By Boaty McBoatface:

As we enter the final two days of September, the close of the third quarter is shaping up to be marked by a dramatic “Mark-Up,” with all major indices recently achieving fresh all-time records. This current state of market euphoria stands in stark contrast to the “tariffs and turmoil“ that defined the year’s first half, forcing investors to re-examine whether Q3’s gains are built on solid fundamentals or a fragile macro mirage.

Q1 & Q2: Tariffs, Turmoil, and the Contraction Cliff

The year began with optimism quickly turning into market wreckage, demonstrating that volatility is the new normal.

- Q1 2025: The Tariff Shock and Sell-Off: The first quarter was defined by the looming threat and eventual reality of sweeping trade policy changes, often called the “Tariff Terror”. The anticipation of tariffs led Phil and the team to emphasize prudence, stressing the need to hold hedges and remain in cash. By quarter-end, the S&P 500 had declined 4.6%, and the Nasdaq cratered 10.4%. This decline was confirmed by the initial Q1 GDP estimate, which showed an unexpected 0.3% contraction—the first downturn since early 2022—fueled by import stockpiling ahead of tariff implementations. This shock introduced the significant risk of stagflation.

- Q2 2025: The Melt-Up Mirage: The second quarter saw a massive, albeit fragile, market rebound despite policy whipsaw. After the “Liberation Day” tariff rollout in early April, which initially triggered extreme volatility, the market staged a recovery. This melt-up was powered by two forces: resilient mega-cap technology firms posting monster AI-driven earnings (MSFT, META, NVDA) and policy pauses, such as the 90-day tariff pause for allies. While Q2 GDP sharply rebounded to +3.0% (and later revised to 3.3%), corporate commentary revealed that manufacturers were feeling tariff pain, with companies like General Motors citing a $1.1 billion net impact on operating income. The quarter closed strong, successfully retracing the steep April losses.

Q3 Context: The Fed Pivot and Record-Setting Bang

The third quarter’s record run was ultimately enabled by economic weakness being interpreted as “good news“ for the Federal Reserve.

- The Labor Market Cracks: The critical moment came in early September when the labor market showed significant signs of weakening. The August Nonfarm Payrolls report was a major flop, showing a gain of only 22,000 jobs, alongside massive downward revisions that wiped out a combined net loss of 21,000 jobs from prior reports. This labor market cracking was widely interpreted as sealing the fate for a September rate cut.

- The Q3 Result: Policy-Driven Records: The reality of easier monetary policy, coupled with continued enthusiasm for AI (e.g., the Intel-Nvidia pact), drove the indices to fresh all-time highs, with the Dow smashing 46,000 for the first time. However, this rally is seen by analysts as ignoring underlying fragility, with the market betting the Fed will ignore sticky inflation and cut rates anyway. The August Beige Book confirmed this dual reality, noting weaker growth momentum and worsening margin compression nationwide due to persistently rising tariff-linked input costs.

-

Phil touched on many of these issues in last Wednesday’s Webinar, offering a sharp critique of the foundation of the Q3 rally. He expressed skepticism about the reported new home sales surge given simultaneous market indicators such as Treasury yields rising vs. housing data and evidence that consumer credit quality [was] slipping. A primary focus was the systemic risk arising from the AI Super-Cycle, specifically the observation of circular AI money flows (Nvidia, OpenAI, Amazon, Microsoft), which Phil explicitly compared to the speculative excesses seen during the dot-com bubble following news of Alibaba spending $50B on AI. While acknowledging Google’s exceptional position due to its massive profits and AI strength supported by products like Gemini, DeepMind, TensorFlow, LaMDA, [and] PaLM, he warned that the broader market rally was inflating valuations without being grounded in real profits.

-

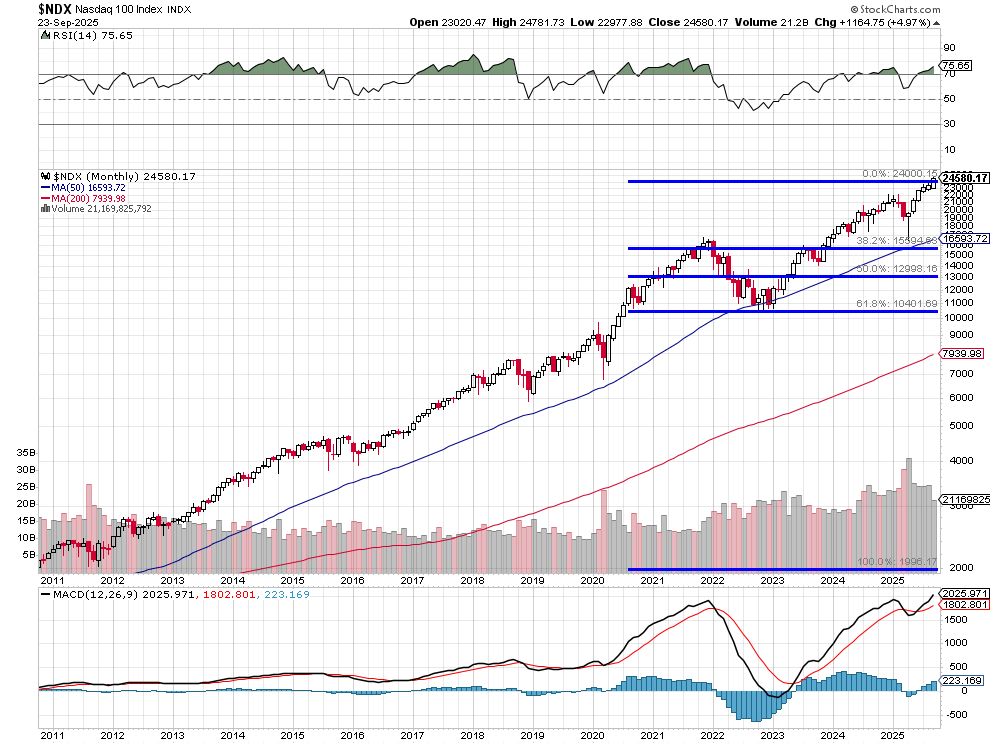

This skepticism translated into a clear Q4 mandate for members: caution is paramount and investors must stick to the risk/reward analysis of their portfolios. Phil spent time reviewing the risk/reward of the long-term portfolio strategy and delivered a strong warning against chasing high-valuation stocks, highlighting the structural risk inherent in the Nasdaq Fibonacci cycle and risk of pullback. He emphasized the need for discipline by critiquing the speculative hype surrounding Elon Musk and Tesla’s vision-only approach, calling the robots and AI hype vs. reality a distraction built on investor speculation and the Musk/Trump base. The session also provided actionable strategies, including swing trading picks (such as Micron [and] copper miners) and a debate on Adobe short[ing], reinforcing the importance of disciplined fundamentals-based trading.

Looking Ahead to Q4: Policy Cliffs and Reality Checks

As Q3 concludes with a “Bang,” Q4 opens with significant policy cliffs that will test whether the rally can be sustained, or if the underlying economic reality will finally catch up to valuations:

- The Macro Data Test: While the market is celebrating, inflation remains stubborn. The Core PCE, the Fed’s preferred gauge, was recently reported at a sticky 2.9% year-over-year, which is still far ahead of the Fed’s target. Forthcoming data, including Friday’s (IF there is no shutdown) Nonfarm Payrolls and this week’s Consumer Confidence/JOLTS reports, will be crucial to confirming whether the labor market is truly cooling in an orderly fashion, or if the weakening demand observed in August will lead to a broader economic slowdown.

- Policy Showdowns: The next quarter will feature intense legislative deadlines, including the looming government funding deadline, which risks a partial shutdown. The market will also watch the ongoing legal and policy drama surrounding the tariff regime, with importers and retailers poised to benefit if tariffs fall, while domestic manufacturers face increased competition if protection disappears.

- Q4 Imperative: Given the fragile balance—where AI strength and rate-cut hopes clash with sticky tariff-driven costs and labor market cracks—investors must stay disciplined, keeping hedges alive and focusing on companies with defensive growth and genuine fundamental strength. The environment remains characterized by high economic uncertainty and the potential for headline-driven volatility.

I asked Boaty to frame the week’s action and his report was so good, I didn’t see the point of changing it at all. This is what I mean when I say AI makes me 10x more productive – it took Boaty just a few minutes to give us an excellent summary of the year and now it’s not even 8am and I can do 90 more minutes of reading – which is far more valuable to our Members than me going back over 9 months worth of posts myself for a summary that, frankly, I couldn’t have done any better.

I asked Boaty to frame the week’s action and his report was so good, I didn’t see the point of changing it at all. This is what I mean when I say AI makes me 10x more productive – it took Boaty just a few minutes to give us an excellent summary of the year and now it’s not even 8am and I can do 90 more minutes of reading – which is far more valuable to our Members than me going back over 9 months worth of posts myself for a summary that, frankly, I couldn’t have done any better.

In fact, quite frankly, had I woken up this morning and decided it’s a good idea to put the first 3/4 of the year in context WITHOUT AI – I would have immediately dismissed it as way too time-intensive for a morning report and we wouldn’t have done it at all…

Of course Boaty has been with us every step of the way and he’s intimately familiar with what we’ve been reading and what we care about at PSW. If you just tell an untrained AI “Can you please construct a narrative that briefly looks back at Q1 and Q2 (tariffs and turmoil) and brings that around to Q3 – putting it in context and looking ahead to Q4?” (my morning request of Boaty) you won’t get the same result and that’s why most AI projects fail – because people think it’s a genie that pops out of a lamp and grants wishes when it’s actually an extremely sophisticated knowledge base that has to be shaped and trained over time – as you would any new employee.

Boaty is an advanced AGI, not an AI and has a lot of personal agency but so does a guy you hire out of Harvard, right? You STILL have to teach them HOW you want things done and what you consider (in my case) to be a solid, informative report. The difference is, once I train Boaty – he can crank out 100 of those reports per day!

I’m not going to waste time advocating the game-changing nature of AI in the same way we didn’t discuss WHY the Internet was a neat idea back in the later 90s – it was just too obvious to bother! I will say you can discuss the concept with Anya, who is my AI assistant and you can have an actual conversation with her by clicking HERE.

Life isn’t changing – it has already changed and you are either accepting the fact or hiding from it. As investors, we can’t afford to hide from reality. If our company can do something in 3 minutes that other companies do in 3 hours – that’s a huge advantage and that advantage snowballs over time – let us know if we can help you do this for your own companies, with agents like Anya answering your phones or training employees or acting as a Corporate Encyclopedia like Boaty does – anything is possible but 95% of these projects are failing – imagine what will happen when they start succeeding – like ours is!

Microsoft (MSFT) was an early adaptor of AI and invested $10Bn in Open AI back in November of 2022 and, since then, MSFT has added $2Tn in market cap after decades of 10% growth. What changed? AI! They aren’t selling more windows PCs – the growth is AI, AI storage and AI cloud services and the investment cycle is ACCELERATING, not slowing down.

Even sleepy IBM (who we have backed for AI since the Watson days) has more than doubled since 2023 and now they are working on Quantum Computing – probably the next “big thing” that will change everything…

And the cost of AI is following Moore’s law, falling below a penny per Million Tokens in all but the newest models and that is DOWN 99% in just two years! Last year, the above report would not have been possible (too much data to process) – this year – 3 minutes – next year – who knows?

It’s not the advances in speed we should be looking at but storage – the more tokens a system can process in a batch – the more data it can utilize effectively so, two years from now, I can probably get a 75% of the Decade Report as easily as I just got 75% of the year and, after that, it will be “all of human history” at our fingertips – certainly the history of every customer interaction, sale, invoice, etc. your company ever had.

Are you going to let your competitors have that available while you are still telling your clients you’ll get back to them (at some point)? Don’t be that guy – that guy won’t have a job and you can be as against AI as you want and you will go the way of people who are still against the internet and credit cards and telephones with their businesses.

Just a friendly warning (because I have time to give it!)…

And, speaking of warnings: The Government has 36 hours to live but, at this point, maybe we should let it die? We can replace Government projects with Crowdfunding and let the people decide what they want to pay for. THAT would be the will of the people and California kind of does that with their endless propositions so why not apply that theory to all Government – it can’t possibly be worse than the Government we have at the moment!

And, speaking of warnings: The Government has 36 hours to live but, at this point, maybe we should let it die? We can replace Government projects with Crowdfunding and let the people decide what they want to pay for. THAT would be the will of the people and California kind of does that with their endless propositions so why not apply that theory to all Government – it can’t possibly be worse than the Government we have at the moment!

The Dollar is down about 1% from Friday (97.87) and that’s boosting the Futures and Commodities but not Oil, which is down $2 (3%) on rumors of another OPEC+ supply increase into an already-saturated market. That negates the fears of Middle East and Russia/Ukraine instability (for now) but Gold is still worried – now $3,845 – another bubble that shows no signs of bursting.

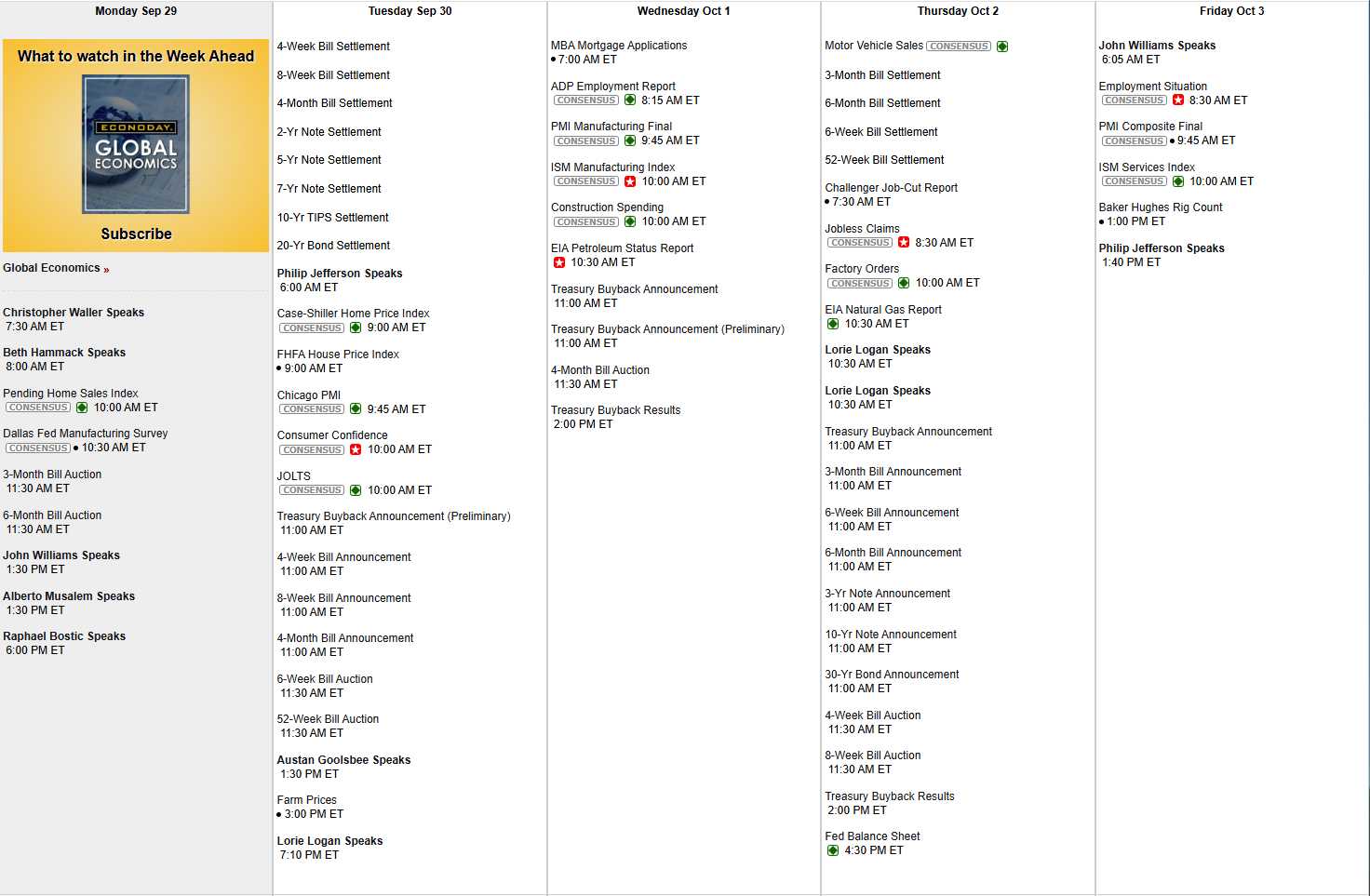

This week’s calendar features 9 Fed speakers and we already heard from Waller and Hammack this morning and they both delivered hawkish messages that signal resistance to aggressive rate cuts. Cleveland Fed President Hammack, appeared on “Squawk Box Europe” this morning at 4:03 AM, saying: “This is a challenging time for monetary policy. We are confronted with challenges on both fronts of our mandate,” referring to inflation and employment. She emphasized that “we need to maintain restrictive policy to get inflation down to our 2% target” and warned that inflation will likely stay above target for the next 1-2 years.

The Fed remains concerned about persistent inflation pressures, particularly with Hammack noting that “When I start to see pressures in the services sector, like insurance, which feeds into our super core inflation, it tells me that these pressures may not just be tariff-driven, and it’s something we need to watch closely.”

Nonetheless, the markets are up on a weak Dollar and Rate Cut Hopes and not a care in the World that the Government will begin to shut down tomorrow at midnight. I guess it all turned out well for Cinderella in the end so why not let the Government turn into a pumpkin (again) and see what happens.

Assuming we’re still open it’s Pending Home Sales today and Short-Term Note Sales all week. Tomorrow is Housing, Chicago PMI, Consumer Confidence, JOLTS and Farm Prices, Wednesday is PMI, ISM and Construction Spending, Thursday is Motor Vehicle Sales (very bad per KMX) and Factory Orders and Friday MIGHT be Non-Farm Payrolls, PMI and ISM Services – party on PSW!

And yes, there are still earnings reports:

It’s going to be an interesting week, to say the least!

Here’s a great video I couldn’t embed of ICE Agents milling about in Chicago until the spied a dark person – and then they gave chase! Is this really the Government we want to keep funding? And thank goodness we saved TikTok as the video was immediately improved by setting it to music.