Our last Watch List was published on June 4th.

Our last Watch List was published on June 4th.

It has PLENTY of great ideas but it did not include the stocks we had in our old portfolios, which we cashed out in mid-May to avoid... THIS! Now that the reality of Trump's Tariffs, Renewed Inflation and the Economic Slowdown are BEING (it's a process) priced into the market and now that we have the clarity of Q2 earnings and since we are still about 80% CASH!!! in our new portfolios - it's a fun time to start shopping again!

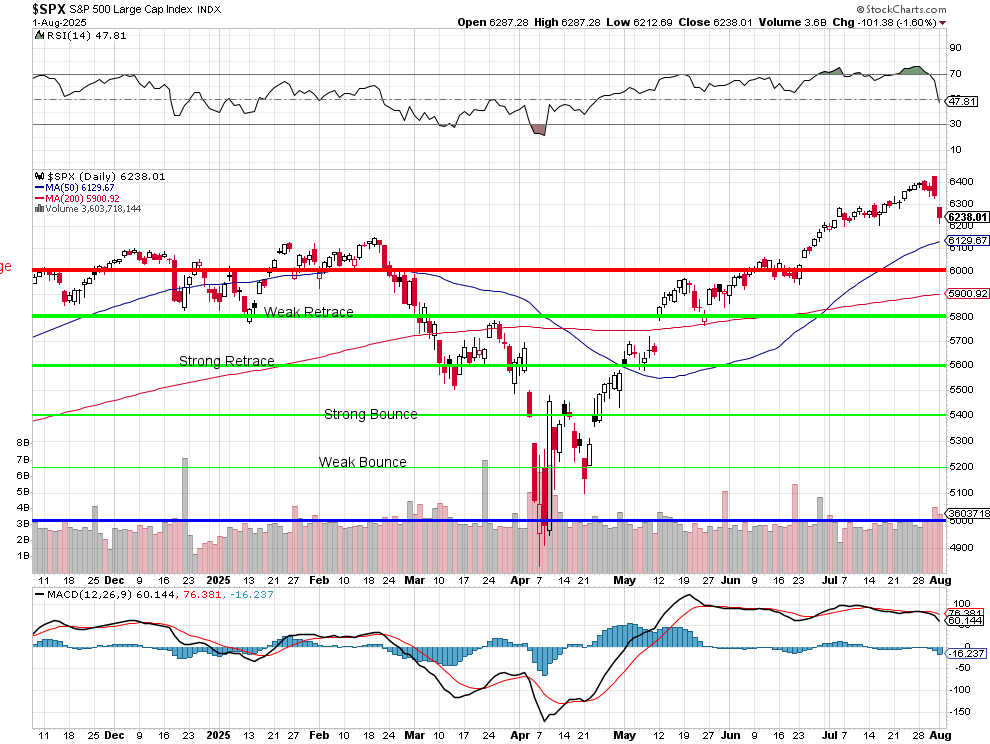

The S&P 500 was at 5,970 back on June 4th and now it's August 3rd and we're at 6,238 so up 268 points (4.4%) since we cashed out but it's not all about the S&P, it's about what bargains we can find in the individual stocks we care about - so let's see what's on sale.

One of the most critical trading skills, especially in markets like this, is knowing when your wins came from both skill and luck. Our 5% Rule™ and technical toolset gave us a decisive edge in the first half of the year, capturing the rangebound whipsaws and profitably timing several major turns. But let’s be real: the deft trade management only gets you so far when policy chaos and macro storm clouds keep rolling in. Luck played its part, and knowing when to take gains off the table is absolutely essential - especially with today’s level of uncertainty.

As we jump into the back half of 2025, that lesson is even more important. Markets are flying on narrative one day, plunging on policy the next, and the “certainty premium” has never been thinner. With Trump’s tariff regime resetting every global relationship, fiscal and monetary levers already maxed out, and risk assets priced as if all will be forgiven… this is the time for humility and discipline.