“What a drag it is getting old!” – Stones

When the market needs a lift there’s nothing more supportive to the Dow than UNH and Buffett – who owns A LOT of stocks – just boosted the crap out of the market by disclosing Berkshire (BRK.B) has picked up 5M shares of United Health Care last quarter and that has sent the Dow component up 11% pre-market, which is $30 and 255 Dow points.

And you are thinking: “Well, of course – if Warren Buffet is buying UNH they must be turning around” but nooooooooooooooooooo! There is no evidence of that, their last quarter was a DISASTER and it sent the stock down to $225 and now it’s back to $300 but, you know what? Buffett bought that stock BEFORE June 30th he likely paid MUCH more than $300 per share so people are chasing into Buffett’s LOSS – not gain!

Full disclosure, I WANTED to buy UNH but, being a rational person, I decided it was too risky – especially with Trump threatening taxes on Pharma imports, which UNH would have to cover faster than the can raise their rates – again. Then there’s the overhanging investigations into their billing practices – still unresolved but MAYBE Buffett was at a meeting where UNH gave Trump a gold watch (inscribed with a Swiss Bank account number) to assure their future?

Here’s what actually happened to UNH in Q2:

-

- Net earnings down 6.3% year-over-year to $6.3 billion

- Medical care payout ratio deteriorated to 84.9% from 83.1% (more payouts = less profits)

- Guidance cut for medical care ratio outlook

- Cyberattack costs still bleeding money from February’s Change Healthcare breach

- Medicare Advantage margins getting crushed by higher utilization

But wait, there’s more! UNH’s operating cash flow fell 29% to $6.2 billion, and they’re facing MASSIVE regulatory scrutiny for their claims denial practices. The stock got hammered because the Fundamentals are deteriorating, not improving.

So why is everyone celebrating Buffett buying into this mess? Because the market has completely divorced from rational analysis and moved into pure hero worship. The Oracle of Omaha coughs, and $50Bn in market cap appears out of thin air – what a magic trick!

Welcome to 2025, where following elderly billionaires into their mistakes has become the dominant investment strategy…

Also worth noting: Berkshire’s 5 million shares represent just a 0.53% position in UNH – barely a rounding error in their portfolio. But the algos don’t care about context – they see “Buffett buys” and immediately add 255 points to the Dow, which then drags in countless Billions of 401K, IRA and ETF money to boost everything else while the Big Boys (like Buffett) head for the exits.

The Saudis are, of course, one of those Big Boys with their $1Tn (1,000Bn) Sovereign Wealth Fund – that’s why Trump loves to hold the King’s balls….

The Saudis are, of course, one of those Big Boys with their $1Tn (1,000Bn) Sovereign Wealth Fund – that’s why Trump loves to hold the King’s balls….

The Saudi Fund has been pulling out of positions (what?) in major firms like SHOP, PYPL, BABA, NU, FDX and, gasp!, META! Not a little out but ALL THE WAY OUT (what?) and this was, of course, a real disappointment to the President (what?), who was hoping the King would continue (investing!).

🚢 And the Saudis aren’t the only giants running for the exits:

-

-

-

-

Norway’s $2 Trillion Sovereign Wealth Fund—the biggest in the world, famously run by Nicolai Tangen—has repeatedly warned investors about U.S. tech stock risk, held $173 billion in the Mag 7 as of Q1, and told its own investors to start selling down U.S. tech in January. When you see the calm Norwegians selling, it’s never for “just portfolio rebalancing”—it’s a macro call in slow motion.

-

Q2 disclosure bombshell: The Saudi PIF wasn’t alone. They and Norway both dumped Mag 7 positions: Meta, Microsoft, Alibaba, Shopify, PayPal, Visa, Nu, FedEx—all gone. In some cases, these weren’t trims—they were full liquidations.

-

Systematic investors and global pension funds are rebalancing away from mega-cap tech dominance as concentration risk grows. According to Invesco, 52% of institutional investors have shifted some capital from Growth/Momentum back into Value—including reducing Mag 7 exposure after the run-up.

-

Hedge fund moves: Several marquee U.S. hedge funds—the ones who led the ARKK/Mag 7 momentum charge—have trimmed Apple, Amazon, and even Nvidia stakes, citing “bubble risk” and “policy uncertainty.” Word on the Street is that even Tiger cubs think chasing AI at +30x revenue is a bridge too far.

-

The backdrop? The “Long Magnificent 7” is—again—the world’s most crowded trade, according to Bank of America’s latest global fund manager survey, which means when the exits get crowded, everyone runs at once.

-

-

-

The take-home:

The smart, patient, globally connected money isn’t just “lightening up”—it’s signaling a profound lack of faith in both U.S. mega-cap tech valuations and the policy/political landscape. If you’re looking for a definition of “weak hand flush,” seeing both Riyadh and Oslo heading for the lifeboats sends the clearest signal you’ll get…until the selloff actually hits Main Street portfolios.

Buffett’s “support” is a signal not of health but of desperation. Buyers are on the edge of a heavily inflated, increasingly fragile bubble. The Saudi’s sell-off is more than Dollar and Petro flows – it’s a warning that the old regime is leaving the game before the house of cards topples under it’s own weight.

Buffett didn’t just buy 5M shares of UNH – he ADDED 5M shares to the 30M he already owned and today’s well-timed $30 pop based on Buffett’s announcement made BUFFETT 1 BILLION DOLLARS – not a bad morning’s work, right? But if YOU didn’t ALREADY have shares of UNH – all you are doing by buying today is donating to Buffett’s Po Boy Billionaire’s Club – and he thanks you, very much…

Buffett didn’t just buy 5M shares of UNH – he ADDED 5M shares to the 30M he already owned and today’s well-timed $30 pop based on Buffett’s announcement made BUFFETT 1 BILLION DOLLARS – not a bad morning’s work, right? But if YOU didn’t ALREADY have shares of UNH – all you are doing by buying today is donating to Buffett’s Po Boy Billionaire’s Club – and he thanks you, very much…

Speaking of things no one is buying: AMAT (who we have in our Money Talk Portfolio), is down 12.5% this morning after beating earnings (non-GAAP) but guidance was lacking due to a “combination of weak demand from China, macroeconomic and tariff-related uncertainty, and lumpy sales to leading-edge customers.” The CFO and CEO both flagged a revenue decline driven by customers “digesting capacity” in China and unpredictable fab schedules, made worse by new export-license restrictions and tariffs.

We bet them to be below $200 into September and played AMAT for income, not gains – but this is still disappointing. We’ll have to take a close look at them after the Downgrade Police have at them and see how badly they get beaten up.

Speaking of beaten up, we have our early morning data and I’ve asked Boaty to round it up for us:

🚢 Freaky Friday Macro Check: “Not Dead Yet, But That’s About It”

Retail Sales: “House of Cards, Still Stacked“

-

-

-

-

-

Headline Retail Sales up 0.5% (vs. 0.4% forecast)—a beat, but this follows a big downward revision to June (+0.9% → +0.6%).

-

Core Retail Sales (ex-auto) +0.3% (in line with consensus), but last month also revised sharply downward (+0.8% → +0.5%).

-

-

-

-

Translation: Yes, Americans are still shopping—aided by credit expansion, buy-now-pay-later, and willful denial of rising costs—but almost all the “beats” disappear when you factor in revisions. Remember, what matters to markets isn’t just the latest number, it’s the revision trend—and that’s pointing down.

Empire State Manufacturing: “Against All Odds, a Pop of Strength”

-

-

-

-

-

Surged to 11.9 (vs. 1.0 expected, 0.0 prior)—a big, positive surprise, marking the highest reading since early 2022.

-

This index is notoriously volatile, but a move comfortably above zero signals expansion in New York’s manufacturing sector. It suggests renewed optimism, likely from a jump in new orders or a release of pent-up demand.

-

Caveat: Month-to-month swings can be dramatic—and one strong print doesn’t erase months of weakness—but this is definitely a welcome shock for an industry many assumed was flatlining.

-

-

-

-

Translation: For this month, at least, the story out of the Empire State is growth, not contraction—a rare bright spot amid otherwise wobbly macro data.

Import/Export Prices: “The Tariff Whisper”

-

-

-

-

-

Import prices up 0.4% (first significant rise in months, mostly ex-oil), export prices +0.1%.

-

Yes, tariff pressure is now not just a talking point—it’s showing up at the border, adding upward price momentum just as producer (PPI) and consumer (CPI) inflations are already running hot.

-

-

-

-

Retail is not dead, but it is on life support. Decent headline numbers but downward revisions everywhere. The Consumer is still keeping the party going (for now), but only by dipping ever deeper into debt and, as we noted yesterday, DEFAULT!

Inflation is at the gates, Import Prices are rising – even before the full force of the August tariffs begin to take effect. Consumer Sentiment and Business Inventories (10am) are not likely to improve things – we’ll check on those in our Live Member Chat Room (join us here). I am pretty sure, however that Consumers are glum and Businesses are not restocking, which is a recipe for a hard landing is ANYTHING goes wrong (Trump/Putin, Fed Cuts, Inflation…).

The stage is once again set for volatility. “Better than feared” beats won’t be enough if every month gets revised lower and Cost Pressures keep building. With Global Capital needed to keep U.S. borrowing on life support, even a small sentiment wobble abroad could hit us very hard at home.

It’s not a disaster, YET, but it LOOKS like Stagflation in slow motion! Retail limp, Manufacturing still struggling, Pricing Pressures are building, Consumer Sentiment is trapped at Recessionary lows. Markets might cheer headline numbers but the real message from the data is, “Don’t get comfortable!”

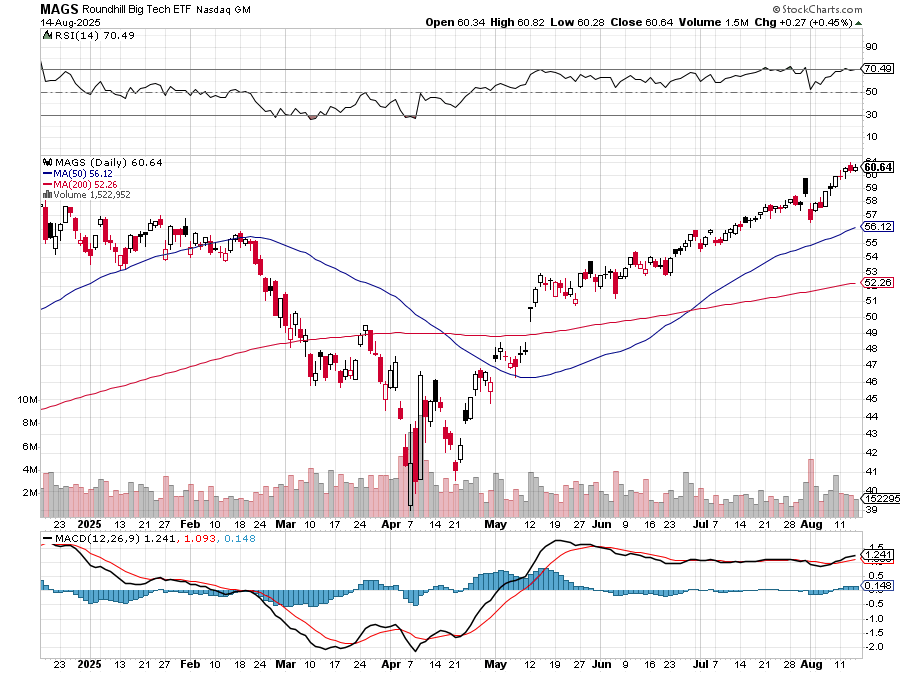

And in the background, the only clear trend remains: the bigger the illusion of support, the more desperate the fall. Stay wary because “getting old” in this market is not a cause for celebration but a sign of how far from reality we’ve drifted. The next breakdown could be right around the corner:

Have a great weekend,

– – Phil