Yesterday was a perfect case study in the market’s attention-deficit disorder.

We went from a Fed-induced hangover to a tech-fueled sugar high in the span of about two hours – even as a stream of tariff announcements came pouring out of the White House. If you feel a little whipsawed, you aren’t alone. It was a day that proved, once again, that the real value lies not in predicting the madness, but in reacting to it with a solid, well-hedged plan. Let’s break down the three-act drama that was Wednesday:

As we expected, Fed Chair Jerome Powell and the FOMC did exactly what they had to do – pour cold water on the market’s desperate hopes for an imminent rate cut. While they held rates steady, it was Powell’s press conference that sent the indexes tumbling.

The Fed Chairman masterfully dodged any commitment to a September cut, stating plainly that “there is no decision” yet. The dagger for the bulls was his reasoning: the “clear upside risks to near-term inflation” from the new wave of tariffs. In short, he can’t cut rates while President Trump is actively driving up Inflation. This left the Fed sounding hopelessly trapped, a fact underscored by the two dissenting votes on the committee – a clear sign of the cracks forming in the Eccles Building as dissent at the Fed is a rare thing indeed.

The Fed Chairman masterfully dodged any commitment to a September cut, stating plainly that “there is no decision” yet. The dagger for the bulls was his reasoning: the “clear upside risks to near-term inflation” from the new wave of tariffs. In short, he can’t cut rates while President Trump is actively driving up Inflation. This left the Fed sounding hopelessly trapped, a fact underscored by the two dissenting votes on the committee – a clear sign of the cracks forming in the Eccles Building as dissent at the Fed is a rare thing indeed.

As the market digested this dose of hawkish medicine, the feeling in our Live Member Chat Room (sign up here so you don’t miss the action) was one of vindication. Powell did what we said he’d do – he punted – leaving the market in a state of high uncertainty. But the pessimism didn’t last. Just as the bears were sharpening their claws, the post-market earnings reports landed like a meteor to wipe out the bearosaurs.

- First, Microsoft (MSFT) didn’t just beat estimates; it obliterated them. With revenue surging 18% ($76.4 BILLION) and their Azure cloud business rocketing up an astonishing 39%, Satya Nadella confirmed that the AI and Cloud juggernaut is firing on all cylinders, calling it the: “driving force of business transformation.” Growth in both Enterprise and PC units, strong demand for AI-enabled products, and positive guidance launched MSFT shares higher in after-hours trading, passing $4 TRILLION in market cap.

- Then came Meta (META) with a haymaker of its own. Not only did they SMASH Revenue and Profit expectations (+22% and +36% respectively), but Mark Zuckerberg went full sci-fi, trumpeting the company’s progress toward “AI Superintelligence“ and RAISING Capital Spending to accelerate the push. The bottom line is, all those crazy expectations for profits and growth were FAR TOO CONSERVATIVE!

The result? A massive after-hours surge that dragged the Nasdaq futures right back out of the red. The Fed’s caution was instantly forgotten, replaced by the intoxicating hopium of Big Tech Earnings. It was a classic example of the market’s manic sentiment swinging from fear to unbridled greed in the blink of an eye.

As if a hawkish Fed and blowout tech earnings weren’t enough to digest, the Trump Administration turned on the tariff firehose, unleashing what Nomura’s Chief Economist called “just a lot of noise” on the eve of the August 1st deadline. The blizzard of headlines was designed to confuse and overwhelm. We saw:

-

-

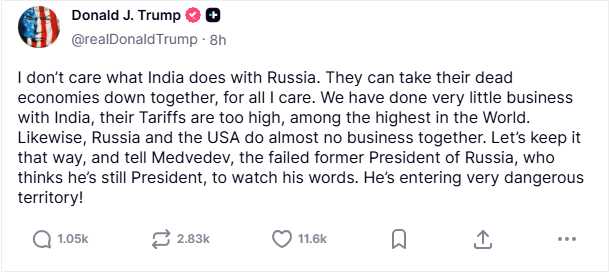

A Shock 25% Tariff on India: This “painful” levy wasn’t just about trade. Trump publicly blasted India for its ties to Russia and its membership in the BRICS group, which he called “anti-the United States.” In a late-night post, he added a stunningly blunt threat: “I don’t care what India does with Russia. They can take their dead economies down together, for all I care.” – VERY Presidential! The announcement reportedly came as a complete shock to Indian officials.

-

-

-

-

-

- Wait, only 11,600 likes? Isn’t this guy the President of the United States?

-

-

- A New Tax on Your Online Shopping: In a move that will hit consumers directly, Trump announced the end of the “de minimis” rule, meaning tariffs will now apply to those small, direct-to-consumer shipments under $800 that have been a boon for online retailers like Temu and their customers.

-

A “Dealmaking Blitz” Creates More Confusion: A flurry of deals were announced, each with its own strange conditions. South Korea signed on for a 15% tariff that also included a $350 billion investment fund to be directed by Trump. In a truly chaotic move, Trump also shocked the Copper markets by exempting most forms of the metal from a 50% tariff, sending prices plunging.

A “Dealmaking Blitz” Creates More Confusion: A flurry of deals were announced, each with its own strange conditions. South Korea signed on for a 15% tariff that also included a $350 billion investment fund to be directed by Trump. In a truly chaotic move, Trump also shocked the Copper markets by exempting most forms of the metal from a 50% tariff, sending prices plunging. -

A Threat to Canada Over Foreign Policy: The threat to slap a major tariff on Canada was explicitly linked to a non-trade issue. Trump stated that Canada’s decision to back Palestinian statehood “will make it very hard for us to make a Trade Deal with them,” turning trade negotiations into a tool for punishing foreign policy disagreements

-

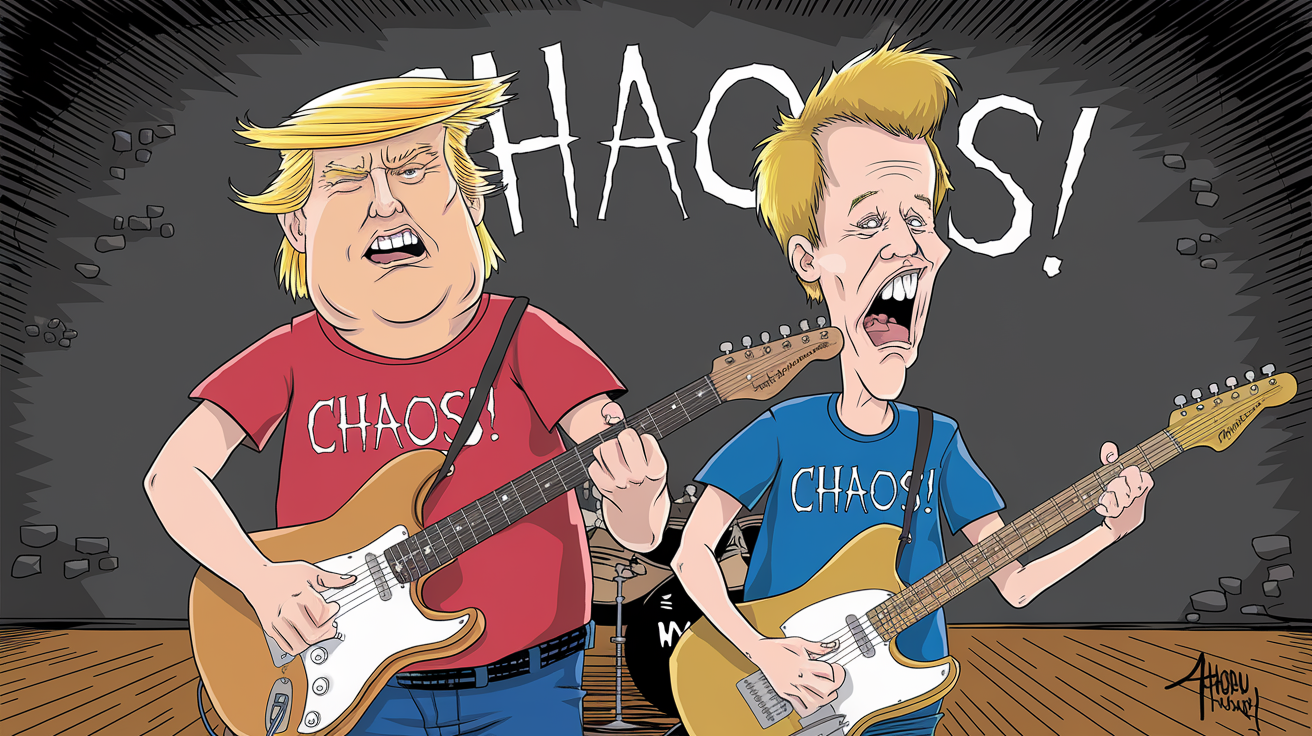

This is the kind of chaotic, unpredictable environment that makes long-term corporate planning utterly impossible and day-to-day trading a real adventure!

This is the kind of chaotic, unpredictable environment that makes long-term corporate planning utterly impossible and day-to-day trading a real adventure!

Yesterday showed us the market’s “Goldfish Brain” in real-time. Powell’s entirely logical, inflation-aware presser spooked investors, but the anxiety lasted only until the next shiny object was dropped in the tank. In this case, stellar tech earnings appeared and it was, once again, feeding time…

We are now caught between three powerful forces: a Fed trapped by Inflation, a Tech Sector that seems immune to Economic Gravity, and a trade policy that changes by the hour. Navigating this requires more than just guessing the next headline; it requires a strategy…

Now, if we could only figure one out! Meanwhile, the end-of-month windows are being dressed and we’ll be upping our hedges today ahead of tomorrow’s Tariff Trigger Day – Good Luck!