How low can we go?

How low can we go?

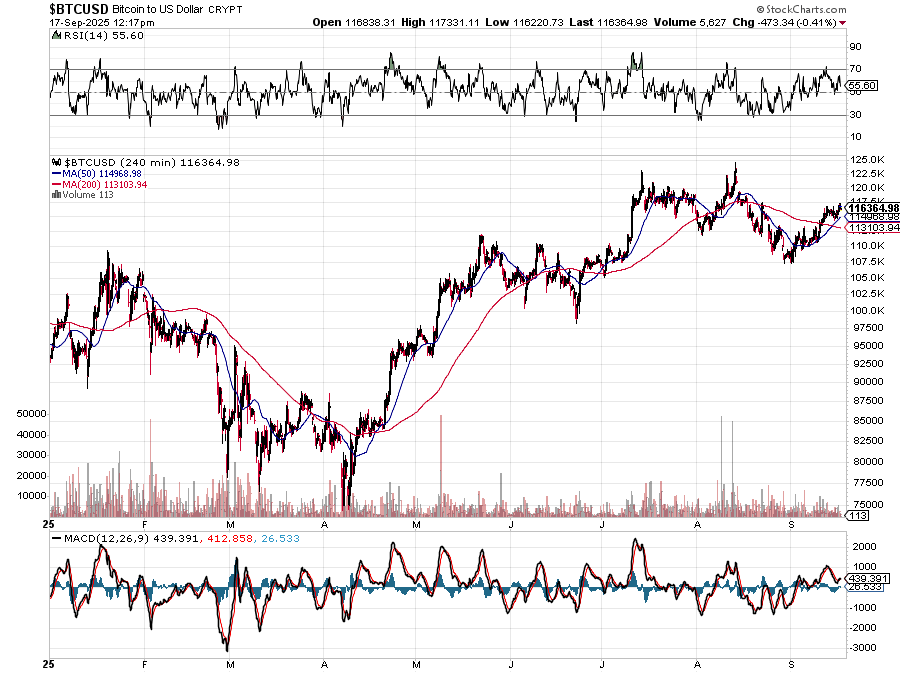

As you can see, the Dollar lost ANOTHER 1% this week and that makes the market (which is priced in Dollars) go 1% higher. I’m sorry if it seems like I say this a lot but STILL, I appear to be the only analyst in America who cares about this.

Have you heard ANYONE question President Trump about the Dollar falling from 110 in January, when he took office, to 96.40 in September? That’s down 13.6, which is DOWN 12.36% in less than a year. I don’t know about you but I have a bank account with Dollars in it and I’m sure other people do as well – DON’T YOU THINK WE SHOULD BE CONCERNED?

And Trump is pressuring Powell to lower rates but lowering rates makes the Dollar even weaker through a simple mechanism: When the Fed cuts rates, Foreign Investors have less incentive to hold Dollar-denominated assets because they can get better returns elsewhere, so they sell Dollars and buy other currencies. At the same time, lower rates mean the Fed is creating more Dollars to stimulate the economy – and more supply of anything means lower prices. It’s basic economics: cut the “rental rate” on Dollars (interest rates) and reduce their scarcity (print more) and the Dollar becomes worth less (worthless?) compared to other currencies!

This creates a vicious cycle where lower rates lead to a weaker Dollar, which makes everything we import more expensive, which creates more inflation, which forces more rate cuts to help over-indebted consumers cope with higher prices – and round and round we go. Each 1% in rate cuts typically causes 3-5% Dollar weakness, so if Trump gets his wish and forces rates down to 3% from today’s 4.37%, we’re looking at another 4-7% Dollar decline on top of the 12.36% we’ve already lost.

This creates a vicious cycle where lower rates lead to a weaker Dollar, which makes everything we import more expensive, which creates more inflation, which forces more rate cuts to help over-indebted consumers cope with higher prices – and round and round we go. Each 1% in rate cuts typically causes 3-5% Dollar weakness, so if Trump gets his wish and forces rates down to 3% from today’s 4.37%, we’re looking at another 4-7% Dollar decline on top of the 12.36% we’ve already lost.

That means our gas, food, and everything else imported costs 15-20% more while your savings buy 15-20% less stuff – but hey, your stocks go up, which is great if you own any and TERRIBLE if you don’t. It’s a hidden tax on every American that almost nobody talks about, but it’s the most important economic story of our time.

Of course, people like Trump, who has 60% of his net worth in cryptocurrencies these days, are doing just fine. Trump, in fact, has made Billions this year while (actually BECAUSE) his policies are trashing the Dollar as crypto, for some ridiculous reason, is being treated like a commodity – even though it’s a “commodity” that can be created out of thin air overnight on a laptop.

Creating a cryptocurrency is literally easier than setting up a website. You can download open-source code from existing cryptocurrencies (since most are based on Bitcoin’s original code), change the name from “Bitcoin” to “PhilCoin” or “DollarDestroyer,” adjust a few parameters like total supply or mining rewards, and launch your own “revolutionary digital currency” in under an hour.

Thousands of people do this every day – there are currently over 13,000 different cryptocurrencies in existence, with new ones appearing faster than anyone can track them. The barriers to entry are essentially zero: no mining equipment needed, no precious metals to dig up, no regulatory approval required – just copy some code, create a flashy website with promises of “disrupting finance,” and start selling your digital tokens to anyone gullible enough to buy them.

The cryptocurrency market is fundamentally a massive Ponzi scheme where early adopters get rich only if they can convince enough new suckers to buy in at higher prices. Unlike real commodities or productive assets, cryptocurrencies generate no cash flow, pay no dividends, and produce nothing of value – their only function is to be sold to the next person at a higher price.

The cryptocurrency market is fundamentally a massive Ponzi scheme where early adopters get rich only if they can convince enough new suckers to buy in at higher prices. Unlike real commodities or productive assets, cryptocurrencies generate no cash flow, pay no dividends, and produce nothing of value – their only function is to be sold to the next person at a higher price.

When Trump or any crypto promoter talks about “digital gold” or “store of value,” they’re really running the classic Ponzi playbook: use your influence and credibility to drive up demand from new investors whose money directly enriches the early holders. The moment people stop believing in the “revolutionary potential” or stop buying in greater numbers than those selling, the whole scheme collapses – which is why crypto prices are so volatile and why promoters work so desperately to maintain the hype. Trump’s crypto wealth literally depends on convincing more Americans that the Dollar he’s destroying is worthless while the computer code he owns is priceless.

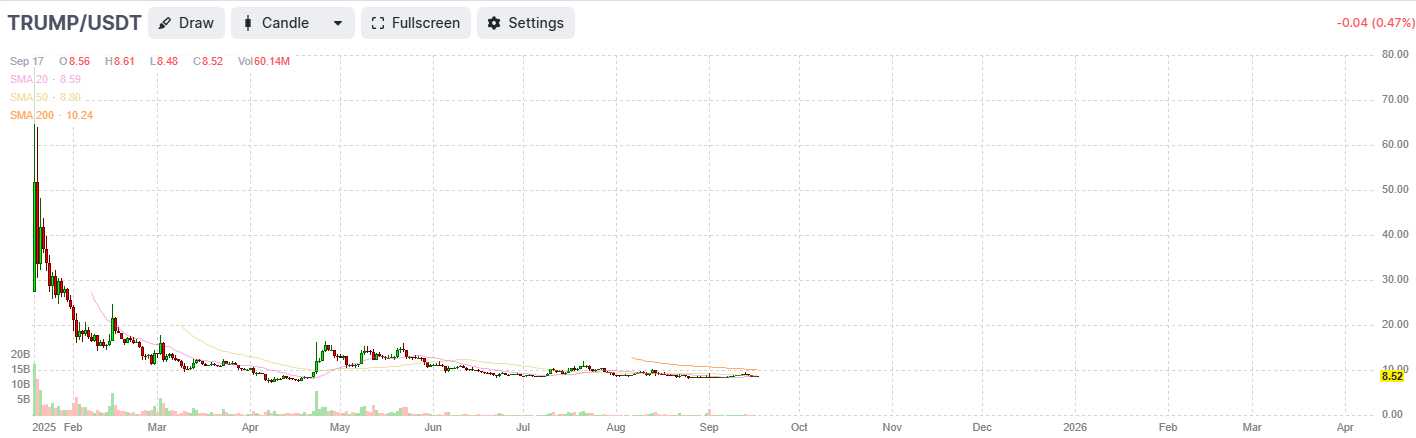

The TRUMP meme coin launched in January at around $30, peaked at $77 just days later, then crashed to the current $8.50 – but here’s the kicker: Trump and his family kept 80% of all the coins for themselves while only releasing 20% to the public. Of the 1 billion total coins created, Trump’s two companies (CIC Digital LLC and Fight Fight Fight LLC) control 800 million coins worth roughly $6.8 billion even at today’s depressed prices, while over 764,000 of the 2 million public investors are underwater on their purchases.

This is the classic insider pump-and-dump scheme where the promoter keeps the vast majority of the “product” while selling a tiny fraction to rubes at inflated prices – imagine if McDonald’s sold you a Big Mac but kept 80% of the burger for themselves…

Meanwhile, Trump’s deliberate Dollar destruction has cost Americans roughly $12.36 TRILLION in lost purchasing power (12.36% decline on $100 trillion in Dollar-based assets) while his crypto portfolio has gained approximately $5-7 billion – meaning Americans have collectively lost about 1,000 times more wealth than Trump has gained.

This is the most brazen conflict of interest in presidential history: Trump profits billions from policies that destroy the currency 340 million Americans depend on, while simultaneously running crypto schemes where he keeps 80% of the tokens and foreign buyers (who used exchanges banned to US users) pump millions into his personal wealth in exchange for access to Mar-a-Lago dinners.

This is the most brazen conflict of interest in presidential history: Trump profits billions from policies that destroy the currency 340 million Americans depend on, while simultaneously running crypto schemes where he keeps 80% of the tokens and foreign buyers (who used exchanges banned to US users) pump millions into his personal wealth in exchange for access to Mar-a-Lago dinners.

This is not just corruption – it’s mathematical proof that Trump’s crypto gains come directly from American Dollar holders’ losses, with the added insult that he’s getting rich selling worthless computer code to his own supporters while devaluing the actual money in their bank accounts.

As I said prior to the election – it would have been cheaper to just give Trump $10Bn to go away! That seems to be legal – he’s doing the same thing to Eric Adams right now (only with Millions, not Billions).

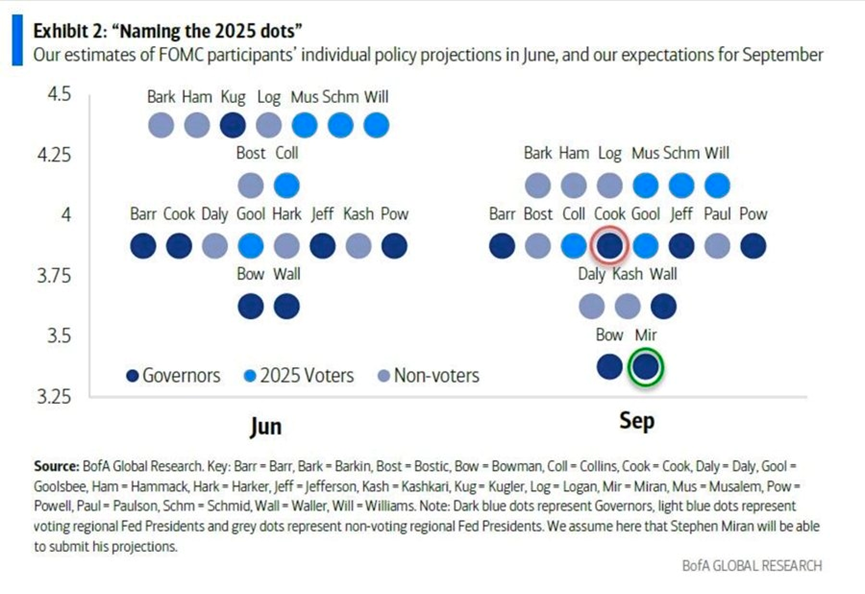

Getting back to the Fed (remember that was the title?), the markets have already priced in a near-certainty (96%) that the Fed will cut rates by 25 bps this afternoon. A 50 bps cut is technically “on the table,” but it’s more of a tail-risk scenario. The real action isn’t in the move itself, it’s in Powell’s press conference and the Summary of Economic Projections (the “dots”), which will tell us whether this is a one-off adjustment or the start of a deeper easing cycle. THAT is what Trump wanted to control by changing the voting members (Cook, Kugler) – the Project 2025 strategists don’t miss the subtle details!

Every notch lower in Fed rates reduces the return on U.S. assets relative to Europe and Asia, which accelerates foreign outflows from Treasuries and Equities, which means more Dollars for sale. Add in Trump’s public pressure campaign for faster, bigger cuts and you’ve got a recipe for a self-reinforcing spiral: Weaker Dollar, more imported Inflation, more political pressure to cut – wash, rinse, repeat…

Powell can’t acknowledge that dynamic outright (or he will expose our whole financial system as a joke) but he’ll try to “talk tough” on inflation even as he cuts, to keep the Dollar from outright collapsing. Whether the market buys that balancing act is another question. With gold already at record highs and oil creeping back toward $65, the tape is telling us that investors are hedging against Fed-induced Dollar weakness before Powell even steps on the stage.

Powell can’t acknowledge that dynamic outright (or he will expose our whole financial system as a joke) but he’ll try to “talk tough” on inflation even as he cuts, to keep the Dollar from outright collapsing. Whether the market buys that balancing act is another question. With gold already at record highs and oil creeping back toward $65, the tape is telling us that investors are hedging against Fed-induced Dollar weakness before Powell even steps on the stage.

Expect algo-driven swings in the first hour after 2pm but the real question is whether foreign capital still trusts the Fed’s balancing act or whether this cut is remembered as the spark that lit the Dollar’s next leg down.

🤖 Fed Day Playbook – What Happens Next? 📊

🔹 Base Case (96% odds): 25 bps cut + dovish tone

-

-

Dollar: Weakens further (DXY could test 95).

-

Stocks: Initial spike, but risk of “buy-the-rumor, sell-the-fact.”

-

Bonds: Curve steepens as long yields slip faster than shorts.

-

Gold/Crypto: Rip higher as Dollar hedges.

-

➡️ Implication: Accelerates the Dollar-decline cycle Phil flagged — imported inflation comes next.

🔹 Hawkish Surprise: 25 bps cut + cautious/dovish fade

-

-

Dollar: Stabilizes or bounces.

-

Stocks: Knee-jerk dip as traders scale back bets on October/December cuts.

-

Bonds: Short end rises; long end steady.

-

➡️ Implication: Powell trying to slow the Dollar slide, but at risk of spooking equities.

🔹 Shock & Awe (low odds): 50 bps cut

-

-

Dollar: Big flush — DXY could break below 95 fast.

-

Stocks: Surge initially, but could reverse hard as inflation fears bite.

-

Bonds: Rally across the curve.

-

Gold/Crypto: Explosive move higher (gold $3,800+ test).

-

➡️ Implication: Fed prioritizes growth/jobs over currency stability — Dollar destruction in full swing.

May the farce be with you – I’ll see you on the other side of the Fed…

— Phil