Time flies when you're watching markets defy gravity.

Time flies when you're watching markets defy gravity.

It's been a wild month since our July Portfolio Review, and what a difference 30 days can make. Back then, we were worried about market tops, tariff deadlines, and Q2 earnings. Now? We're dealing with 100% semiconductor tariffs, revenue-sharing protection rackets with Nvidia and AMD, gold import duties(yes, they're actually taxing money now) and Inflation that's stubbornly refusing to cooperate with Trump and the Fed's Dovish Dreams.

We are only two months into our brand-new $500,000 Long-Term Portfolio (LTP) and our $200,000 Short-Term Portfolio (STP) after cashing out our previous portfolios at about $7M in May and we are STILL sitting on 80% CASH!!!, which is looking smarter and smarter as earnings season progresses.

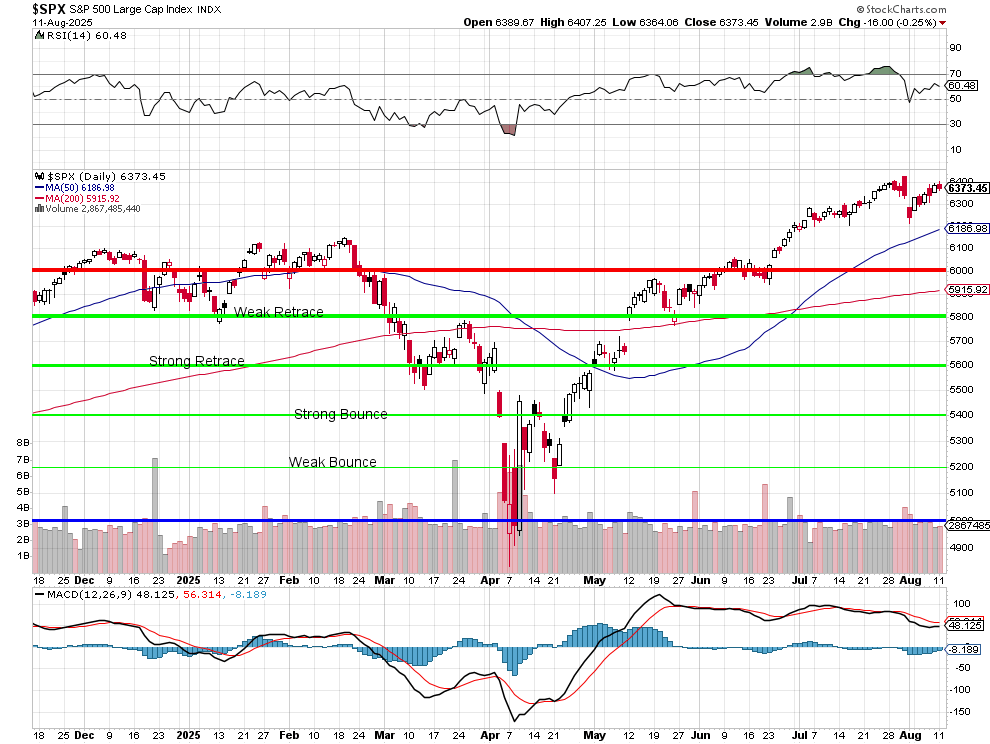

Since July 15th, the S&P 500 has climbed 105 points: from 6,268 to 6,373 (1.6%) but RSI has fallen from a stressed 68.74 to a more neutral 60.48 after taking a dip to 50 at the end of July. The VIX has remained suspiciously calm at around 17 – the kind of complacency that usually precedes "interesting times." As usual (these days), the Magnificent Tech Sector and their Bankers are having THE BEST time - while the rest of the market struggles.

What has really changed is the oligarchy has gone fully operational. We're no longer dealing with traditional trade policy – we're watching the Systematic Monetization of Governmental Power. This is not smaller Government, this is Bigger Brother! Apple pays $600 Billion in tribute and gets tariff exemptions. Nvidia and AMD fork over 15% of their China revenue to the Treasury and can now sell China the chips that were banned for "NATIONAL SECURITY MEASURES." Small businesses? They get to pay an average of $856,000 per year in tariff taxes with zero recourse.