It’s the end of Summer.

It’s the end of Summer.

Monday is Labor Day and this may be the last one that doesn’t mean “the day we round up the workers and check their papers.” This Labor Day, dates back to 1894 as a day to celebrate “Trade Union and Worker Movements” and “the contributions of laborers to the developments and achievements in the United States.” Obviously, that’s a lot of “woke” nonsense and will be banned from the Smithsonian, school textbooks, etc. – so I just thought I’d take note of its passing…

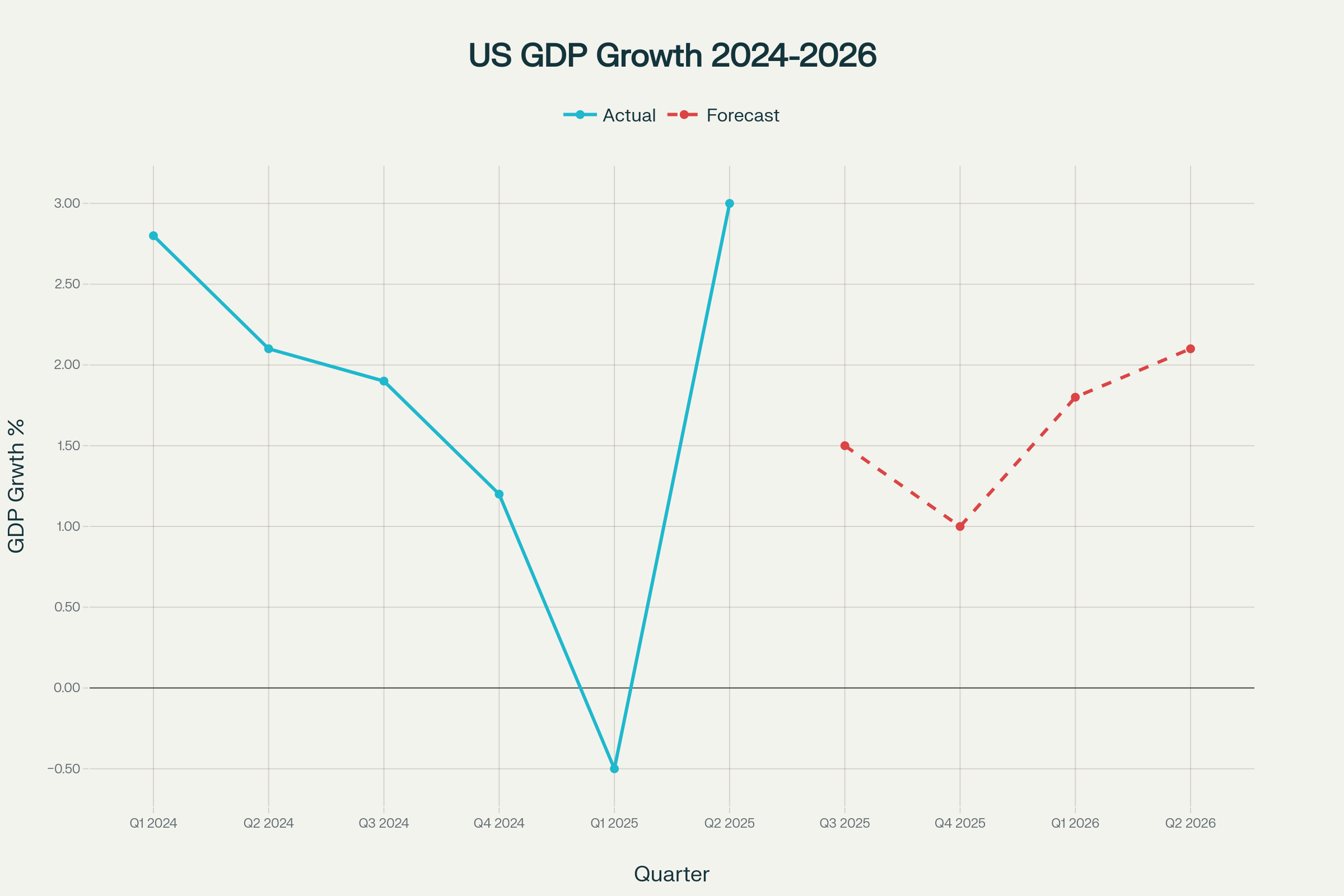

On Friday, Chairman (for now) Powell’s speech marked a pivotal moment for the U.S. Economy, signaling the Federal Reserve’s readiness to cut interest rates as soon as September while acknowledging the complex balance of risks that is facing policymakers. The Economy is sitting at an inflection point, with Q2 showing a robust growth recovery but there are underlying concerns about the Labor Market softening while the country still endures PERSISTENT Inflation pressures from Tariffs.

The Economy, for its part, demonstrated remarkable resilience – expanding at an annualized rate of 3.0% after contracting 0.5% in the first quarter. This rebound exceeded expectations of 2.4% growth and was primarily driven by a dramatic 30.3% plunge in Imports following the stockpiling surge in Q1 – when businesses rushed to purchase goods ahead of expected tariff-induced price increases. In other words, it was an illusion…

Consumer Spending accelerated to 1.4% in Q2 from 0.5% in Q1, though this still represents the lamest growth in consecutive quarters since the COVID pandemic. Government Expenditure, despite DOGE, rebounded to 0.4% from -0.6%, while Fixed Investment slowed to 0.4% from the previous quarter’s 7.6% – an insanely steep drop-off.

The Labor Market itself presents a complex picture that Powell described as a “curious kind of balance“. The unemployment rate rose to 4.2% in July from 4.1% in June, with the economy adding only 73,000 jobs – well below the 115,000 forecast by Leading Economorons. Substantial downward revisions to May and June job figures erased a combined 258,000 jobs that the market had already celebrated, bringing the three-month average payroll gain to just 35,000 – a level not seen since Trump’s first term.

Labor Force Participation has declined to 62.2%, its lowest level since November of 2022, while the Employment-Population Ratio fell to 59.6%. Long-term Unemployment increased by 179,000 to 1.8M, now accounting for 24.9% of all Unemployed Individuals. While workers are hitting the bricks, Inflation has re-accelerated for two consecutive months, reaching 2.7% in July, the highest since February. Core Inflation rose to 3.1% year-over-year, with monthly Core CPI increasing 0.3% (3.6% annualized). This uptick reflects the gradual, EARLY impact of Tariffs on Consumer Prices, particularly in categories such as Household Furnishings, Apparel, and Recreational Goods (so far).

DESPITE all this TERRIFYING Inflation Data, Powell’s August 23rd speech carefully balanced competing economic concerns while opening the door to rate cuts under tremendous pressure from the President. Powell is essentially a lame duck, into the last year of his term and Trump has begun to go after Powell’s allies on the Fed to place additional pressure on the Chairman. Powell said that “the balance of risks appears to be shifting” between the Fed’s dual mandate objectives, with downside risks to Employment increasing (indicating cuts to stimulate the economy) while Inflation remains elevated (indicating that cutting rates will likely be a disaster).

DESPITE all this TERRIFYING Inflation Data, Powell’s August 23rd speech carefully balanced competing economic concerns while opening the door to rate cuts under tremendous pressure from the President. Powell is essentially a lame duck, into the last year of his term and Trump has begun to go after Powell’s allies on the Fed to place additional pressure on the Chairman. Powell said that “the balance of risks appears to be shifting” between the Fed’s dual mandate objectives, with downside risks to Employment increasing (indicating cuts to stimulate the economy) while Inflation remains elevated (indicating that cutting rates will likely be a disaster).

Key takeaways from the speech included:

-

Labor market focus: Powell highlighted unusual weakness in both job supply and demand, describing it as a “curious kind of balance” that poses increasing risks

-

Tariff assessment: While acknowledging tariffs could trigger “more persistent inflationary trend,” Powell suggested the baseline scenario points to “temporary effects“

-

Policy flexibility: The statement that “this shifting balance of risks may warrant adjusting our policy stance” was interpreted as a clear signal for September rate cuts

Financial markets responded dramatically to Powell’s dovish pivot. The S&P surged 1.5%, the Dow gained over 860 points (1.9%) and the Nasdaq climbed nearly 2%. Treasury yields fell across maturities, with the 10-year yield dropping 7.1 basis points to 4.258% and the 2-year falling 10.2 basis points to 3.689% BUT IT WAS ALL AN ILLUSION as the Dollar fell 1.5% (lower rates = weaker currency) and was the root cause of those moves.

Financial markets responded dramatically to Powell’s dovish pivot. The S&P surged 1.5%, the Dow gained over 860 points (1.9%) and the Nasdaq climbed nearly 2%. Treasury yields fell across maturities, with the 10-year yield dropping 7.1 basis points to 4.258% and the 2-year falling 10.2 basis points to 3.689% BUT IT WAS ALL AN ILLUSION as the Dollar fell 1.5% (lower rates = weaker currency) and was the root cause of those moves.

In fact, all of 2025 has been an illusion when you take into account the fact that the Dollar has fallen from 110 to 98, which is 12 points or 10.9% and the indexes have, for the most part – not even managed to make up for the loss of buying power:

| Index | December 31, 2024 Close | August 25, 2025 Current | Points Change | Percentage Gain |

|---|---|---|---|---|

| Dow Jones Industrial Average | 42,544.22 | 45,631.74 | +3,087.52 | +7.26% |

| S&P 500 | 5,881.63 | 6,452.34 | +570.71 | +9.70% |

| Nasdaq Composite | 18,933.28 | 21,172.86 | +2,239.58 | +11.83% |

| NYSE Composite | 18,830.00 | 21,150.11 | +2,320.11 | +12.32% |

| Russell 2000 | 2,201.00 | 2,361.95 | +160.95 | +7.31% |

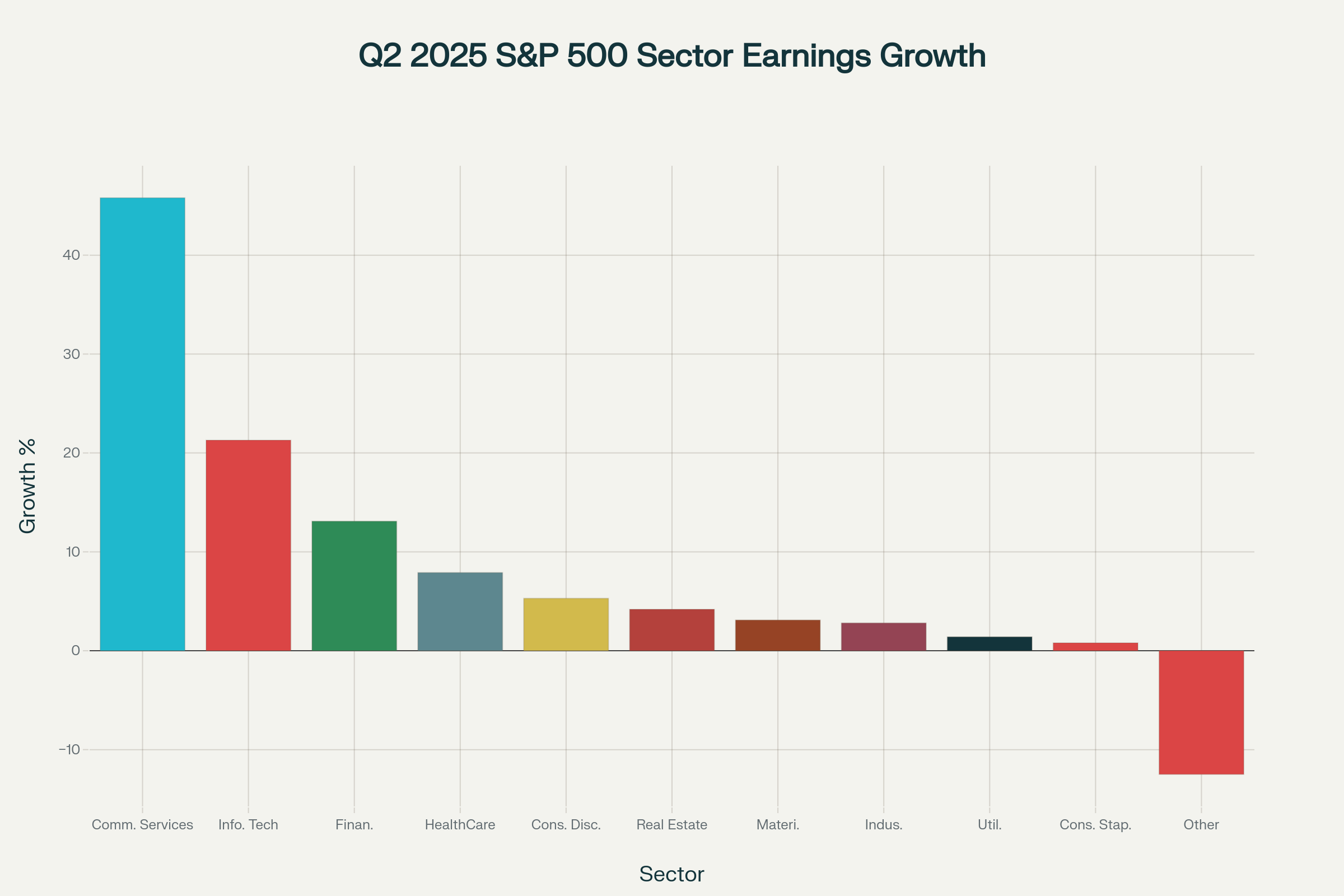

The Q2 2025 earnings season delivered robust results that exceeded expectations across multiple metrics. With 90% of S&P 500 companies having reported, 81% beat earnings per share estimates—the highest percentage since Q3 2023. The blended earnings growth rate reached 11.8%, marking the third consecutive quarter of double-digit growth.

Sector Performance

Technology Leadership: Information Technology and Communication Services sectors drove much of the growth, with AI-related companies leading the charge. Communication Services posted the highest growth at 45.8%, driven significantly by Warner Bros. Discovery’s turnaround.

Financial Strength: The Financials sector showed robust 13.1% growth, benefiting from higher interest rates and strong fee income.

Healthcare Resilience: Healthcare delivered 7.9% growth, with positive surprises from Pfizer, Eli Lilly, and Amgen contributing significantly.

Energy Weakness: The Energy sector remained the only major laggard, reporting -12.5% earnings decline due to lower commodity prices.

Revenue Trends

Revenue growth reached 6.3% year-over-year, the highest since Q3 2022. Information Technology led with 15.0% revenue growth, while Healthcare contributed 10.8%. Notably, 80% of companies exceeded revenue expectations, above historical averages.

So a combination of Inflation and a Weaker Dollar led to higher revenue numbers and higher profits but NOT ENOUGH to offset the Inflation and the Weaker Dollar… And the bulk of the Tariffs haven’t even hit yet – this is going to be VERY INTERESTING!

So a combination of Inflation and a Weaker Dollar led to higher revenue numbers and higher profits but NOT ENOUGH to offset the Inflation and the Weaker Dollar… And the bulk of the Tariffs haven’t even hit yet – this is going to be VERY INTERESTING!

Based on Powell’s comment and the most recent data, it does look like we will get an 0.25% cut in September as it would be economically meaningless but it may prevent Trump from having a complete melt-down while giving the Fed a chance to compile more data. Of course, the data itself is no longer trustable but, whatever – it’s all we’ve got…

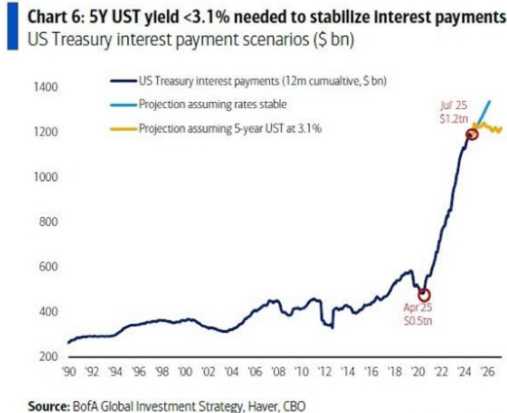

Trump wants at least 1% off ASAP and that, plus the tariffs are likely to push Inflation back to 5% and possibly much worse if our Bond Auctions begin failing (because of our refusal to acknowledge realistic rates). If we do indeed avoid an economic collapse – then we can move through 2026 rolling over another $10Tn worth of debt AND going $2Tn further into debt (passing $40Tn total) which, even at 3% (33% lower than current rates), would be $1.2Tn in Interest Payments alone.

This is, by the way, our BEST CASE scenario!

This is, by the way, our BEST CASE scenario!

That is NOT the scenario we are in. At the moment, we have a debt of $37.3Tn and, at 4.375%, that’s $1,631,875,000,0000 in Interest Payments alone if rates don’t come down and that is 22% of our ENTIRE Budget spent servicing our debt. $1.6Tn is our ENTIRE Medicare/Medicaid budget, it is MORE than our $1.5Tn Social Security Budget and even more than our $922Bn (claimed) Defense Budget (which doesn’t count veterans benefits, R&D, the portions of Entitlements that go to Military Personel, etc.), which is proposed to go up by 13.1% next year – well over $1Tn.

We’re currently spending “just” $1Tn servicing our debt but that’s because, in order to avoid the higher long-term rates this year, we’ve been rolling over our long-term notes into short-term notes – which is great if rates go lower but will completely BLOW UP IN OUR FACE if rates go higher. Thus Trump’s DESPERATION to get rates lower – the rollovers we face in 2026 will quickly take our debt service up another $600Bn – completely consuming all possible Tariff benefits.

Unfortunately, Economic Growth is slowing drastically. Even 2025, despite Q2, is widely expected to deliver just 1.5% GDP growth and we’ll be lucky to hit that next year as the full impact of Tariffs take hold. Government spending, now $7.25Tn, is also subject to inflation and if revenues aren’t increasing (unlikely with Trump’s tax cuts), then the DEFICIT between Government Spending ($7.25Tn) and Taxes/Tariffs Collected ($5.2Tn) is going to WIDEN!

Tariffs are indeed “transitory” inflation factors – as they provide a one-time boost in prices (so 10% this year, 0% additional next year) UNLESS workers (remember workers, this is a post about workers) are foolish enough to demand wages that keep up with Inflation and then companies will seek to again raise prices to cover their rising labor costs and we are all jumping right back on that Inflation treadmill that everyone is trying to pretend doesn’t exist.

Tariffs are indeed “transitory” inflation factors – as they provide a one-time boost in prices (so 10% this year, 0% additional next year) UNLESS workers (remember workers, this is a post about workers) are foolish enough to demand wages that keep up with Inflation and then companies will seek to again raise prices to cover their rising labor costs and we are all jumping right back on that Inflation treadmill that everyone is trying to pretend doesn’t exist.

Unemployment will keep climbing as companies try to squeeze more Productivity out of AI and, though 95% of those projects are currently failing to produce measurable results – either those 95% catch up or they will be bought by their more-successful competitors. Either way, workers go bye-bye…

So Unemployment will creep towards 5% next year and job creation will remain anemic but there’s a wild-card as ICE’s $150Bn budget should be able to chase down, capture and “remove” at least 1M people ($150,000 each!) and that would offset 100,000 job losses per month for Trump – SMART!

Despite Powell’s optimistic baseline scenario, Tariff impacts remain the primary wildcard. Current effective Tariff Rates around 9% could rise to 15% or higher, potentially triggering more persistent Inflation. The Administration’s ongoing trade negotiations and potential for additional sectoral tariffs create significant policy uncertainty. For example, just this weekend, Trump announced he would impose “Furniture Tariffs” at “A rate yet to be determined.” This should be great for LZB ($37.25) who just had a terrible quarter but make most of their furniture in the US:

Because, of course, this is how America wants to succeed in business (without really trying) – propping up weak manufacturers by taxing their competitors so the local manufacturers don’t have to improve themselves to compete on the International Stage – they can just carve our a niche in the local markets – selling overpriced, low-quality goods to a captive market until, one day, even that won’t be enough to save the dying business and we are left with NO businesses that are able to compete in a fair market. Smart!

That is why, more and more, our future is looking like Stagflation. A stagnant Economy with rising Inflation and that really does not tend to end well. The U.S. Economy stands at a critical juncture as it navigates the complex interplay of Recovering Growth, Softening Labor Markets and PERSISTENT Inflation Pressures. Powell’s Jackson Hole speech has clearly signaled the Fed’s readiness to support the Economy through rate cuts while acknowledging SIGNIFICANT uncertainties ahead.

The path through 2026 will largely depend on how successfully the Economy absorbs Tariff-Related Price Pressures WITHOUT triggering a broader slowdown. While the Q2 earnings season demonstrated Corporate Resilience (so far), the narrowing base of Job Growth and Rising Unemployment suggests that economic momentum is waning. Success will require careful Fed Policy calibration, resolution of Trade Uncertainties and continued Corporate Adaptability to changing Economic Conditions.

The next six months will be particularly crucial in determining whether the Economy achieves a “soft landing” or faces more significant challenges ahead.

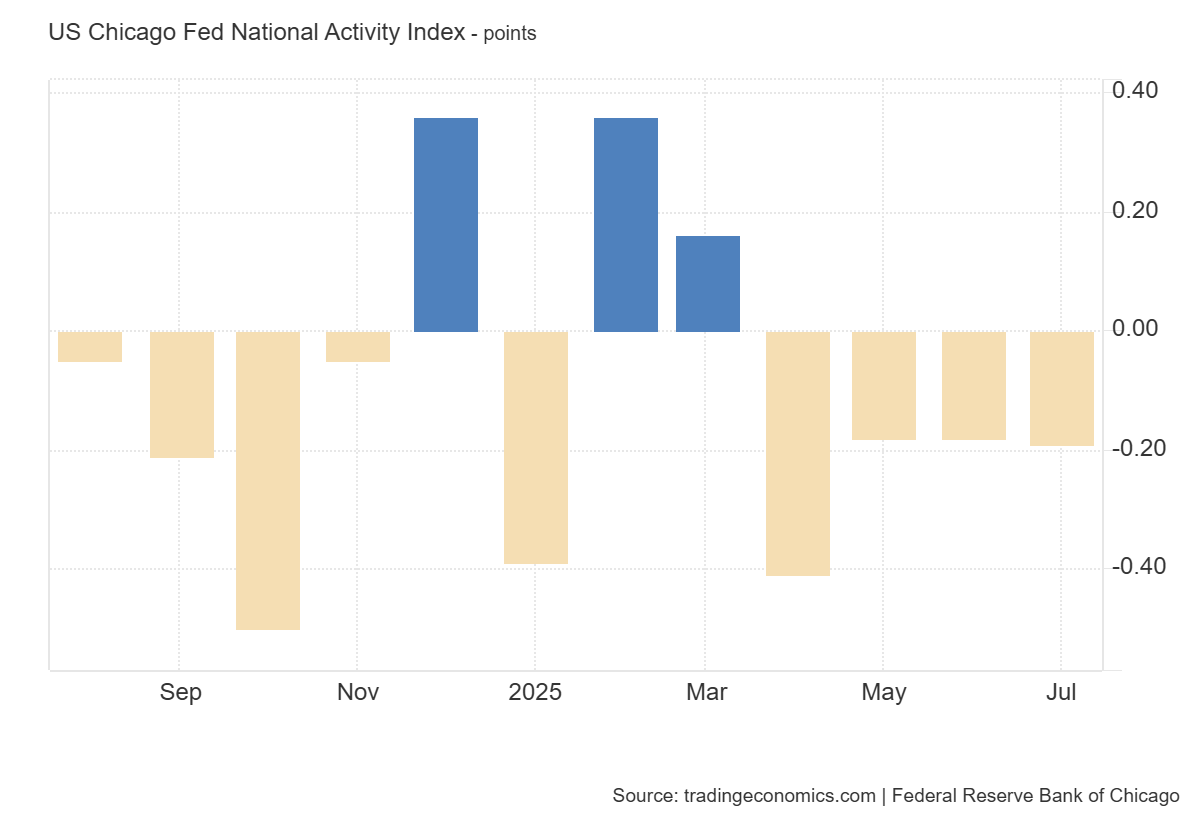

I don’t want to say how bad that chart looks as I’m trying to maintain a Positive Mental Attitude as our Glorious Leader spent the weekend threatening to take away the Broadcast Licenses of non-Skydance/Paramount/CBS networks ABC (DIS) and NBC/Universal (CMCSA) – so who knows who’s next, right?

I don’t want to say how bad that chart looks as I’m trying to maintain a Positive Mental Attitude as our Glorious Leader spent the weekend threatening to take away the Broadcast Licenses of non-Skydance/Paramount/CBS networks ABC (DIS) and NBC/Universal (CMCSA) – so who knows who’s next, right?

After all, our Long-Term Portfolio (LTP) popped to $713,150 last week – up $38,842 from our Aug 12th Review and our Short-Term Portfolio (STP) gained $20,000+ (10%) despite being on the wrong side of history – thanks to our short-term call selling (hedging our hedges).

So what do we do after having a great week? We lock in our gains by adjusting our hedges and THEN we can use a bit of our remaining ill-gotten gains to make some speculative plays – earnings or otherwise!

“He deals the cards as a meditation

And those he plays never suspect

He doesn’t play for the money he wins

He doesn’t play for respect

He deals the cards to find the answer

The sacred geometry of chance

The hidden law of a probable outcome

The numbers lead a dance” – Sting