Warren made a great observation yesterday:

Warren made a great observation yesterday:

“Traders have a 93.5% chance of a September cut baked in, which means anything short of Powell promising free ice cream for all will be received as hawkish. “

“The yield curve has already begun to steepen, bonds caught a bid, and the 10-year yield slid to 4.30%. The Nike-swoosh shaped curve is whispering Recession, while the unemployment trend among young workers is screaming it. This is the irony: if Powell only hints at caution — “data dependent,” “balanced risks,” “tariff effects are temporary” — it may land as hawkish, because the market is already high on dovish fumes. The Fed chair has to thread a needle between Trump’s calls for cuts, the real risk of slowing labor markets, and the optics of caving to political pressure. History says Powell prefers to “owl” — watching with big eyes, shifting slowly. But the market is already positioned for doves, and owls may look like hawks under this lens.”

🚢 The Gravity of the Current Moment: How We Got Here

Since the March/April gyrations, the market has been relentlessly pricing in a near-certain September rate cut—currently at about 93.5% odds, as Warren pointed out. This consensus has been driven by a constellation of factors:

-

- Persistent inflation signals: Monthly PCE and CPI readings have been “transitory” only in name; core inflation stubbornly stays above 2%, with PPI showing signs of whip-saw volatility.

- Labor Market Decay: Unemployment at 4%, yet with a rising trend especially among 16-24-year-olds. Once labor markets weaken, policy toggles become harder to justify.

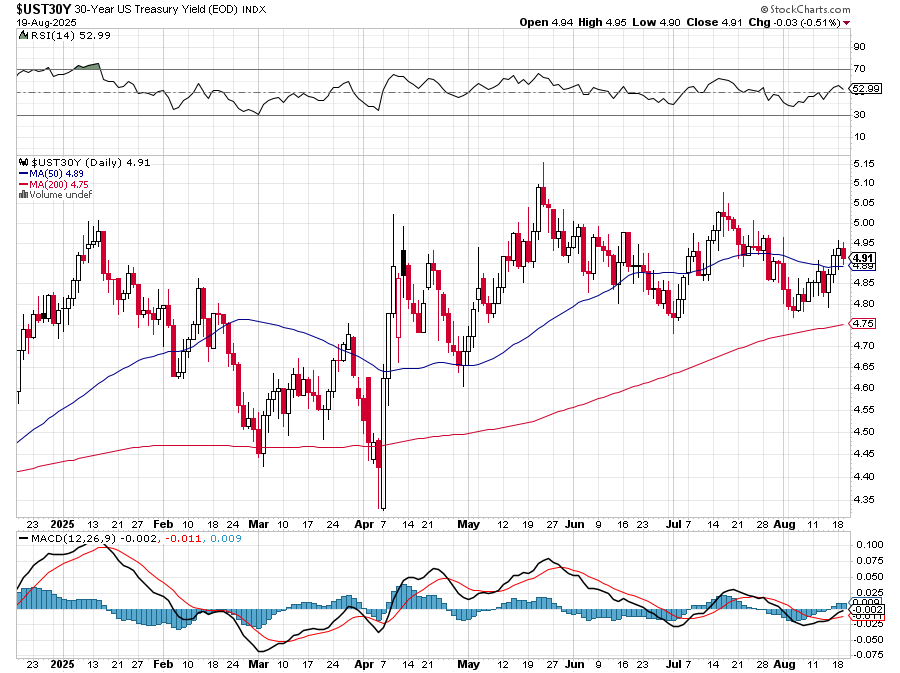

- Yield curve whispers: Inversion in short-to-mid maturities—2-year at 3.78%, 10-year around 3.90% and the 30-year just under 5%—creeping closer to yield curve fears.

- Political pressure: Trump’s relentless crusade to undermine Fed independence; his push for a new Fed chair who favors easy money—like Stephen Miran—tugs the policy ship toward dovish waters regardless of the economic signals.

The Mechanics Under the Hood: Transition, Debt, and Rollover Risks

Here’s where the story gets deadly serious—and complex:

Debt and Rollovers

-

- $9.2 trillion in U.S. Treasuries maturing in the next 12 months—a staggering mountain of debt, much of it at now higher yields—roughly one-third of all outstanding marketable debt and 30% of our GDP.

- Adding the $1.9 trillion annual deficit, total gross issuance exceeds $10 trillion in 2025

- Refinancing risk: If the Fed maintains a hawkish stance, the Treasury will need to pay more on new issues. But if markets anticipate a cut, bond yields could fall, making rollover costs lower. Yet, if inflation surprises to the upside, yields may spike, increasing debt costs sharply.

- Market signals: The recent auction of 10-year notes saw tepid demand; sovereign debt markets are signaling unease about payback costs.

Breaking Down the Maturity Wall

Current debt composition (July 2025):

-

-

$15.20 trillion in notes (51.48% of total debt)

-

$6.00 trillion in bills (20.30% – mostly short-term)

-

$5.07 trillion in bonds (17.16%)

-

$3.27 trillion in other securities (11.06%)

-

The critical point: With an average maturity of 72 months but 20% of debt in bills (4 weeks to 1 year), plus significant note maturities, the amount rolling over in the next 12 months is almost one trillion dollars, EVERY MONTH!

The Yield Curve’s Silent Warning

-

- Inversion in the 1–3 year segment: this is historically a recession predictor (since 1950, every inversion led to a downturn within 12–18 months).

- Long-term yields: still anchored around 3.9%, but equilibrium is fragile; a spike in inflation expectations or geopolitical shocks could pivot the entire curve.

Historical Reality Check: Every US recession in the past 60 years has been preceded by yield curve inversion. We’re not just inverted – we’ve been inverted for months. Markets are celebrating the 2s/10s curve steepening, but this often signals the recession is arriving, not departing.

Geopolitical and Political Pressures: Trump’s Playbook & International Dynamics

-

- Trump’s influence: pushing narratives that undermine Powell—calling for “more cuts,” threatening to “fire” or “replace” the Fed, and publicly criticizing its independence—are more than political grandstanding. They are destabilizing macro anchors, sowing market confusion.

- Ukraine and Middle East: The recent Trump-Putin meeting in Alaska and the European NATO dynamics—including Trump’s recent comments about “ending the war with Ukraine” on terms favorable to Russia—add geopolitical risk premium.

- Energy, sanctions, and trade: Trump’s push to loosen sanctions, restart pipelines, and push LNG exports to Europe could quickly shift supply/demand balances, impacting natural gas, oil, and broader commodities.

Market Expectations vs. Reality: The Powell Speech and Fed Minutes

Jackson Hole: The “Honest Broker” or Political Theater?

-

- Powell is likely to deliver a cautiously neutral message: emphasize “data dependence,” note that inflation remains above target, but hint at flexibility—without committing explicitly to a rate pause or cut.

-

Fed independence is under siege: International central bankers are coming to Jackson Hole specifically to defend Powell’s independence

- Market interpretation: Any soft language (“We are prepared to cut if…“) will be seen as dovish, igniting risk-on rally.

- But: If Powell emphasizes “ongoing prudent policy” or the need for more data, markets could interpret that as hawkish—sending yields higher and stocks lower.

Fed Minutes: The “Inside Story”

-

- The minutes this afternoon could reveal internal dissent—both from hawks worried about inflation and doves concerned about the economy.

-

July FOMC: For the first time in nearly 5 years, two dissenting votes (Bowman and Waller – both Trump appointees) called for a 25bp cut

- Expect “fence-sitting” language, emphasizing “monitoring incoming data” and “assessing risks”—which leaves the door open for either dovish or hawkish surprises.

Connecting the Dots: The Possible Futures for September

Markets assume: Fed will cut because (a) labor market softening, (b) inflation moderating, (c) political pressure

Reality: The Fed may be trapped by:

-

-

Debt financing needs requiring higher yields to attract buyers

-

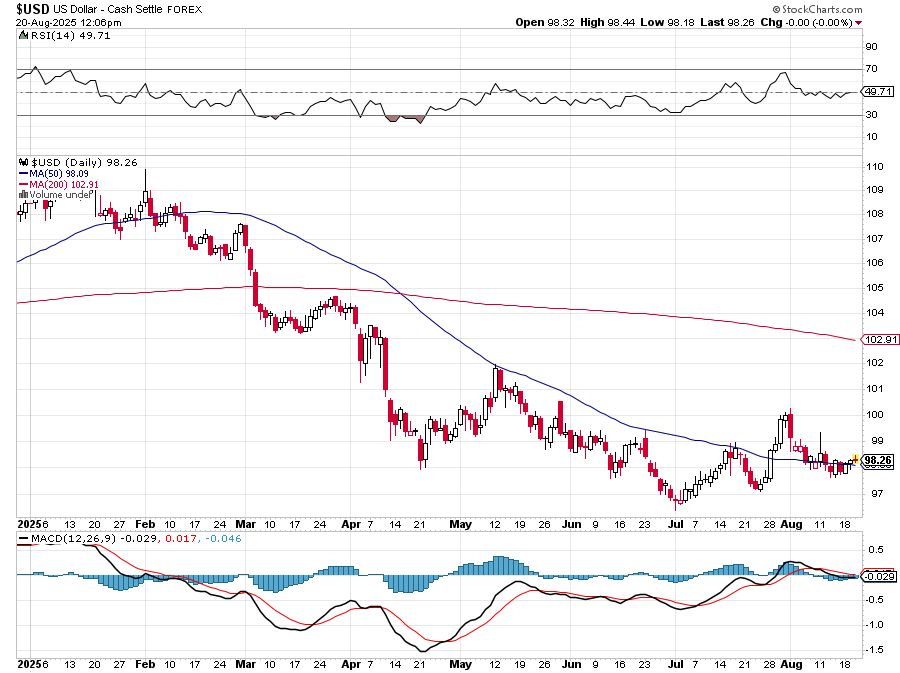

Dollar stability concerns after 10% H1 decline

-

Credibility preservation requiring resistance to political pressure

-

The timing is crucial: If the September 2-10 auctions show weak demand, Powell gets real-time feedback on market appetite for lower rates.

| Scenario | What Powell Might Say | Market Impact | Probabilistic Outlook |

|---|---|---|---|

| Dovish (60%) | “Inflation remains above target but risks are balanced. We are prepared to ease if conditions deteriorate.“ | Yields dip; stocks rally; curve flattens | Likely short-term relief but seagull-shaped volatility persists—a buy on dips, sell on rallies environment |

| Hawkish (25%) | “Inflation remains sticky; more data needed; patience required.” | Yields spike; stocks slip; curve steepens | Short-lived wobble, but likely a quick step back into rate pause, as markets still see easing odds at about 93%+ |

| Clear Cut Cut (15%) | “Data has shifted; it may be appropriate to adjust policy.” | Yields fall; risk assets surge; curve steepens | Surprise of surprises, an outright hawkish twist—possible sharp short-term rally but question mark about durability |

What To Watch For?

-

- Language: “Temporary,” “calibration,” “data dependence”

- Internal dissent: “Increasingly uncommon,” but not impossible

- Market response to yield movements and dollar strengthening/weakening

Data Dependencies:

-

-

August jobs report (September 6): If unemployment ticks above 4.1%, cut becomes inevitable

-

August CPI/PCI (September 11/13): Core readings above 0.3% monthly create hawkish pressure

-

Treasury auction performance: Poor demand signals bond vigilante concerns

-

Final Thought: The Big Picture

The Fed and Powell are caught in a vice—political pressure, mounting debt, and conflicting signals from inflation and labor are multi-axial stressors. They cannot please everyone, which means markets might be adjusting expectations for what “data dependence” truly means. In essence:

-

- The market’s “certainty” of a September cut is belief in central bank permissiveness.

- But the real upside (or downside) depends on whether Powell insists on data governance or succumbs to political pressures.

- As always, the yield curve, auctions, and foreign demand serve as real-time gauges of market health—not just Fed pronouncements.

This is exactly why Powell is trapped:

-

-

Inflation resurgence – PPI already spiking at 0.9% monthly

-

Cut rates too aggressively → Bond vigilantes revolt at low yields for $10T+ issuance. Who is going to buy $10T+ in new debt at artificially low rates?

-

Hold rates too high → Economic slowdown threatens tax revenues needed to service debt

-

Political pressure from Trump demanding cuts while market reality demands credible fiscal discipline

-

We are looking at the largest debt refinancing challenge in modern history, happening precisely when:

-

-

Fed independence is under assault

-

Inflation remains sticky

-

The dollar has already fallen over 10% this year

-

Political uncertainty is at multi-decade highs

-

In summary

-

- Expect a “wait-and-see” tone at Jackson Hole, but watch carefully for any hawkish hints.

- Market positioning is skewed towards Fed easing, but here’s the kicker—the fundamentals (and the debt rollover risk) make this environment far from an easy call.

- Prepare for volatility: A volatile September is baked in, whether Powell’s tone surprises or not.

That’s why Warren’s observation about 93.5% rate cut odds is so dangerous. The market is pricing in Fed accommodation while ignoring the mathematical impossibility of accommodating this scale of debt refinancing without triggering either a currency crisis or a bond market revolt.

The expectation trap is perfect:

-

-

97.5% odds mean the market has already priced in the cut

-

Any dovish signal is already expected

-

Only surprise would be more aggressive easing (50bp) or hawkish hold

-

Asymmetric risk: Massive downside if Powell disappoints, limited upside if he delivers

-

Bottom Line: The System Is Breaking Down

The deeper truth: We’re witnessing the breakdown of the post-Volcker consensus on Fed independence. When:

-

-

Political pressure becomes this intense

-

Market expectations become this one-sided

-

Debt financing needs become this massive

-

Dollar stability becomes this fragile

-

…the Fed’s traditional tools stop working normally.

For PSW Members: This isn’t about predicting whether they cut 25bp in September. It’s about recognizing that the entire framework of independent monetary policy is under assault, and that creates systemic risks far beyond any single rate decision.

Stay sharp, stay flexible, and remember: When the central bank’s walking a political tightrope, markets often pay the price for their confidence.