We have an EU deal!

We have an EU deal!

I was very skeptical but Trump played golf until it happened and let’s give credit where credit is due – he has pulled it off. Trump has essentially gotten the World (the dominoes are now falling into place) to accept 15% tariffs on pretty much everything and that’s going to be about $600 BILLION per year on $4 TRILLION worth of imports. Of course, the reason he was able to get these “concessions” is because the exporters don’t pay a penny of the tariffs – WE DO!

This will lead to less consumption, less growth and less profits and possibly push the US into a massive Recession – BUT THE TAX CUTS ARE JUSTIFIED! That’s right, $600Bn worth of tariffs PER YEAR justifies $6,000,000,000,000 in tax cuts (16.2% of our total $37Tn in debt) and additional spending (like $150Bn for ICE) during Trump’s term – everything has worked out and everything will be… fine…

(*) Not really and, sadly, we have to have disclaimers now because PEOPLE CAN’T TAKE A F’ING JOKE ANYMORE!!!

“Southern man better keep your head

Don’t forget what your good book said

Southern change gonna come at last

Now your crosses are burning fast

Southern man

I saw cotton and I saw black

Tall white mansions and little shacks

Southern man, when will you pay them back?

I heard screaming and bullwhips cracking

How long? How long? (Ah)” – Neil Young

Makes you think, doesn’t it? WELL DON’T!!! Thinking is exactly what got us into the mess so STOP IT, right now!!!

Makes you think, doesn’t it? WELL DON’T!!! Thinking is exactly what got us into the mess so STOP IT, right now!!!

“To know and not to know, to be conscious of complete truthfulness while telling carefully constructed lies, to hold simultaneously two opinions which cancelled out, knowing them to be contradictory and believing in both of them, to use logic against logic, to repudiate morality while laying claim to it, to believe that democracy was impossible and that the Party was the guardian of democracy, to forget whatever it was necessary to forget, then to draw it back into memory again at the moment when it was needed, and then promptly to forget it again, and above all, to apply the same process to the process itself—that was the ultimate subtlety: consciously to induce unconsciousness, and then, once again, to become unconscious of the act of hypnosis you had just performed. Even to understand the word—doublethink—involved the use of doublethink.” – Orwell

Now, where was I? Oh yes, our glorious trade deal which also has Europe agreeing to buy $750Bn worth of Energy from US but it’s NOT like we will produce more Energy or SELL more Energy – it’s just that, instead of buying the Energy they now buy from other places – the EU will buy Energy from the US and the people who WERE buying Energy from the US (US consumers, perhaps?) will now have to pay more to get less-convenient energy that they were getting before – leading to HIGHER PRICES which are, of a sort, YET ANOTHER tax on the US Consumer.

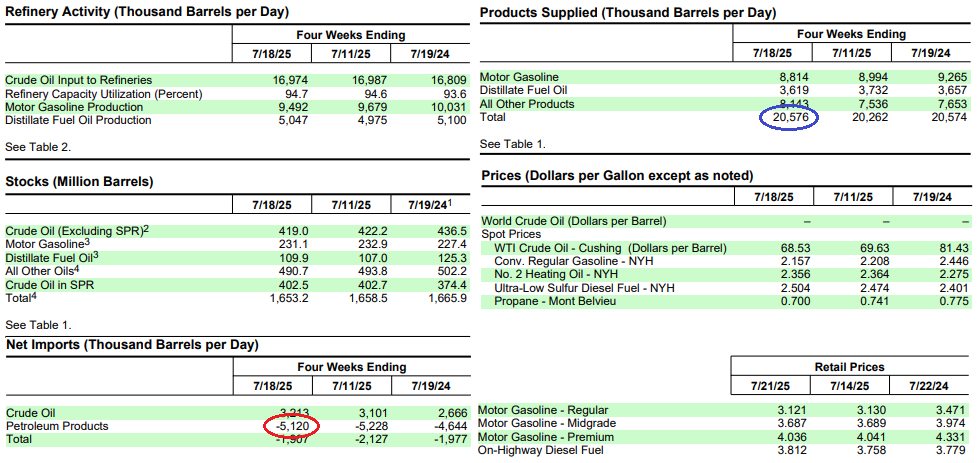

As it is, the US EXPORTS 5 MILLION BARRELS of Oil EVERY DAY – that is 25% of our total “consumption” of oil – according to lazy reporters and analysts whose two-dementional brains don’t even understand the CONCEPT of looking beyond the surface of the data they report on. Is it REALLY so hard to look at an EIA report and find:

Was that so hard to find? This report is published EVERY WEEK, so the only reason Reporters and Analysts would be missing it is MALPRACTICE or MALFEASANCE or, let’s give them the benefit of the doubt – STUPIDITY… Think (or don’t!) about it – how many times has your brain been washed with the statement that the United States is the World’s largest consumer of oil?

Was that so hard to find? This report is published EVERY WEEK, so the only reason Reporters and Analysts would be missing it is MALPRACTICE or MALFEASANCE or, let’s give them the benefit of the doubt – STUPIDITY… Think (or don’t!) about it – how many times has your brain been washed with the statement that the United States is the World’s largest consumer of oil?

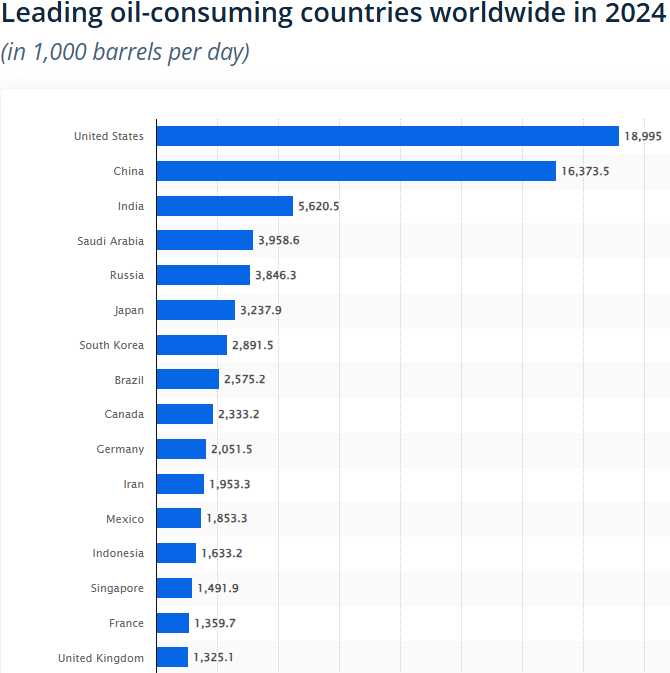

Well, WE’RE NOT, China is – by a wide margin. If this vital, global statistic can be blatantly wrong by a factor of 26.6% – what else are they lying to us about? Probably everything but that’s depressing so let’s just say “a lot” and leave it at that.

So, now we can move on to more market bullshit, like the value of a Dollar – which popped back over 98 this morning as Americans (who use Dollars to buy things) will now need 15% more Dollars to buy the same things they bought last year for 15% less – THANK YOU MR PRESIDENT!

So, now we can move on to more market bullshit, like the value of a Dollar – which popped back over 98 this morning as Americans (who use Dollars to buy things) will now need 15% more Dollars to buy the same things they bought last year for 15% less – THANK YOU MR PRESIDENT!

The strong dollar rally this morning is being driven by a surprise EU trade deal that lifted policy uncertainty – forcing currency traders to unwind their short-Dollar positions. There is also the usual Global preference for Dollar assets as hedges amid macro and policy crosscurrents – and there are PLENTY of those still going on. The DXY Dollar Index jumped more than half a percent, its sharpest daily gain in weeks, signaling the world’s money – and anxiety – have temporarily swung back to the Greenback.

And speaking of the “strong” Dollar: Don’t mistake that for strength in the real Economy. A Dollar that buys you less but registers as “higher” against a basket of other weakening currencies is just the latest mirage in this hall of Economic mirrors.

The so-called windfall of our glorious trade war settlement (which is really just a tax the Consumer cannot deduct!) will show up as higher prices on store shelves, at the pump, and in utility bills. But hey, Stock Buybacks and Corporate Profit-padding, still fluffed up by artificially juiced EPSs, will keep the Earnings PowerPoint Presentations looking heroic… for now (see: “Q2 Earnings and the Market’s Bubble Risk: A Deep Dive into Profits, Valuations, Buybacks, and Macro Disconnects“).

The so-called windfall of our glorious trade war settlement (which is really just a tax the Consumer cannot deduct!) will show up as higher prices on store shelves, at the pump, and in utility bills. But hey, Stock Buybacks and Corporate Profit-padding, still fluffed up by artificially juiced EPSs, will keep the Earnings PowerPoint Presentations looking heroic… for now (see: “Q2 Earnings and the Market’s Bubble Risk: A Deep Dive into Profits, Valuations, Buybacks, and Macro Disconnects“).

The market, of course, doesn’t care. It’s too busy celebrating “certainty.” Certainty about what, precisely? That Profits will keep outpacing Paychecks, or that Inflation will magically vanish just because we pretend tariffs aren’t Inflationary? That policy “certainty” is just the confidence to offload more risk onto households, disguised as wins for American business?

You’ll hear a lot about $600 Billion in “new revenue” from tariffs, with breathless praise for how it covers Tax Cuts and Military toys as if money just appeared from thin air. The reality: every penny is siphoned from Consumers’ Real Spending Power. The math is simple: This may pad Government coffers or Corporate ledgers for a season, but it hollows out the Middle Class and kneecaps future Consumption!

Just don’t look for this reality on TV -not with “Comptrollers” (or the fear of them) monitoring content. The networks will run clips of ceremonial signings, handshakes, and a President “winning” and “what Epstein files?” Market Strategists will gush over “policy clarity” and “room for multiple expansion.” Meanwhile, your grocery bill is up double digits, your paycheck doesn’t stretch as far, but buybacks are still at $1 TILLION annualized. Welcome to Doublethink, USA…

Just don’t look for this reality on TV -not with “Comptrollers” (or the fear of them) monitoring content. The networks will run clips of ceremonial signings, handshakes, and a President “winning” and “what Epstein files?” Market Strategists will gush over “policy clarity” and “room for multiple expansion.” Meanwhile, your grocery bill is up double digits, your paycheck doesn’t stretch as far, but buybacks are still at $1 TILLION annualized. Welcome to Doublethink, USA…

So as we stare down those celebratory headlines and another new-high rally in the S&P, ask yourself: Is this what WINNING looks like? Or are we just arranging the deck chairs, humming along to a tune about “strength” that the band is inexplicably still playing – while the engines below the waterline gasp for air?

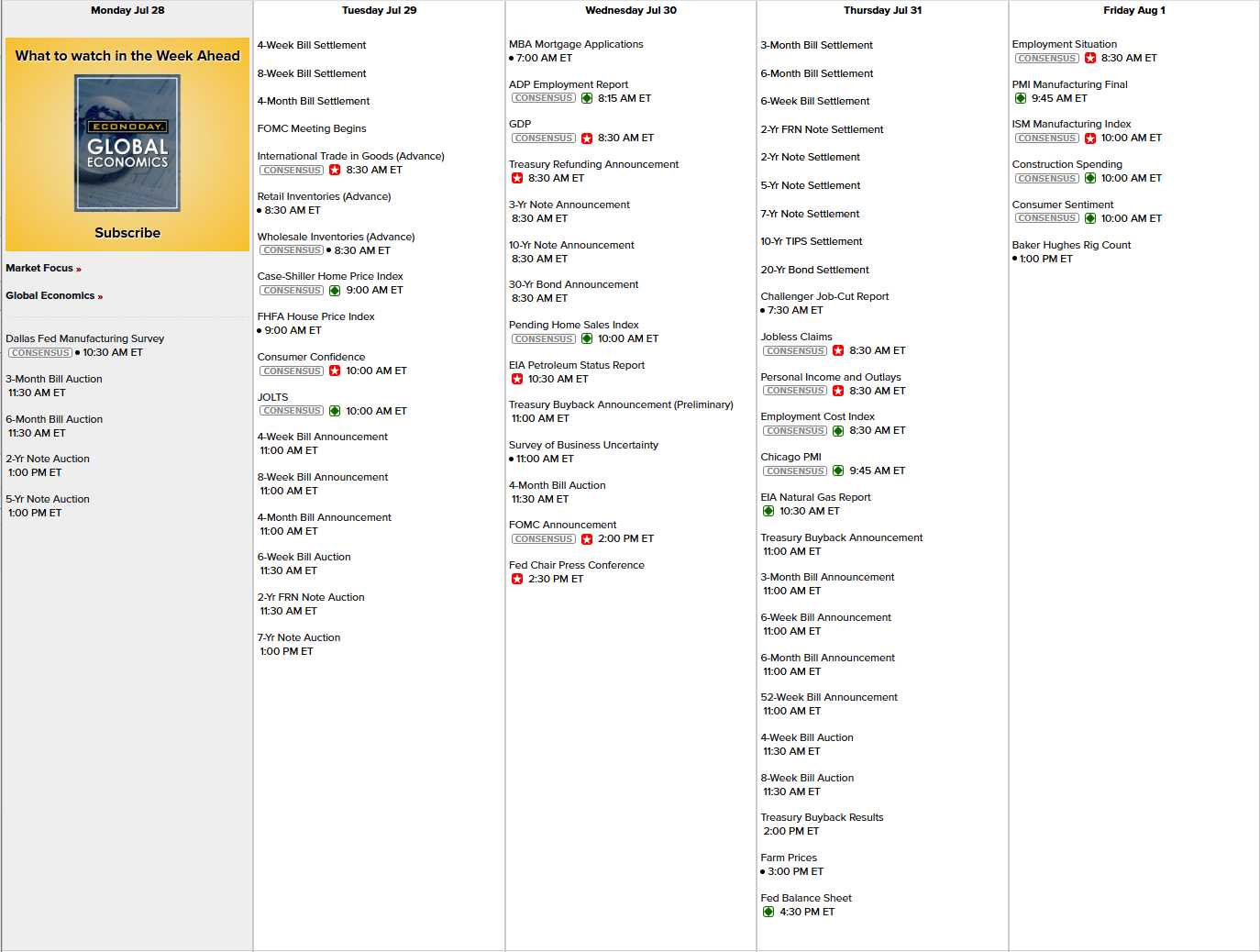

Anyway, it’s Monday so let’s see what’s coming (aside from Friday’s tariff deadline). I look into the Magic Mirror (is anyone as old as me?) and I see the Dallas Fed and I see 2-year and 5-year Note Auctions sitting on the floor today. I see Retail and Wholesale Inventories on the couch tomorrow with their friends Home Prices, Consumer Confidence and JOLTS – along with a 2 & 7-year Not Auction in the afternoon – what a lot of debt! Wednesday we’ll get our first guess at Q2 GDP (it was -0.5% in Q1 and that means RECESSION!) and that will be served with Pending Home Sales, the misunderstood EIA Report Business Uncertainty and, in the afternoon – the FOMC Announcement and our special guest during our Live Trading Webinar will be Jerome Powell – who will explain why he bought such a fancy chair for his new office!

If we can still wake up in the morning after all that, Thursday will bring us Job Cuts, Personal Income and Outlays, the Employment Cost Index, Chicago PMI, even MORE Note Auctions and Farm Prices. Friday we expect a drop in Non-Farm Payrolls and then it’s PMI, ISM, Construction Spending and Consumer Sentiment to finish us off finish off the week!

And, on the earnings front, this is the biggest week of the season with 200 S&P 500 companies reporting – so anything can happen and it probably will:

So strap in – it’s going to be a wild ride!

Enjoy Anya’s new Song: “Falling Down“