Yesterday’s PPI Report gave us a break.

The Fed makes their rate decision next Wednesday and, at the moment, the chance of a 25-point rate cut (to 4.12%) is 115% according to consensus and there’s about a 20% chance of a cherry-on-op additional 0.25% cut (to 3.87%) if CPI (in 20 minutes) comes in cooler than 0.3% because we already know Unemployment was just adjusted UP by 911,000 jobs (it’s 9/11, by the way) and, as the great Economist, Milton Freidman, once said “Recessions are bad.“

8:30 Update: As Warren predicted, CPI came in hot at 0.4%, double July’s 0.2% measure while Core CPI is a steady 0.3%. That’s the end of 0.50 cut dreams next week. Year over year CPI is 2.9% and 3.1% core – about 50% over the Fed’s preferred 2% Inflation target.

As noted by GS, 70% of the tariff costs are being passed along to Consumers (that’s US Consumers, not China consumers, by the way) and that’s why PPI was down and CPI was up. Money does have physical laws that govern it – no matter how much the Administration wishes it didn’t – once again, math and science are the enemy… Service inflation is also sticky and that’s a big problem in a 60% Service Economy.

In even worse news, Initial Jobless Claims blasted up from 236,000 to 263,000 – 11.4% higher in 7 days! The Fed risks losing control of the narrative, which is badly muddied at this point. Are they seriously about to cut rates with Core Inflation at 3.1%? That seems ridiculous to most of the World. Still, 3% is the new 2% as Structural Inflation may be here to stay with Supply Chain Reshoring (it costs more to make things in the US – that is an absolute fact even Trump doesn’t deny), Tariffs (which create Cost-Push Inflation), Labor Market Tightness (wages are still spiraling higher, increasing costs) and, of course, Energy Transition Costs are rising out of control – embedding themselves in Consumer Prices.

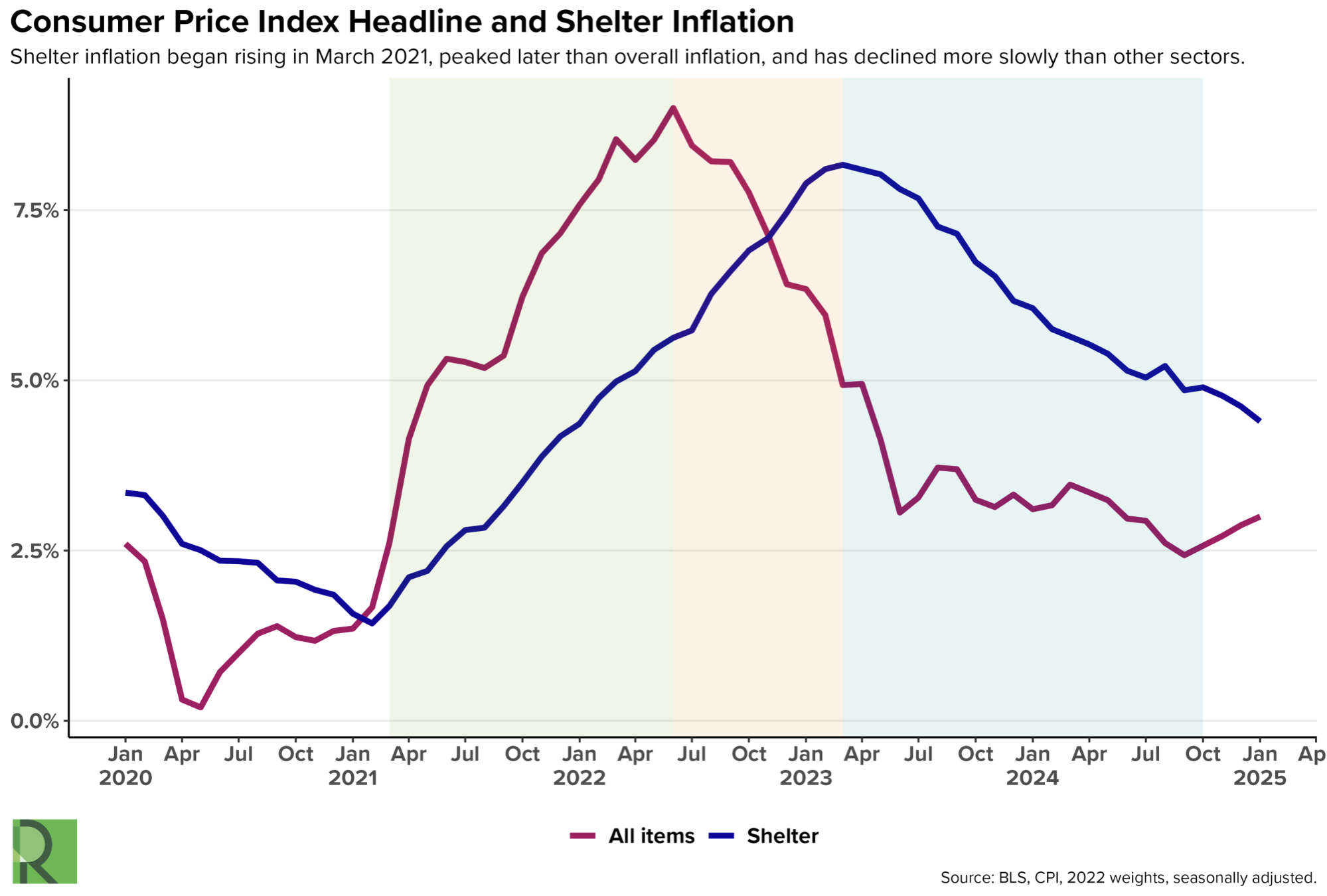

Cutting rates makes people FEEL like they can afford the inflation – so they run up bills and debts instead of cutting back on purchases – which is great for banks! Breaking down where the real pain is coming from I see Shelter Costs are still crushing Consumers, with the median mortgage payment now 30.9% of median income with rents of 3.5% over last year but all that is an illusion we cling to because it includes the home your parents paid off 20 years ago. The painful reality is a typical US Household needs to spend 44.6% of their income to afford a median-priced home in 2025!

Cutting rates makes people FEEL like they can afford the inflation – so they run up bills and debts instead of cutting back on purchases – which is great for banks! Breaking down where the real pain is coming from I see Shelter Costs are still crushing Consumers, with the median mortgage payment now 30.9% of median income with rents of 3.5% over last year but all that is an illusion we cling to because it includes the home your parents paid off 20 years ago. The painful reality is a typical US Household needs to spend 44.6% of their income to afford a median-priced home in 2025!

That doesn’t leave a lot of money for spending on other things. Consumers brave enough to go from renters (30.5% of income) to owners (44.6% of income) BETTER be buying a house they love – as they won’t be able to afford to leave it… This kind of thing matters even in home design as most people can’t afford to have a small kitchen anymore – because the alternative of going out to eat is far more expensive.

Food costs, of course, are rising at the grocery store too and the price of Gasoline to get to the grocery store is also up from last year and wage-driven inflation is making home repairs very expensive as well and, of course, insurance costs are out of control…

The indications then are that we have WIDE-RANGING, STICKY INFLATION that is NOT going away and Fed Rate Cuts INCREASE inflation so homes may become a little bit more affordable but EVERY SINGLE AMERICAN will suffer greatly from the increased prices that will be caused by these potential rate cuts.

🚢 Investment Implications: The New Rate Cycle Begins

Winners from “Higher for Longer” Reality

Financials (XLF):

-

-

Net interest margin benefits from slower rate cutting cycle

-

Credit quality concerns offset by higher yields longer

-

Banking sector particularly benefits from steeper yield curve

-

Commodities/Energy:

-

-

Inflation persistence supports commodity pricing power

-

Energy companies benefit from cost-push inflation environment

-

Materials sector gains from supply chain inflation

-

Real Assets/TIPS:

-

-

Inflation-protected securities become more valuable

-

Real estate benefits from inflation pass-through ability

-

Infrastructure assets with inflation-linked revenue streams

-

Losers from Inflation Reacceleration

Long-Duration Bonds (TLT):

-

-

Duration risk increases as rate cuts become shallower

-

Real yields remain elevated with persistent inflation

-

Treasury market faces continued selling pressure

-

High-Multiple Growth Stocks:

-

-

Discount rate pressure from slower rate cuts

-

Margin compression from persistent cost inflation

-

Valuation multiples face gravitational pull from higher real rates

-

Consumer Discretionary:

-

-

Purchasing power erosion from inflation outpacing wages

-

Margin pressure as companies struggle to pass through costs

-

Trade-down behavior as consumers prioritize essentials

-

The Fed’s September 17 Communications Challenge

Powell’s Press Conference Becomes Critical:

Must Explain:

-

-

Why cutting rates with 3.1% core inflation is appropriate

-

How PPI decline relates to CPI acceleration

-

What inflation level would trigger policy pause

-

Forward Guidance:

-

-

“Data dependent” takes on new meaning with conflicting indicators

-

Dot plot likely shows shallower cutting cycle than previously expected

-

2025 outlook becomes much more uncertain

-

Market Positioning for Next Week

Pre-Fed Meeting (September 12-16)

Tactical Trades:

-

-

Long financials on steeper curve expectations

-

Short duration bonds on reduced cutting expectations

-

Long energy/materials on inflation persistence

-

Avoid:

-

-

Rate-sensitive REITs facing higher-for-longer reality

-

Utilities losing bond proxy appeal

-

High-dividend stocks with duration characteristics

-

Post-Fed (September 18+)

Scenario Planning:

If 25bp Cut + Hawkish Guidance:

-

-

Financials rally continues

-

Growth stocks face continued pressure

-

Dollar strength on relatively hawkish Fed

-

If 25bp Cut + Dovish Messaging:

-

-

Market confusion on mixed signals

-

Volatility spike as conflicting narratives emerge

-

Gold strength on currency debasement fears

-

The Bigger Picture: Regime Change Confirmed

This CPI report confirms we’re entering a new monetary regime:

Old Paradigm (2010-2021): Disinflationary environment with predictable easing

New Paradigm (2025+): Persistent inflation with constrained monetary policy

Investment Strategy Must Adapt:

-

-

Inflation hedges become permanent portfolio allocation

-

Real assets gain structural importance

-

Duration risk becomes more dangerous than equity risk

-

International diversification critical as dollar policies become inflationary

-

Bottom Line: The Fed’s Impossible Position

Today’s CPI reading places the Fed in an unprecedented situation:

-

-

Must cut rates due to labor market deterioration (911K jobs revision)

-

Should pause cutting due to inflation reacceleration (0.4% monthly CPI)

-

Cannot satisfy both mandates simultaneously

-

For investors: This is exactly the kind of policy uncertainty that creates market volatility and favors nimble tactical positioning over buy-and-hold strategies.

The era of “don’t fight the Fed“ is ending. The new era of “the Fed can’t win“ is beginning.

Next week’s decision will be 25bp and done for a while – not the start of an aggressive easing cycle markets were hoping for. Position accordingly. 📊⚡🎯