The ides of September are here!

The ides of September are here!

Podcast: https://share.transistor.fm/s/08a48901

That means we’re going to be reviewing our Member Portfolios this week (we already reviewed our Short-Term Portfolio on Friday) and the Fed decides and Powell speaks on Wednesday and the air is thick with anticipation (or collective delusion) as Wall Street braces itself for the week’s main event. While the big banks are already popping champagne corks, let’s peel back the layers and see what’s really happening beyond all the glittering headlines.

The market is essentially unanimous in expecting the Fed is going to cut rates by 0.25% on Wednesday, with many now whispering about a “jumbo” 0.5% drop. The S&P 500, having notched record highs last week, is already on an “upbeat note,” with futures rising this morning BUT, as you can see from the EuroStoxx chart, indexes that are not priced in Dollars are still not back to where they were in February. Why the sudden urgency from our esteemed Central Bankers? Well it turns out we have 911,000 less jobs than we thought and Consumer Confidence shows the bottom 80% already in a deep Recession (see our Weekend Wrap-Up for more on this topic).

Our economy is so “robust” that jobless claims just hit their highest levels since late 2021 (when Covid had us all locked in our homes). Inflation, meanwhile, isn’t exactly tamed; “it’s complicated,” still dominated by services and stubbornly stalled above the Fed’s NOW 3% target (because 2% was a fantasy we may never see again). Core Goods and Food Inflation are rising fast – a potential consequence of those glorious tariffs. So, the Fed isn’t cutting because inflation is under control; they’re cutting because the labor market is flashing red, creating a a much higher risk of stagflation down the road – the very thing the Fed is SUPPOSED to be guarding against!

Adding to the cocktail of economic contradictions, the gap between the lowest and best-paid workers is widening at a “startling extent,” with real wage raises for the lowest paid barely keeping pace with Inflation. Consumers? They’re not convinced. Especially our independent voters, who are “more negative than at any time during the pandemic“. But hey, don’t worry, lower real yields due to weakening data are boosting risky assets, so “investors are so much more confident than consumers” that we’re adding 10 points to Confidence – which would be in the 40s otherwise! Nothing to see here, just another triumph of the Financial Class.

Speaking of confidence, Gold just broke a four-decade-old inflation-adjusted record, trading with more purchasing power than its 1980 peak. The usual suspects: Inflation fear and Financial Repression, have “alibis in 2025“. So, what’s driving this modern-day gold rush? It seems the main driving force… is changes in the Real Rate of Return, and a subtle “Fear of Recession“.

Speaking of confidence, Gold just broke a four-decade-old inflation-adjusted record, trading with more purchasing power than its 1980 peak. The usual suspects: Inflation fear and Financial Repression, have “alibis in 2025“. So, what’s driving this modern-day gold rush? It seems the main driving force… is changes in the Real Rate of Return, and a subtle “Fear of Recession“.

Apparently, Gold isn’t rising because the Dollar is less attractive – it’s because Gold itself is more attractive as Real Rates collapse. So, while shiny stuff distracts the eyes, it might just be whispering about deeper economic anxieties that the market is generally choosing to ignore.

While Wall Street enjoys the party, Main Street is facing a different kind of reality. Small businesses, the supposed backbone of the economy, are in a bind. Tariffs on Chinese imports, averaging 50%, are jacking up costs. To avoid a cash crunch, many small retailers are turning to lending startups, taking out short-term credit lines at 20%-plus interest rates just to cover the duties due within days of cargo arrival. Demand for these “debt-fueled desperation” loans surged a staggering 730% year-over-year in August. These businesses are now being “forced to work twice as hard to find some profit and stay alive“.

And it’s not just tariffs. Small businesses are now facing a new, insidious threat: extortion via fake one-star Google Maps reviews. Scammers, often leveraging AI tools, bombard businesses with phony negative reviews, then demand payment to remove them. It’s an “ocean of disinformation“, leaving businesses like Natalia Piper’s, which lost its 5.0-star rating in a day, scrambling for solutions while Google is accused of “not doing enough“.

And it’s not just tariffs. Small businesses are now facing a new, insidious threat: extortion via fake one-star Google Maps reviews. Scammers, often leveraging AI tools, bombard businesses with phony negative reviews, then demand payment to remove them. It’s an “ocean of disinformation“, leaving businesses like Natalia Piper’s, which lost its 5.0-star rating in a day, scrambling for solutions while Google is accused of “not doing enough“.

The Trump administration’s tariff strategy, meanwhile, is wreaking havoc on America’s farmers. China has halted all purchases of American soybeans, leading to an estimated $400,000 loss for some farms this year, pushing them towards the brink of bankruptcy reminiscent of the 1980s farm crisis (Farm Aid’s 40th anniversary is Friday). North Dakota farmers, who sent 70% of their soybeans to China, are scrambling for storage, facing plummeting prices, and tightening lending terms. All of this, as one farmer eloquently put it, is “unnecessary“.

In global news, US-China tensions remain a key focus. China’s antimonopoly regulator announced today that Nvidia (NVDA) has violated Antitrust LLaw in an acquisition, sending the chip maker’s stock down 2-3% premarket. This comes amidst ongoing US-China trade talks in Madrid, where Treasury Secretary Scott Bessent (who, coincidentally, owns thousands of acres of North Dakota farmland and has been slow to divest as per ethics agreements) is trying to hammer out a deal.

Meanwhile, Wall Street is thriving, thanks to what Morgan Stanley co-president Dan Simkowitz calls “derivative-ization”. This basically means that banks are making a killing by selling increasingly complex derivatives to professional investors and, crucially, to a “new generation of gamer-traders” on platforms like Robinhood. Increased volatility, “Economic Uncertainties and, most recently, the return of Donald Trump to the White House” have created a bonanza for banks, with trading income exceeding $150 BILLION last year. While this “turn simplicity back into higher margin complexity” is “good news for Big Banks,” it will “of course, end in tears” for many aggressive Retail Investors caught up in the game.

As we stand on the precipice of another Fed decision, remember that the Economy is “flattening out, employment is threatened, and so is liquidity“. While bank lending has kept M2 Money Supply rising (up $10 TRILLION this year), Delinquency Rates are climbing for auto loans, and a significant chunk of FHA mortgages are getting “modified” (read: propped up to keep them from looking “defaulty“). This suggests a pause in the very bank lending that has fueled recent Money Supply growth that has been fueling our rally…

Stock market valuations are at or near historic highs, screaming for “more M2 or higher earnings or both“. Technical patterns, like the “megaphone” and “head and shoulders” in the Nasdaq 100, are ominous, potentially foreshadowing a “bigger correction” or a “long choppy period“. There’s also the creeping reality of “fiscal dominance,” where the government gains more control over the Fed, potentially leading to future “money printing” policies, “damn the inflation it will create,” after a crisis.

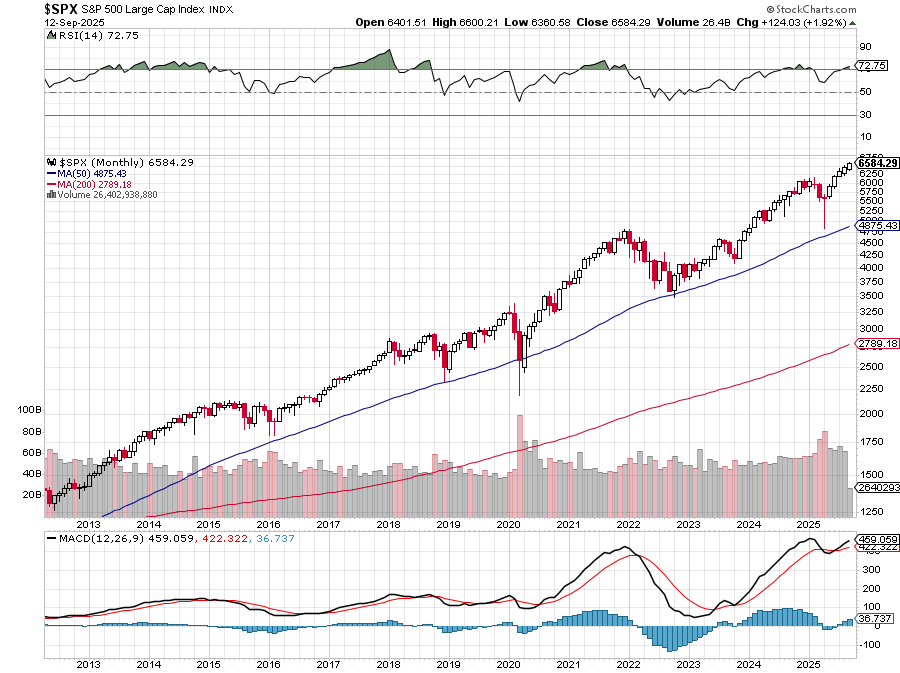

On the monthly S&P chart, it’s RSI 72.75 and MACD 459 and we’re 35% over the 50-day moving average and, HISTORICALLY, that does not end well. In early 2022, we were 53% over the 50-day moving average before we fell (and there was a catalyst of a banking crisis) and that led to a 30% pullback. We are hedged for a 20% pullback – not 30% – so do stay alert!

The market seems to be gambling and, while a correction could be a buying opportunity, we still have to mind the momentum and not reach for falling knives. We’re still holding a good amount of CASH!!!

The charts are bullish in the long term, with the S&P 500 eyeing 7000. However, an upside DeMARK exhaustion signal matures this week (which freaks out the TA people), and the Fed might remind markets that cuts are a response to weakness, not strength. A break below the 6481 area on the S&P 500 could signal a more significant correction – so let’s keep an eye on that level if we pull back (what’s that, right?).

Earnings are really down to the last few but some of them are interesting:

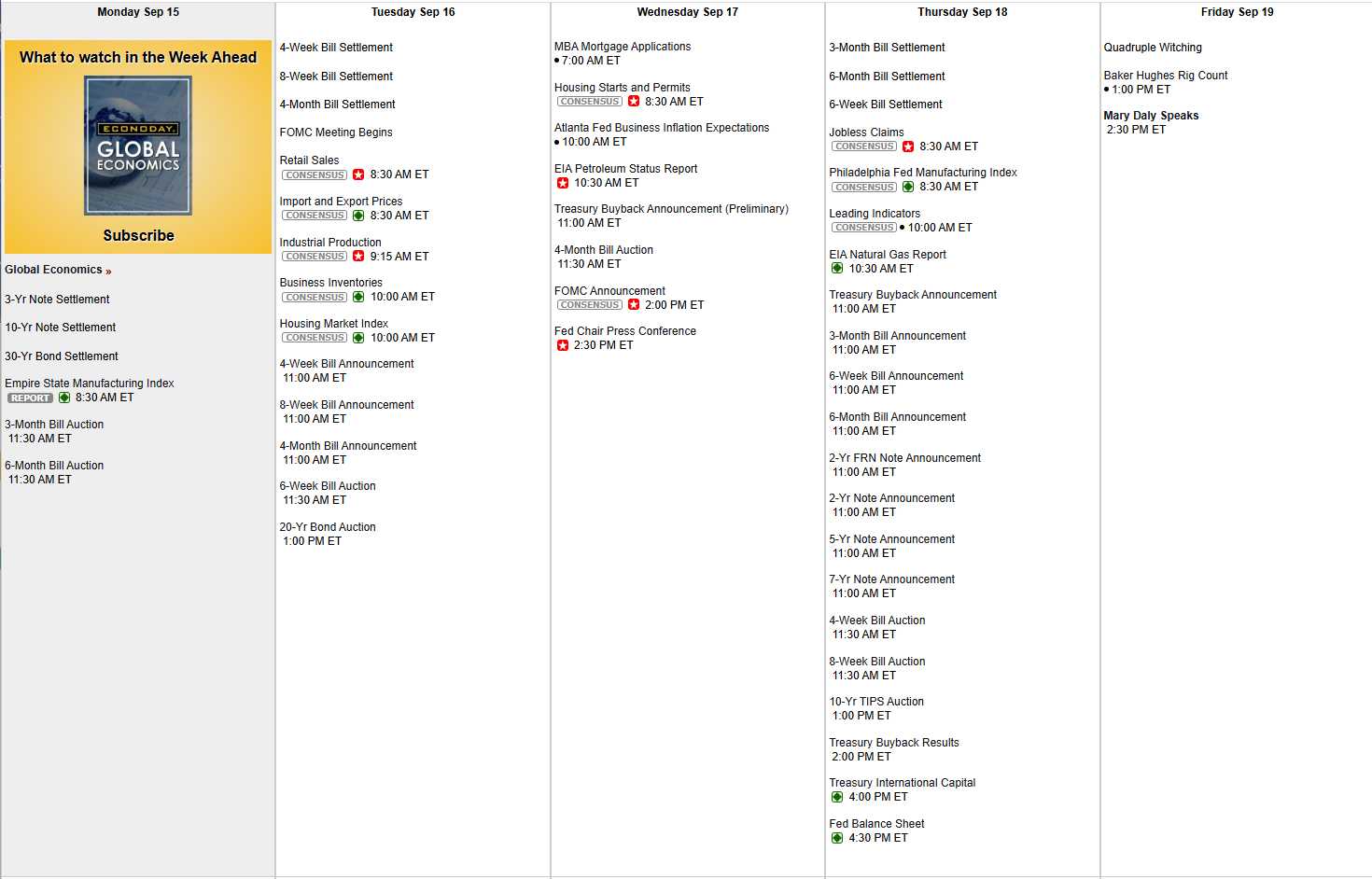

And, of course, aside from the FOMC Decision and Powell’s speech on Wednesday, we had Empire State Manufacturing this morning which, of course, was -8.7, plummeting from 11.9 last month, which seemed like BS anyway. This is yet another Recessionary warning sign flashing red… Lots and lots of auctions for our massive debts and Retail Sales, Industrial Production and Housing tomorrow, Atlanta Fed and more Housing on Wednesday, Philly Fed, Leading Economic Indicators on Thursday and Friday is Quarterly Options Expirations and that could be chaos as well:

Not much we can do for now but wait for Powell and the Fed and then wait to see how the market reacts because that too has become unpredictable these days…