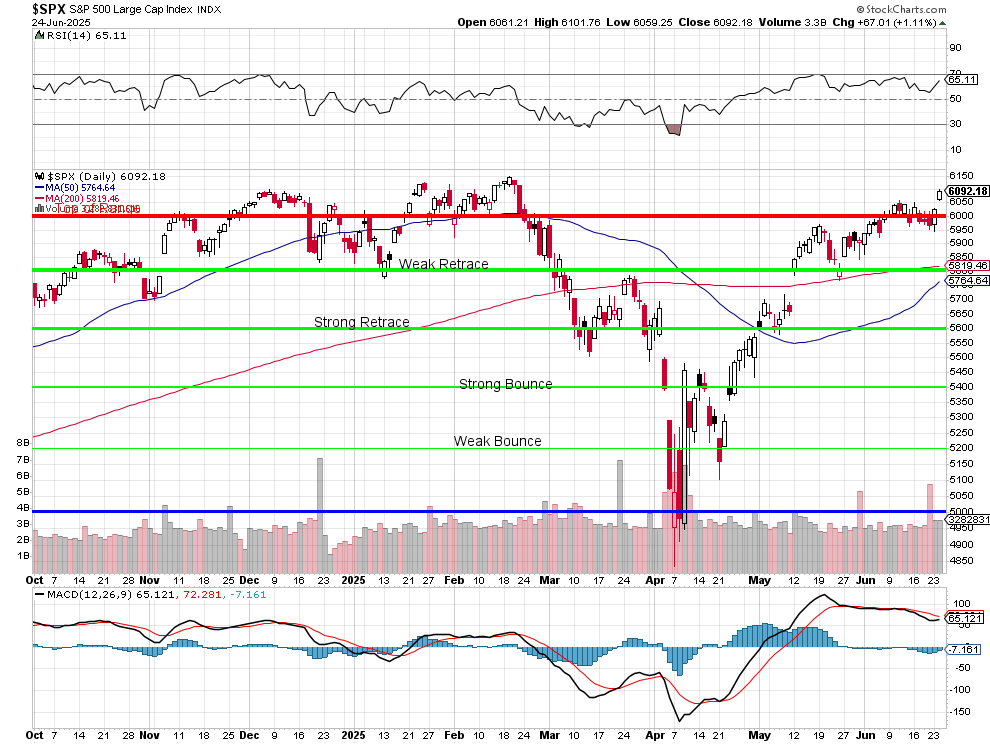

Here we are again:

The Nasdaq is back at the February highs (22,191 on Feb 18th), while the Dow (45,073 on Dec 4th) is still 2,000 points away from goal. 6,147 was the S&P 500’s high on Feb 19th and we’re 50 points away there while the Russell, at 2,161 is 281 points (11.5%) below 2,442 – which it hit back on Nov 25th. Happy days are indeed here again as the markets have climbed right back to the edge of the cliff they fell over 20% off of when Trump originally imposed his “Liberation Day” tariffs on Feb 2nd – leading to a massive market melt-down but that’s all behind us as now we have this VERY CLEAR tariff policy (and don’t mention the war!):

2025 U.S. Tariff Timeline and Status

JANUARY–FEBRUARY 2025: INITIAL ANNOUNCEMENTS

-

-

-

Jan 20: Trump signs “America First Trade Policy” memo, ordering reviews of trade deficits and unfair practices.123

-

Feb 1: Trump announces broad tariffs:

-

Feb 3: Deals with Canada and Mexico delay their tariffs to March 4, contingent on border/fentanyl cooperation.5

-

Feb 4: 10% tariffs on Chinese goods take effect. No delay for China.4523

-

-

MARCH 2025: IMPLEMENTATION & ESCALATION

-

-

-

Mar 4: 25% tariffs on Mexico and Canada take effect (with some exemptions for USMCA-compliant goods and certain products).4523

-

Mar 5–6: Auto imports and USMCA-compliant goods from Canada/Mexico are exempted until April 2. Non-USMCA potash from Canada gets a 10% tariff.2

-

Mar 26: Trump announces new 25% tariffs on all imported autos and parts, effective April 3 for vehicles, May 3 for parts.62

-

-

APRIL 2025: “LIBERATION DAY” AND UNIVERSAL TARIFFS

-

-

-

Apr 2 (“Liberation Day”): Trump declares a national emergency and announces:

-

Apr 5: 10% universal tariff goes into effect for all countries except Canada/Mexico and certain exempted goods.78

-

Apr 9: Reciprocal tariffs (17–49%) on targeted countries layered on top of the 10% base tariff.78

-

Apr 9: 90-day pause and reduction for non-retaliating countries; reciprocal tariffs lowered to 10% (except China, which is increased to 125%).9

-

-

MAY 2025: REDUCTIONS, PAUSES, AND NEW AGREEMENTS

JUNE 2025: STATUS AND UPCOMING CHANGES

CURRENTLY IN EFFECT (as of June 25, 2025):

-

-

-

Canada: 25% on most goods, 10% on energy, but USMCA-compliant goods are exempt indefinitely. Some tariffs may be reduced to 12% after 2025.2

-

Mexico: 25% on most goods, USMCA-compliant goods exempt indefinitely. Some tariffs may be reduced to 12% after 2025.2

-

China: 30% (down from 145%) for 90 days (until mid-August), then likely to revert to higher rates if no new deal.1073

-

Universal 10% tariff: In place for most countries since April 5, with exemptions for Canada, Mexico, and some products.78

-

Reciprocal tariffs: 10–49% for targeted countries, layered on top of the universal tariff, with some currently paused or reduced.9127

-

Autos and parts: 25% tariff on all imported vehicles (since April 3), parts since May 3.62

-

Steel/Aluminum: 50% tariff since June 4 (except UK at 25%).117

-

-

CANCELLED, REDUCED, OR PAUSED

-

-

-

USMCA-compliant goods from Canada/Mexico: Exempt from most tariffs indefinitely.2

-

China 145% tariff: Reduced to 30% for 90 days (from May 14 to mid-August 2025).1073

-

Some reciprocal tariffs: Paused or reduced for non-retaliating countries through July.912

-

Canadian/Mexican auto tariffs: Exempted indefinitely as of April 2.2

-

-

SCHEDULED/LIKELY TO BE REINSTATED

-

-

-

China tariffs: If no new deal by mid-August, tariffs likely revert to 145% or higher.1073

-

Reciprocal tariffs: Some delayed EU tariffs may go into effect July 9 or July 14.12

-

Universal 10% tariff: No announced end date; could be modified by further executive order or trade deals.78

-

Steel/aluminum tariffs: 50% rate to remain unless modified by future action.117

-

-

Summary Table

| Country/Region | Tariff Rate (as of June 25, 2025) | Notes/Exemptions/Status |

|---|---|---|

| Canada | 25% (most goods), 10% (energy), USMCA-exempt | USMCA goods exempt; energy/others may drop to 12% after 2025 |

| Mexico | 25%, USMCA-exempt | USMCA goods exempt; may drop to 12% after 2025 |

| China | 30% (90-day reduction), baseline 10% | Likely to revert to 145%+ after August 2025 |

| EU | Reciprocal tariffs (10–49%), some delayed | Some tariffs to start July 9 or July 14 |

| All others | 10% universal tariff | Since April 5, 2025 |

| Autos/Parts | 25% | Since April/May 2025 |

| Steel/Aluminum | 50% (except UK at 25%) | Since June 4, 2025 |

Key Takeaways:

Key Takeaways:

-

-

-

The U.S. tariff regime is now the most complex and aggressive in decades, with many rates subject to ongoing negotiation, reduction, or reinstatement.

-

USMCA-compliant goods are largely exempt from the highest tariffs.

-

The 90-day U.S.-China tariff reduction expires in mid-August 2025—watch for a potential snapback to much higher rates.

-

Steel/aluminum tariffs are at historic highs.

-

Some EU tariffs are delayed but may go into effect in July.

-

-

So, as you can “clearly” see, the markets are loving this new era of predictable trade policy – where tariffs are only sometimes in place, occasionally paused, sometimes doubled, and always subject to a 3 am tweet or a new Executive Order. Investors, of course, thrive on certainty, and what could be more certain than a tariff regime where the only constant is change?

After all, who needs stable supply chains or rational input costs when you have the thrill of waking up every morning to see which country is in the penalty box today? Forget about long-term business planning: real traders live for the adrenaline rush of watching the S&P 500 ricochet between “tariffs on” and “tariffs off” like a game of international Pong.

As of June 20th the U.S. has collected $75 Billion in tariff revenue, an 85.7% year-over-year increase (so essentially all from the new tariffs) and May was $23Bn – $276Bn annualized. If Trump reinstates on July 9th, the Administration’s projections are for over $40Bn a months ($480Bn annualized) in tariff revenue – almost enough to pay for $600Bn a year in tax cuts for people in Trump’s tax bracket!

Expect a 1.5-2% rise in CPI and that’s IF other countries do not retaliate. The impact on GDP and Corporate profits are likely to be severe but, as Q2 is over – companies will be able to punt any negative outlooks to Q3 to avoid making Trump angry by telling people the truth. July 9 isn’t just a deadline – it’s a fiscal time bomb about to go off and, at the moment, no one seems to be diffusing anything.

And let’s not forget the “Liberation Day” bounce! The markets plunged over 20% when the tariffs were first announced, but look at us now. Like the cartoon coyote, we’ve sprinted right back to the edge of the cliff, legs spinning in mid-air, blissfully ignoring the laws of gravity (and basic economics) – even with the clock ticking away on the dynamite in Trump’s hand.

And let’s not forget the “Liberation Day” bounce! The markets plunged over 20% when the tariffs were first announced, but look at us now. Like the cartoon coyote, we’ve sprinted right back to the edge of the cliff, legs spinning in mid-air, blissfully ignoring the laws of gravity (and basic economics) – even with the clock ticking away on the dynamite in Trump’s hand.

So, with the Nasdaq at new highs, the S&P within spitting distance the Russell “only” 11.5% in the hole and Consumer Confidence already deader than a door-nail, it’s clear that nothing says “bull market” like a good old-fashioned tariff rollercoaster. Just don’t ask what happens if we look down…

And remember, don’t mention the war!