It’s a week that could define the rest of 2025. While futures tick modestly higher and the media celebrates another “record-breaking” run toward all-time highs, the smart money is quietly bracing for chaos. Why? Because underneath the market’s euphoric surface, we’re witnessing the systematic dismantling of the Global Economic Order – one tariff, one “revenue-sharing deal,” and one Constitutional VIOLATION at a time.

We’re at a classic inflection point: A moment when the market’s veneer of calm is hiding a tectonic shift that could turn this Sunday-night lull into a Monday morning maelstrom. As you lace up your mental combat boots, let’s take a look at this week’s Big Picture, because if history has taught us anything, it’s that the markets really don’t like surprises. And this week, the surprises are coming fast and furious…

The Protection Racket Goes Nuclear

Let’s start with the most disturbing headline you probably missed: Nvidia and AMD just agreed to pay the U.S. government 15% of their revenue from chip sales to China. Not profits – REVENUE! This isn’t trade policy; it’s digital-age racketeering with a Commerce Department stamp…

Former U.S. trade negotiator Stephen Olson put it perfectly: “We’ve entered into a new and dangerous world.” When the government can demand a cut of your sales just for the privilege of conducting business, you’re no longer operating in a free market—you’re operating in a protection racket.

But here’s where it gets interesting: the market initially loved it. Nvidia and AMD agreed to the tribute, their stocks held up, and investors cheered the “clarity.” Why? Because in an oligarchy, being on the inside is incredibly profitable—until you are suddenly not (but that will be tomorrow’s problem, right?).

Trade expert Deborah Elms warns that the arrangement “looks like an export tax, which is forbidden by the U.S. Constitution” but when has constitutional law ever stopped a determined autocrat? Trump has already threatened a “GREAT DEPRESSION” if courts rule his tariffs illegal. The message is clear: comply, or we’ll crash the economy.

Trade expert Deborah Elms warns that the arrangement “looks like an export tax, which is forbidden by the U.S. Constitution” but when has constitutional law ever stopped a determined autocrat? Trump has already threatened a “GREAT DEPRESSION” if courts rule his tariffs illegal. The message is clear: comply, or we’ll crash the economy.

Small Business Massacre in Progress

While Apple and Nvidia cut deals in the White House, 236,000 small U.S. businesses are getting crushed by an estimated $202Bn ANNUAL tariff hit. That’s $856,000 PER small firm PER year. These companies don’t have Billion-Dollar tribute budgets or direct lines to Mar-a-Lago. They just have to absorb the costs or die.

The National Retail Federation isn’t being subtle: “Small businesses especially are grappling with the ability to stay in business.” Yet somehow, the narrative remains that these tariffs are “pro-business” and “pro-American.”

Goldman Sachs’ data destroys that fiction: U.S. businesses have absorbed 64% of tariff costs so far, but that share will drop to under 10% as companies pass those costs along to US Consumers. By December, Consumers will shoulder 67% of the burden, pushing core Inflation to 3.2%, well above the Fed’s 2% target.

Tariffs are a massive tax on American families, disguised as economic nationalism.

Tuesday’s Inflation Reality Check

Speaking of inflation, Tuesday’s CPI Report could be the most important data release of the year. Economists expect July CPI to hit 2.8% year-over-year, with core inflation climbing to 3%, driven largely by tariff-induced price spikes in everything from furniture to automobiles – and these are just the early effects!

Here’s the Fed’s impossible situation: Inflation is rising due to policy choices, NOT Economic Fundamentals. How do you fight Policy-Driven Inflation with Monetary Policy? You can’t, which is why Powell and company are trapped between political pressure to cut rates and Economic Reality, which demands they hold rates steady.

The market is now pricing in 85% odds of a September rate cut but, if Tuesday’s CPI comes in hot, those bets could evaporate faster than a crypto rug pull. With Trump openly demanding rate cuts while simultaneously fueling inflation through tariffs, the Fed faces an unprecedented crisis of Independence.

And the market? It’s pricing in nearly 3 rate cuts in September – as if this is all a game… Meanwhile, Treasuries are volatile with yields swinging on rumors, fake data and the moon. Trust in the data is now out the window as well after the last BLS drama – not even two weeks ago! The real question isn’t just HOW Fed will act but whether they CAN act or if the entire system is now caught in a feedback loop of policy chaos.

The China Card Gets Played (again)

Adding another layer of chaos: the U.S.-China trade truce expires tomorrow. Although whispers suggest it may be extended – there’s nothing solid yet with 24 hours to go (less if you count morning in Beijing). Trump’s latest gambit? Demanding China quadruple its U.S. soybean purchases – a move China-based analysts are calling it “extremely improbable.”

But that’s not the point. The point is leverage and theater. China’s exports to Southeast Asia surged 16.6% in July while U.S. shipments plummeted 21.7% as manufacturers rushed to beat the tariff deadlines. The Global Supply Chain is already fragmenting and NOT TOWARD American shores, but away from America’s now-greedy reach entirely.

Meanwhile, China South City (one of the country’s largest builders by assets) just got LIQUIDATED by a Hong Kong court, and battery giant CATL shut down a major lithium mine in China, sending lithium prices soaring 19% overnight.

The ripple effects of the trade war are accelerating, not subsiding!

AI’s Creative Destruction Accelerates

While the oligarchs play tribute-politics, the AI revolution is quietly eviscerating entire industries. Bank of America tracks 26 companies “most at risk from AI“: Web Developers, Digital Imaging Firms, Service Businesses with high headcounts… and they have ALL underperformed the S&P 500 by 22 percentage points since May. At what point do you declare an EMERGENCY???

As Futurum Group CEO Daniel Newman notes: “We thought the disruption would happen over five years. It seems like it’s going to happen over two.” Yet somehow, the market keeps betting that AI will create more value than it destroys. History suggests otherwise…

Every transformative technology creates winners and losers. The winners get the headlines; the losers get Unemployment checks. With record numbers of fund managers now calling U.S. stocks “too expensive,” maybe it’s time to ask what happens when AI’s creative destruction meets a market that is already priced for perfection?

The Oligarchy Tax in Action

Step back to see the pattern:

-

-

Apple: Pays $600 billion tribute, gets tariff exemptions

-

TSMC: Builds Arizona plants, gets exemptions

-

Nvidia/AMD: Pay 15% revenue cuts, get to keep selling to China

-

Small businesses: Pay $856,000 annual tariff tax, get nothing

-

This isn’t Capitalism, it’s FEUDALISM with stock options! And the most terrifying part? It’s working! Markets are hitting records, mega-cap stocks are soaring and Bitcoin just crossed $121,000 as investors flee traditional stores of value for ANYTHING outside of the increasingly corrupt traditional system.

This isn’t Capitalism, it’s FEUDALISM with stock options! And the most terrifying part? It’s working! Markets are hitting records, mega-cap stocks are soaring and Bitcoin just crossed $121,000 as investors flee traditional stores of value for ANYTHING outside of the increasingly corrupt traditional system.

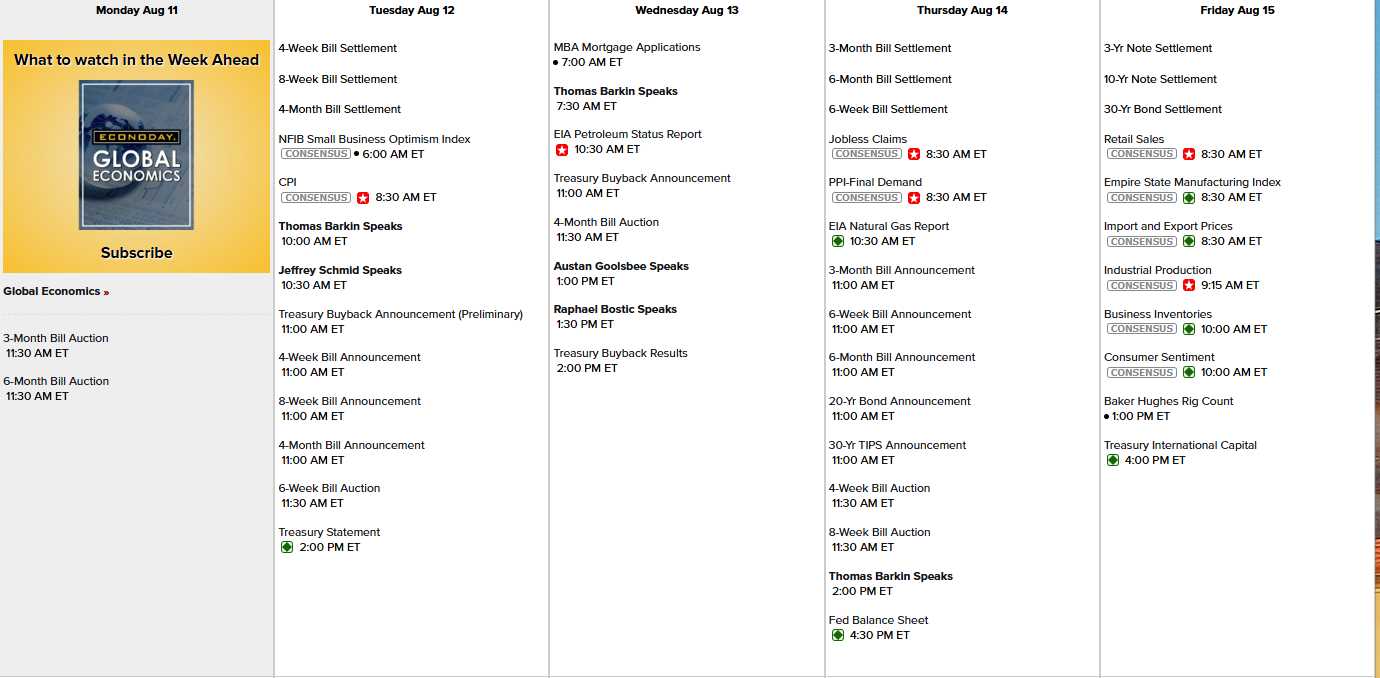

What We Will Be Watching This Week:

Forget the noise. Here’s what matters:

-

- Tuesday, 8:30 AM: July CPI data. If it comes in hot (3%+ core), rate cut dreams die and the market’s “Fed put” disappears.

- Tuesday, all day: China trade truce deadline. Extension = temporary relief; expiration = immediate supply chain chaos.

- Wednesday-Friday: How small businesses react to their first full month under the new tariff regime. Bankruptcies? Price hikes? Supply disruptions?

- All week: Which CEO makes the next pilgrimage to Washington with a billion-dollar tribute check.

We’re witnessing the real-time transformation of American Capitalism into something unrecognizably Authoritarian. When trade policy becomes a protection racket, when Constitutional Law gets ignored for political convenience and when market success depends more on White House Access than Business Fundamentals – you are NOT investing in a free market – you are gambling on the whims of Autocrats!

The market may celebrate this chaos for now, but history has a harsh lesson: Systems built on corruption and arbitrary power don’t create lasting prosperity… They create spectacular collapses. Try to stay nimble, stay skeptical, and remember: In an Oligarchy, there are no permanent allies – only temporary conveniences.

Markets are near all-time highs, yet the ground is quaking underneath: tariffs biting the cost of everything, central banks jammed between inflation and recession, geopolitical tensions simmering, and the Fed’s policy tools as useful as a screen door on a submarine.

Meanwhile, the government—by attacking gold, taxing chip sales, and trying to “own” the supply chain—has embarked on a reckless, volatile course that risks collapsing the very system that has, for a century, fostered confidence.

The prudent investor’s best approach? Steady, skeptical, and prepared to pounce when the chaos reveals the real winners—and the fake ones.

Our Strategy: Patience! WAIT for a correction, verify the data, and remember: The markets don’t care about your political views – only where the real money flows when the bottom falls out!