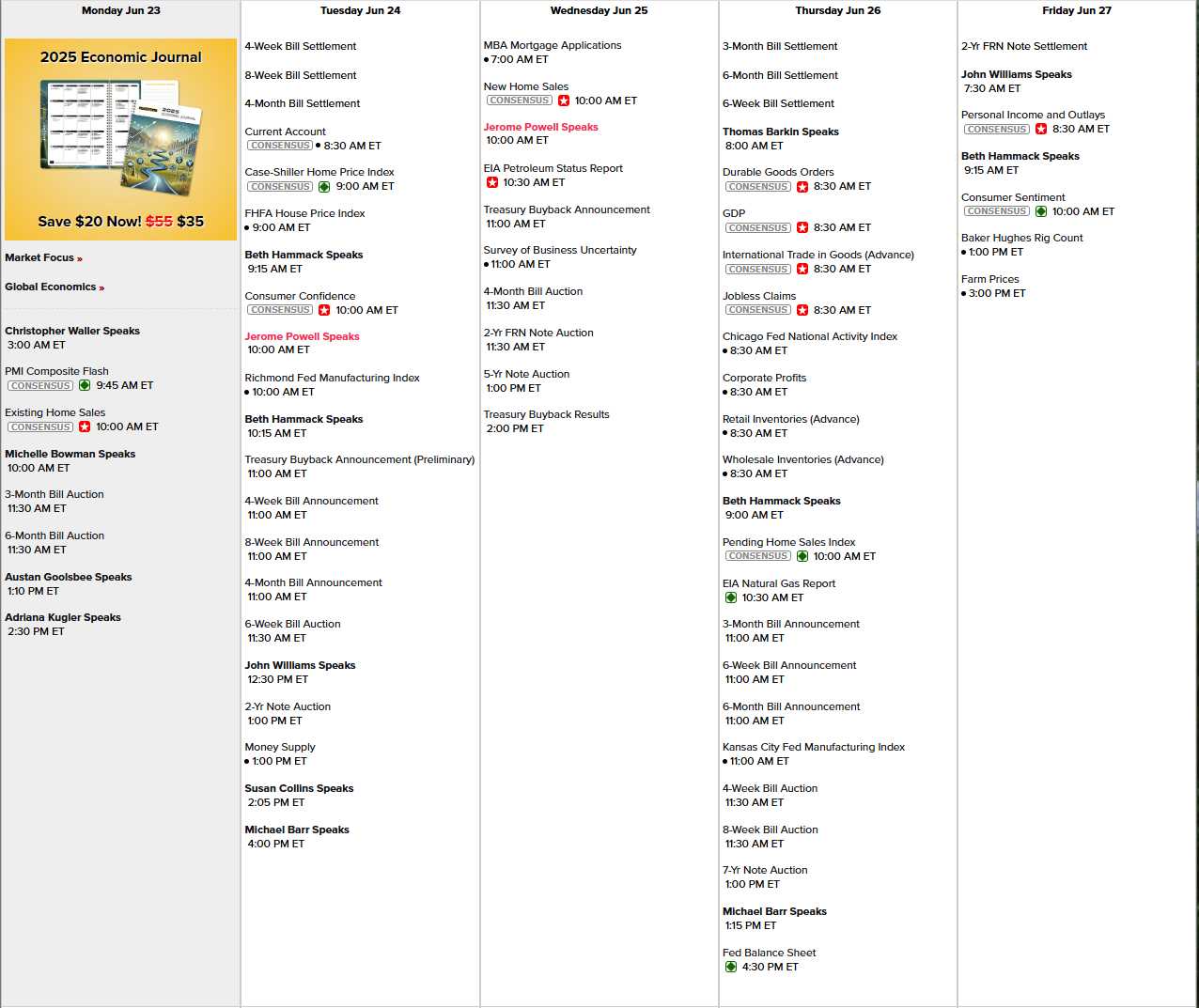

Speaking of the Fed, they are back in force this week with Powell testifying to Congress tomorrow and Wednesday (10 am) and he is surrounded by 14 (Fourteen!!!) other Fed speeches in an attempt to smooth out what is likely to be a rocky week ahead of next week’s (already!) short Holiday Week. Gosh, I only just put away my Juneteenth decorations… 😉

Lots and lots of note auctions is much more scary to the Fed than what Iran does and they will try to steer trader confidence towards US Bonds or we will have the Mother of All Defaults (MOAD) on our debt! We also have PMI this morning, Consumer Confidence is a big hurdle tomorrow and we get the Richmond Fed. Wednesday is Business Uncertainty (should be a lot of that), Thursday Durable Goods, GDP (revision), Chicago Fed, Retail Inventories and Pending Homes (another potential disaster). Friday we wrap things us with Personal Income and Outlays along with Farm Prices:

And that brings us to earnings, which are still dribbling in (or early reporting) and we have some biggies this week with KBH, CCL, FDX, GIS, PAYX, MU, JEF, WBA and NKE on deck and we’re just 3 weeks away from the official start to Q2 Earnings Season – exciting!

So let’s stay on our toes and see if we can engage in some good, old-fashioned war profiteering! Not much else we can do about it – it’s not like Trump needs permission to start wars these days. Of course, Trump is just fulfilling the Republican dream they’ve had for the last 25 years: