Last day of the month!

Last day of the month!

You’ll hear less about fundamentals and more about “how great the quarter looked.” That’s no coincidence: It’s window-dressing season, when Fund Managers polish up their portfolios to look smarter and more risk-aware than they actually are.

Window dressing is when Institutional Iinvestors buy the winners and dump the losers right before quarter’s end – not for performance, but for APPEARANCES. The goal is to make quarterly reports look like they held the “right” stocks all along, often by rotating into momentum names, blue chips, and index leaders so that, when they show their quarterly reports to new prospective investors over the next 90 days – the suckers investors will be very impressed with their holdings in the report.

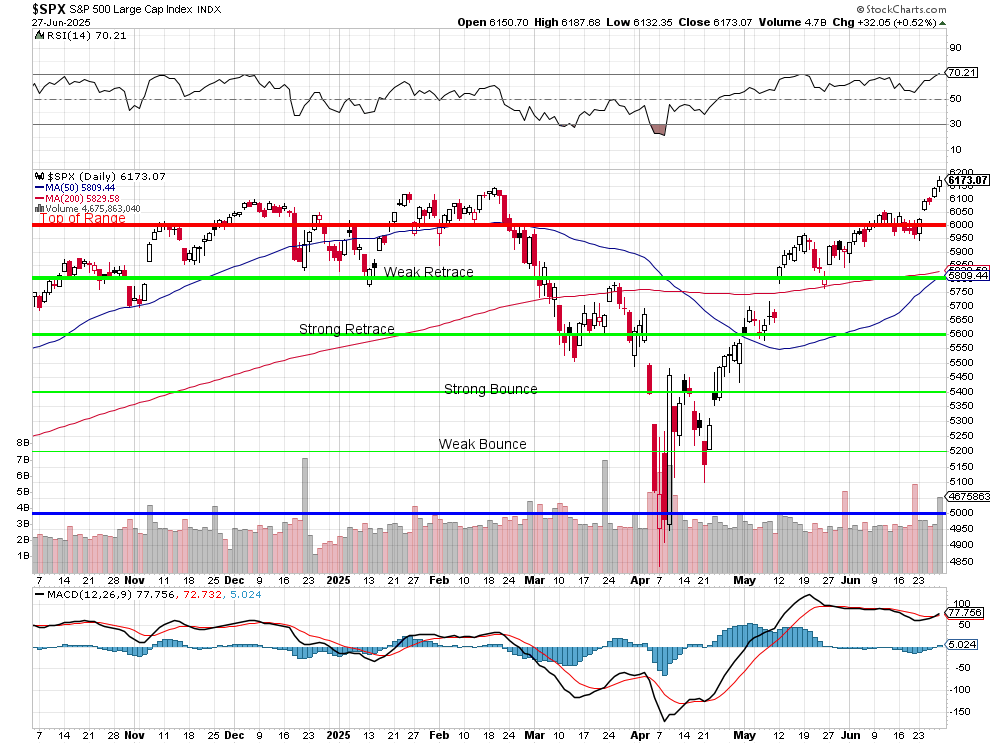

This matters now because the S&P 500 and Nasdaq are at record highs, YET valuations are stretched FAR above historical norms while macro risks, Recession signals, Geopolitical Instability, a still-hawkish Fed, multiple wars, Consumer angst… are being ignored. Earnings growth expectations are also fragile and may not support current prices as reports begin to come out in two weeks.

Fund managers, many of whom lagged behind the index in Q1, are desperate to catch up or at least not look foolish to their clients. This creates a false sense of market strength as the indexes APPEAR strong, but the breadth is very weak (Russell still down 11.6%) and real conviction is lacking. Once Q2 ends and the “mirage” is no longer needed, these same fund managers could just as easily dump high-fliers and raise cash, especially if earnings disappoint in July.

Window dressing is not real buying, it’s reputation management! Don’t confuse last-minute buying of mega caps with broad institutional confidence. And remember: when the music stops in July, the market often has to confront the very risks that were conveniently ignored during the quarterly beauty pageant.

The other illusion on the market stage is the U.S. Dollar, whose steep decline in the first half of 2025 (down about 12% since January) is propping up everything from stocks to commodities, masking the true underlying weakness across risk assets. 104 to 97 in Q2 has been a 6.7% drop while the S&P rose from 5,600 to 6,173 (10.2%) we’re on a road to nowhere and God save the markets if the Dollar comes bouncing back in Q2.

A falling Dollar makes U.S.-denominated assets LOOK stronger in relative terms but that’s optics, not fundamentals. Stocks priced in USD appear to rally even if Global capital is just trying to escape worse alternatives. Gold, oil, and other commodities rise, not because of strong demand, but because of weaker purchasing power of the Dollar. Multinationals get a short-term earnings boost from currency conversion as well, which can juice the indexes around earnings but this is monetary distortion, not sustainable economic growth…

If the Dollar were to stabilize or reverse (and that becomes more likely as central banks globally start to cut while the Fed stays cautious) it could reverse the tailwind that’s been artificially inflating asset prices all quarter. The illusion of strength in equities could quickly unwind and commodity inflation could also soften, denting recent rallies and margin-compressed companies would lose their FX bump – all at once!

Just as window dressing disguises poor portfolio performance, the Dollar’s decline disguises broader fragility in the markets. Be cautious about buying into asset strength that may be no more than a currency illusion. Don’t mistake a rising price for rising value.

Did anything happen this weekend?

Here’s a summary of the current market news for investors, along with key areas to focus on and potential trading opportunities:

♦ News Summary for Investors:

-

Easing Geopolitical Tensions: The recent de-escalation in the Israel-Iran conflict and a new U.S.-China trade agreement have reduced global uncertainty, leading to lower oil prices and boosting investor confidence.

-

Anticipated Interest Rate Cuts: While inflation figures show some stickiness, market expectations for Federal Reserve interest rate cuts later this year continue to be a positive driver for equities.

-

Tech Sector Strength: The “Magnificent Seven” and other AI-related technology stocks have been instrumental in leading the market’s ascent, fueled by significant investment and innovation in artificial intelligence.

-

Mergers & Acquisitions Rebound: U.S. corporate dealmaking is seeing its strongest first-half performance since 2022, indicating a resilient appetite for M&A despite market volatility. This is particularly strong in sectors less affected by tariffs and those focused on AI capabilities.

-

Government Policy in Focus: The U.S. Senate is debating a substantial tax and spending bill, which could impact various industries from defense and AI to renewable energy. This bill includes extensions of 2017 tax cuts, increased defense spending, and adjustments to Medicaid and clean energy incentives.

-

Company-Specific News: Several companies have released important updates:

-

Boeing (BA) and Juniper Networks (JNPR) saw their stocks rise after the DOJ settled a lawsuit paving the way for the HPE-Juniper merger.

-

Nike (NKE) stock popped on better-than-expected earnings and plans to reduce reliance on Chinese manufacturing due to tariffs.

-

Micron Technology (MU) reported strong earnings and guidance driven by AI demand.

-

American Express (AXP), Goldman Sachs (GS), Morgan Stanley (MS), Wells Fargo (WFC), and Citigroup (C) all cleared the Fed’s stress tests, which could lead to increased share buybacks and dividends.

-

Palvella Therapeutics (PVLA), Tonix Pharmaceuticals (TNXP), and Indivior (INDV) are being added to Russell indexes, which can increase their visibility and liquidity.

-

Klarna (KLAR) is diversifying into neobank offerings, potentially ahead of another IPO attempt.

-

Innovent Biologics gained regulatory approval for an obesity drug in China, posing a new rival to Novo Nordisk (NVO) and Eli Lilly (LLY).

-

Key Things to Focus On and Potential Trades:

-

Artificial Intelligence (AI) Boom: This continues to be a dominant trend.

-

Focus: Companies providing AI infrastructure (chips, data centers), AI software, and those leveraging AI for competitive advantage.

-

Potential Trades:

-

Nvidia (NVDA): Despite insider selling, it remains a core AI play.

-

Microsoft (MSFT) and Alphabet (GOOG, GOOGL): Both are heavily investing in AI and could see continued growth from their AI offerings.

-

Palantir Technologies (PLTR): Its partnership with Accenture Federal for U.S. government AI deployments is a significant development.

-

Cognex (CGNX), Zebra Technologies (ZBRA), and Honeywell (HON): These companies are positioned to benefit from the rise in warehouse automation and machine vision driven by AI.

-

-

-

Trade and Tariff Developments: The ongoing negotiations and shifts in policy have a direct impact on various sectors.

-

Focus: Companies and industries sensitive to import/export tariffs, and those benefiting from eased trade tensions.

-

Potential Trades:

-

Boeing (BA): Benefits from easing trade tensions with China.

-

Automakers (GM, F): Highly exposed to trade policies; a resolution with Canada could be positive.

-

Renewable Energy Stocks (DNNGY, VWDRY, NEE, ENPH, SEDG, FSLR): These stocks are impacted by proposed changes to U.S. wind and solar tax rules, especially regarding Chinese components. This could create volatility and opportunities depending on the final bill.

-

Rare Earth Stocks (MP, USAR, CRML): Their performance is highly sensitive to China’s export policies.

-

-

-

Monetary Policy and Financial Sector Health: The Fed’s stance on interest rates and the stability of the banking sector remain crucial.

-

Focus: Major banks and regional banks, given the recent stress test results and potential for capital returns.

-

Potential Trades:

-

Large U.S. Banks (JPM, BAC, GS, WFC, C, MS): All passed stress tests, potentially leading to increased dividends and share buybacks.

-

Regional Banks (KEY, TFC, MTB, SNV, EWBC, WBS, UMBF, FNB, WAL): BofA suggests an attractive risk/reward profile for some, especially if the macro outlook improves.

-

-

-

Healthcare Innovation and Regulation: Developments in drug pricing, new drug approvals, and healthcare policy will influence the sector.

-

Focus: Companies with new drug approvals, those in competitive drug markets (like obesity drugs), and those impacted by healthcare policy changes.

-

Potential Trades:

-

Novo Nordisk (NVO) and Eli Lilly (LLY): While facing new competition in China, the global demand for obesity drugs remains high.

-

Exact Sciences (EXAS), Guardant Health (GH), Labcorp (LH), and Gilead (GILD): Beneficiaries of the Supreme Court ruling ensuring free preventive care.

-

Companies exposed to Medicaid (HCA, THC): Changes to Medicaid funding could impact these providers.

-

-

-

Specific Growth Areas/Catalysts: Look for companies with unique product launches, strategic partnerships, or strong internal initiatives.

-

Focus: Companies expanding market reach, diversifying offerings, or making significant operational improvements.

-

Potential Trades:

-

Apple (AAPL): Expected launch of affordable MacBooks and smart glasses could drive future growth.

-

SunCar Technology (SDA): Extended partnership with Xiaomi for intelligent vehicle insurance.

-

Hut 8 (HUT): Energizing a large bitcoin mining facility.

-

VinFast Auto (VFS): Opening a new EV manufacturing plant in Vietnam for international markets.

-

JinkoSolar (JKS): Supplying high-efficiency solar modules for a large project in Spain.

-

Lennox International (LII): Positive catalyst call from Deutsche Bank due to potential for strong Q2 earnings and raised guidance.

-

-

Important Considerations:

-

Volatility: While the overall market is trending positively, some sectors and individual stocks may experience significant volatility due to specific news or policy changes.

-

Risk Management: Always consider your risk tolerance and diversify your portfolio.

-

Due Diligence: This summary highlights potential areas; further research into individual companies and their financials is crucial before making any investment decisions.

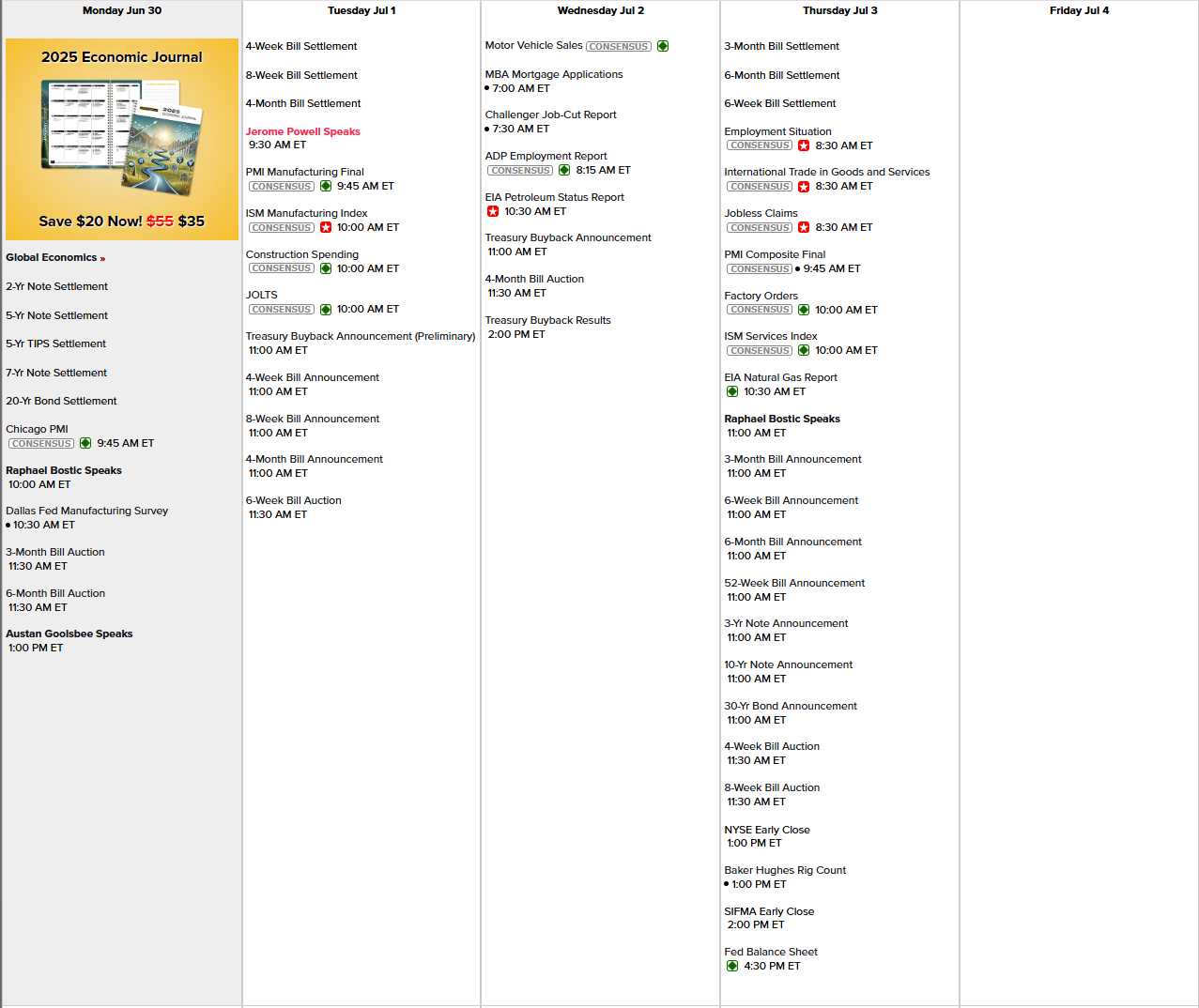

That sets us up nicely for the week ahead! Looking at the calendar, it’s a short week and the markets close at 1pm on Thursday – nice! Before that, we’ll hear from Bostic and Goolsbee today, Powell tomorrow and Bostic again on Thursday. Today we have Chicago PMI and Dallas Fed (yawn). Powell speaks at the open tomorrow along with PMI, ISM, Construction Spending and JOLTS. Wednesday we get Job Cuts and ADP and Thursday is busy for some reason with Non-Farm Payrolls (biggie), PMI, Factory Orders and ISM Services and the Fed will sneak in their Balance Sheet when no one is looking:

Earnings? Not really:

Let’s enjoy our short week at record highs before Trump’s tariffs kick back in!