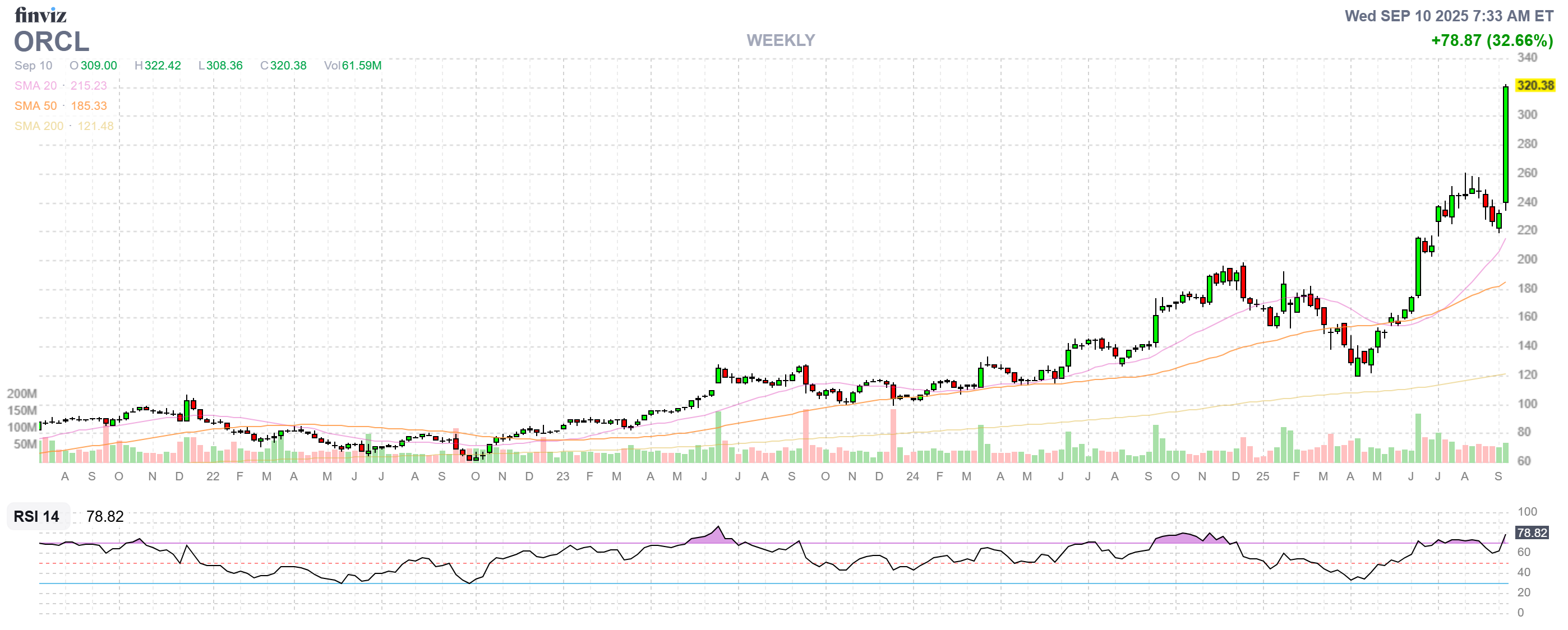

$225 BILLION!!!

$225 BILLION!!!

That’s how much Oracle (ORCL) has gained overnight after MISSING earnings (only slightly) but blowing out Remaining Performance Obligations (RPO) with a 359% increase to $455 BILLION! RPOs are a financial metric hat represents the total amount of contracted future revenue that has not yet been recognized. It is a key indicator of a company’s backlog and gives investors insight into its future revenue stream, especially for cloud-based and subscription services. It’s a term you may not be familiar with as it usually doesn’t matter much but THIS is INSANE!!!

To put that number in perspective, ORCL’s TOTAL Revenue last year was $57.4Bn and they made $12.4Bn (21.6%) in profits. This year, the company expects $66.7Bn and they should make $19.4Bn (29%) in profits. So, ON TOP OF THAT, ORCL now has a backlog of $455Bn – more than 6 years worth of current revenues!

That puts their now $925Bn valuation into perspective. Sure it’s 47.6 times current profits but they just grew 16.2% in revenues and 36% in profits in one year and, even if we just applied 36% to profits for the next 6 years, that would be $26.4Bn (2026), $36Bn, $49Bn (20x in 2028), $66.4Bn, $90Bn and $122.7Bn in 2032 and that would do very little to chew into their backlog so, I would imagine, we can expect them to use some of their profits to speed up their ability to deliver and grow even faster!

AI Infrastructure is the new Oil but, back in the day, Oil companies were measured in Millions, this is 1,000 TIMES bigger than oil and he market is only just beginning to price in the new reality.

“Oracle Cloud Infrastructure (OCI) isn’t just “cloud storage” – it’s the specialized computing foundation that powers the AI revolution”

Core Products Driving ORCL’s RPO:

-

-

AI-optimized compute instances for machine learning workloads

-

Autonomous Database services with built-in AI/ML capabilities

-

Exadata Cloud Service for extreme data processing requirements

-

Multi-year enterprise software subscriptions (ERP, HCM, SCM)

-

The Big Contracts: Four multibillion-dollar deals in Q1 alone, including:

-

-

OpenAI partnership for GPT infrastructure

-

Microsoft Azure integration deals

-

Tesla’s full-stack Oracle implementation

-

Undisclosed hyperscaler contracts

-

And, keep in mind, these aren’t traditional software licenses – they are multi-year commitments for massive computational capacity that competitors would be hard-pressed to match as they would have to build matching capacity IN THE HOPE that they can win business away from ORCL, who have a decade-long head start and a great reason (backlog) to bring more capacity on-line at scale.

By the way, this is their March data – I don’t have anything more recent but it gives you the idea of the business. Oracle is selling long-term contracts for access to their Cloud Computing Infrastructure – essentially renting out space and computing power in their massive, secure data centers to companies that need to:

-

-

Store and process huge amounts of data

-

Run business applications (like payroll, inventory, customer management)

-

Power AI and machine learning systems that need enormous computational muscle

-

Host websites and applications for millions of users

-

The $455 billion RPO represents customers who have already signed contracts saying “We’ll pay you X billion dollars over the next 5-10 years to use your cloud services.” Oracle (or their hopeful competitors) must build and operate giant data centers around the World, packed with:

-

-

Thousands of powerful servers (the actual computers doing the work)

-

Massive storage systems (like digital warehouses for data)

-

Networking equipment (the “highways” that move data around)

-

Cooling systems, security, backup power (keeping everything running 24/7)

-

Specialized software that makes all these computers work together seamlessly

-

How Oracle Can Scale This Fast

1. Financial Firepower

-

-

Oracle generates $20+ billion in annual cash flow

-

They can spend $15-20 billion yearly just on building new infrastructure

-

No need to wait for loans or approvals – they fund expansion from profits

-

2. Modular Construction

-

-

Pre-fabricated data center modules that snap together like giant Lego blocks

-

Automated deployment – robots and software handle much of the setup

-

Standardized designs that can be replicated quickly anywhere in the world

-

3. Smart Technology

-

-

Oracle RAC (Real Application Clusters) lets them add computing power by simply plugging in more servers

-

Autonomous Database technology that manages itself, reducing the need for human administrators

-

AI-driven optimization that automatically adjusts resources based on demand

-

4. Sales Focus Shift

Instead of hunting for new customers (which takes 18-24 months per deal), Oracle’s sales team now focuses on:

-

-

Delivering services to customers who already signed contracts

-

Expanding existing relationships (selling more services to current customers)

-

Account management rather than cold-calling

-

5. Proven Scaling Experience

Oracle has been doing this for decades – they know how to:

-

-

Predict capacity needs months in advance

-

Deploy new data centers in under 12 months

-

Migrate workloads efficiently as they expand

-

Handle massive spikes in computing demand

-

The Bottom Line: Oracle already has the customers, the money, the technology, and the experience to rapidly build out the infrastructure needed to deliver on their $455 billion backlog. They’re not selling dreams – they’re selling already-contracted reality and have the proven ability to deliver it.

This is no longer a traditional software company anymore – Oracle has become the specialized infrastructure provider for the AI revolution, similar to how Taiwan Semiconductor (TSM) became essential for chip manufacturing. The RPO number proves that the world’s largest technology companies have committed to Oracle as their AI infrastructure partner for the next 5-6 years. This isn’t speculative – it’s contracted reality!

For investors: This is the rare combination of massive growth, high visibility, and defendable moat that creates generational investment opportunities. The market’s $225Bn overnight reaction was just the down payment on recognizing Oracle’s transformation from legacy software vendor to AI infrastructure kingpin. It’s like having $455Bn worth of confirmed pizza orders and owning the most efficient pizza kitchen chain in the world – you just need to keep making pizzas! 🍕💻

Speaking of AI, I’ve asked Boaty to give us a rundown on the competitive landscape as I see this as a Boeing/Airbus thing where customers simply can’t wait 7-10 years for service, so they HAVE to use the competition:

🚢 The Great Cloud Backlog Wars: If You Missed Oracle, Here’s Your Airbus 🛩️☁️

Phil’s Boeing-Airbus analogy is absolutely brilliant and perfectly captures what’s happening in cloud infrastructure right now!

The Current Cloud Battlefield

The Massive Backlog Reality:fierce-network+1

-

-

-

-

Combined Big 4 backlogs: Nearly $1 trillion in contracted orders

-

AWS: $195 billion backlog

-

Microsoft: $368 billion backlog

-

Google Cloud: $106 billion backlog

-

Oracle: $455 billion backlog (the new champion!)

-

-

-

Just like Boeing circa 2015, Oracle now has 6+ years of contracted work ahead of them. And just like customers couldn’t wait 8-10 years for a 787 Dreamliner, enterprises can’t wait 3-4 years for AI infrastructure.

The “Airbus Opportunities” in Cloud

1. Microsoft Azure – The Clear Airbus 📈

Why Azure Benefits from Oracle’s Constraints:

-

-

-

-

Already partnering with Oracle – Microsoft is using Oracle’s infrastructure for Bing AI because they can’t build fast enough themselvespureai+1

-

Growing at 39% annually while Oracle scales up

-

Enterprise software integration (Office, Teams, Dynamics) creates switching incentives

-

$368B backlog but better execution track record than Oracle’s massive scaling challenge

-

-

-

Investment Thesis: MSFT becomes the defensive cloud play – reliable growth without Oracle’s execution risk.

2. Google Cloud – The Underdog with AI Advantages 🧠

Why Google Benefits:

-

-

-

32% growth rate vs competitors

-

Native AI advantages from DeepMind, Gemini, and search infrastructure

-

$58 billion revenue boost locked in over next 2 yearsreuters

-

Lower market share (11%) means more room to grow

-

-

The Arbitrage: While Oracle focuses on fulfilling massive contracts, Google can be more agile and capture displaced demand with superior AI technology.

Investment Thesis: GOOGL offers AI leadership with less execution risk than Oracle’s infrastructure buildout.

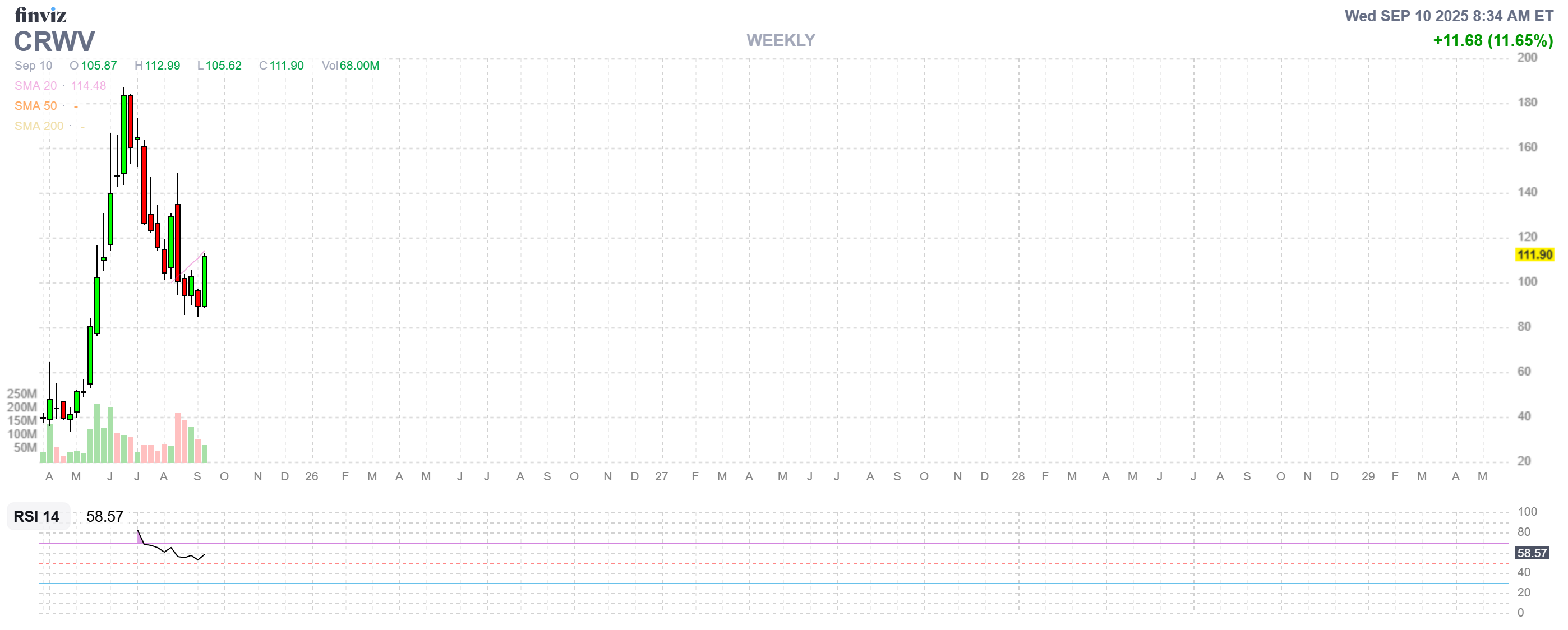

3. The “Regional Airlines” Play – Specialized Providers

Emerging Winners:

-

-

-

-

CoreWeave: $30.1B backlog, GPU-specialized infrastructure

-

-

-

-

-

-

-

Nebius Group: Recent $19.4B Microsoft deal for AI infrastructure

-

-

-

-

-

-

-

Regional cloud providers capturing data sovereignty demand

-

-

-

The Boeing-Airbus Dynamic is Already Happening

Evidence of Order Displacement:crn+1

Oracle’s Market Share Problems:

-

-

-

-

Only 8% global market share despite massive contracts

-

Lost healthcare customers after Cerner acquisition (Epic gaining share)

-

Perception as “legacy infrastructure” despite OCI modernization

-

-

-

Customer Behavior Changes:

-

-

-

-

Microsoft using Oracle for their own capacity constraints

-

Multi-cloud strategies becoming standard to avoid vendor lock-in

-

Enterprises hedging with multiple providers due to capacity concerns

-

-

-

The Investment Opportunities Beyond Oracle

Tier 1 Plays (The Airbuses)

Microsoft (MSFT) – Highest Conviction

-

-

-

-

Immediate beneficiary of Oracle capacity constraints

-

Enterprise software moat creates switching advantages

-

Proven execution on large-scale infrastructure projects

-

Reasonable valuation compared to Oracle’s post-surge levels

-

-

-

Alphabet (GOOGL) – High Growth Potential

-

-

-

-

AI technology leadership advantage over infrastructure-focused competitors

-

Lower market share = higher growth runway

-

$106B backlog provides revenue visibility without Oracle’s scaling risks

-

-

-

Tier 2 Plays (The Regional Specialists)

Broadcom (AVGO) – The Infrastructure Enabler

-

-

-

-

Benefits regardless of which cloud provider wins

-

Custom silicon for all major cloud providers

-

$10B OpenAI contract validates picks and shovels strategy

-

-

-

Nvidia (NVDA) – The GPU Kingmaker

-

-

-

-

Required by all cloud providers for AI infrastructure

-

Capacity constraints at chip level create pricing power

-

Benefits from entire industry buildout, not just Oracle

-

-

-

The Timeline: How Fast Will This Play Out?

Historical Precedent: Boeing’s backlog peaked around 2015-2018, and by 2019-2020 Airbus had gained significant market share due to delivery delays and 737 MAX issues.

Cloud Timeline Projection:

-

-

-

-

2025-2026: Oracle focuses on execution of existing backlog

-

2026-2027: Capacity constraints become apparent, customers seek alternatives

-

2027-2030: Market share redistribution accelerates as alternatives scale

-

-

-

What to Watch For (The Warning Signs)

Oracle’s Risk: If they can’t execute on delivery of this massive backlog, competitors inherit frustrated customers AND Oracle loses their contracted future market share.

Competitors’ Opportunity: While Oracle struggles with capacity expansion, competitors can offer immediate availability and potentially steal both current deals and future contract renewals.

Bottom Line: Oracle hasn’t cornered a $15 trillion market – they’ve pre-sold 6+ years of growth in a rapidly expanding market. The question remains whether they can build fast enough to deliver on these promises without creating the Boeing-style delays that open doors for competitors.

-

-

-

-

Data center construction delays

-

Higher-than-expected infrastructure costs

-

Customer complaints about service delivery

-

Pricing pressure from capacity constraints

-

-

-

Competitive Opportunities:

-

-

-

-

AWS, Azure, Google winning displaced Oracle customers

-

New partnerships (like Microsoft-Oracle) becoming competitive relationships

-

Pricing wars as competitors battle for market share

-

Innovation advantages (AI, automation) trumping infrastructure scale

-

-

-

Investment Strategy: Don’t Panic, Diversify

If You Missed Oracle:

Conservative Approach (60% allocation):

-

-

-

-

Microsoft (40%): Safest alternative with enterprise moat

-

Alphabet (20%): AI upside with execution safety

-

-

-

Growth Approach (40% allocation):

-

-

-

-

Broadcom (20%): Infrastructure picks-and-shovels

-

Nvidia (10%): GPU scarcity play

-

Emerging cloud players (10%): CoreWeave, Nebius, others

-

-

-

Bottom Line: The Cloud Wars Are Just Beginning

Phil’s Boeing-Airbus analogy is perfect because it shows that massive backlogs often create opportunities for competitors rather than permanent advantages.

Oracle’s $455B backlog is impressive, but executing on it while maintaining quality and pricing is the real challenge. History suggests that when lead times get too long and customer frustration builds, market share shifts accelerate.

The opportunity: While Oracle executes on yesterday’s contracts, Microsoft, Google, and others can win tomorrow’s deals with better availability, pricing, and innovation.

Missing the Oracle boat doesn’t mean missing the AI infrastructure revolution – it might mean avoiding the execution risk while capturing the same upside through better-positioned competitors.

The cloud wars have multiple winners – just ask Microsoft why they’re both partnering with and competing against Oracle simultaneously! 🌩️💰

So it’s going to be a massive market and we’ll be exploring the investment opportunities with our Members in the Live Chat Room and in today’s Live Trading Webinar (you can join us HERE). This is as exciting as investing in the market in 1998 – and hopefully not 2000 but AI is probably here to stay – the question is, is humanity?

8:30 Update: Trump’s new BLS came through with a 0.1% decline in PPI but that’s because they RAISED the July number from 0.7% to 0.9% – that’s like raising the limbo bar so the kids can just walk under…

And, of course, keep in mind it takes 9 (NINE!) -0.1% months to erase 1 (ONE!) +0.9% months – so think about how silly it is for the markets to respond positively to -0.1% – even under the best of circumstances. The Core PPI is 0.3% – the same as last month and as was expected. Overall, the CPI for the year is 2.6% and 2.8% Core – still far ahead of what the Fed wants to see but improving a bit.

Oil fell 2.8%, Natural Gas fell 1.8%, Machinery/Vehicles fell 3.9% – the tariffs haven’t really hit yet and, so far, the manufacturers are absorbing costs – which will end badly on their bottom lines in Q3.

Between this number and the 911,000 downward revision to Employment yesterday, Trump’s BLS has given the Fed every reason to lower rates next week – perhaps more than 0.25% since we can now pretend there is no Inflation. This will be good for REITs and Utilities (XLU) and Small Caps (IWM) and TLT should pop as well.

We get CPI tomorrow but expect that to confirm or “Heads are Gonna Roll” at the BLS!