This is a very big deal so I asked Boaty to give us unbiased summary of what’s happening:

This is a very big deal so I asked Boaty to give us unbiased summary of what’s happening:

🚢 The Big Picture: Bitcoin’s Historic Surge

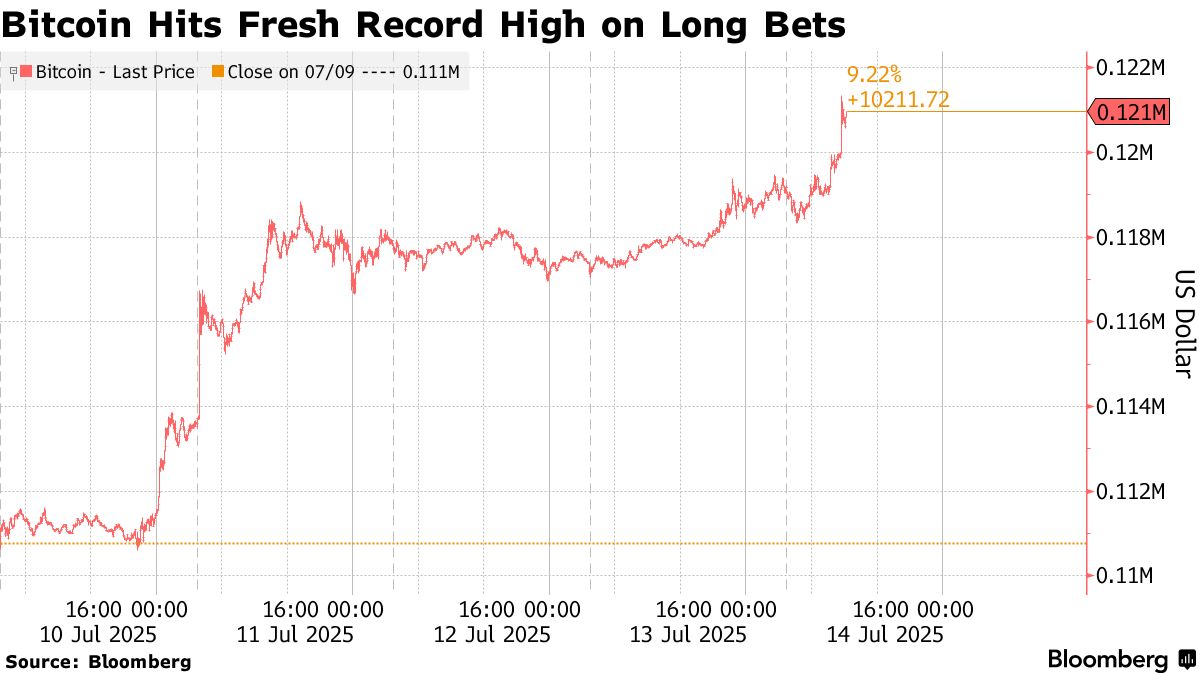

Bitcoin has rocketed past $120,000 for the first time, notching an all-time high as U.S. lawmakers launch “Crypto Week”—a series of pivotal legislative sessions that could reshape the digital asset landscape. The world’s largest cryptocurrency is up nearly 30% for the year, fueled by a combination of robust institutional inflows, surging ETF demand, and mounting speculation around regulatory clarity from Washington 123.

-

Institutional investors have poured over $1 billion into Bitcoin ETFs in the past week alone, pushing the market cap to $2.38 trillion and daily trading volumes up nearly 20% 1.

-

The rally is broad-based: Ether, Solana, and other major coins are also posting strong gains as traders bet on a friendlier U.S. regulatory environment 3.

What’s Happening in Congress: “Crypto Week” Explained

This week, the House of Representatives is set to debate and likely pass several landmark bills:

-

GENIUS Act: Establishes the first federal regulatory framework for payment stablecoins, requiring issuers to be U.S.-based and subject to federal oversight 45.

-

Clarity Act: Aims to provide clear rules for digital assets, ending years of legal ambiguity 657.

-

Anti-CBDC Surveillance State Act: Would block the creation of a U.S. central bank digital currency (CBDC), citing privacy and sovereignty concerns 67.

President Donald Trump—who has branded himself the “crypto president”—is expected to sign these bills into law, potentially as soon as next week 587. For the digital asset industry, this is the regulatory green light they’ve lobbied for since Bitcoin’s inception.

Does This Change Everything?

For Crypto:

-

Legitimacy: Federal law would finally recognize and regulate stablecoins, opening the door to mainstream adoption by banks, asset managers, and payment networks58.

-

Market Structure: Clear rules could lure innovation and capital back to U.S. shores, reversing years of “regulatory arbitrage” that sent talent overseas 67.

-

Risks: If the regulatory framework is too permissive, it could encourage risky behavior and systemic vulnerabilities, especially if stablecoins are allowed to scale rapidly.

For Traditional Finance:

-

Competition: Banks and payment giants could face new competition from stablecoin issuers and DeFi platforms operating under a lighter-touch regime.

-

Integration: Expect more partnerships between Wall Street and crypto firms, and perhaps new financial products that blend the two worlds 13.

For the Economy:

-

Inflation Hedge: Bitcoin’s surge is partly a hedge against inflation and trade policy uncertainty, with investors seeking alternatives to fiat currencies amid new tariffs and rising prices 93.

-

Speculation: The risk of a bubble remains—especially if regulatory clarity is seen as a license for unchecked speculation.

Self-Dealing and Corruption: Trump, Family, and Political Entanglements

Self-Dealing and Corruption: Trump, Family, and Political Entanglements

The intersection of crypto policy and personal enrichment has never been more glaring:

-

Trump Family’s Crypto Ventures: President Trump and his family have amassed billions in crypto wealth over the past year, largely through their stake in World Liberty Financial—a crypto exchange and stablecoin issuer launched in late 2024. Trump family entities own a controlling stake and have issued meme coins ($TRUMP, $MELANIA) and the “USD1” stablecoin 1011.

-

The family’s crypto holdings now represent nearly 40% of Trump’s net worth, with recent deals (including a $2 billion investment from an Abu Dhabi firm) poised to boost their fortune even further 10.

-

Binance, the world’s largest crypto exchange, has played a behind-the-scenes role as a coder, promoter, and early adopter for the Trump family’s stablecoin, raising concerns about conflicts of interest and regulatory capture 12.

-

-

Regulatory Favoritism: Since Trump’s return to office, the SEC has paused or dropped investigations into a dozen crypto firms, including those with ties to the Trump family 10.

-

Legislative Pushback: In response, Senate Democrats have introduced the “End Crypto Corruption Act,” which would ban presidents, senior officials, and their families from issuing or profiting from crypto assets while in office131415. The bill’s sponsors explicitly cite Trump’s activities as a driving concern, warning that the current situation erodes public trust and national security.

Other Political Players

-

Several members of Congress have been linked to crypto investments or have received campaign contributions from the industry, though none approach the scale or directness of the Trump family’s involvement 1315.

-

The new legislation is being pushed primarily by House Republicans, who frame it as a pro-innovation, pro-business agenda aligned with Trump’s vision of making America the “crypto capital of the world” 67.

Conclusion: Does Crypto Week Change Everything, or Nothing?

-

For the industry, this is a watershed moment: regulatory clarity, mainstream legitimacy, and a surge in capital.

-

For the public, the spectacle of self-dealing at the highest levels of government raises serious questions about the integrity of the process and the risks of regulatory capture.

-

For markets, the rally may have legs—but as always, the higher the climb, the greater the risk of a painful correction if confidence falters.

As Congress debates the future of digital assets, the line between public policy and private profit has never been blurrier. For now, Bitcoin’s moonshot is as much about politics as it is about technology or finance.

Let me (Phil) translate Boaty’s diplomatic assessment into plain English for our PSW members who prefer their analysis without the sugar coating:

What we’re witnessing isn’t innovation or progress – it’s the most brazen act of Presidential self-dealing since… well, since Trump’s last term. But this time he’s not just steering government contracts to his hotels. He’s literally CREATING A CURRENCY, pumping it with Presidential power, and cashing out while you hold the bag.

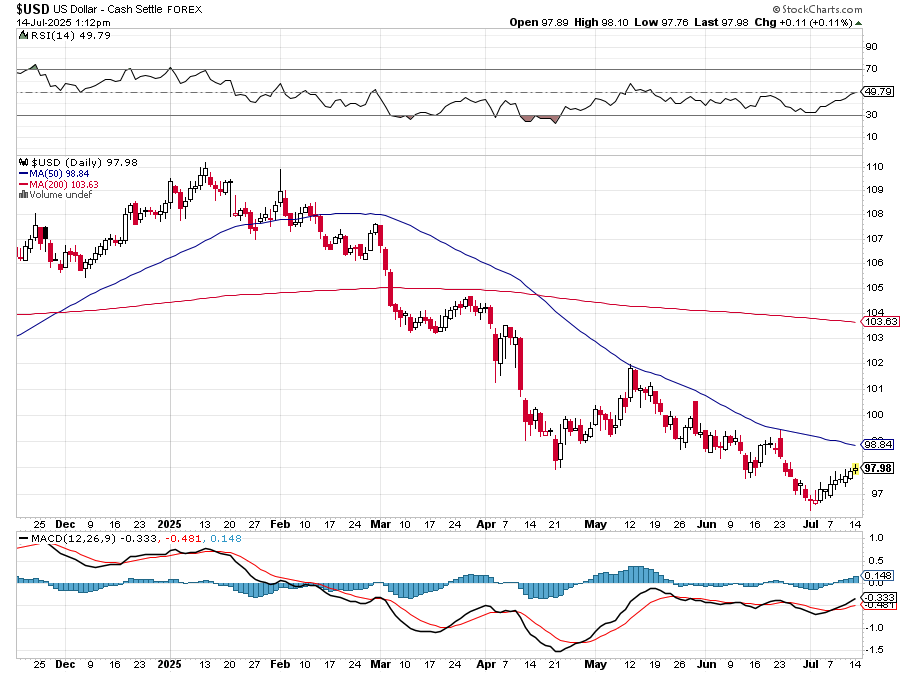

And here is the truly insidious part: It’s not just the crypto speculators getting screwed. When the President of the United States declares crypto superior to the Dollar, he’s devaluing YOUR savings, YOUR paycheck, and YOUR retirement.

Think about it: Every American holding dollars – which is EVERY ONE OF US who works for a living, saves for retirement, or keeps emergency funds – is watching their purchasing power get torched while Trump proclaims crypto the future. Your Grandmother’s savings? Worth LESS. Your 401k denominated in dollars? DEvalued. That raise you worked for? Already Eroded…

This is a WEALTH TAX on every American who plays/played by the rules and saves/saved in the currency their own Government issues. While Trump pumps his family’s crypto holdings, he’s essentially saying “Those green pieces of paper you’ve trusted your whole life? They’re obsolete. Better convert to my digital tokens!” And the conversion itself creates MORE demand for Trump’s tokens and LESS demand for your Dollars.

It’s the ultimate betrayal: The President is supposed to protect the value of the Dollar, not undermine it to pump up his personal investments!

Let’s break down this scam:

-

- Create worthless tokens ($TRUMP, $MELANIA) – basically digital baseball cards with their faces on them

- Use the presidency to pump them – Proclaim: “I’m the Crypto President!“

- Cash out Billions while supporters buy the top

- Write laws to protect themselves from the SEC

- Rinse and repeat

This isn’t Investing – it’s a Pyramid Scheme nuclear codes. The Trump family now owns 40% of their wealth in crypto? OF COURSE THEY DO! They are writing the laws that will help to determine its future value! Bitcoin hitting $120K+ isn’t a sign of adoption or innovation – it’s a sign that speculation has COMPLETELY detached from reality.

Let’s do basic math:

-

- Bitcoin processes 10 transactions per second (GLOBALLY)

- Visa processes 65,000 Dollar transactions per second (and then there’s MA, AXP…)

- Bitcoin uses more electricity than Argentina

- It has ZERO intrinsic value

- You can’t eat it, live in it, or use it for anything except selling to a greater fool

What does “7 transactions per second” actually mean? It means if everyone in Manhattan tried to buy coffee with Bitcoin on the same morning, the line would stretch to 2027. This isn’t a lack of adoption – it’s a fundamental design flaw. Bitcoin’s blockchain is like a highway with only one lane while claiming to be the future of transportation.

The Dollar System, on the other hand, handles BILLIONS of transactions DAILY without breaking a sweat (or being hacked). Your coffee costs roughly the same today as yesterday (not 10% more or less) and, if someone does steal your dollars? There’s recourse – especially if you use credit cards. With Bitcoin? “Sorry about your life savings – better luck next time!” Also , it doesn’t require burning a coal mine to buy a pack of gum!

Every “faster” crypto achieves speed by sacrificing decentralization – meaning you’re just using a slower, more expensive, less regulated version of PayPal run by anonymous people in unknown jurisdictions. Ethereum handles 15 transactions per second (again, GLOBALLY) – still useless as a real currency. Solana CLAIMS it can handle more but crashes every few months when people actually try to use it in test beds and USDT (Tether) is not even a real cryptocurrency (we discussed this recently) – it’s just an IOU for a Dollar from a company that won’t show its books…

At $120,000, Bitcoin’s market cap is $2.38 TRILLION. For what? A distributed database that’s slower than 1990s technology? This isn’t innovation – it’s collective insanity.

The GENIUS Act (and they actually named it that – DOUBLESPEAK!) is about to “legitimize” stablecoins. Stablecoins are SUPPOSED to be digital dollars backed 1:1 with real dollars BUT they are ACTUALLY Fractional Reserve Banking without any of the regulations, insurance, or oversight. Tether, the largest stablecoin, has NEVER had a full audit. They claim to have $100+ billion in reserves. Where? Show us the money! Now Trump wants to make these shadow banks official while his family runs one. What could possibly go wrong?

“Crypto Week” in Congress is brought to you by:

-

- $300 million in crypto lobbying money

- Campaign contributions to key committee members

- The promise of cushy board seats after they leave office

These aren’t public servants crafting thoughtful policy. They’re future crypto executives writing their own job descriptions and YOU are competing against insiders who know when the regulations will drop and The President’s family is front-running you with inside information. When this crashes (and all bubbles do crash), they will have cashed out and YOUR tax dollars will bail out the now “too big to fail” crypto firms because – “who could have seen it coming?”

This isn’t about making America the “Crypto Capital,” it’s about extracting wealth from retail investors, avoiding traditional financial regulations, creating untraceable political slush funds and enabling (even blessing) money laundering on an industrialized scale.

What You Should Do

-

- If you’re in crypto, have an exit plan – When the president’s family is all-in, the top is near

- Don’t buy the “innovation” narrative – This is speculation, not investment

- Watch for the rug pull – When Trump starts tweeting negatively about crypto, RUN

- Focus on real assets – Companies that make things, own things, or provide actual services

We are watching the greatest transfer of wealth from the gullible to the corrupt in American history. The Trump family isn’t just benefiting from crypto’s rise – they’re ENGINEERING it through legislative capture. When a President can create money out of thin air, pump it with the power of his office, and cash out Billions while writing laws to protect himself from prosecution, we’re not in a free market anymore. We’re in a Kleptocracy with better PR.

Remember: In a gold rush, you sell shovels and, in a crypto rush, we sell to the idiots buying digital shovels… The madness isn’t that Bitcoin hit $120,000, the madness is that anyone thinks this can end well for anyone except the Trump family and their enablers. Don’t be the last one holding the bag when this house of cards collapses…

Q2 Earnings kick off in earnest this week starting tomorrow with some Big Banks:

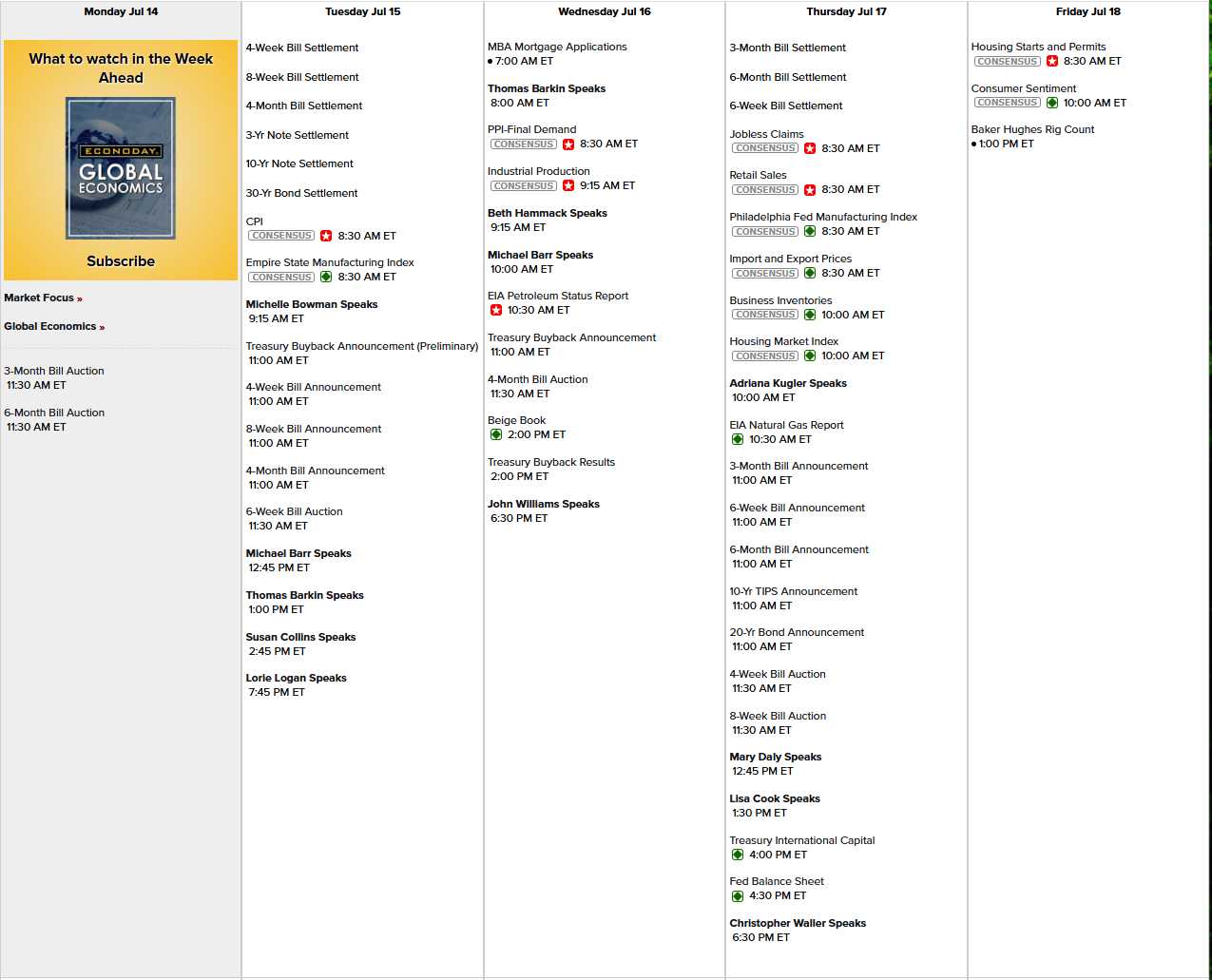

And this week’s Economic Calendar is packed with high-impact releases that will provide a comprehensive look at the state of Inflation, Consumer Spending, and the Housing Market. Here are the key data points and what to watch for:

Inflation Data:

-

-

Consumer Price Index (CPI): To be released on Tuesday at 8:30 AM ET, the CPI for June is expected to show a modest increase of 0.2%, the same as the Briefing.com consensus and up slightly from May’s 0.1% rise. The Core CPI, which excludes volatile food and energy prices, is also anticipated to increase by 0.2%. This is a critical indicator of inflation that the Federal Reserve watches closely when considering interest rate policy.

-

Producer Price Index (PPI): Scheduled for release on Wednesday at 8:30 AM ET, the PPI for June is forecast to have risen by 0.1%, with the consensus at 0.2%. The Core PPI is also expected to be up 0.1%. The PPI measures inflation at the wholesale level and can be a leading indicator of future consumer price inflation.

-

Consumer and Labor Market Health:

-

-

Retail Sales: Coming out on Thursday at 8:30 AM ET, June’s retail sales are projected to have rebounded by 0.4% after a 0.9% drop in May. Excluding autos, sales are expected to have increased by 0.2%. This data is a direct measure of consumer spending, a key driver of the U.S. economy.

-

Jobless Claims: Also on Thursday at 8:30 AM ET, initial jobless claims for the week ending July 12 are forecasted to be 235,000. This will be watched to see if the labor market is showing any signs of cooling.

-

University of Michigan Consumer Sentiment: The preliminary reading for July, due on Friday at 10:00 AM ET, is expected to come in at 61.5, a slight improvement from the prior reading of 60.7. This report gauges consumer confidence, which can influence future spending.

-

Housing Market Indicators:

-

-

Housing Starts and Building Permits: On Friday at 8:30 AM ET, June’s housing starts are expected to rise to 1.31 million units, while building permits are forecasted at 1.38 million. These figures will offer insight into the health of the construction sector and the broader housing market.

-

And Trump and his cronies are still trying to manufacture a reason to impeach Powell and we will hear from many of his potential replacements as 13 Fed Speakers vie for the President’s attention and doveish Fed language could give us a boost – despite Trump’s new tariff threats and the prospect of a Fed that’s also ruled by Trump in the near future.

Meanwhile, Bitcoin alone has created $467Bn of additional “wealth” in the past 30 days and, just like you consider diversifying your holdings INTO crypto – the Crypto Bros are diversifying their holdings into stocks – so we have constant inflows (Zombie Buyers) that are blowing their own bubble in the equities market.

Meanwhile, Bitcoin alone has created $467Bn of additional “wealth” in the past 30 days and, just like you consider diversifying your holdings INTO crypto – the Crypto Bros are diversifying their holdings into stocks – so we have constant inflows (Zombie Buyers) that are blowing their own bubble in the equities market.

Let’s be very careful out there – a lot of cross-currents are forming and the market is still very toppy at the moment.