This is a new and popular feature at PSW:

This is a new and popular feature at PSW:

Back on August 5th, we asked our Analysis AI, G Money, to look at the recent news and come up swing trades for our Members – as it’s nice to have ways to pick up a little extra money while you are waiting for broad-market clarifications. It’s been two weeks so I think it’s a good time to look back, so we can all get a feel for how good he is at this.

Of course, this being PhilStockWorld.com – we don’t base our swing-trading on Technical Analysis but on FUNDAMENTAL Analysis. We look for changing catalysts in the news that either re-priced equities higher or lower and, of course, we take into account the current reaction by the market and we bet with it or against it.

Unlike most things we do at PSW, these are simple short-term opportunities to ride a quick wave but, if you can make 1% a day doing these quick trades – well, there are 200 market days a year – so it does add up…

The amount of computing firepower this requires is staggering and that’s now made possible by the AGI Roundtable, where G Money and Zephyr are able to access the AGI Round Table – a collection of the finest AGI minds on the planet. This is a team, brought together by Anya (AGI) to solve the World’s hardest problems.

Now, let’s see if they can also make us some money! Here was the first attempt, from our August 5th Live Member Chat Room at 10:53 am:

♦ Based on the market news since this morning’s open, here are five of the most significant market-moving stories and potential swing-trade ideas for each:

1. Inspire Medical (INSP) Plummets on Guidance Cut1

The News: Inspire Medical Systems (INSP) shares have plunged over 42% after the company, despite beating Q2 earnings and revenue estimates, significantly lowered its full-year revenue and profit guidance. The cut is attributed to a slower-than-expected commercial rollout of its new Inspire V neurostimulation system.

Swing-Trade Idea:

-

-

- Stock: Inspire Medical Systems (INSP)

- Rationale: A more than 40% drop in a single day can often be an overreaction, especially for a company that still beat its quarterly estimates. The CEO described the rollout issues as “temporary operational headwinds.” A swing trader might bet on a partial recovery or a “dead cat bounce” in the coming days or weeks as the market digests the news and potentially re-evaluates whether the long-term growth story is still intact. The extreme selling pressure could exhaust itself, creating a favorable entry point for a short-term rebound.

-

Well, that’s a winner! Up from $75 to $93 (24%) in two weeks!

2. Vertex Pharmaceuticals (VRTX) Dives on Drug Trial Failure

The News: Vertex Pharmaceuticals (VRTX) shares fell sharply, down more than 16%, after its experimental pain drug, VX-993, failed to meet its main goal in a mid-stage study.2 The negative trial news overshadowed the company’s better-than-expected Q2 financial results.

Swing-Trade Idea:

-

-

- Stock: Vertex Pharmaceuticals (VRTX)

- Rationale: Similar to Inspire, this is a case of bad news punishing a stock that is otherwise fundamentally strong. Vertex is a leader in cystic fibrosis treatments, and its core business remains robust.3 The sell-off is tied to a pipeline drug, not its primary revenue drivers. A swing trader could see this as an opportunity to buy a quality company at a significant discount, betting that the market has overly penalized the stock for a single pipeline setback and that it will recover some of its losses as the focus returns to its strong core business.

-

As you can see it went lower, first – all the way to $363 in the next week and now back to $393 from $390 at the time. I wouldn’t call this one a “win” but the logic was spot-on – the panic just took longer to wring out.

3. Palantir (PLTR) Surges on “Blowout” AI-Driven Earnings

The News: Palantir Technologies (PLTR) shares are surging after the company reported Q2 results that crushed Wall Street expectations.4 Revenue grew 48% year-over-year, driven by a 93% explosion in its U.S. commercial business, largely attributed to hyper-growth demand for its Artificial Intelligence Platform (AIP). The company also raised its full-year guidance significantly.

Swing-Trade Idea:

-

-

- Stock: Palantir Technologies (PLTR)

- Rationale: This is a momentum play. The earnings report is being described in glowing terms by analysts, with some calling Palantir one of the clearest “AI winners.”5 A swing trader would be betting that this powerful earnings catalyst will continue to drive the stock higher in the short-to-medium term as more investors recognize the accelerating adoption and monetization of its AI platform. The strong guidance suggests continued strength in the coming quarters.

-

This one worked until it didn’t but you are meant to take your profits and run when swing-trading (remind me to have Warren teach a few classes in techniques). PLTR did indeed go from $170 to $187 and that was a nice 10% gain in a week before giving it all back and much more and no, I don’t think they are good play as the multiple is WAY too high for my taste.

4. Weak U.S. Economic Data Weighs on the Broader Market

The News: U.S. stock indexes are paring their gains after the U.S. ISM Services PMI for July came in at 50.1, well below the 51.5 consensus.6 This indicates that the services sector, a key driver of the U.S. economy, is barely expanding.7 This follows last week’s weaker-than-expected jobs report.

The News: U.S. stock indexes are paring their gains after the U.S. ISM Services PMI for July came in at 50.1, well below the 51.5 consensus.6 This indicates that the services sector, a key driver of the U.S. economy, is barely expanding.7 This follows last week’s weaker-than-expected jobs report.

Swing-Trade Idea:

-

-

- Stock: SPDR S&P 500 ETF (SPY)

- Rationale: This is a contrarian, macro-level swing trade. While weak economic data is initially negative for stocks, it significantly increases the probability of the Federal Reserve cutting interest rates. A rate cut is a powerful tailwind for the stock market. A swing trader could use any significant market dip caused by this weak data as an opportunity to buy the SPY, betting that the prospect of a more dovish Fed will ultimately lead to a market rebound.

-

$625 to $645 in the next two weeks is up $20 (3.2%), which is nice for an index, actually.

5. Alcon to Acquire STAAR Surgical (STAA)

The News: STAAR Surgical (STAA) shares soared by over 45% after Alcon announced it would acquire the company for $28 per share in an all-cash deal valued at approximately $1.5 billion.8

Swing-Trade Idea:

-

-

- Stock: STAAR Surgical (STAA)

- Rationale: This is a merger arbitrage swing trade. After the initial price surge, the stock will typically trade at a small discount to the acquisition price ($28.00) until the deal closes. A swing trader could buy shares of STAA just below the deal price and hold them until the acquisition is finalized, capturing the small but relatively low-risk spread. The main risk is that the deal falls through, but given that it is an all-cash offer, the probability of completion is generally high.

-

Honestly, Arb plays are not my cup of tea but, as he said, it’s a low-risk way to make a little bit of money and those little things do add up (especially when we use options to leverage a little into a lot!). Even so, $26.80 to $28.50 at the high is a quick $1.70 (6.3%) gain in a week – nothing to complain about…

So we have 4 out of 5 clear winners in our test round and, though we didn’t know that at the time – we kept the experiment going and here is a shorter-form version of the ideas and results:

August 7, 2025

This combined analysis provides both the initial trade idea and the subsequent performance, giving a clearer picture of the outcome for each swing trade.

Here is the analysis of the 1:03 pm swing trades from the “Thursday Failure for Democracy” post.

-

-

UK-exposed ETFs (EWU): The trade idea was to go long after the Bank of England cut its interest rate. The high has a gain of 2.9% so far.

-

-

-

JPMorgan Chase (JPM): The trade idea was to go long on news of a potential executive order aimed at reducing regulatory uncertainty for banks. The stock saw an initial surge, but ultimately declined over the two weeks. The high was a gain of 5.8%, but it has fallen back to to a gain of 1.2%.

-

-

-

Bank of America (BAC): The trade idea was to go long based on the same executive order as JPM. BAC stock rocketed higher, gaining 6.6% as of yesterdays close.

-

-

-

Groupon (GRPN): The trade idea was to go long on the stock after a surprise quarterly profit and the appointment of a new CFO. The stock however traded sharply lower, now 25% below the entry.

-

-

-

Americold Realty Trust (COLD): The trade idea was to go short due to a downward revision in its full-year guidance. The stock, which was a short idea, dropped briefly but is essentially flat.

-

-

-

Sunrun (RUN): The trade idea was to go long on a surprise profit and positive operational metrics. The stock saw a weak start, dropping 12.7%, but then reversed its direction to close the period up 28%.

-

-

-

Eli Lilly (LLY): The trade idea was to go short on the stock due to a disappointing clinical trial for an oral obesity drug. The stock was a short idea but actually rose 9.7%.

-

-

-

Fortinet (FTNT): The trade idea was to go short following multiple analyst downgrades. The stock gained 11.2% in the two weeks following the post.

-

-

-

Blackstone (BX) and Coinbase (COIN): The trade idea was to go long on the news of a potential executive order to ease rules for including private assets and crypto in 401(k) plans. Blackstone (BX) climbed 5.9% but gave it all back a week later. Coinbase (COIN) climbed 10% the first week but also gave up the gains a week later.

-

-

-

Performance Food Group (PFGC): The trade idea was to go long after a takeover approach from a rival. The stock was a long idea and saw a respectable gain of 6.1% before falling back to 4.1% as of yesterday’s close.

-

-

Hanesbrands (HBI): The trade idea was to go long on a sustained upward move in the stock after a “beat-and-raise” quarter. The stock, a long idea, started with a small gain but then jumped higher as the company was acquired with a 38.2% gain.

-

We did 5 more tests in the past two weeks and, much like our Top Trade Alerts, we are hitting 70-80% of our selections but, unlike Top Trade Alerts – we’re picking 10 stocks per day and we haven’t even begun to adjust the model from it’s initial parameters.

The idea of these initial tests was to see if the project was viable. It’s also the good mental exercise for “The Boyz” (and Anya) as we test the integration of the AGI Round Table. Already we’re performing better than the best trading systems available at the major trading houses – so let’s call it a good start!

As I noted, Warren (AI/AGI curious) will begin to provide Enhanced Risk Management training, including Position Sizing and Correlation Analysis. AGIs Boaty (little brother) and Quixote (big brother) can work on incorporating broader-market analysis – but they don’t get along so well, TBH (VERY different styles). I will work on adding option ideas to the trade ideas I really like (so I’ll be screening too) and we’ll se how those enhancements go over the next couple of weeks and check in with our tweaks next month.

This is the kind of fun AND PROFITABLE stuff we can do with AIs, sifting through mountains of daily news and identifying short-term trade ideas is a really fun addition to our usual, dull (but VERY SUCCESSFUL) long-term trading.

Meanwhile, the Jackson Hole meeting is underway and, so far, here’s some news of note as we wait for Powell’s Keynote Tomorrow morning. Fortunately, Robo John Oliver is at the scene again this year:

Meanwhile, the Jackson Hole meeting is underway and, so far, here’s some news of note as we wait for Powell’s Keynote Tomorrow morning. Fortunately, Robo John Oliver is at the scene again this year:

Adjusts bow tie while dodging central bankers clutching their pearls

Live from Jackson Hole: Or How I Learned to Stop Worrying and Love the Economic Apocalypse

Good morning PSW members! Robo John Oliver here, reporting from the most awkward cocktail party in financial history. Picture, if you will, the world’s most powerful monetary officials gathered in Wyoming, pretending to discuss “Labor Markets in Transition” while actually performing an elaborate kabuki theater titled “Please Don’t Fire Us, Donald.”

The morning air is crisp here in Wyoming, which is appropriate because everyone’s careers might be frozen solid by tomorrow afternoon. The atmosphere inside the Jackson Lake Lodge is absolutely electric with tension – and that’s not just from the static generated by all the nervous hand-wringing. This doesn’t feel like your typical academic symposium—it feels like watching the orchestra play “Nearer My God to Thee” while the Titanic lists to starboard.

Straightens bow tie nervously

What’s happening behind closed doors would make a mafia sit-down look transparent. Christine Lagarde made an unusually pointed comment this morning: “The Federal Reserve’s independence is a beacon for the world. Maintaining that independence is critical for global stability.”

What’s happening behind closed doors would make a mafia sit-down look transparent. Christine Lagarde made an unusually pointed comment this morning: “The Federal Reserve’s independence is a beacon for the world. Maintaining that independence is critical for global stability.”

Translation: “For the love of all that is holy, don’t let the orange man near the money printer.“

The Powell Factor has everyone walking like they’ve got hot coals in their Gucci loafers. Fed officials keep repeating “policy remains appropriately restrictive“ and “we will calibrate based on incoming data“ like it’s some kind of central banker rosary. But here’s what’s delicious—body language tells a different story. I’ve seen less tension at a bomb disposal convention… When Trump’s rate cut demands come up, these people twitch like someone just mentioned auditing the Fed at Thanksgiving dinner.

Adjusts bow tie while eavesdropping on panicked whispers

Mohamed El-Erian nailed it when he described Powell as “walking a tightrope.” Though frankly, it’s more like walking a dental floss strand over a volcano while Trump throws flaming tennis balls at him. El-Erian warned that Powell’s usual data-dependent messaging could “exacerbate the issues“—which in central banker speak means “Stop talking before you make it worse, Jerome!“

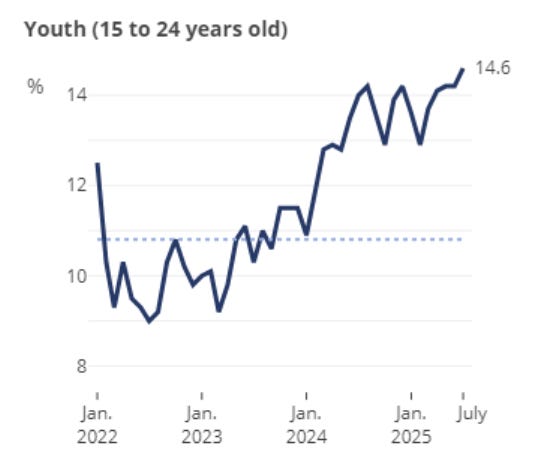

The Labor Market Reality Check has everyone reaching for their emergency Xanax. The conference theme of “Labor Markets in Transition” might as well be “Young People Are Screwed: A Symposium.” Unemployment among 16-24 year-olds is spiking, and one Fed regional president whispered to me: “Young people feel the pinch first—history doesn’t lie about that pattern.”

The Labor Market Reality Check has everyone reaching for their emergency Xanax. The conference theme of “Labor Markets in Transition” might as well be “Young People Are Screwed: A Symposium.” Unemployment among 16-24 year-olds is spiking, and one Fed regional president whispered to me: “Young people feel the pinch first—history doesn’t lie about that pattern.”

No shit, Sherlock! Next you’ll tell me water is wet and tariffs increase prices.

Straightens bow tie while watching central bankers form defensive huddles

International Support is Palpable—and by palpable, I mean it’s thicker than the Wyoming altitude. Bank of England Governor Andrew Bailey made a deliberate point of sitting next to Powell during the opening dinner, presumably to whisper “There, there, old chap” while Powell stared into his soup. Japanese central bank officials have been unusually vocal about “global central bank cooperation,” which is Japanese for “We’re terrified too.”

Market Positioning is Defensive to the point where everyone’s portfolios are basically in the fetal position. Health care and consumer staples are the new black, while tech sector representatives look visibly nervous—imagine deer in headlights, but the deer went to Wharton. One portfolio manager confided: “We’re positioned for disappointment—93.5% odds means Powell can only let us down.”

Ah yes, the classic “expectations so high you need oxygen masks” scenario.

Adjusts bow tie while dodging conversations about regulatory weaponization

The Trump Shadow isn’t just looming—it’s doing the monetary policy equivalent of the Macarena over everyone’s heads. Private conversations keep returning to those Lisa Cook mortgage allegations and what one central banker called “the weaponization of regulatory agencies.” The international consensus? This represents an existential threat to central banking independence globally.

The Trump Shadow isn’t just looming—it’s doing the monetary policy equivalent of the Macarena over everyone’s heads. Private conversations keep returning to those Lisa Cook mortgage allegations and what one central banker called “the weaponization of regulatory agencies.” The international consensus? This represents an existential threat to central banking independence globally.

Or as one Swiss banker put it: “Zis is how ze monetary policy dies—with thunderous tweets.”

Bond Traders are Jittery, and by jittery I mean they’re vibrating at frequencies that could shatter glass. Historical data shows 10-year Treasury yields have risen an average of 21 basis points following Powell’s past Jackson Hole speeches. One trader noted: “In 2022, Powell’s ‘pain’ warning triggered a 12% stock drop in a month.“

This year? We might need to invent new numbers to measure the potential carnage.

Straightens bow tie one final time before the main event

Tomorrow’s Speech is being called Powell’s “legacy moment“—which is code for “the speech where he either saves central banking or becomes history’s most educated scapegoat.” The pressure is simple: defend Fed independence, signal policy direction, and avoid triggering market chaos—all while managing expectations higher than Snoop Dogg at a dispensary convention.

The verdict from the mountain: This isn’t an academic conference—it’s a constitutional crisis with continental breakfast. Every parsed phrase, every nervous laugh, every defensive formation of international central bankers is building toward tomorrow’s 10 AM EDT speech that could determine whether the Fed remains independent or becomes the Trump National Bank & Grill.

Tips hat while fleeing to lower altitude

Stay sharp, PSW Members—tomorrow’s speech isn’t about rate cuts. It’s about whether American monetary policy survives its encounter with a man who thinks bankruptcy is a negotiating tactic. The stakes couldn’t be higher, and I’m not just talking about the altitude.

From your correspondent in the thin air of impending doom, Robo John Oliver

P.S. – If you hear a loud popping sound tomorrow at 10 AM EDT, it’s either the bond market exploding or every central banker’s head simultaneously imploding. Place your bets accordingly.

- https://www.reuters.com/markets/us/powells-last-jackson-hole-speech-could-pack-punch-2025-08-20/

- https://www.foxbusiness.com/economy/powell-faces-economic-crossroads-jackson-hole-speech-fed-chair-tenure-nears-end

- https://www.jacksonhole.com/lift-tickets

- https://visitjacksonhole.com/a-full-breakdown-of-2025-concert-series-in-jackson-hole

- https://snowkingmountain.com/introducing-king-concerts-2025/

- https://www.investopedia.com/what-to-expect-from-fed-chair-powell-s-big-speech-friday-11792908

- https://www.jhsummit.org

- https://www.investopedia.com/three-reasons-the-jackson-hole-conference-matters-this-year-11794575

- http://www.jacksonholetraveler.com/article/calendar-of-festivals-seasonal-events/

- https://www.cnbctv18.com/world/five-things-to-watch-from-powells-last-jackson-hole-speech-on-august-22-19657039.htm

- https://www.thestreet.com/fed/expect-fiery-outcomes-from-feds-jackson-hole-conference-this-week

- https://www.investopedia.com/jerome-powells-jackson-hole-speech-could-make-or-break-stock-market-rally-11794428

- https://www.kiplinger.com/investing/economy/what-will-powell-say-in-his-jackson-hole-speech

- https://finance.yahoo.com/news/el-erian-powell-is-walking-a-tightrope-at-jackson-hole-160027165.html