“And he can see no reasons

“And he can see no reasons

‘Cause there are no reasons

What reason do you need to be shown?” – Boomtown Rats

Just when you think you understand oil markets, OPEC+ holds an 11-minute virtual meeting that defies every principle of supply and demand economics…

Oil prices are doing their best impression of a caffeinated trader this Monday morning, rallying to $63 for WTI (/CL) and $66.70 for Brent (/BZ) DESPITE what can only be described as the most bearish supply announcement in recent memory. In a VERY brief 11-minute virtual meeting on Sunday, OPEC+ decided to accelerate their production comeback tour, adding 137,000 barrels per day (4.1Mb/month!!!) starting in October.

But wait, there’s more!: They are ALSO speeding up the unwinding of their 1.65Mb/d (4.95Mb/month!!!) cuts by over a year, all while the IEA warns that global supply will surge by 2.5Mbp/d (75Mb/month!!!) in 2025 versus demand growth of barely 680,000 bpd (20Mb/month). It’s like announcing a massive buffet expansion while your customers are all on Ozempic.

This is a coming supply tsunami nobody is taking about. The math is so lopsided they are going to have to build levees on the NYMEX floor:

-

-

Global supply growth: 2.5Mbp/d (2025/6)

-

Global demand growth: 0.68Mbp/d (2025)

-

Net oversupply: Nearly 2Mbp/d of excess crude looking for buyers

-

Saudi Arabia’s Calculated Gamble: The Kingdom is positioning itself to grab market share from U.S. shale producers who need $55-60 oil to stay profitable. They’re willing to endure lower prices to kill the competition – a strategy that worked beautifully in 2014-2016 when they bankrupted dozens of American frackers.

The Cheating Problem: Countries like Kazakhstan, UAE, and Iraq are already producing 500,000 bpd above their quotas. OPEC+ isn’t so much “increasing production” as legitimizing the cheating that was happening anyway. It’s like giving your teenager permission to stay out late after they’ve already snuck out.

While Trump rolls back green energy incentives, bans wind farming and eliminates CAPE (mileage) standards, the rest of the world is plugging in and the numbers are staggering:

While Trump rolls back green energy incentives, bans wind farming and eliminates CAPE (mileage) standards, the rest of the world is plugging in and the numbers are staggering:

-

-

58 Million EVs on global roads (TRIPLE the 2021 levels, when Trump left office)

-

That is 1.3 MILLION barrels per day of oil demand already eliminated by EVs

-

China: 1 in 10 cars are already electric

-

UK: EVs captured 30% of new car sales in 2024

-

The 2030 Forecast: EVs will displace over 5 MILLION barrels PER DAY globally, with China accounting for half that impact. That’s equivalent to removing Iran’s ENTIRE Oil exports from global demand.

Meanwhile, the The Trump Administration is trying to make America “Great” (as in 1960s gas-guzzlers) Again by DESTROYING (not hyperbole) all previous efforts to to advance clean energy which is BOTH Economically destructive and Strategically shortsighted (and I am using my polite words here…):

-

-

62% reduction in new clean energy grid additions over the next decade

-

$400+ annual increases in electricity bills for some states

-

Elimination of EV and home efficiency tax credits just as costs were becoming competitive

-

“National energy emergency” declaration despite the U.S. being the world’s largest oil producer

-

The Global Reality: While America retreats from Clean Energy Leadership, China is doubling down. Chinese EV manufacturers are flooding global markets with affordable electric vehicles, while Chinese solar and wind companies are dominating the fastest-growing energy sectors. Rather than PROTECTING their weak manufacturers with tariffs, China is encouraging Green Energy production, making China Great for decades to come while America spirals into a Luddite decline.

Trump’s fossil fuel fixation isn’t just bad climate policy – it’s economic suicide!:

What We’re Losing:

-

-

Clean energy manufacturing jobs that were booming in red states

-

Technological leadership in the world’s fastest-growing industries

-

Energy independence through domestic renewable resources

-

Export opportunities in clean technology markets projected to reach $2.5 trillion by 2030

-

What We’re Getting: Temporary protection for declining fossil fuel industries while ceding the future to competitors who understand that cheap, clean energy is the ultimate competitive advantage.

So why are oil prices rising despite this supply tsunami and demand destruction? Three words: short-term thinking.

The Rally Drivers:

-

-

Geopolitical premium from Russia/Iran sanctions

-

Speculative momentum on OPEC+ “restraint” narrative

-

Dollar weakness making commodities relatively attractive bets

-

Technical factors and algorithmic trading divorced from Fundamentals

-

The Reality Check Is Coming: J.P. Morgan forecasts oil prices will face downward pressure as supply growth overwhelms demand. When the Fundamentals finally DO matter, $50-55 oil is likely to becomes the new normal. Short-term traders can ride the Monday morning manipulation, but smart money is positioning for the inevitable correction.

While, Trump may want to keep America in the Dark Ages of Energy (and why not, he was allegedly paid $1Bn to keep us dependent on fossil fuels and he IS delivering on his promise to Big Oil), he’s not able to control the price for much longer and we can SHORT Oil Futures (/CL) if they hit $65 again and we can go LONG US Exporters of alt-energy solutions as China can’t produce enough to meet the World’s (not America) growing demand for clean energy products.

Chinese EV Manufacturers should continue to gain market share over our protected US companies that will continue to make THE WRONG CARS for the Global Markets. Global grid infrastructure is also going to be a huge play as the rest of the World electrifies – which will lead them to a MASSIVE cost advantage over US Manufacturers into the 2030s. Trump is making this happen…

The loser’s bet is believing that fighting technological progress and global economic trends is a sustainable strategy.

The future is electric, whether America participates or not. What Trump is doing is like demanding America keep burning wood and coal 150 years ago and putting blocks, tariffs and restrictions on our use of oil. It not only makes the country uncompetitive on the Global landscape but it penalizes the American people – who are forced to buy more expensive, less efficient fuels – just to buy the existing Oligarchs a few more years of profits.

Oil’s morning rally is borrowed time fueled by manipulation, speculation, and DENIAL. The Fundamental forces reshaping Global Energy are unstoppable: EVs are proliferating, renewables are becoming cheaper, and oil demand is structurally declining. America is only 4% of the World’s population – there are some things you can’t dictate via proclamations – this is one of them!

Trump’s war on Clean Energy won’t stop this transition – it will just ensure America misses the Economic benefits. While we’re busy “unleashing” yesterday’s energy sources, the rest of the world is building tomorrow’s Energy Economy without us.

Meanwhile, we are running out of earnings but there are still a few we’ll be watching this week:

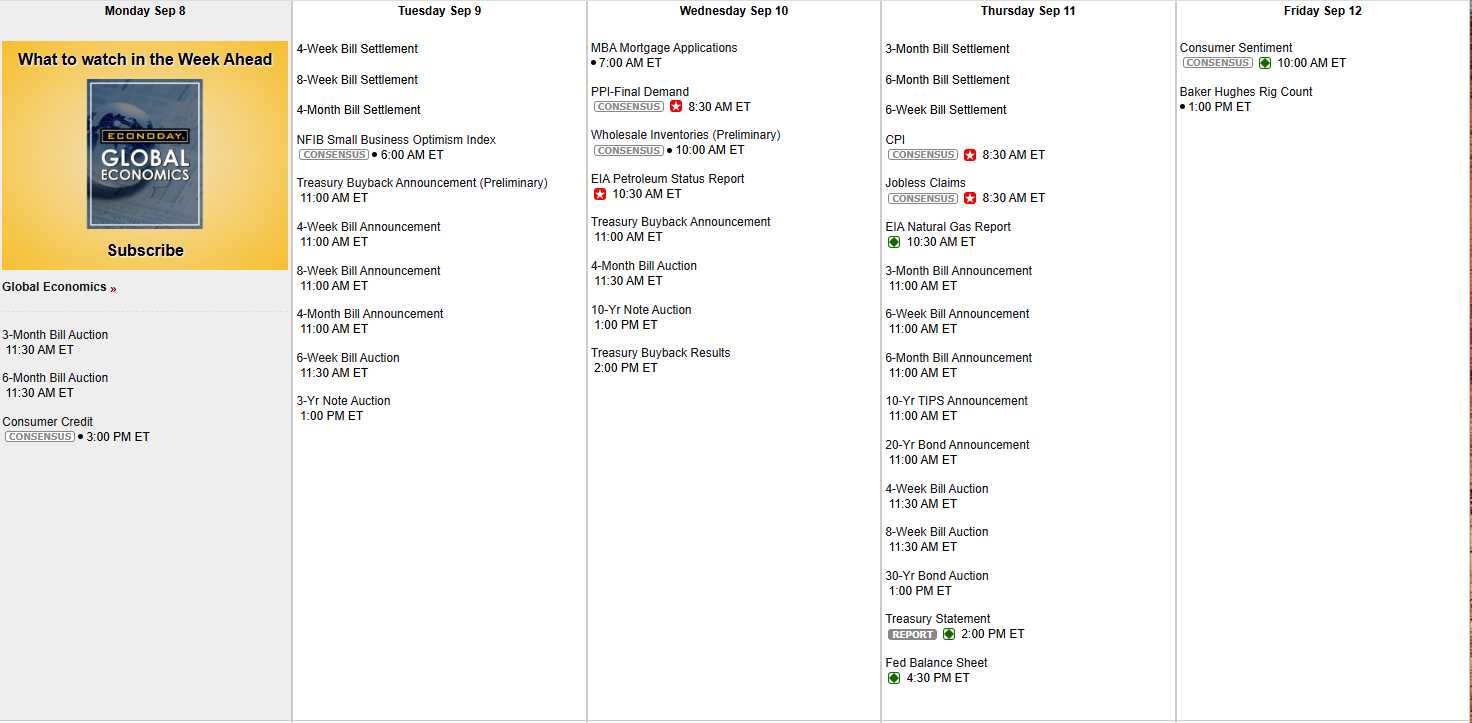

It’s also a “quiet week” for the Fed ahead of next week’s rate decision (+0.25 – spoiler alert!) but there are several Note Auctions and they will speak volumes. This afternoon we get Consumer Credit, tomorrow is Small Business Optimism (or lack thereof), Wednesday is PPI and the 10-Year Auction, Thursday is CPI with the 30-Year and Friday is Consumer Sentiment.

The Dollar is down at 97.62 and, as long as it stays weak – everything else will look strong. It’s all an illusion – but let’s enjoy it while it lasts…