Has it been a month already?

Has it been a month already?

We cashed in 4 of our Portfolio back in June, after 2 years of AMAZING gains and we started back last month with a brand new $500,000 Long-Term Portfolio (LTP) and a $200,00 Short-Term Portfolio (STP) so this will be our first review of our new portfolios at what, I am worried, is another market top. Of course that is why we cashed out our other portfolios - at about $7M - that took us 4 years to make and I didn't see the sense of risking it all but risking 1/10th (and we're still 80% in CASH!!!) is fine and, hopefully(?), we'll get another nice correction to take advantage of.

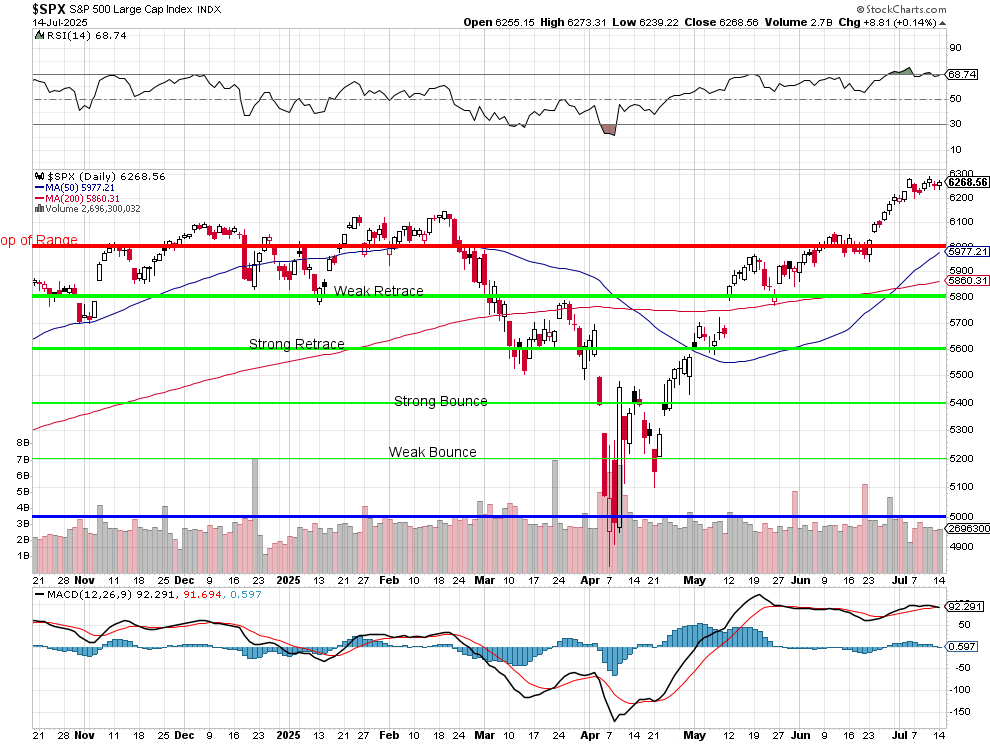

At the moment, the S&P 500 is at 6,268 and that's up 235 points (3.8%) and the RSI on the S&P has gone from 62.75 to 68.74 (9.5%) while the Volatility Index (VIX) has fallen from 21.50 to 16.95 (21%) but none of that matters now. What matters now - and what we were too frightened of to risk $7M on - is Q2 Earnings, Inflation and, of course, Trump's on-again tariff deadline of August 1st. Until then - everything is up for grabs.

Even as I write this (8am), Jason Smith is on CNBC saying we had a $24Bn Budget Surplus in June and he is attributing that to Trump's tariffs but June is also a big month for tax collections and tariff revenue was only $27Bn in June our of $600Bn in MONTHLY Federal Spending and $432Bn of monthly Federal Collections and that $168 BILLION MONTHLY DEFICIT is over $2Tn a year so a single-month surplus of $24Bn is barely a rounding error in the grand scheme of things.

Not only that but here's a lesson is what kind of crap you are being fed by the people you rely on for "News".