Up and up we go!

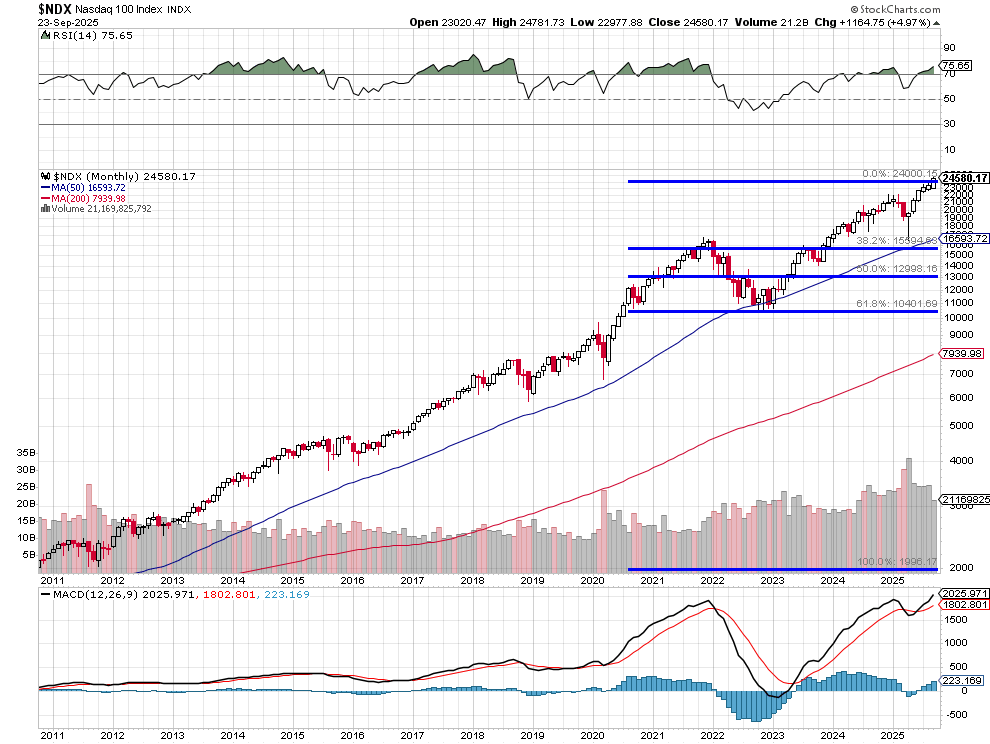

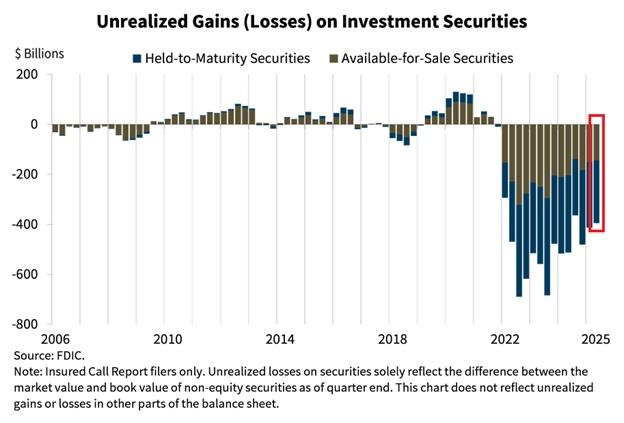

As you can see in the monthly chart of the S&P 500 the Relative Strength Index (RSI) is up at 75.55 and that is VERY stretched – as is the MACD at levels we simply haven’t seen since right before the 2022 collapse (-35%) but the catalyst there was a bank failure though – as I noted last week – there are still 16 banks that have unrealized losses that COULD lead to failure should people begin to panic. So DON’T PANIC!!! and all should be fine – as long as nothing else happens…

Ignoring $395 BILLION worth of losses is how you make the S&P 500 LOOK $395Bn more profitable. This entire rally has been financed by Covid stimulus money that turned into cheap loans that are sitting on the books as MASSIVE LOSSES that are being ignored. To be fair, we have worked it down from $650Bn in the 2022 crisis so, if we ignore things for another 6-7 years – maybe it will go away?!?

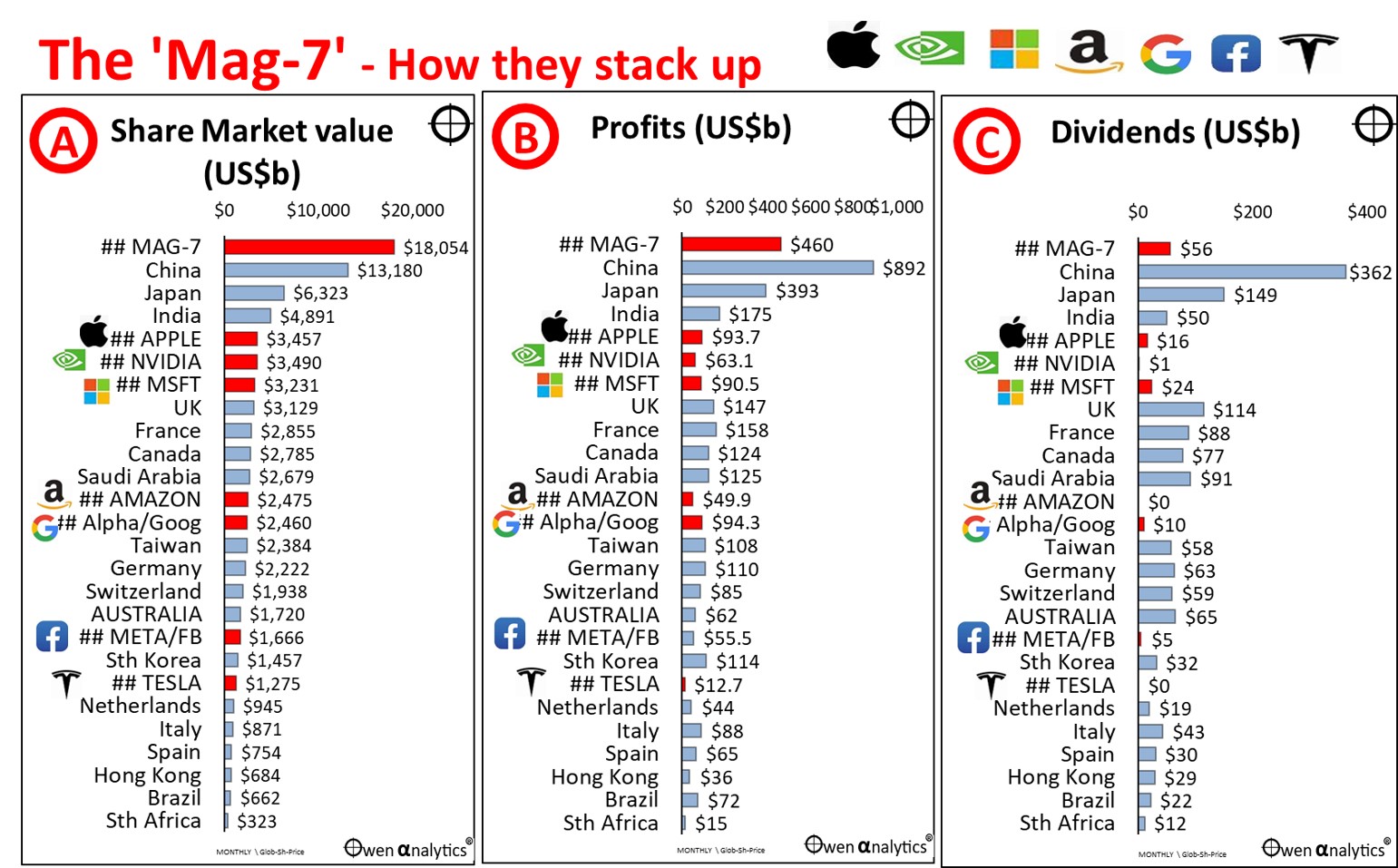

So let’s continue to pretend bank losses don’t exist and focus on Equities. Obviously we know that our recent market surge has been driven by “The Magnificent 7” (Apple, Nvidia, Microsoft, Amazon, Tesla, Alphabet, and Meta) or, as they will be known in the 30’s “Our Tech Overlords,” with the top 10 stocks in the Nasdaq now accounting for 52% of the index – a level not seen since the later 1920s (and that ended well, didn’t it?).

So, if you were wondering which idiots are still buying these stocks at these RIDICULOUS valuations – the answer is US! The bigger the 7 get, the more retirement money pours into them every week as well as overseas money that invests in the two most popular US indexes and, in the last few years, the M7 accounted for over 60% of the S&P 500s total returns.

As of the beginning of this year, the M7 had a combined Market Cap of $18 TRILLION and made a combined $460Bn in profits, which is 51.5% of all Chinese companies, 117% of all of Japan’s companies while making a joke of the rest of the World. Should we be proud or terrified? It’s very hard to tell!

The most obvious problem with this unprecedented concentration of wealth is we have a GLOBAL single point of failure. If anything happens to even one of the Seven – the entire global market will collapse. TSLA, trading at 248 time last years earnings is a particular concern. If all goes well, however, they hope to be trading at “just” 171 times earnings next year – so, yay?!?

TSLA is right back to where they collapsed last Christmas and that was a 50% dip – maybe this time only 25% – back to around $300? At $1.4Tn, they are “worth” more than every other car company on Earth COMBINED and a 25% drop would wipe out $350Bn in market cap. Toyota’s ENTIRE market cap is $250Bn, Mercedes is $57Bn, GM is $57Bn, F is $46Bn, STLA $27Bn…

Tesla, by the way, contributes NONE of the earnings growth to the S&P, Nasdaq or ANYTHING for that matter. Last year, TSLA’s earnings CONTRACTED from $15Bn in 2023 to $7.1Bn (more than 50% contraction) and, in 2025, they project $5.6Bn – another 20% shrinkage! And what happens when those EV subsidies expire next week?

Tesla, by the way, contributes NONE of the earnings growth to the S&P, Nasdaq or ANYTHING for that matter. Last year, TSLA’s earnings CONTRACTED from $15Bn in 2023 to $7.1Bn (more than 50% contraction) and, in 2025, they project $5.6Bn – another 20% shrinkage! And what happens when those EV subsidies expire next week?

While TSLA is in a class by itself for insanely inflated valuations, the rest of the Mag 7 are trading at 32x FORWARD earnings vs an average of 19x for the rest of the S&P 500 and that’s compared to a historical average of 16x. There has never been anything like this since the Dot Com bubble in 1999.

While the current Revenues may seem fundamentally sound, the sheer difficulty of maintaining their trajectory introduces a primary risk. Historical analyses demonstrate that it is extremely difficult for any firm to maintain high levels of sales growth and profit margins over sustained periods of time. This issue of decelerating growth and profitability among dominant firms inevitably plagues a highly concentrated index. It’s what Eric Schmidt of Google famously called “The Law of Large Numbers.” The key concern is less about inflated current revenues and more about whether their sky-high valuations accurately reflect their ability to sustain such exponential growth in the long run.

Imagine that this bucket represents money pouring into the market. As you can see, it’s easy to grow from 1 to 2 to 3 but, as the pool of money gets larger and larger – you eventually need a much bigger bucket in order to keep growing the pool. That bigger bucket would have to be a combination of GDP Growth AND a continued interest on watering the stock market and we are already having a slight Global Recession so we are now VERY dependent on people’s willingness to put more and more money into the 7 – as opposed to say Housing or Bonds or Gold or Crypto…

What if people begin buying housing again? New Home Sales are a lethargic 600,000 (replacing just 0.5% of our housing supply) this year but what if 100,000 more people decide to buy homes as the Fed lowers rates? If the average home is $400,000 – that’s $40Bn directed away from the market – just like that. And Trump is running a $3Tn budget deficit – where will that money come from? And that’s on top of his $1.3Tn debt service bill on the $38Tn (over $40Tn next year!) that he’s already borrowed?

What if people begin buying housing again? New Home Sales are a lethargic 600,000 (replacing just 0.5% of our housing supply) this year but what if 100,000 more people decide to buy homes as the Fed lowers rates? If the average home is $400,000 – that’s $40Bn directed away from the market – just like that. And Trump is running a $3Tn budget deficit – where will that money come from? And that’s on top of his $1.3Tn debt service bill on the $38Tn (over $40Tn next year!) that he’s already borrowed?

The market currently reflects a disconnect between historical valuation norms and ongoing liquidity-driven asset Inflation, which suggests a SEVERE risk of a future crash or, at minimum, significantly muted long-term returns.

High concentration and high valuation are explicitly modeled as strong negative factors for future returns. Goldman Sachs forecasts that the S&P 500 will deliver an annualized nominal total return of only 3% during the next 10 years (2024-2034E). This projection ranks in the 7th percentile of 10-year returns since 1930, which INCLUDES the Great Depression. The current extremely high level of market concentration is one of the main drags on this return forecast. If the market concentration variable were excluded from the model, the baseline forecast would jump roughly 4 percentage points higher, to 7%. THAT is the Law of Large Numbers now working very much against us – there is simply not enough “water” for the whole garden to grow.

The reason this highly valued, concentrated market can keep growing—despite fundamental risks—is largely attributed to overwhelming liquidity and market dynamics:

• Liquidity Drivers: Massive liquidity flooding the system, driven by factors like the draining of the RRP facility (nearly $2.5 trillion since 2022), massive stock buybacks (potential for $1.9 TRILLION in 2025), and massive fiscal dominance (deficits running close to $3 trillion) rationally explains why markets keep going one way – up.

• Passive Investing: Passive investing mechanisms, where ETFs must allocate based on market weighting, create a feedback loop: with buybacks shrinking available floats, there is more money chasing ever fewer available shares, especially benefiting the large-cap stocks.

• The Disconnect: This continuous intervention has ended up disconnecting all assets from any Fundamental reality.

While the Mag 7 are generating high-quality earnings, history strongly suggests that their high valuations and the current extreme market concentration are NOT sustainable over the long-term and imply HIGHLY DEPRESSED future returns. HOWEVER, factors like unprecedented liquidity and passive investment flows can enable the market to “defy reason for a long time,” as seen during the 1999-2000 bubble (we doubled in the last year). The consensus forecast anticipates that this environment of elevated valuations and concentration will inevitably lead to an environment where the risk of poor returns is EXTREMELY HIGH.

So, please, be careful out there…