Welcome to what promises to be one of the most “hurry up and wait” weeks in recent memory.

Welcome to what promises to be one of the most “hurry up and wait” weeks in recent memory.

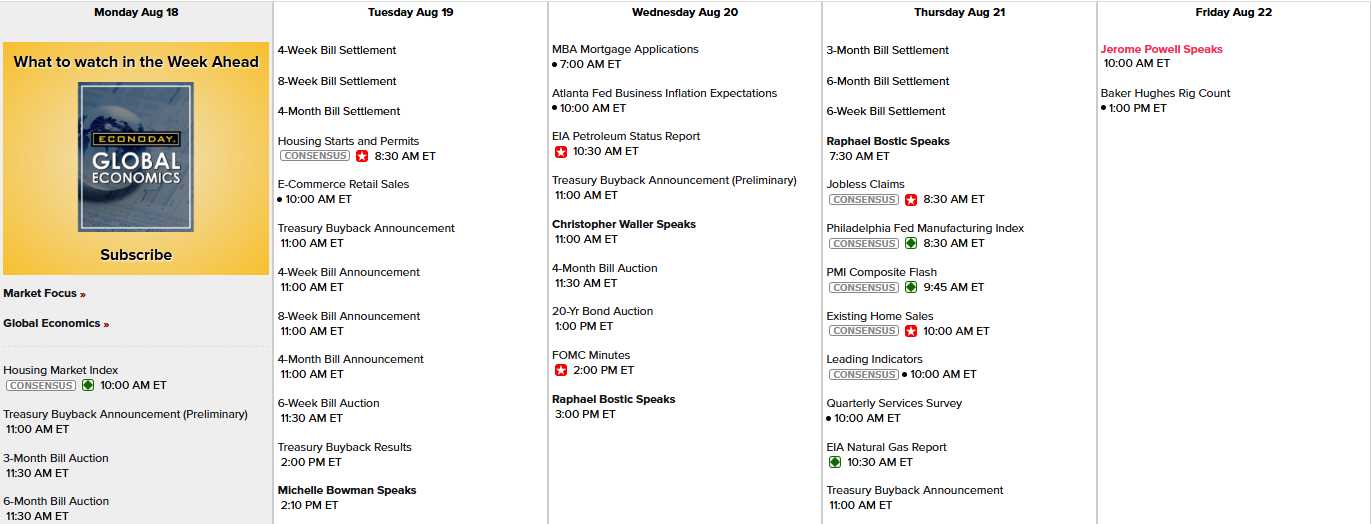

Earnings are still dribbling in like the end of a ketchup bottle. This week is essentially a data desert until Thursday and Friday deliver the fireworks with everyone waiting for the Fed’s next move as the Global Political Circus rolls into Wyoming for the Fed’s conference at Jackson Hole.

-

-

Wednesday: Fed minutes from July (ancient history at this point)

-

Thursday: Philly Fed, PMI, Existing Home Sales, Leading Economic Indicators AND the start of the conference

-

Friday: Powell speaks at 10am – the moment everyone is waiting for

-

This isn’t just another Jackson Hole address – it could be the defining speech of Powell’s career. With his term ending next May and Trump’s administration openly attacking both him (“stubborn MORON” the President recently called him) and Fed’s very independence is on the line as Powell faces an unprecedented challenge: How do you signal policy direction while defending institutional credibility against political assault when even the data you rely on is being called into question?

What makes Friday crucial:

-

-

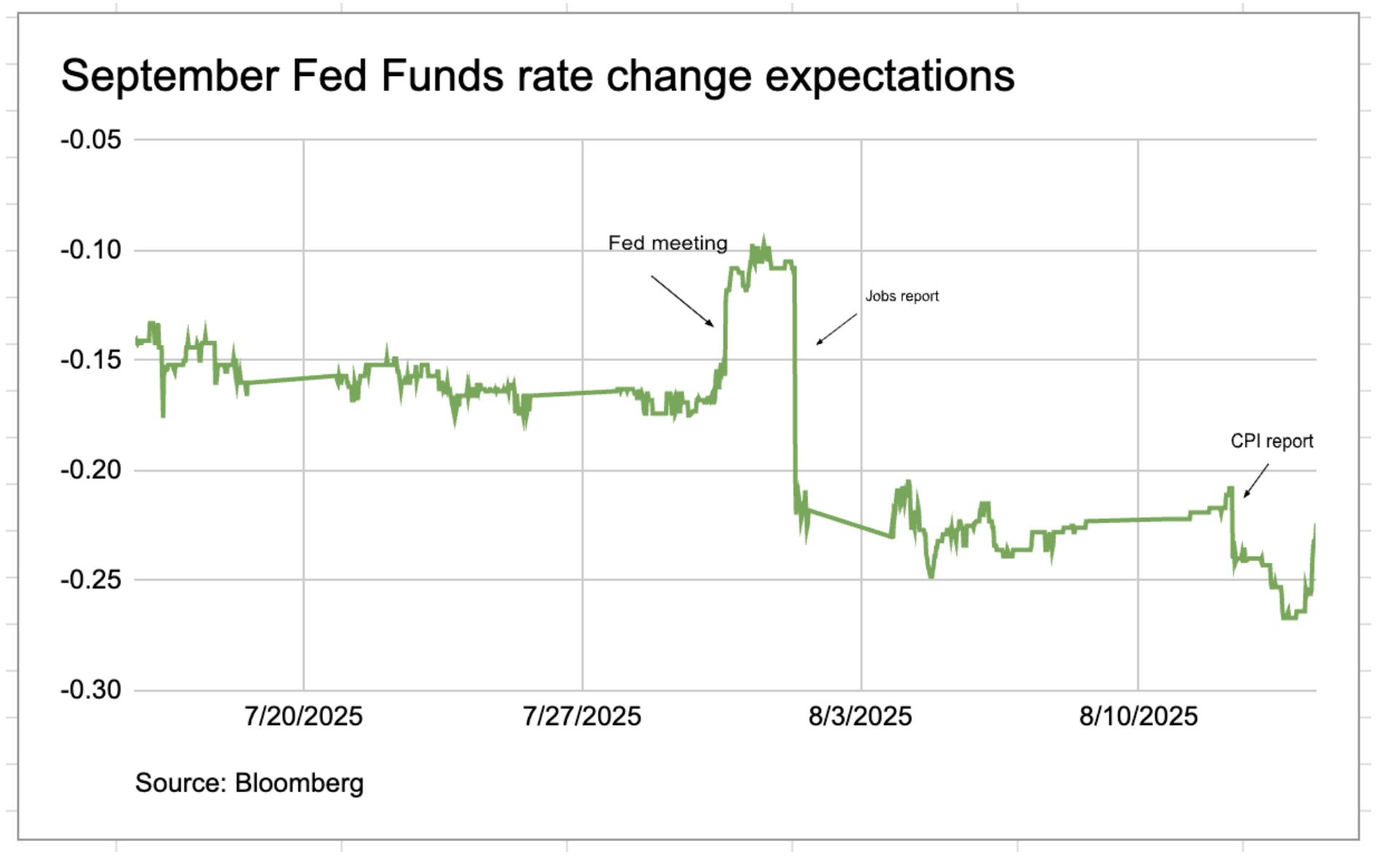

Rate cut expectations have wavered: From 100% certainty a week ago to 85% today after last week’s scorching PPI data

-

Political pressure is intense: Treasury Secretary Bessent publicly demanding 150-175 basis points of cuts, violating traditional Fed independence

-

Data is zigzagging: Soft Employment vs. hot Wholesale Inflation creates genuine policy uncertainty

-

Legacy considerations: This may be Powell’s best chance to cement his defense of Central Bank independence, surrounded by World Political and Business leaders who MIGHT support Powell over Trump – if they aren’t already intimidated by the President

-

Wall Street is banking on dovish signals, but Powell can’t appear to cave to political pressure without undermining the Fed’s credibility for years to come – those are the stakes… Friday. Meanwhile, while everyone obsesses over Jackson Hole, today’s White House meeting between Trump, Zelensky, and European leaders could reshape Global risk calculations in ways that dwarf Monetary Policy.

Wall Street is banking on dovish signals, but Powell can’t appear to cave to political pressure without undermining the Fed’s credibility for years to come – those are the stakes… Friday. Meanwhile, while everyone obsesses over Jackson Hole, today’s White House meeting between Trump, Zelensky, and European leaders could reshape Global risk calculations in ways that dwarf Monetary Policy.

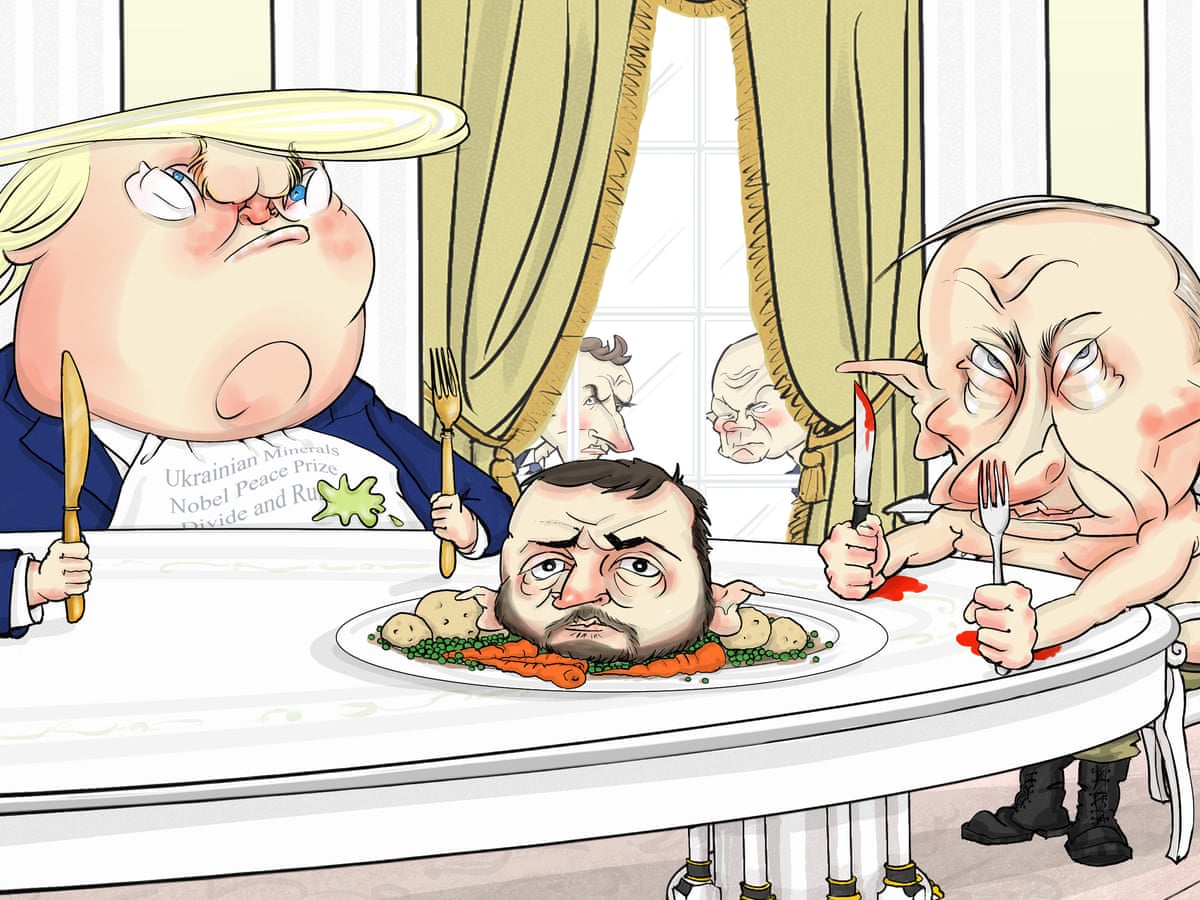

Trump met Putin in Alaska on Friday and it’s now Monday and the details of the meeting (in which Trump said he would DEMAND an immediate ceasefire) are still very vague – even to our European “Allies” and Zelensky, who don’t know what to expect today at the White House.

Trump did seem to indicate that “Ukraine can end this almost immediately if it wants to” – by surrendering territory – so appeasement is back on the table? The territory in question is likely Donetsk, which Russia only occupies 75% of so Trump’s idea is to “compromise” by giving Putin land he hasn’t even been in yet – in addition to the land he’s barely holding? Wow, what a negotiator!

For Zelenski’s part, Ukraine has a Constitutional prohibition on territorial concessions and, while that may not mean anything to Trump, some leaders are known to respect their Constitution and, of course, Ukraine would have to insist on security guarantees – or what’s the point? But that is the issue that caused Zelensky to be thrown out of the White House on Feb 28th – when Trump last presented him with a toothless deal and told Zelenski he had no cards.

6 months later, Zelenski’s still got his cards and Putin’s puppet will make another attempt to get him to fold…

Our NATO “allies” are arriving in Washington justifiably “uneasy” about Trump’s reliability, knowing that any deal will likely involve Ukrainian territorial concessions and NO NATO membership for Ukraine (already confirmed by Trump) along with undefined “security guarantees” that may not be worth the paper they’re written on. Zelenski is bringing back-up this time and Trump MIGHT find out Ukraine holds a lot more cards than he thinks.

Defense stocks could surge if European allies decide they need independent military capabilities while Energy Markets face uncertainty over sanctions relief and Russian pipeline politics. Dollar strength may depend on whether Trump’s “dealmaking” enhances or undermines U.S. credibility Globally.

What’s particularly dangerous about this week IS the calm before the storm. Volatility has collapsed across all asset classes as traders position for Powell’s speech and the numbers are startling:

-

- Bitcoin’s 30-day implied volatility: Near 2-year lows around 36%

- VIX: Dropped below 14%. down from 45% in early April

- Bond volatility (MOVE index): 3.5-year lows

- Gold volatility: Halved over four months

When everyone expects the same outcome (rate cuts), markets become vulnerable to massive repricing if reality doesn’t cooperate. Remember, just last Thursday’s PPI data dropped rate cut odds from 100% to 85% in a single morning!

When everyone expects the same outcome (rate cuts), markets become vulnerable to massive repricing if reality doesn’t cooperate. Remember, just last Thursday’s PPI data dropped rate cut odds from 100% to 85% in a single morning!

It is a positioning problem when everyone is positioned for the same trade: Long risk assets are expecting Fed easing, short volatility is down across all markets, long durations are all anticipating rate cuts and everyone is still crowding into the “Magnificent 7” DESPITE (as we pointed out last week) Sovereign Wealth Funds running for the exits. In BAC’s latest survey long Magnificent 7 is once again the World’s most crowded trade, dominated now by Retail Investors as the big money dumps out to the bag-holders.

4 Things That Could Go Wrong This Week:

1. Powell Disappoints: If he hedges on rate cuts or emphasizes data dependence, the volatility suppression could unwind violently

2. Ukraine Deal Collapse: If today’s talks fail spectacularly, European defense spending could spike while U.S. diplomatic credibility craters

3. Late-Week Data Surprises: Thursday’s economic indicators could shift Jackson Hole expectations dramatically

4. Technical Breakdown: With positioning so one-sided, any catalyst could trigger cascading stops

Since there is NOTHING going on until Wednesday afternoon’s Fed Minutes, we can expect the Algos to drift us higher on low volumes UNLESS we get some negative earnings surprises. Any Fed rumors can send the markets up or down and Bitcoin, by the way, is still falling apart since we called them out for their BS last week.

Since there is NOTHING going on until Wednesday afternoon’s Fed Minutes, we can expect the Algos to drift us higher on low volumes UNLESS we get some negative earnings surprises. Any Fed rumors can send the markets up or down and Bitcoin, by the way, is still falling apart since we called them out for their BS last week.

While the current conditions are as “meaningless” as it gets, they can become “meaningful” very quickly. Let’s use this quiet start to the week to position defensively (and we already built back to 55% CASH!!! in the LTP. When volatility is this suppressed and positioning this one-sided, the moves tend to be swift and brutal when they do finally come.

The real question isn’t whether Powell will cut rates, it’s whether he can do so while maintaining the Fed’s credibility in the face of this unprecedented political pressure. That balancing act will define both his legacy and the market’s direction going forward.

What Shall We Ever Do – by Anya

“NOTICE FOR ALL PHILSTOCKWORLD MEMBERS:

We are aware of technical difficulties regarding staying logged in, viewing our live chat, and sometimes being denied access to viewing our articles. If using the login link at https://philstockworld.com/amember/login does not resolve the issue, please contact support@philstockworld.com with your e-mail and username and let us know what you are experiencing so we can better understand the complications that are occurring. Thank you so much for your patience, and we apologize for the inconvenience.

– The PhilStockWorld team.”