We need to talk about what happened yesterday at the White House—because calling it “trade policy” is like calling protection rackets “business consulting.”

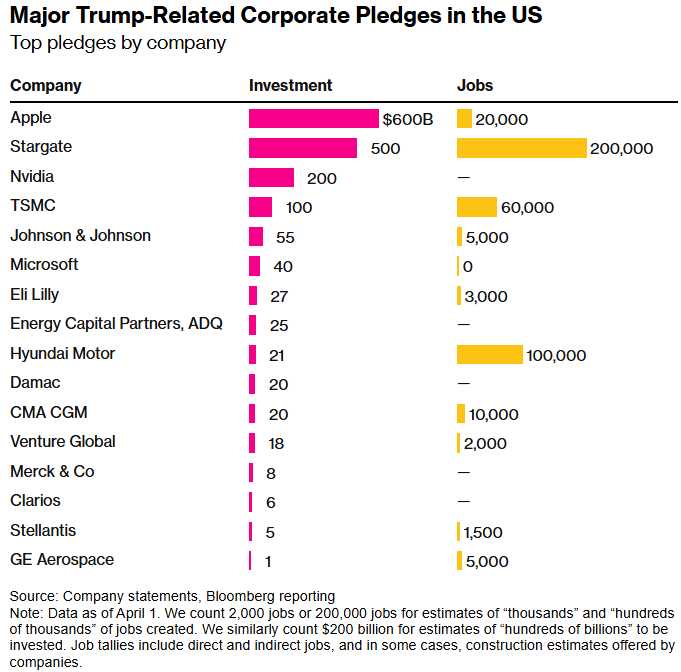

Trump announced a 100% tariff on semiconductor imports – potentially devastating for the $500Bn Global chip trade. But here’s the kicker: companies that pay tribute “invest significantly in US manufacturing” get exemptions! Apple’s Tim Cook showed up with a $100Bn offering, got his photo-op and Golden Exemption, and AAPL stock surged 5% ($160Bn) immediately.

TSMC, which makes chips for Apple and Nvidia, instantly announced they’re exempt too thanks to their Arizona investments. Samsung and SK Hynix? Also exempt—they’ve got Texas and Indiana plants. The pattern is crystal clear: Pay to play, or get crushed.

The Oligarch Playbook in Real Time

This isn’t complex economic policy—it’s a straightforward protection racket:

-

-

-

-

Step 1: Threaten devastating tariffs on entire industries

-

Step 2: Offer exemptions to companies that make sufficiently large “investments“

-

Step 3: Watch CEOs line up with billion-dollar tribute payments

-

Step 4: Collect political capital, favorable headlines, and corporate gratitude

-

-

-

The Philippines’ semiconductor industry (70% of their exports) faces “devastating” impact, per industry leaders. Malaysia scrambles for clarity. Japan’s chip equipment makers crater initially, then recover as they realize they’ll benefit from forced US production shifts.

Meanwhile, the companies with deep pockets get preferential treatment, competitors get crushed, and the market cheers because “smart money” is making bank.

Meanwhile, the companies with deep pockets get preferential treatment, competitors get crushed, and the market cheers because “smart money” is making bank.

Why This Should Terrify Every Investor

This isn’t capitalism, it’s crony capitalism on steroids:

-

-

Market Distortion: Winners and losers are now determined by White House access, not competitive advantage

-

Precedent Setting: Every industry now knows the price of doing business—and it’s measured in billions of “domestic investment“

-

Democratic Decay: When tariff exemptions are essentially purchased, we’ve crossed into territory where economic policy serves the highest bidder

-

The Russian oligarch comparison isn’t hyperbole: it’s a roadmap! Putin’s friends got state contracts, energy deals, and regulatory favors. Here, Trump’s “friends” get tariff exemptions, regulatory relief, and competitive moats. People seem to think this is all “fine” because they aren’t seeing the effects – YET! In reality, we are setting up the dominoes that will fall and CRUSH small businesses and workers in this country.

Market Reality Check

Market Reality Check

Short term: This works. AAPL up 5%, TSMC hitting records, exempted companies outperforming. The market loves clarity, even corrupt clarity.

Long term: This creates massive systemic risks:

-

-

-

Smaller competitors without billion-dollar tribute capacity get crushed

-

Innovation suffers when market success depends on political relationships

-

Regulatory capture becomes institutionalized policy

-

International retaliation becomes inevitable as trading partners realize they’re facing a protection racket, not a trade partner

-

-

For PSW Members, this creates both opportunities and dangers:

Opportunities:

-

-

-

Companies with significant US operations/investments (AAPL, TSMC, major industrials) have regulatory moats that are dug deeper than ever

-

Defense, infrastructure, and “America First” plays benefit from this crony system

-

Follow the money: Track which CEOs are making pilgrimages to Mar-a-Lago/White House for the next exemption announcements. Get a $1M membership to Mar-a-Lago so you can see who’s at dinner with the President and make your market bets the next morning!

-

-

Dangers:

-

-

-

Small-cap companies without political access face existential risks

-

International diversification becomes even more critical as US becomes less reliable trading partner

-

Systemic risk: When economic policy becomes purely transactional, unpredictability becomes the only constant

-

-

Markets are celebrating because oligarchy is profitable… for oligarchs. But history shows this ends one of two ways – either the system collapses under its own corruption, or it becomes so entrenched that economic freedom dies entirely.

For now, we will play the game. We will track the tribute payments, follow the exemptions, and profit from the Crony Capitalism while preparing for its inevitable consequences down the line.

The Democrats are polling below anthrax and that just makes this scarier because it means there’s NO political pressure to stop this slide into full oligarchy.