The madness continues.

The madness continues.

This morning we have Trump threatening Canada with 35% tariffs and said he may increase the rates on other countries. The reality is, as the new Aug 1st deadline gets closer, no one wants to play Donald’s game and he’s starting to look foolish, ineffective and that “TACO” (Trump Always Chickens Out) meme is driving him crazy(er).

Trump said in a letter to Canadian Prime Minister Mark Carney that Canada has many “Tariff, Non-Tariff, Policies and Trade Barriers, which cause unsustainable Trade Deficits against the United States“. Trump also told NBC News that he’s eyeing blanket tariffs of 15% to 20% on “most trading partners“, with the current global baseline minimum tariff rate for nearly all US trading partners being 10%.

Back on March 7th, we discussed Trump’s “Distributive Bargaining” mindset towards trade, which views dealmaking as a zero-sum game where one side’s gain inherently means another’s loss – something that dominates the President’s business thought process. This mindset prioritizes asserting dominance through “big, headline-grabbing moves” but it’s a style makes success virtually impossible in the complex world of integrated economies, where common sense dictates “Integrative Bargaining,” which seeks mutual benefits as an outcome.

Back on March 7th, we discussed Trump’s “Distributive Bargaining” mindset towards trade, which views dealmaking as a zero-sum game where one side’s gain inherently means another’s loss – something that dominates the President’s business thought process. This mindset prioritizes asserting dominance through “big, headline-grabbing moves” but it’s a style makes success virtually impossible in the complex world of integrated economies, where common sense dictates “Integrative Bargaining,” which seeks mutual benefits as an outcome.

Trump’s focus on perceived unfairness and trade deficits, and his tendency to see only isolated aspects like steel, copper, aluminum and microchips exemplify this distributive thinking. Trump often overlooks other critical factors, such as currency wars, which serve as silent retaliatory weapons in Global Trade.

At the time, I called Trump’s distributive bargaining approach as using the “WRONG TOOL FOR THE JOB” in international trade and I felt so strongly about it that I called for cashing 1/3 of our long positions in a special post later that day. Raising CASH!!! like that ahead of what the macros told us was an obvious market crash (we were halfway through it at the time) is why we had such spectacular first half performance and now – coming into the second half of the year – we are again mainly in CASH!!! and patiently waiting for Trump’s next massive mistake.

One thing that still, after 20 years of doing this, amazes me about traders is how quickly they forget. Here we are trading at about 23 times forward earnings on the S&P (over 30x on the Nasdaq) and traders are chasing stocks like NVDA at $4Tn – $4,000,000,000,000!!! NVDA had $130Bn in sales last year and HOPES to have $200Bn this year, so it’s trading at 20 TIMES SALES!

Profit is half of sales for NVDA, but only because there is CURRENLY a shortage of AI chips and EVERYONE is trying to build AI at the same time (like the dot.com bubble) – as we discussed last night on Bloomberg. Once competitors catch up (next year), chip prices will come down and margins will compress and NVDA’s p/e will go UP from 40x – not down…

Getting back to the S&P 500, we were this high on July 3rd and this morning we’re being rejected at 6,300 (again) as Trump pursues additional tariffs (again) and NO, Trump fans, the President is not going to get people to agree to his terms because his terms are ECONOMICALLY DAMAGING to our trading partners and THERE ARE OTHER PEOPLE THEY CAN TRADE WITH!!!

America may have a $30Tn GDP (though, as I mentioned in our Webinar, I think it’s exaggerated) but what do we actually import in raw numbers? “Just” $3.8Tn, which is 12.5% of our own GDP but only 3.3% of the Global Economy – not even as much as the US population (340M) out of 8.2Bn people who are not Donald Trump (4.1%). In other words, WE ARE NOT EVEN PULLING OUR WEIGHT, GLOBALLY!

🚢 :

-

-

-

- Industrial Supplies (incl. oil, metals): $780 billion

-

-

-

-

-

-

Capital Goods (machinery, computers, telecom): $720 billion

-

Consumer Goods (phones, apparel, toys): $670 billion

-

: $410 billion

-

: $200 billion

-

-

-

-

:

Country 2024 Imports ($B) Share of Total Imports China $480 14% Mexico $420 13% Canada $390 12% EU (total) $510 15% Japan $145 4% Vietnam $125 4%

| Category | 2024 Import Value ($B) | Examples |

|---|---|---|

| Crude Oil & Petroleum | $240 | Canada, Mexico, Saudi Arabia |

| Semiconductors & Chips | $85 | Taiwan, South Korea, Malaysia |

| Cell Phones & Electronics | $160 | China, Vietnam, South Korea |

| Vehicles & Auto Parts | $410 | Mexico, Canada, Japan, Germany |

| Pharmaceuticals | $160 | Ireland, Germany, Switzerland, India |

| Apparel & Footwear | $110 | Vietnam, China, Bangladesh |

| Industrial Metals | $70 | Copper, aluminum, steel (Canada, Chile) |

$240Bn of our imports are oil, which we burn. That’s like taking 240Bn Dollars and lighting them on fire. We could address that by focusing on better mileage vehicles (Trump abolished the standards), growing our green energy infrastructure (Trump reversed Biden’s initiatives) or encouraging the use of electric cars (also reversed by Trump) and we WERE on that path – until January.

We outsourced the polluting factories and child labor that manufacture Chips, Cell Phones and Electronics decades ago. Trump wants to force those jobs back here for some reason but I guess if my girls could have made $15/hour after school instead of wasting time playing with their friends, we could have had a bigger pool – so go for it Conservatives!

We outsourced the polluting factories and child labor that manufacture Chips, Cell Phones and Electronics decades ago. Trump wants to force those jobs back here for some reason but I guess if my girls could have made $15/hour after school instead of wasting time playing with their friends, we could have had a bigger pool – so go for it Conservatives!

Unfortunately, $15/hr is a DREAM for workers in China, who are paid $2.76 to $4 an hour to assemble iPhones in China so you CAN’T move the factories to America and increase labor costs 5 times, can you? It simply doesn’t work, it’s not realistic, it’s not economically feasible… I don’t know how many ways I can say it but that is why this entire tariff thing is madness – there’s no realistic end-game here – unless you want to pay 2-3x more for your phones.

And that is what Trump is doing, he’s placing a TAX on all of our imports that will be paid by the American people so that he can give TAX BREAKS to Billionaires, like himself. Donald Trump is SCREWING OVER the American people so HE can give himself a tax cut – plain and simple. It would have been MUCH CHEAPER for the voters to just give him $20Bn and tell him to go away.

Autos are good jobs and we have the manufacturing base in the US so why not ENCOURAGE US Auto Manufacturing? Give them the tools they need to succeed and maybe we can EXPORT more cars and import LESS cars. It is our single biggest export by 100% – how is this complicated?

Pharma is just stupid, should a foreign Pharma company be penalized for inventing a cure that Americans want to buy? Does it make sense to increase the price of those treatments for Americans? That’s just cruel… Footwear and Clothing are the same as iPhone assembly – we don’t have enough children to fill those $2 jobs and I don’t think we want to pay $100 for t-shirts, do we?

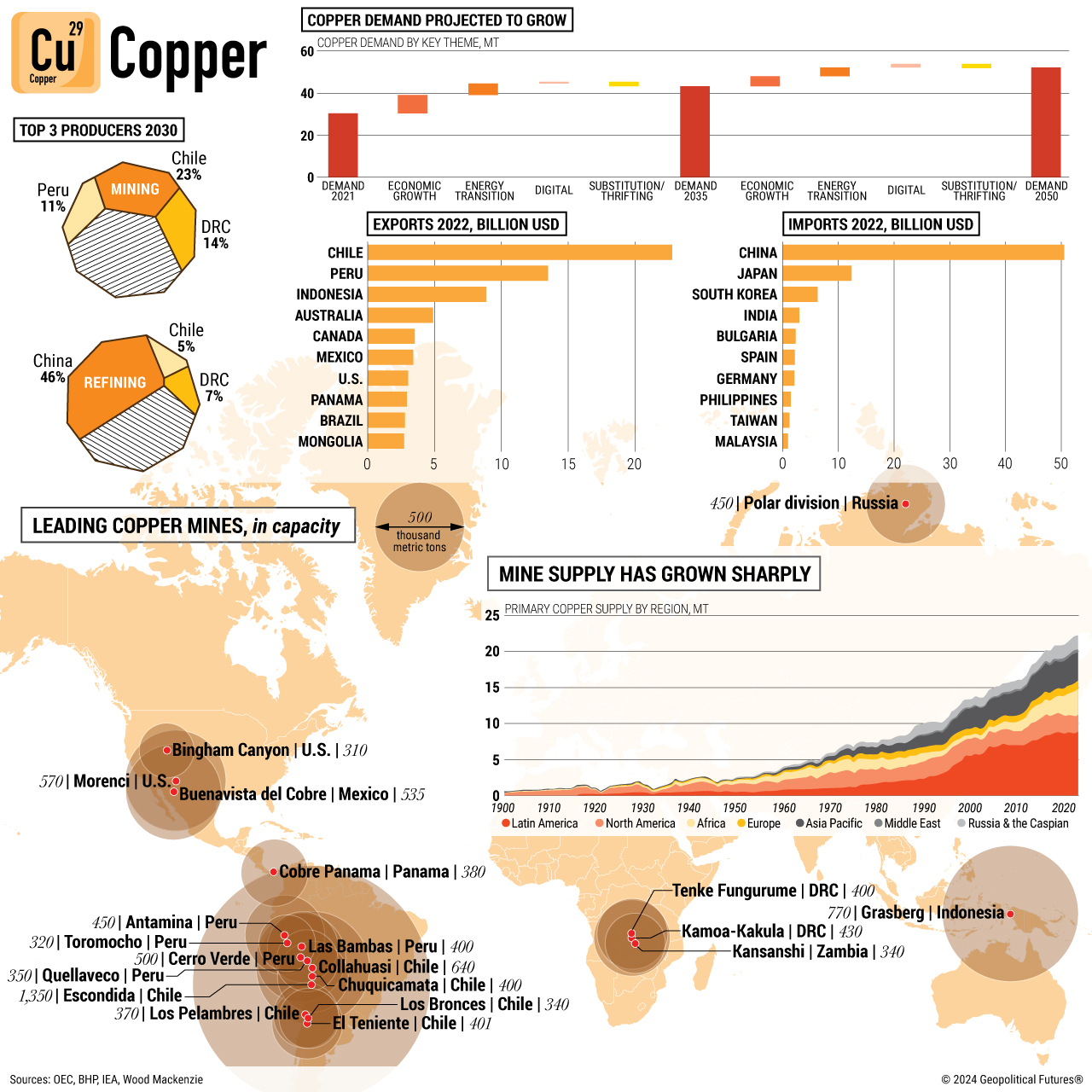

And metals are commodities – they come from where they are to where they are needed by manufacturers. Does taxing copper encourage the mines to move to the US? NO, because the US doesn’t have enough copper to mine YOU F’ING IDIOT!!! Oh, sorry, I meant “Mr. President…”

Not only that but these mines can be an environmental disaster that destroy the quality of life for millions of people. In fact, Northern Dynasty Minerals (NAK) has had an Alaskan mining project held up for years because the EPA (and the people of Alaska) had MAJOR concerns that waste run-off from the mine would endanger Alaska’s $5Bn salmon-fishing industry but, knowing Trump was taking power again – we bet that he could care less about fish not served at McDonalds and we bet on NAK to get their approval when Trump was re-elected in November:

And THAT is how you invest! You don’t have to agree with bad policy to profit from it…

🚢

-

-

: Raising tariffs on Canada, Mexico, or “most trading partners” doesn’t change the fact that the U.S. is deeply integrated into global supply chains. Tariffs simply shift sourcing, raise costs, and invite retaliation.

-

: The U.S. imports over $3 trillion in goods annually because it makes economic sense—no country can or should try to produce everything domestically.

-

: If the U.S. becomes too difficult to trade with, partners have options—and the U.S. risks losing both supply and influence.

-

:

America’s $30 trillion GDP is built on a foundation of global trade. The U.S. imports nearly $3.4 trillion in goods each year, and tariffs—no matter how dramatic—can’t change the underlying economic reality that the world is interconnected, and that prosperity depends on cooperation, not confrontation.

Have a great weekend,

— Phil