Record highs all over!

Record highs all over!

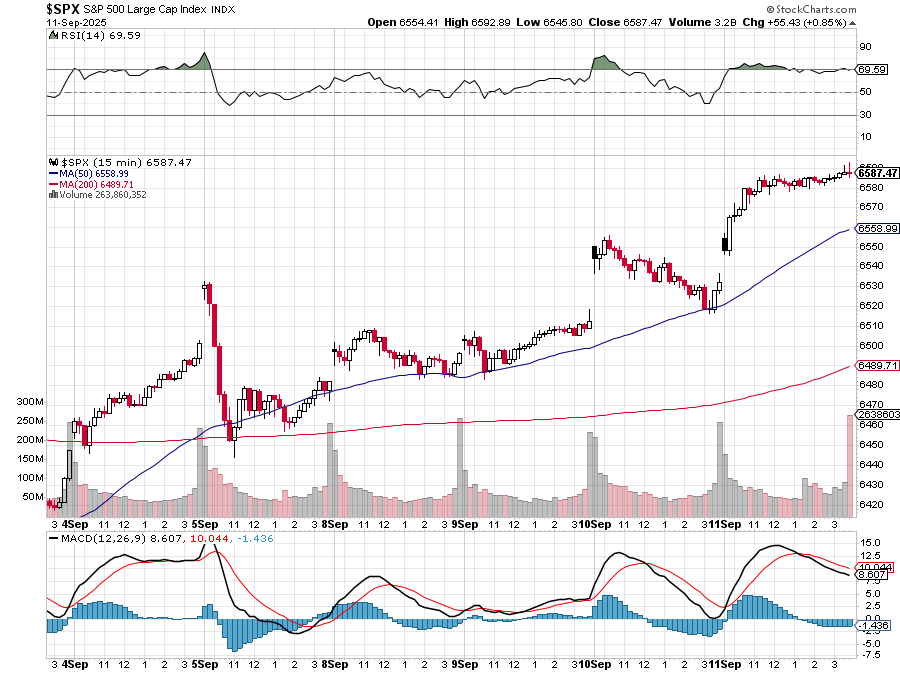

Will it last? Who cares – it’s fun for now. As you can see, the S&P 500 has been hugging the top (70) of the RSI line since yesterday morning but does that mean the party is over? Well, yes, actually it does… usually. But in this case who knows how high things can go as we are getting a rate cut next week and, even if it’s only 0.25% and even if there are no more rate cuts next year, Trump is picking a new Fed Chair and Trump wants rates back to 3% (down 1.37% from here) and, since consumers are $19Tn in debt (including $13Tn housing), 1.37% will save them $178Bn in interest payments that we can give to the Oligarchs next year. Isn’t that WONDERFUL?!?

More importantly, it’s $400Bn less interest to be paid on our $40,000,000,000,000 National Debt (which climbed $345Bn in August) and that will let Trump give another $4Tn in tax cuts to himself and his family and “friends” (not Epstein! He didn’t write that card or appear in those pictures or go to those parties or fly on that jet or grab any minors by the…). Isn’t that WONDERFUL?!?

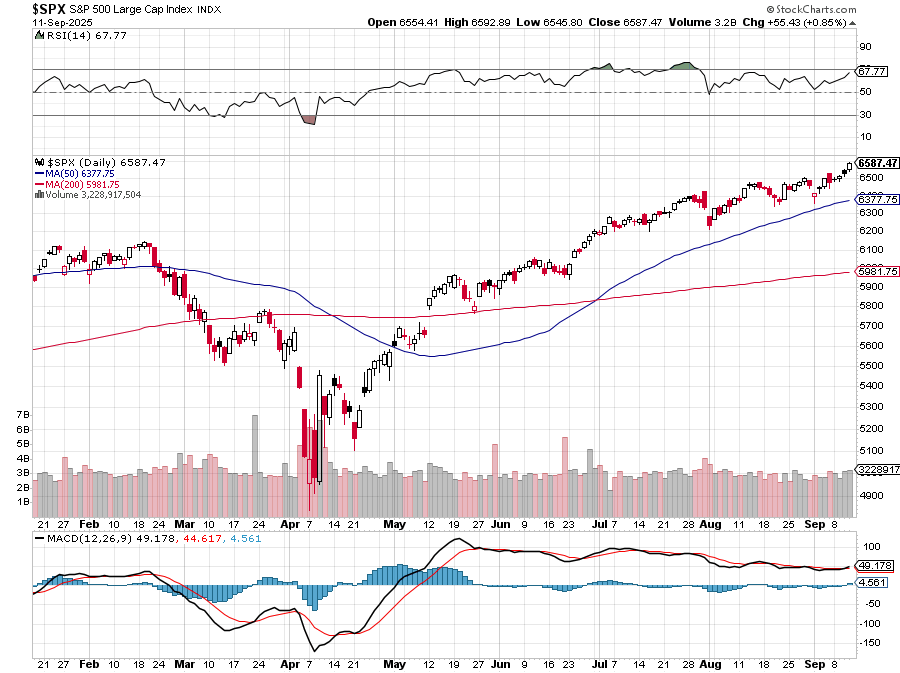

While this market climb is impressive, it does pay to have SOME perspective on things because we started the year at 5,903 on Jan 2nd and 6,600 (which we just tested yesterday) is up 697 points and that’s 11.8% BUT, without the Magnificent 6 + TSLA, we’d only be up about 3-4% for the year:

But we’re not – we’re up 11.8% – that’s our story and we’re sticking to it, right? Well, actually we have a boatload of hedges in place and we’ll be adding more into the weekend because, as we discussed earlier in the month, unless Powell is serving up 0.5% rate cuts with free ice cream – people are going to be disappointed next week.

It’s not that we’re bearish, per se – we’ve been adding longs all month – it’s that I don’t feel all that comfortable without insurance – ESPECIALLY with so many new longs that haven’t had a chance to make a profit yet. This is the stage at which they are the most vulnerable – once you are up 20% on a trade a 10% pullback is an inconvenience but STARTING with a 10% pullback, then even a 20% gain from there only gets you back to 108% – these are the holes we don’t like to dig ourselves into – so we hedge…

Monday we’ll see the Empire State Manufacturing Index and that has been awful, for the most part (last month broke the trend). Retail Sales come on Tuesday along with Import & Export Prices AND Industrial Production and Cap Utilization – all to kick off the Fed Meeting. Wednesday is just Housing Data but, if it’s turning around – the Fed may take notice and then, at 2pm, during our Live Webinar – we’ll get the Fed Decision and Powell speaks at 2:30.

Nothing else matters until then so enjoy the weekend – we’re already partying like it’s 1999!

-

- Phil