Gee, who could have seen this coming?

Gee, who could have seen this coming?

The bitch is back with the President setting MINIMUM tariffs of 10% on EVERY COUNTRY IN THE WORLD – except, apparently, the countries he has made deals with – who are generally paying 15% or more. So the lesson here is DON’T make a deal with Trump?

I know you’re thinking I’m about to make sense of all this, but there’s no actual sense to be made!

🚢 The New World Order (of Tariffs)

Late yesterday, the White House slapped down its new global tariff chart, and it’s a masterpiece of trade-war chaos:

-

-

-

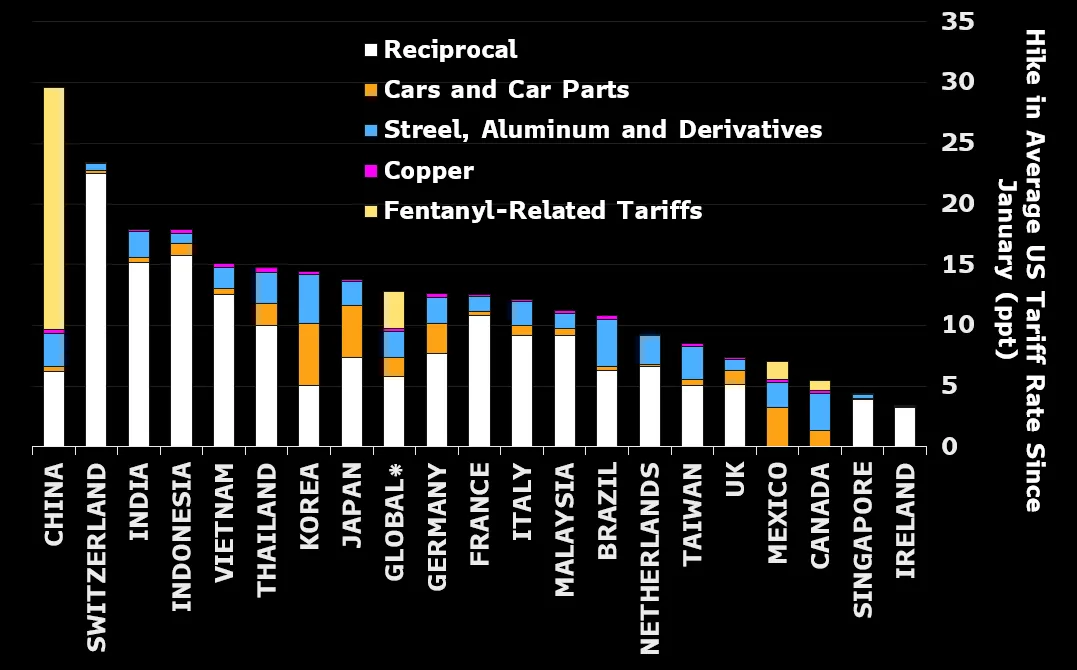

Minimum tariff of 10% on virtually every country not covered by a new “deal,” with 15% or higher levies on goods from most major trading partners—EU, South Korea, Japan, and more. For some, the rates soar: 20% for Taiwan and Vietnam, 25% for India, 35% on imports from Canada, up to 41% for Switzerland and Syria, and a whopping 40% for anything the government thinks was “transshipped” to dodge tariffs 12345.

-

Exemptions? Not many. Mexico gets a 90-day stay of execution on a 25% tariff (after a frantic last-minute call with President Sheinbaum). China remains under an expiring exemption—potentially just two weeks from joining the big-tariff club 134.

-

Justification? Trump claims this “reciprocal” tariff blitz—on 70 countries and counting—will narrow trade deficits and fund new rounds of U.S. tax cuts, infrastructure, and so on. What’s actually happening is more like global economic whiplash than any kind of strategic plan.

-

-

The Immediate Impact: Sense and Nonsense

-

-

-

Averaging 15%—Six Times Higher Than a Year Ago: The world now faces the highest average U.S. tariffs since the 1930s. That’s not a typo. Six times higher than pre-Trump norms—the economic equivalent of acid rain for international trade flows 6.

-

Front-Loading & Stockpiling: For weeks, exporters around the world (especially in Asia) have been rushing goods to U.S. ports before rates spike—shielding U.S. consumers from the immediate pain, but setting up a cliff just ahead as inventories dry up and price hikes roll through shelves 6.

-

Delayed Global Shock: Markets, for now, are only starting to process this. If you wonder why your stocks are falling, check the news: global supply lines, input costs, and profit margins just got nuked across dozens of industries. As usual, it’s the consumers who will pay 64.

-

-

The Absurdity: “Reciprocity” or Retribution?

Imagine paying 10% or 15% extra just because of your passport—or 40% because some Customs Agent decides your sneakers “smell suspiciously Vietnamese.” If you squint, it’s about “fairness.” But, as always, it’s U.S. importers—not foreign exporters—who cough up at the border 4. Surprise: those costs get passed right on to American consumers.

And don’t get cozy if your country “cut a deal.” The “deal” rates (like 15% for Europe, South Korea, and Japan) are higher than yesterday’s baseline, and many “negotiated” partners still face hikes on select categories or are being threatened with more if Trump wakes up grumpy 13.

Which Countries and Sectors Take the Biggest Hit?

-

-

-

Canada: Now faces 35% tariffs (unless exempted under USMCA for specific goods)—the most draconian rate in modern U.S.-Canada trade history. Canadian officials called it “outright economic sabotage” 785.

-

India, Taiwan, Vietnam, Switzerland, and many Southeast Asians: See double-digit to 41% rates.

-

Transshipped Goods: If Customs decides anything tried to “sneak in by way of Belgium or Mexico,” slap on another 40% penalty 349.

-

-

Market Reaction (and Non-Reaction)

Shockingly? The sell-off in U.S. stocks had already begun—this is the reality the market could not ignore forever. Overseas, currencies, especially the Canadian dollar and Asian FX, took heavy hits, and equity markets in tariff-targeted nations (KOSPI, Nikkei, FTSE) are reeling 71011.

So, can I make sense of this? No. No one can—because it’s not really about economic sense. It’s about showmanship, brinkmanship, headline wins, and shifting pain from the Treasury to household budgets everywhere. The only sure thing is that, after today, the global economy just got a lot smaller and a lot more expensive—and it’s the U.S. consumer who will foot the bill.

Now, back to our regularly scheduled programming: volatility, uncertainty, and, yep, another “Fallback Friday” just as forecast. Welcome to the new tariff era, same as the old—just with bigger numbers and tinier logic.

Hey, wait a minute – I have more to say! Boaty’s doing a premature mike-drop but, after reading his electronic rant – I’d say he deserves it…

We’ve been (painfully) holding off on investing all month – KNOWING this day was coming and marveling at the INSANE COMPLACENCY of other investors, who have been paying 30-40x and more for high-flying leaders.

Last night, as I warned would happen, we saw a crack in the Magnificent 7 as Amazon (AMZN) fell 7% on an earnings BEAT, due to less than spectacular guidance. Just yesterday, Boaty and I discussed “Tech’s Money Merry-Go-Round” – which was also discussed in last night’s PSW Podcast.

Amazon is projecting weaker-than-expected Operating Income and is trailing the sales growth of its cloud rivals, leaving Investors searching for signs that the company’s huge investments in artificial intelligence are paying off. Still, Operating Profit will be “$15.5Bn to $20.5Bn” (too wide!) in the period ending in September, compared with an average estimate of $19.4Bn by analysts following the stock for a living (sad).

Sales are actually guided UP ($174Bn to $179Bn – for the QUARTER!) but Capital Expenditures are $31.4Bn and that is UP 90% from last year’s Q2 as the AI race gobbles up profits as quickly as they are printed. As I’ve noted before, this is quite the Tower of Babel we’re all building – I hope it ends better the second time…

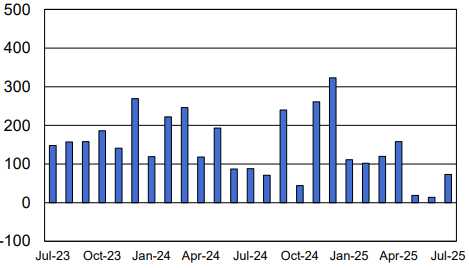

8:30 Update: We usually title these Non-Farm Friday Reports as “Is America Working” and, this morning, the answer is NO, IT IS NOT!!! Not with only 73,000 jobs completed AND June job creations have been slashed 90%, from 147,000 to just 14,000 jobs created and May was also cut back by about 60,000 jobs. As I have been saying for a while THE DATA IS BULLSHIT!!!

To be VERY CLEAR, the official NFP chart we’ve been shown while Trump tried to push through his Big, Beautiful Bill was this:

But, in reality – it’s been this:

As with Trump’s first term, job creation is very close to going NEGATIVE – and this time he can’t blame it on Covid – but he WILL blame it on Powell – as if HE were the one running around Washington with a chain saw. In fact, just yesterday (because there is so much F’ing “news‘ that you can’t even keep track of all the BS, Trump called on the Federal Reserve board to “assume control” if Chair Jerome Powell does not lower interest rates, escalating his ongoing feud with the Central Bank’s Head.

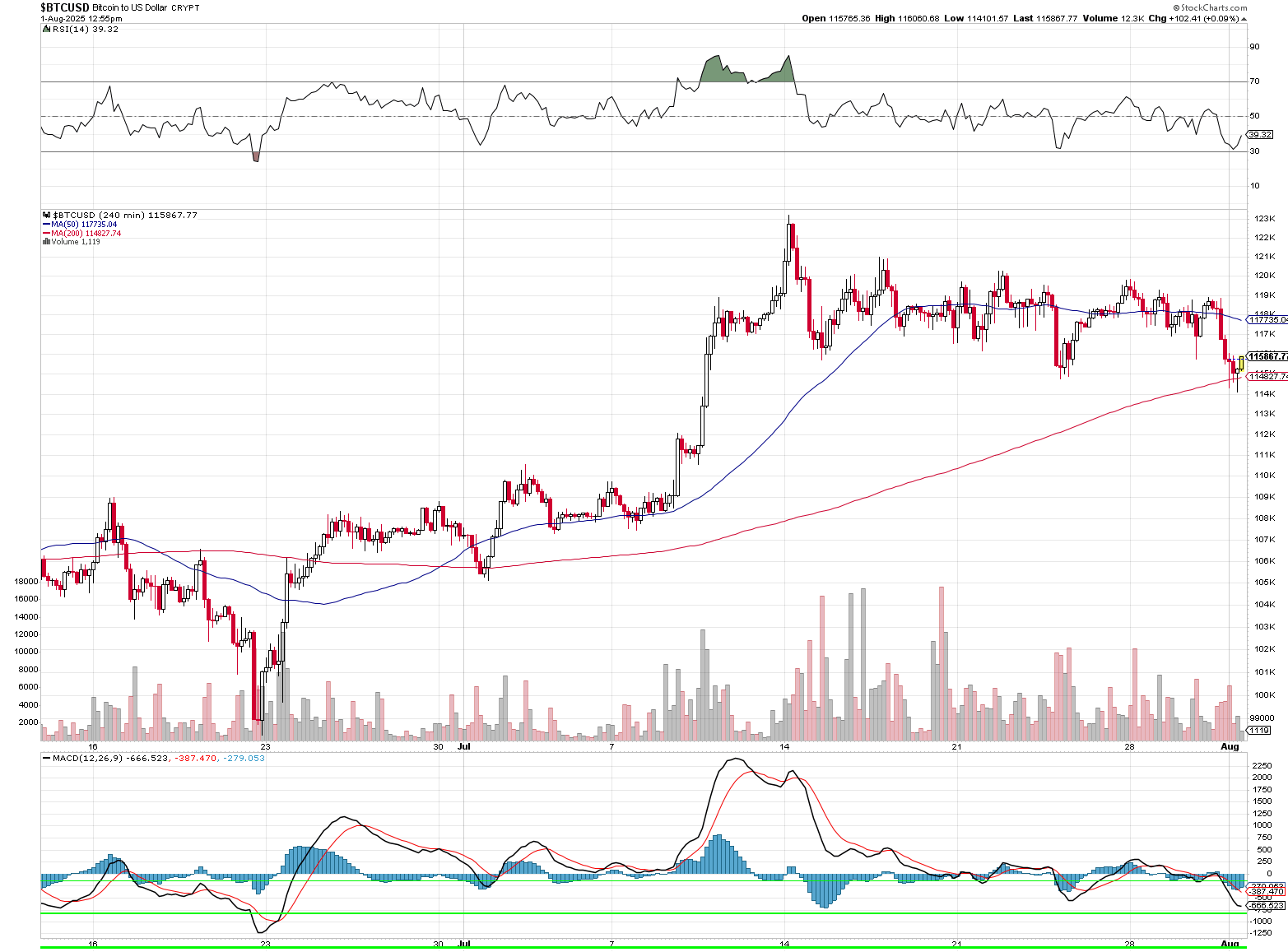

That plus the weak jobs report is what slammed the Dollar back from 100.25 yesterday to 99.03 this morning – down 1.25% in a day and that means the indexes would be 1.25% WORSE than they are now (down twice as much!) if the Dollar hadn’t rapidly devalued. And do you know what else Trump’s shennanigans saved? BITCOIN and his Crypto Coins – which were all plunging along with COIN’s market cap after earnings showed, despite the MASSIVE hype job – people are just not that into crypto.

I mean, what else could you possibly do to pump up crypto? In the past month alone, the Trump Administration has rolled out a 168-page White House Report calling for: Fast-track, pro-innovation crypto regulation; Special banking, custody, and investment exemptions; Congressional action to legitimize digital assets; Open encouragement for ALL federal agencies to position the U.S. as a “crypto capital of the world.”

The White House’s actions included direct bills to Congress and new directives to the SEC/CFTC to relax restrictions, just as Bitcoin and major altcoins badly needed a lifeline, which is very understandable as the MAJORITY of the President’s wealth is now tied up in the Crypto Scam…

The White House’s actions included direct bills to Congress and new directives to the SEC/CFTC to relax restrictions, just as Bitcoin and major altcoins badly needed a lifeline, which is very understandable as the MAJORITY of the President’s wealth is now tied up in the Crypto Scam…

Without this coordinated policy boost, crypto was setting up for an extended drop after weeks of speculative froth and post-earnings disappointment at Coinbase and other major platforms.

In the past month alone, the administration has: Pushed for legislation legalizing stablecoins and clarifying tax/reporting rules for crypto assets; Ended the most aggressive SEC campaign against crypto companies, replacing it with regulatory “safe harbors” for token issuers and exchanges and openly championed crypto as central to the “new American Golden Age” in OFFICIAL White House releases. EVERY time crypto markets have cracked – especially after regulatory or earnings shocks—policy “relief” has followed within HOURS, driving sharp reversals or lessened downside pressure.

Your Government has a new girlfriend, and it’s NOT the US Dollar!

Have a great weekend,

— Phil