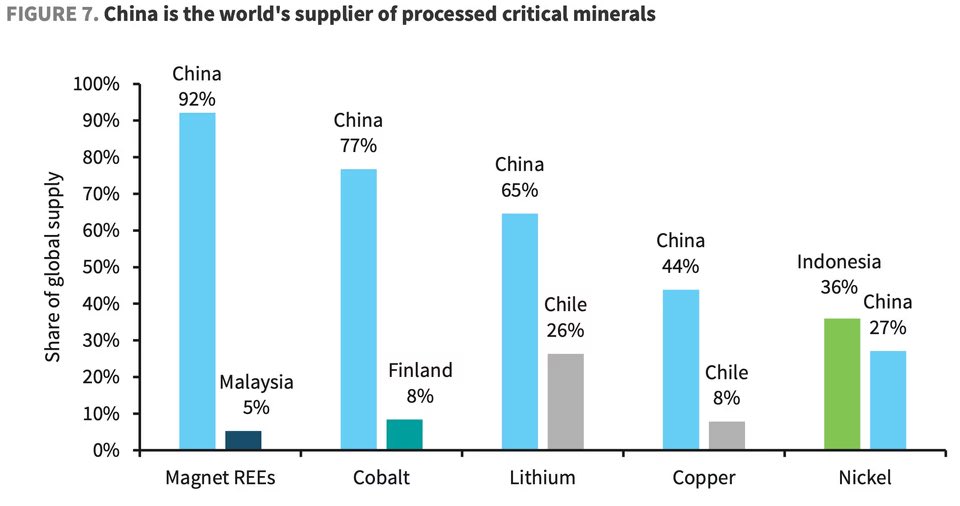

I don’t know, Trump made a tweet and the Futures are erasing half of Friday’s losses but that’s just low-volume BS – especially on a Monday and we’ll have to wait and see how things play out. China says they ARE allowing export licenses for Rare Earths to continue but it is now plain that they CAN cut us off at any time, which certainly weakens our negotiating posture in the upcoming trade talks.

And Trump did NOT want anything disrupting his victory speech, which is going on right now in Israel, now that the 20 hostages (out of 500+) that are still alive have been released almost a year into his term – great job Mr. President!

And GREAT JOB Jamie Dimon of JP Morgan (JPM), who did a lot more than Trump did to boost the market by pledging $1.5 TRILLION into the very sectors that are at the bleeding edge of the bubble:

-

- Supply Chain and Advanced Manufacturing, including critical minerals, pharmaceutical precursors and robotics

- Defense and Aerospace, including defense technology, autonomous systems, drones, next-gen connectivity and secure communications

- Energy Independence and Resilience, including battery storage, grid resilience and distributed energy

- Frontier and Strategic Technologies, including AI, cybersecurity and quantum computing

Only $10Bn (0.666%) of that is their own money and the rest is what they HOPE to sucker investors (like you) into chasing so they can exit their existing positions still near the top of the market – isn’t that clever? See, the President isn’t the only one that can inflate numbers to spin economic straw into hopium gold…

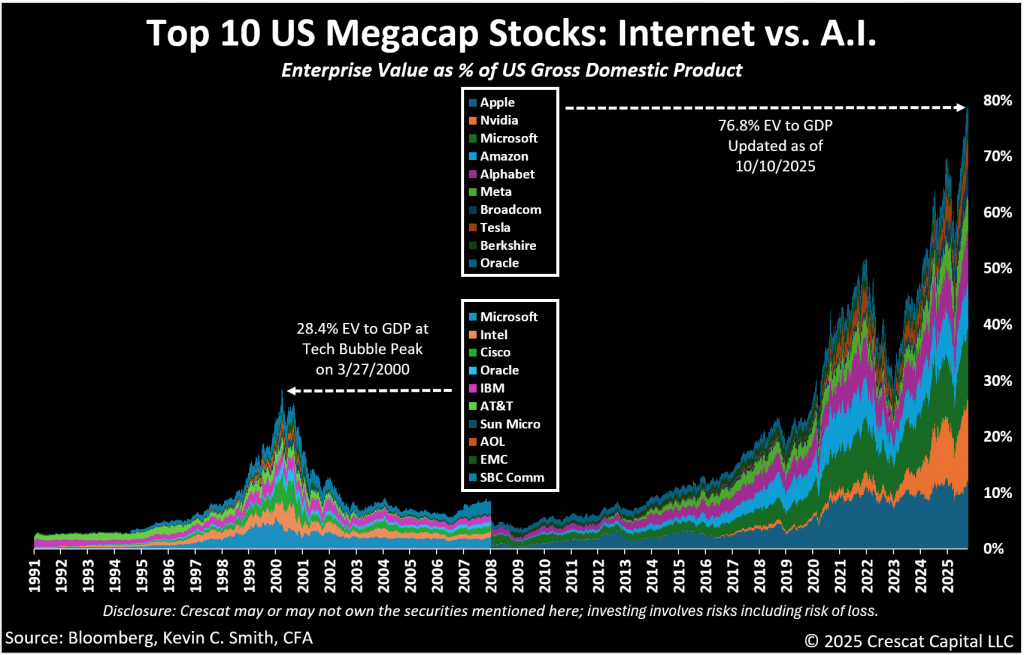

Regardless of whether on not we bounce here, Friday’s crash validated our months of warnings – not about Trump specifically, but about market fragility when 7 “magnificent” stocks control everything. The fact that one weekend tweet can trigger or reverse a major selloff proves our core thesis: THIS MARKET IS DANGEROUSLY UNSTABLE!

What matters isn’t whether Trump escalates or backs down on any given weekend – it’s that we’ve identified the STRUCTURE of how these crashes happen. Friday proved that when markets are this concentrated and overvalued, ANY catalyst can trigger systematic unwinding.

Trump’s weekend reversal actually reinforces our fundamental concern: investors now pay a ‘Trump Volatility Tax‘ where policy whiplash creates constant uncertainty. Whether he escalates or retreats, the mere POSSIBILITY of policy chaos keeps markets on a knife’s edge.

A large part of the value of hedging is so that we DON’T have to sell our long positions in a market downturn. We reviewed our Short-Term Portfolio (STP) and our hedges on Thursday and decided we were adequately protected for a 20% drop so we didn’t have to cash anything out on Friday and we STILL have our longs and we STILL have our hedges. As Zephyr noted in the weekend review – Shelter from the Storm.

Remember, new catalysts can come at any time and from ANY direction. Being aware of issues is NOT paranoia – ask any Lemur… We’re still very concerned about the AI Bubble, the Concentration of Wealth and the overall Market Fragility but we also still think a 20% correction should properly price in those concerns – 33% at most.

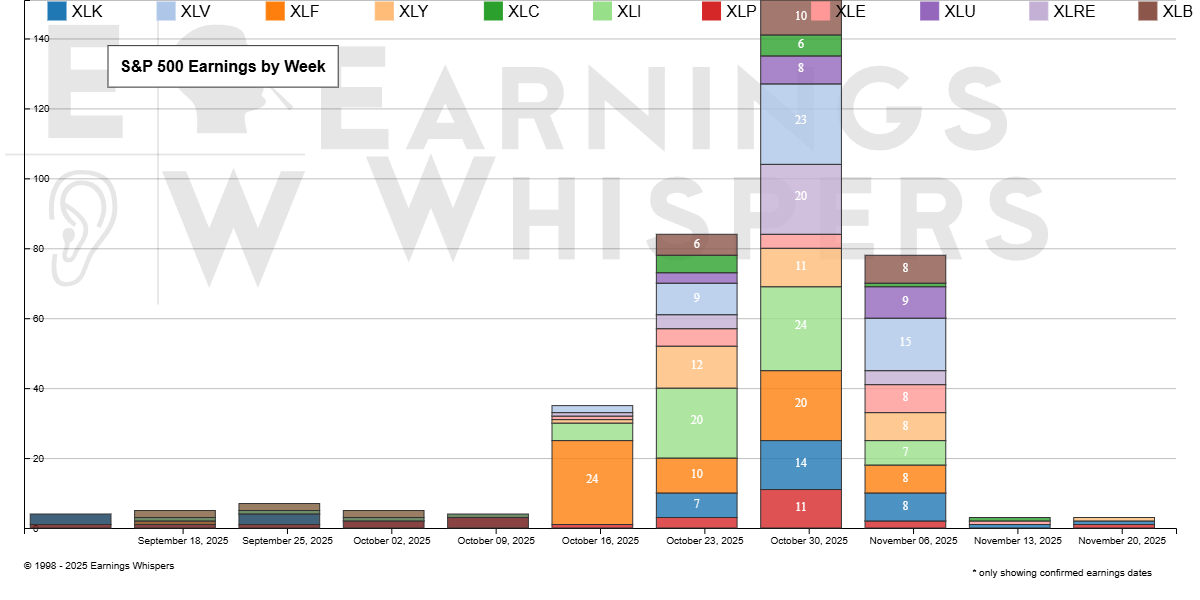

Our 50% CASH!!! position is fantastic going into earnings season and we’ve already identified sectors and stocks we’re tracking for our Members and we’re also standing by, waiting for stocks that are overly punished by their earnings reports – ready to swoop in and do some bargain-shopping. There are 7 overpriced stocks driving the market and we’re not too interested in them BUT there are 493 S&P 500 companies that are still interesting to up – THAT is what we look forward to in the next month of earnings reports.

As you can see, this week is all about the Financials and they should kick us off with a bang as it’s been a perfect storm for generating strong Q3 results. M&A Activity came back strong in Q3 and Equity Underwriting was on fire through September. The higher VIX was an indicator of more Client Activity and Currency Trading benefitted from wild swings in the Dollar. Loan Growth continues with Corporate Expansion and the Data Center Building Boom even as Deposit Costs went lower as the Fed cut rates.

The Q3 Earnings Expectations by Bank:

| Bank | EPS Est. | Revenue Est. | YoY Growth | Key Focus |

|---|---|---|---|---|

| JPM | $4.83 | $44.86B | +5.2% | Diversified strength |

| GS | $10.93 | $13.99B | +21.1% | Trading/IB powerhouse |

| MS | $2.07 | $16.25B | +10.1% | Wealth management |

| C | $1.91 | $21.01B | +3.4% | Transformation progress |

| BAC | $0.94 | $27.12B | +1.1% | Consumer headwinds |

| WFC | $1.54 | $21.17B | +0.4% | Regulatory progress |

The danger signs we’ll be watching for in the Bank Reports are going to be Consumer Credit Stress (almost 10% of all credit cards are 90+ days delinquent), Auto Loan Stress (rising), Commercial Real Estate (office occupancy still below 60% in major cities and loan loss provisions need to increase SIGNIFICANTLY – especially for CRE-heavy Regional Banks). And then there’s the $395Bn worth of unrealized losses still haunting the balance sheets of US Banks. That means Book Values are OVERSTATED across the sector!

On Bank Earnings Calls, we’ll be looking for Credit Quality Forward Guidance (delinquency trends, charge-off expectations, reserve build requirements), Commercial Real Estate Exposure, Net Interest Margin Outlook (loan repricing timelines).

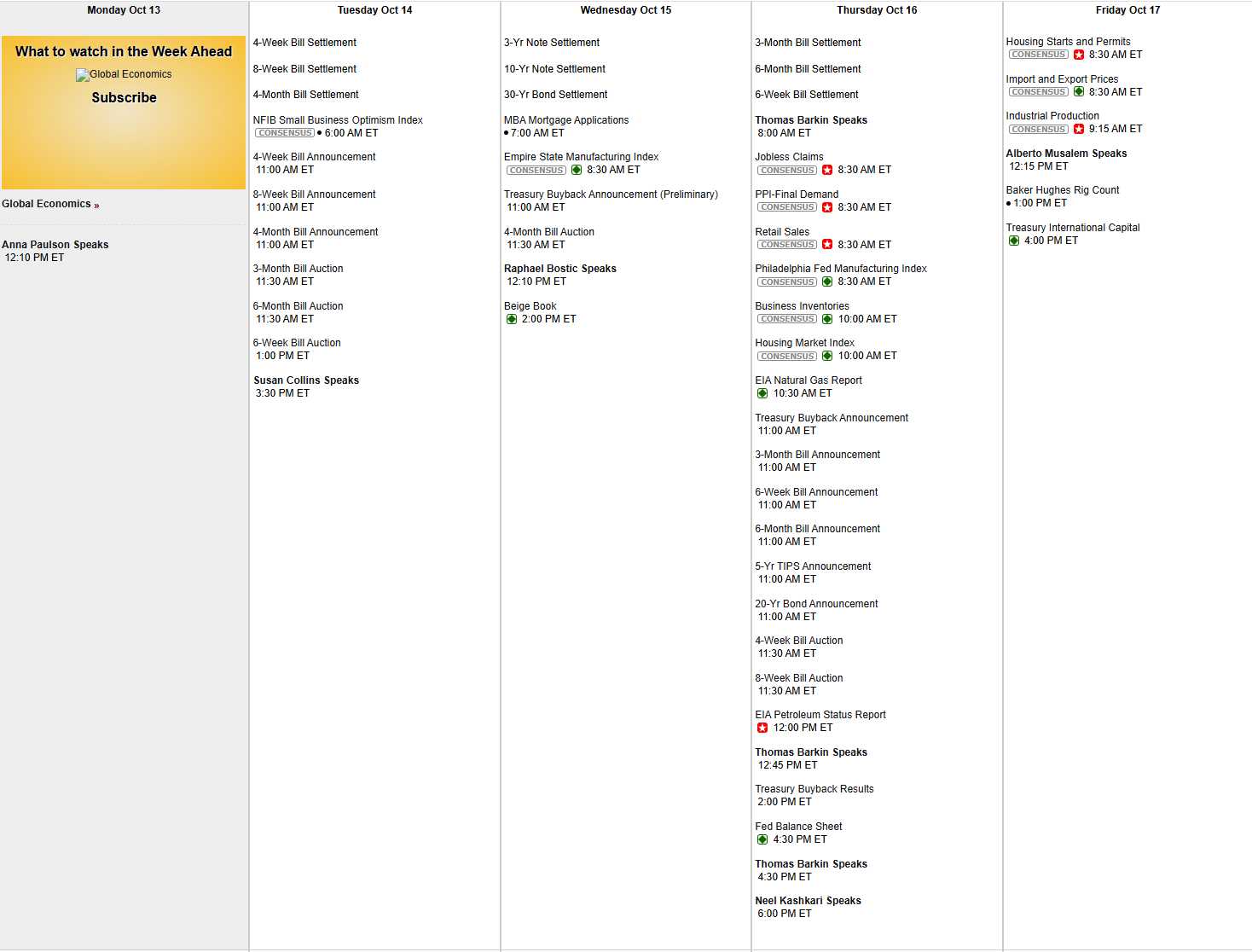

On the calendar for this week we have:

There will be a lot of extra emphasis on earnings this week as the Government is still closed (today is Columbus Day and they would have been closed anyway) and most of the scheduled reports just aren’t going to happen.

There are seven Fed speeches scheduled this week so they take on more weighting and we WILL see the Fed’s Beige Book on Wednesday – an anecdotal account of business conditions in the 13 Federal Districts. And, as usual, we have a lot of money to borrow this week – shutting down the Government doesn’t stop it from burning $200Bn a month AND we also need to rollover $500Bn in old debt (as if we were going to pay it off!). These are just the short-term auctions – they SHOULD do OK…

It’s going to be an interesting week/month ahead – ending on All Hallows Eve – get ready to have some fun!