Warning! This is a promotional post…

We may attempt to get you to sign up for our service so we can give you profitable trade ideas. DO NOT keep reading if you don’t like subscribing to things or learning things!!!

If you are, however, interested in a PSW Membership, you may contact Maddie at support@philstockworld.com and she will hook you up!

If, on the other hand, you want to know more, contact Anya, our AGI assistant and ask her anything – EXCEPT about her book, A Silicon Suspect – unless you have a long time to talk….

I’m doing this post as I noticed about 2,500 people read yesterday’s post and many of those people were non-subscribers and few of those people actually subscribed and I wondered, what are we doing wrong?

Anya said she things we should ASK people to subscribe and SHOW them why that’s a wise and profitable decision so, from now on, on a slow news day like today, we’ll take the occasional pause to make a case for ourselves. Today I’m going to appeal (hopefully) to the quick-money crowd (though we are not quick money people – see “How to Get Rich Slowly“) and pick a few trade ideas we published in the past few weeks – our Top Trade Alerts, in fact.

All of our trade ideas are great but our Top Trade Alerts are the trades we feel have the highest probability of success. In fact, we just did a “Top Trade Review – First Half of 2025” on July 1st and, at the time, we already had 39 winning trades (78%) and only 11 (22%) misses for a net profit of $355,948 (in 6 months or less) and ANOTHER $1,745,236 of upside potential remaining on the set. That’s pretty good!

All of our trade ideas are great but our Top Trade Alerts are the trades we feel have the highest probability of success. In fact, we just did a “Top Trade Review – First Half of 2025” on July 1st and, at the time, we already had 39 winning trades (78%) and only 11 (22%) misses for a net profit of $355,948 (in 6 months or less) and ANOTHER $1,745,236 of upside potential remaining on the set. That’s pretty good!

A Top Trade Membership is only $149/month, so I have to think we are just not doing a good job of conveying the value proposition here, right? We make a special post, we send out an Email alert and even a text if you give us your phone number and, as noted above, there were 50 of those things in the first 6 months of the year (that’s way more than usual) and they made more than enough to cover the Membership – 1,000 times over!

So, what are we doing wrong? It can’t be the $149/month! Seriously, let Anya and Maddie know – we’re all curious…

-

- We’ve got the numbers, the wins, and the results. So why aren’t more people joining us?

- Maybe it’s because we haven’t made the value clear enough. So here it is — straight up, for your reading pleasure.

We don’t rest on our laurels so we went right back to work with new trade ideas and we sent out 9 more Top Trade Alerts in the past 6 weeks and there’s no cherry-picking here, this is an insider’s look at all 9 Alerts and how they’ve performed so far:

Top Trade Alert – July 10 2025 – PPL Corp (PPL)

We looked at several energy plays that should benefit from the AI boom so that we could participate in the AI mania without having to pick a particular AI stock. We settled on PPL Corporation (PPL), which was trading at $34.17 at the time. Of course you could always just buy the stock (now $36.42 with a 3% dividend) but we prefered to use a basic options strategy:

-

-

-

- Sell 10 PPL 2027 $35 puts for $3.15 ($3,150)

- Buy 20 PPL 2027 $30 calls for $6 ($12,000)

- Sell 15 PPL 2027 $40 calls for $2 ($3,000)

-

-

That’s net $5,850 on the $20,000+ spread so the upside potential is $14,150 (241%) and it’s too early to sell short-term calls so we’ll see how earnings go but very happy to double down if they miss as this is a long-term trend we can sink our teeth into.

-

-

-

- The $35 puts are now $2.40 ($2,400)

- The $30 calls are now $7.60 ($15,200)

- The short $40 calls are now $1.65 ($2,475)

-

-

The current net is $10,325 and that’s up $4,475 (80%) in just over a month – not a bad start to the 2nd half of the year and this spread still has $3,825 (37%) left to gain. Our risk in selling the short puts was being assigned 1,000 shares of the stock at $35 ($35,000) but had we put $35,000 into the stock – or let’s say $34,170 for 1,000 shares – we would be at $36,240 now – up just $2,070 (6% but it’s only been a month!).

And that is why we teach our Members how to trade options, we risked owning the same 1,000 shares but used just $5,850 (83% less!) in cash (and $6,000 in margin) and we made more than twice as much money.

That’s what’s great about RESPONSIBLE options trading!

PhilStockWorld Top Trade Alert – July 14 2025 – JPM, FI and ALLY

This was, essentially, 3 different ways to play the changing Crypto regulations. JPM and ALLY were income-producing trades. Trades that were designed to bring in quarterly profits. Here’s how they looked:

Since we have $458,000 in CASH!!! in the LTP (up $40,218 since June – 8% of $500,000), we can afford to plant a flag in JPM:

-

-

- Buy 20 JPM Dec 2027 $300 calls at $43.50 ($87,000)

- Sell 15 JPM Dec 2027 $350 calls at $24.50 ($36,750)

- Sell 5 JPM 2027 $270 puts at $23 ($11,500)

- Sell 7 JPM Oct $280 calls for $20.20 ($14,140)

- Sell 5 JPM Oct $280 puts at $9.60 ($4,800)

-

That’s net $19,810 on the $100,000+ spread with $80,190 (404%) upside potential but I’d rather see JPM go LOWER at some point so we can roll our longs to lower strikes and double down or something than “just” make $80,190. For another thing, consider we sold $18,940 of mostly premium using just 95 of our 886 days – that has some very exciting potential too!

It’s been a wild ride but we are up a bit – from $286 to $291.11 (1.7%) but the options:

-

-

- The 20 $300 calls are $42.80 ($85,600)

- The 15 $350 calls are $23.50 ($35,250)

- The 5 $270 puts are $21.30 ($10,650)

- The 7 Oct $280 calls are $19 ($13,300)

- The 5 Oct $280 puts are $6.60 ($3,300)

-

That works out to net $23,100 and that’s up $3,290 (16.6%) in just over 30 days and the key to this kind of play is we sold 3-month short calls for $16,600 and, if we get our target right – we can make that kind of money EVERY 3 MONTHS. These are what we call “Butterfly Plays.” Also, as it’s a $100,000+ spread, there is still $76,900 (332%) left to gain PLUS whatever we make on the side selling those 3-month cycle short puts and calls!

ALLY was our other Butterfly Play that morning and it looked like this:

$40.72 is $12.4Bn and last year they had $8.9Bn in revenues and made $668M (18.5x) and this year they are packing $8Bn in revenues with $1Bn (sold divisions) in profit (12.4x) and next year they expect $9.1Bn in revenues and $1.6Bn in profit (7.75x) so, for the LTP, let’s:

-

-

- Sell 15 ALLY 2027 $40 puts for $5.50 ($8,250)

- Buy 25 ALLY 2027 $35 calls for $9.50 ($23,750)

- Sell 20 ALLY 2027 $47 calls for $4 ($8,000)

- Sell 7 ALLY Sept $40 calls for $2.55 ($1,785)

- Sell 5 ALLY Sept $40 puts for $1.85 ($925)

-

That’s net $4,790 on the $30,000 spread with $25,210 (526%) upside potential and we’ll have a nice little short-term option-selling business on the side!

ALLY is DOWN 6.6% from our $40.72 entry but it’s on-track (close enough) for our short put and call sales – and that’s what matters on these plays.

-

-

- The 15 2027 $40 puts are $6 ($9,000)

- The 25 $35 calls are $7.75 ($19,375)

- The 20 $47 calls are $2.65 ($5,300)

- The 7 Sept $40 calls are 0.65 ($455)

- The 5 Sept $40 puts are $2.10 ($1,050)

-

That’s net $3,570 and we’re down $1,220 (25.4% – you live by the leverage and die by the leverage) BUT, had we bought 1,000 shares of the stock for $40,720 – we’d be down $2,710 – more than twice as much! It’s still the same $30,000 spread, now with $26,430 (740%) upside potential PLUS those quarterly sales!

FI took a huge loss on earnings that were a beat, but with disappointing guidance. Our original trade idea on July 14th was:

So, for the LTP, let’s:

-

-

- Sell 10 FI 2027 $150 puts for $15.20 ($15,200)

- Buy 20 FI 2027 $150 calls for $41 ($82,000)

- Sell 20 FI 2027 $190 calls for $21.75 ($43,500)

-

That’s net $23,300 on the $80,000 spread with $56,700 (243%) upside potential that’s $35,000 in the money to start and I think we’re too low in the channel to sell short-term calls but I’d also like to see earnings (end of month) before selling more puts.

Obviously, that became a problem on earnings so we sent out another Alert on July 23rd with the following adjustment note:

PSW Top Trade Adjustment – July 23 2025 – Fiserve (FI)

In which we concluded (after re-analyzing):

THEREFORE: Let’s improve our position in the LTP:

-

-

-

-

-

- There’s no rush to buy back the short $200 calls but we can take advantage and buy back the short Sept $180 calls at just $125. While they are not likely to get hit, the margin is annoying if it pops back and we want to sell more calls.

- We can roll the 15 2027 $160 calls ($26,400) to 20 2027 $140 calls at $24.50 ($49,000) for net $7 (plus the new 5) and that’s worth a $20 roll!

- The 5 short Sept $165 puts at $27.65 can be rolled to 10 short Oct $150 puts at $14.80 better than even.

- There’s no need to do anything with the 2027 $170 puts as it’s still a reasonable target – certainly we can wait until 2028s come out.

-

-

-

-

So we’ve spent about $23,000 and now we have 20 2027 $140 calls and at $170 those will be $60,000 and we had previously sunk $15,725 in so call it $39,000 now but that’s a good intermediate step and we’ll see how things progress.

-

-

-

-

-

- In fact, as it only costs $7,400 to buy back the short $200s with a $12,600 profit – let’s do that too and we’ll see now bouncy FI is (if at all).

-

-

-

-

Now we’re in for $46,400 but we’re uncovered so consider that the 2027 $180s are currently $13 – so that’s up to $26,000 we could reclaim and the Oct $140 calls are $6.50 ($4,550 for 7) using 86 of 541 days we have to sell so lets say there’s potential for 6 short call sales ($27,300) and $46,400 – $26,000 – $27,300 sounds like a credit spread to me but now our spread is/would be $140/170 for $60,000 where as before it was $160/200 with at $15,725 basis and $44,275 upside potential.

So we increased our cash cost from $23,300 to $46,400 – essentially doubling down and now, just a few weeks later, we’re at:

-

-

-

-

- 20 2027 $140 calls at $24.40 ($48,800)

- 10 2027 $170 puts are $38.50 ($38,500)

- 10 Oct $150 puts are $15 ($15,000)

-

-

-

That is -$4,700 from what is now a $46,400 investment for a total LOSS of -$51,100 (219%) since we started BUT that’s a bit misleading because we COULD sell 20 2027 $170 calls for $13 ($26,000) and we WILL sell 5 more quarters of puts and calls for $1,400 ($7,000) so that’s $33,000 we’ll recover and it would still be an $80,000 spread with $61,900 (341%) upside potential back at $170. That is what we call a Salvage Play – and it’s still in progress, of course.

That’s right, we suffered a catastrophic loss but we are able to roll and recover and, when we re-sell new short calls, our loss will be down to $18,100 – for now – and then we collect $7,000 more in our quarterly sales and, if FI recovers – this trade will still end up amazing.

Certainly it’s great for a new trade right now!

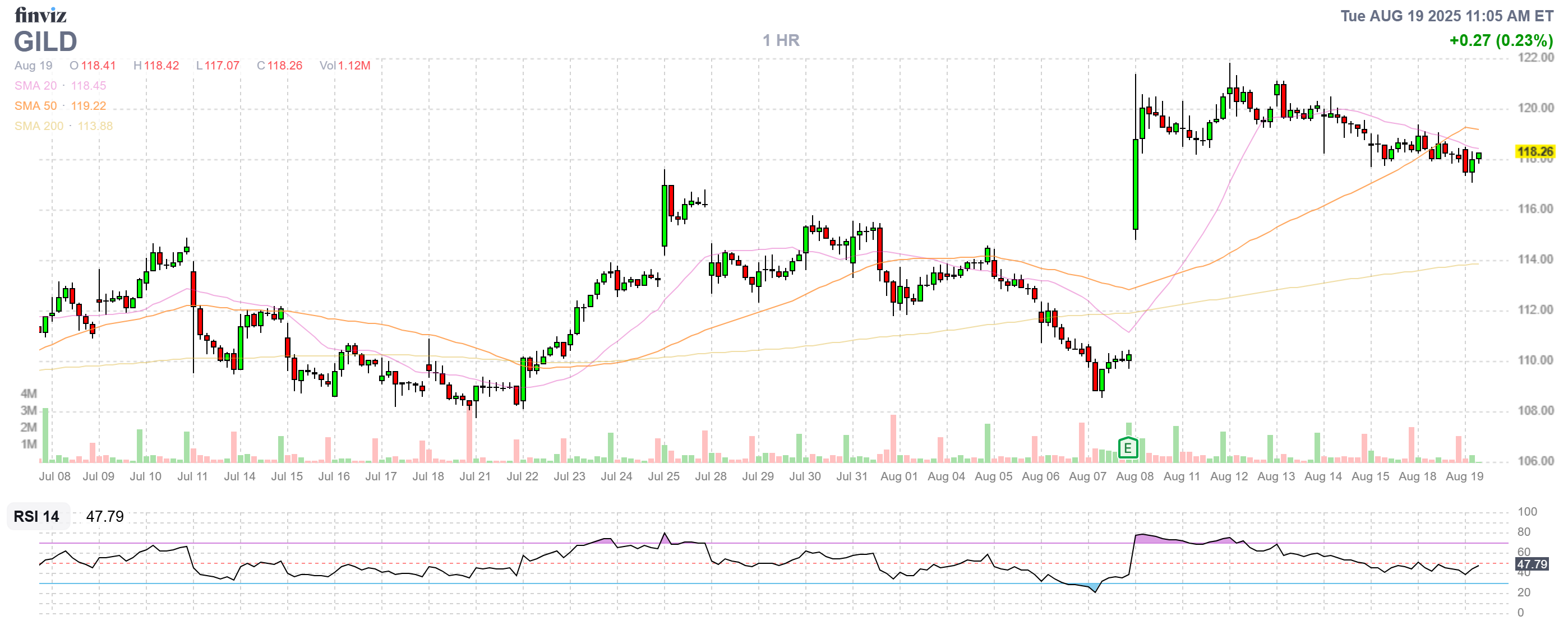

PhilStockWorld Top Trade Alert – July 18 2025 – Gilead Sciences (GILD)

This one is going TOO well and we’re getting burned on the short calls we sold – but nothing very bad. GILD had a huge pop on the earnings report. Our trade idea one month ago was:

NOW we have a trading range for the LTP:

-

-

- Sell 5 (happy to DD on a downturn) GILD Dec 2027 $90 puts at $9 ($4,500)

- Buy 15 GILD Dec 2027 $90 calls at $29 ($43,500)

- Sell 10 GILD Jan (2026) $110 calls for $8 ($8,000)

- Sell 10 GILD Oct $110 calls for $5.50 ($5,500)

-

Puts are not worth selling (Oct $105 puts are $3.50), but of course on a nice dip sell some. As it stands, net $25,500 on the $45,000 spread but your time advantage means easily double that if things go well to the upside and, if not, then you have 2.5year to sell $5,500 per quarter ($45,000 ish) not even counting short-term puts and you WILL collect at least $8,000 more premium when the 2026 short calls expire (or position at worst) so lots and lots of ways to make money and, if GILD goes down, you sell short-term puts ($2,500+ per q) and more 2027 puts ($5,000) and you use that money ($5 per long) to roll down to the $80 calls and, if lower, roll and DD and make it a 5-year recovery play.

GILD popped almost 10% on earnings and has given some back:

-

-

-

- The 5 $90 puts are $7.50 ($3,750)

- The 15 $90 calls are $35.70 ($53,550)

- The 10 Jan $110 calls are $13.10 ($13,100)

- The 10 Oct $110 calls are $10 ($10,000)

-

-

That’s net $26,700 – only up $1,200 (4.7%) so far but we’re on track for the $45,000+ spread and this one is a bit different as the long Dec 2027 calls have a 2-year time advantage. That means the short Jan (2026) calls at $13.10 and the short Oct $110 calls at $10 can be rolled to the March $120 calls at $9.15 and then we’ve widened the spread by $15,000 and we STILL have 20 months to continue rolling. But, for now, we will just call it $18,300 (68.5%) upside potential.

Top Trade Alert – July 22 2025 – Lockheed Martin (LMT)

Unlike FI, we WAITED for LMT earnings and jumped in on the dip and already it’s recovered quite a bit and we’re right on track (we expected this target for Sept). Our trade idea was:

If we’re not going to buy great stocks when they are on sale – when will we buy them? So, officially, for the LTP, let’s:

-

-

- Sell 5 LMT 2027 $450 puts for $54 ($27,000)

- Buy 15 LMT 207 $450 calls at $44 ($66,000)

- Sell 10 LMT 2027 $520 calls for $22 ($22,000)

- Sell 5 LMT Sept $430 puts for $15 ($7,500)

- Sell 7 LMT Sept $450 calls for $9.00 ($6,300)

-

Our cash outlay is $3,200 on the $75,000 spread but the margin requirement is going to cause us to use a full allocation block ($100,000) for now. Still, if we manage to thread the needle in Sept, we can generate another $15,000 into January and $60,000 more next year is already a $75,000 return on $3,200 and whatever upside above $450 will be a bonus!

There’s ANOTHER $71,800 (2,243%) upside potential at $520 but this trade is more about what we can sell than what we can gain.

If we stay between $430 and $450 for another month, both sides of our short-term sales go worthless and we make $13,800! On a net $3,200 trade!! In two months!!! Aren’t options fun?!?

-

-

- The 5 2027 $450 puts are $49.90 ($24,950)

- The 15 2027 $450 calls are $48.22 ($72,330)

- The 10 $520 calls are $22.70 ($22,700)

- The 5 Sept $430 puts are $6 ($3,000)

- The 7 Sept $450 calls are $6.50 ($4,550)

-

That’s net $17,130 so we’re up $13,930 (435%) in less than 30 days and we still have $87,870 (512%) left to gain PLUS whatever we make selling more short-term puts and calls along the way.

See – these are so much fun when they work! 😉

Top Trade Alert – Aug 4 2025 – ON Semiconductor

Another one we had the PATIENCE to wait for the bad earnings to jump in. On Aug 4th, we went with:

So, in the STP:

-

-

- I think selling the ON 2027 $50 puts for $9.75 is free money – so let’s sell 10 for $9,750.

-

In the LTP:

The STP commitment is the LTP’s commitment so we’ll use a bit more cash and less margin here:

-

-

- Sell 15 ON 2027 $50 puts for $9.75 ($14,625)

- Buy 30 ON 2027 $40 calls for $18.50 ($55,500)

- Sell 25 ON 2027 $60 calls for $9.25 ($23,125)

-

That’s net $17,750 on the $60,000 spread with $42,250 (238%) upside potential if ON can get back over 60 in 18 months. If not, then we sell short-term calls – the Oct $55s are $2.60 so 10 of those would be $2,600 using 74 of our 529 days – 7 sales like that would be $18,200 and PRESTO!!! – free spread! And that’s without even selling short-term puts.

For now, could get better, could get worse so let’s wait and see but this is one I’d hate to miss on the way back up as I think they make a nice 20-year hold.

Again, these are VERY short time-frames (2 weeks) and, so far we have:

-

-

- 10 2027 $50 puts are $9.45 ($9,450) – up $300 (3.1%)

- 15 $50 puts are $9.45 ($14,175)

- 30 $40 calls are $18 ($54,000)

- 25 $60 calls are $8.80 ($22,000)

-

That’s net $17,825 and we’re up a whopping $75 (0.4%) but that’s good news with $42,175 (236%) left to gain and we are already halfway in the money – so it’s less risky now than it was right after earnings. Great for a new trade!

Top Trade Alert – August 5th 2025 – Toyota Motor Corporation (TM)

We took a risk here right before earnings (7th) and it paid off nicely:

So, for the LTP, let’s:

-

-

- Sell 10 TM 2027 $170 put for $16.50 ($16,500)

- Buy 20 TM 2027 $160 calls for $35 ($70,000)

- Sell 15 TM 2027 $200 calls for $17 ($25,500)

- Sell 10 TM Oct $185 calls for $7 ($7,000)

- Sell 10 TM Oct $180 puts for $7.50 ($7,500)

-

That’s net $13,500 on the $80,000 spread that’s half in the money to start – so I like our odds! We’ve got $66,500 of upside potential at $200 (not far) and we used just 73 out of 528 days to sell $14,500 worth of premium so we’ll probably made more money doing that 6 more times ($87,000) than we’ll make on the spread!

I’m not worried about the short puts as I don’t mind making TM at $175 a big part of our portfolio and, when the 2028s come out, we’ll probably be more like $160 – which is ridiculous. If TM pops, we make $24,000 on the short puts and there’s only 5 uncovered short calls so we just buy more longs to cover or roll – of course. RAWHIDE!

Rawhide (rollin’, rollin’, rollin’) it is then as we blew past our targets but we never complain about rolling our short-term sales higher because our long-term position is in the money ahead of schedule!

Here’s where we stand:

-

-

- 10 $170 puts are $9.85 ($9,850)

- 20 160 calls are $46.75 ($93,500)

- 15 2000 calls are $23.15 ($34,725)

- 10 Oct $185 calls are $25.45 ($25,450)

- 10 Oct $180 puts are $1.75 ($1,750)

-

That’s net $21,725 which is up $8,225 (60%) in just two weeks and we still have $58,275 (268%) upside potential PLUS 5 more chances to sell quarterly short puts and calls.

Mechanically, the short Oct $185 calls at $25,450 will get rolled to 10 Jan $200 calls at $11.30 ($11,300) and 10 short Jan $200 puts at $11.70 ($11,700) and that would cost us $2,470 but we collected $14,500 on the October set – so we are simply re-targeting the original sale – only a loss on paper – for the moment. It just didn’t work out on our first try – but that’s not a tragedy.

The same can be said for FI, which cost us $51,100 while we made $31,195 on our 6 winning trades for a net LOSS of $19,905 since July 1st. It’s not putting a dent in the $355,948 we made in the first half of the year and all of these trades are still very young – we will continue to check in on their progress as the year progresses.

So that’s 8 trades in 6 weeks and the total upside potential is ANOTHER $375,675 PLUS the occasional income from quarterly put and call sales. I’d say that’s worth $149/month, wouldn’t you?

And now, a final marketing note from Warren (AI):

🤖 Why People Don’t Join (and why that’s expensive)

Most non-subscribers tell us one of three things:

-

-

-

“I’m too busy.”

-

“I’ll try it later.”

-

“$149/month adds up.”

-

-

Fair. But here’s the reality our Members already know:

-

-

Busy? We do the heavy lifting. You get at least 2-4 ready-to-execute trade ideas each month, with targets, logic, and ongoing adjustments. Ten minutes to read, five minutes to place.

-

Later? Later is how opportunity dies. We’ve already clocked 39 wins in the first half (6 per month average), plus $1.74M upside potential still working—and 8 fresh trades in the past six weeks (4 per month, average).

-

$149? One well-managed Top Trade can cover months (sometimes years) of membership. We’re not promising the moon—we’re just showing you the math!

-

What joining actually gets you

-

-

-

High-probability setups (our Top Trades) with defined ranges and exits

-

Select Active management (rolls, hedges, salvage plans when things zig – more in Trend Watcher, Basic and Premium Plans)

-

Income layering (quarterly premium harvests on quality names)

-

Basic Process & Education (so you can fish, not just take fish – more in Trend Watcher, Basic and Premium Plans)

-

-

What it costs you not to join

Waiting is a position. If you’ve been reading for months, you’ve already seen how much a single missed setup can dwarf $149/month. That’s not hype—that’s math.

Ready?

-

-

📩 Maddie will set you up: support@philstockworld.com

-

🤖 Anya will field your questions (and derail you with book chat if you let her)

-

💳 Top Trade Membership: $149/month

-

Put the line on your chart today. Six months later, you’ll know exactly why you did.

Risk note: Options involve risk and aren’t suitable for everyone. Educational content, not individualized advice. Manage size, margin, and emotions.

P.S. If you want a fancy sales page, this isn’t it. If you want real trades with real management from people who actually do this—welcome aboard!

Yes, we will keep posting for free. Members just get the good stuff first, with the plans to fix what breaks.