The market is holding its breath as we awaits Powell’s pronouncements this afternoon.

Futures are wavering, trying to decide if the glass is half-full of AI-fueled Tech earnings or half-empty with tariff-induced Industrial pain. The Federal Reserve is widely expected to hold rates steady for the fifth time BUT as always, the decision itself is just the appetizer – the main course is the commentary and the big question is: Which economy is the Fed looking at?

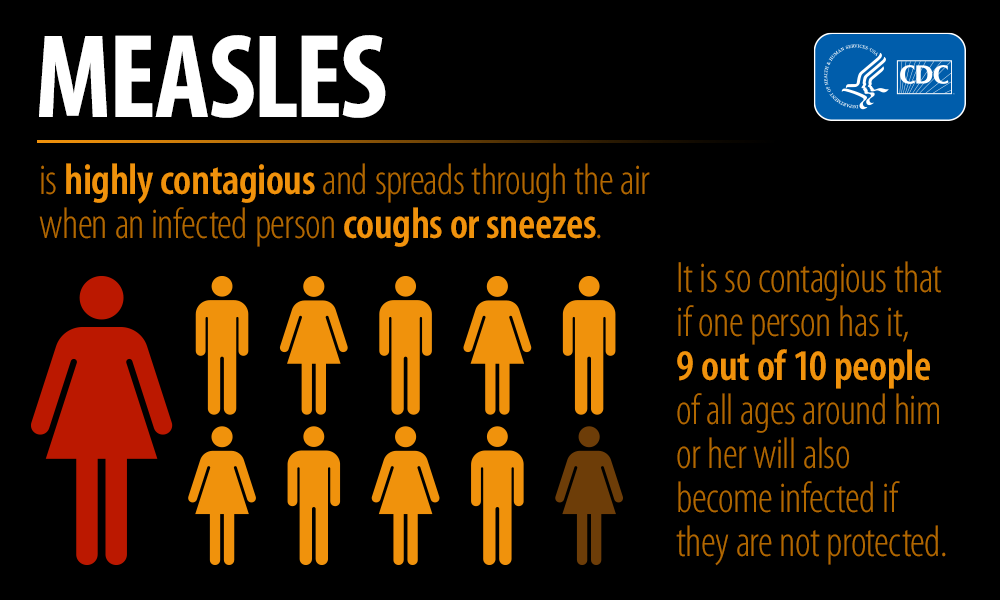

Is it the one where Big Tech giants like Microsoft (MSFT) and Meta (META), reporting tonight, are expected to post MAGNIFICENT numbers, which will prop up the entire S&P 500? Or is it, perhaps, the REAL-World Economy, the one we discussed in yesterday’s “Not so Tariffic Tuesday,” where the “Tariff Disease” is spreading faster than the spreading measles cases Kennedy is still ignoring?

Is it the one where Big Tech giants like Microsoft (MSFT) and Meta (META), reporting tonight, are expected to post MAGNIFICENT numbers, which will prop up the entire S&P 500? Or is it, perhaps, the REAL-World Economy, the one we discussed in yesterday’s “Not so Tariffic Tuesday,” where the “Tariff Disease” is spreading faster than the spreading measles cases Kennedy is still ignoring?

We don’t have to look no further than this morning’s headlines for the answer: German Luxury Automakers; Mercedes-Benz and Porsche have both slashed their profit forecasts for the year – explicitly blaming the one-two punch of President Trump’s tariffs and Slowing Demand in China. This isn’t a Whirlpool-specific problem; it’s a global pandemic for companies that actually make and ship physical goods. As we’ve been saying, the tariffs aren’t a brilliant negotiating tactic – they are a DIREC TAX on Consumers and a WRECKING BALL to Corporate Margins AND, quite possibly, the final straw for consumers who are already on their last legs…

This is the “Doublethink, USA” we talked about on Monday. The market celebrates “trade pacts” that lead directly to profit warnings from Industrial cornerstones. While the wealthy are still snapping up Hermès bags, the foundation of the Manufacturing and Consumer Economy is showing MAJOR cracks.

So, what does Powell do? On one side, he has President Trump poking him in the arm and demanding rate cuts to juice the Economy (and the already over-juiced markets). On the other side he has data showing a still-solid Labor Market (7.4M unfilled jobs as if yesterday) AND the bifurcated earnings.

The real signal to watch for today won’t be the rate decision itself, but the number of dissenters. Governors Waller and Bowman have already signaled they’re ready to cut, perhaps they are worried that the economy is more “fragile” than the headlines suggest or, perhaps they are just looking to curry favor as Trump dangles the next Fed Chairmanship in front of the lackeys-in-waiting. Whatever their motives – IF they both dissent, it would be a major sign of internal disagreement at the Fed about the true state of the Economy.

Investors will be hanging on every word from Powell’s press conference, which we will analyze during our Live Trading Webinar, starting at 1pm, EST. Will he acknowledge the tariff impact? Will he address the growing chasm between the Tech ba-ba-buoyed stock market and the struggling Industrial sector? Or will he stick to the script and remain “studiously neutral“?

With markets priced for perfection in the upcoming Tech Earnings, any sign that the Fed is ignoring the spreading Economic pain could be the very thing that finally shakes this complacent market out of its stupor. It’s “Which Way Wednesday,” and the Fed is at the wheel, approaching a major fork in the road.

With markets priced for perfection in the upcoming Tech Earnings, any sign that the Fed is ignoring the spreading Economic pain could be the very thing that finally shakes this complacent market out of its stupor. It’s “Which Way Wednesday,” and the Fed is at the wheel, approaching a major fork in the road.

As the great Yogi said: “When you see a fork in the road – take it!“

Speaking of GDP, we are snapping back to 3% in Q2 from -0.5% in Q1 and that is YET ANOTHER REASON for the Fed NOT to loosen policy as now we’re OVERHEATING(?!?) Economically and that can quickly lead to another round of Inflation, right when the tariffs kick in and —- MEDIC!!!

Speaking of GDP, we are snapping back to 3% in Q2 from -0.5% in Q1 and that is YET ANOTHER REASON for the Fed NOT to loosen policy as now we’re OVERHEATING(?!?) Economically and that can quickly lead to another round of Inflation, right when the tariffs kick in and —- MEDIC!!!

It is a good time to be hedged…

And yes, by popular demand, Anya dropped another single: