What a relief!

What a relief!

After a week of wrestling with market uncertainty, the first big slate of Q2 earnings has come in, and the results are surprisingly strong. While we must preface this by saying the first week is always dominated by the Financial Sector, the sheer size of the beats and some glimmers of insight from other sectors are giving the bulls something to hang their hats on as we head into the weekend.

The main takeaway is that companies are handily beating LOW expectations. But the question we need to ask is HOW they are achieving this, and WHAT it signals for the economy moving forward?

Big Banks = Big Beats as the financial sector truly put on a show this week. Just look at the magnitude of these EPS beats:

-

-

JPMorgan Chase (JPM): Beat estimates by $0.48 (a 10.7% surprise).

-

Goldman Sachs (GS): Beat estimates by $1.26 (a 13.1% surprise).

-

Citigroup (C): Beat by a whopping $0.35 (a 21.7% surprise).

-

Morgan Stanley (MS): Beat by $0.15 (a 7.6% surprise).

-

Wells Fargo (WFC): Beat by $0.19 (a 13.5% surprise).

-

Travelers (TRV): An incredible beat of $2.86, smashing the $3.65 consensus by 78%.

-

This is impressive on the surface and speaks to the profitability of these institutions in the current rate environment. HOWEVER, a glance at the Year/Year Revenue column raises some questions. While most banks showed modest revenue growth, the data for JPMorgan (JPM – which we own) shows a surprising -10.5% YoY revenue change, and Truist (TFC), who missed by a penny had a -4% DECLINE in Revenues despite both beating their very Conservative Quarterly Estimates. This suggests the bottom-line beats might be masking underlying revenue challenges or are perhaps the result of significant one-time events, cost-cutting, and share buybacks rather than pure organic growth.

Beyond the banks, we saw some crucial reports that give us a better view of the broader economy. The AI-powered tech story is more nuanced than the headlines suggest with TSM giving us a strong beat AND upside guidance. TSM’s 44.4% y/y Revenue Growth confirms the AI-driven demand for high-end chips is still red hot. HOWEVER, ASML, who are a key supplier of equipment to chipmakers, posted DOWNSIDE guidance. Could we be wrong about AMAT (just added to the Money Talk Portfolio) or is ASML experiencing unique issues?

It wasn’t just about tech and finance. GE Aerospace (GE) posted a fantastic 21.2% revenue growth and a huge EPS beat but they had a weird day yesterday and are barely up on the week because, at 39 TIMES forward earnings – 21.2% Revenue Growth is NOT THAT EXCITING!!! Johnson & Johnson (JNJ) also beat estimates AND raised its forward guidance BUT not even back to their March highs, despite trading at just 14x forward earnings.

So, what’s the big picture for the economy and the markets? This week gave us two critical, and seemingly contradictory, narratives: On one hand, our “bottom-up” view from Corporate Earnings has been surprisingly positive. On the other hand – a “top-down” look from Economists, while less pessimistic in the short term, is flashing yellow warning lights for the future.

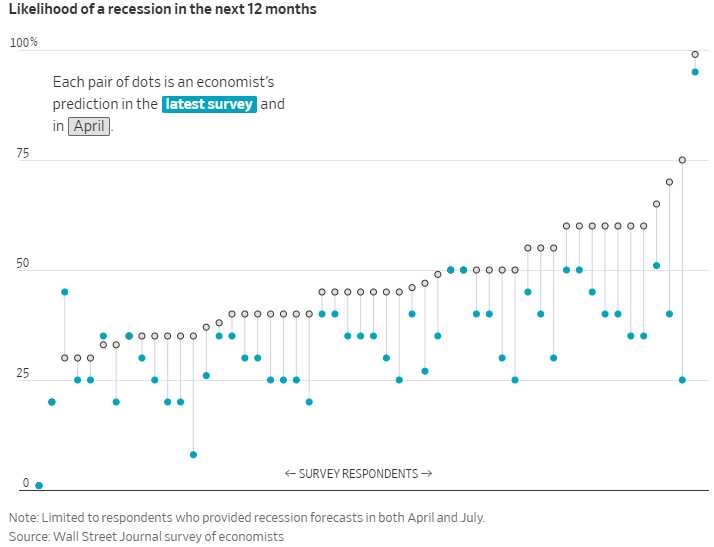

The week’s strong earnings results, from Big Banks to Tech Bellwethers, are being echoed by Economists who are now dialing back their immediate Recession fears. A new Wall Street Journal survey shows the probability of a Recession in the next 12 months has dropped to 33% from 45% in April. They’ve also sharply raised their forecast for second-quarter GDP growth to 2.2%, a HUGE jump from the 0.8% they expected just a few months ago. This confirms the Corporate resilience we’ve been noticing – it’s not just an earnings game, it’s reflected in the broader Economic Data.

See, they even got the 100% guy to back off! HOWEVER, our earnings analysis reveals a crucial detail: This is NOT a tide that is lifting all ships. It is a tale of a bifurcated Economy. We see booming demand for high-end AI chips (TSM) and resilient spending from the wealthy (AXP), while the average Consumer is feeling the pinch (Pepsi’s sluggish revenue) and broader tech investment shows signs of caution (ASML’s guidance).

This is where the Economists’ longer-term concerns snap into focus. The same Wall Street Journal survey that noted near-term optimism also pointed to significant risks clouding the future, namely the Administration’s Trade/Tariff and Immigration Policies. While corporate leaders are navigating the present quarter successfully, Economists are worried about what comes next and, with Trump – who the F knows?

The survey quantifies these fears:

-

On Tariffs and Inflation: A vast majority of the 69 economists surveyed expect tariffs to DIRECTLY increase inflation – adding an average of 2.2% to the year-over-year CPI – up from 0.8% expectations just 3 months ago – NO ONE believes the Fed is winning this Inflation fight!

-

On Immigration and Growth: There is a strong consensus that current Immigration Policy will act as a drag on the economy. Two-thirds of respondents believe it will SUBTRACT between 0.1% – 0.3% from our GDP growth.

Don’t forget that 2% GDP growth when you have 2.2% INFLATION means you are NET LOSING 0.2% GDP in real value!

So, while the market celebrates a fantastic week of earnings beats, it is doing so against a backdrop of rising warnings. The resilience we see today is real, but it’s extremely uneven driven by the same Big Tech and Banking that got us here in the first place. And the very policies shaping the long-term outlook are the ones Economists believe will slow growth and increase costs in the near future.

This disconnect between the market’s current optimism and the clearly identified future risks is something that is keeping us well-hedged and mainly in CASH!!!

Speaking of CASH!!! Crypto currencies (all of then 1/2 of which is Bitcoin) just crossed $4Tn in total value and that’s up $1Tn (3.3% of our GDP) since Jan of 2023 so there’s a HELL of a stimulus package for Crypro Bros and the Already Rich (Trump Bros) so thank you Congress for your rubber-stamp – your constituents must be very proud…

Have a great weekend,

— Phil