Bank earnings are not helping?

As we predicted yesterday(more like “calculated” with our AIs) the Big Banks are beating their estimates and, while that may be nice for XLF – it’s not enough to cheer up the indexes – which are giving up about half (-1%) of yesterday’s low-volume gains in pre-market trading. Despite Trump tweeting that “Everything is fine” on Truth Social (which rallied the market yesterday), shockingly the President was full of shit and things are not, in FACT, fine at all as Beijing banned Chinese companies from doing business with US shipping subsidiaries of Hanwha Ocean.

The “mature” response from the Administration came from Treasury Secretary Scott Bessent, who told the Financial Times that China was “in the middle of a recession/depression,” adding, “They want to pull everybody else down with them.“

This is, of course, CATEGORICALLY FALSE as China’s GDP Growth is 4.8% according to the World Bank (independent of China) and September Exports were just reported up 8.3% year over year while US Exports (are actually not being reported as our Government is non-functional) have been falling off a cliff thanks to Trump and Bessents Trade Wars:

China is not trying to “pull everybody down” – they are DEFENDING themselves against Trump’s attacks. For over 50 years, since Nixon went to China, the US and China have been BUILDING a solid trade relationship that has changed the Word. China became our factory floor and all those dirty, shitty, polluting factory jobs that used to ruin people’s lives got shipped overseas while we became a Service Economy and a tech giant. Under Biden, the Fed was worried that we had reached FULL EMPLOYMENT and were raising rates to fight WAGE INFLATION – what a difference a year makes…

When did it become OK for our elected leaders to say the opposite of the truth without consequences?

As investors, this should really bother us, we NEED facts to make good investment decisions and the FACTS should not have “versions,” depending on who you ask. There IS a TRUTH and it can be determined – how did we all forget this?

Anyway, Earnings Reports are a sort of truth, and JP Morgan (JPM) made $1,000,000,000 more than the $14Bn they expected – up 21% from last year (and exactly what we predicted)! Investment Banking was up 17% and Trading Revenue was up 25% to $8.9Bn. HOWEVER, Jamie Dimon warned on the Conference Call: ““Considerable risks remain — tariffs and trade uncertainty, deteriorating geopolitical situations, high fiscal deficits, and INFLATED ASSET PRICES“ That’s a lot of concerns from a guy who made $14Bn in 3 months…

Goldman Sachs (GS) also hit our estimates with 37% income growth ($4.4Bn) and more than half of that was Investment Banking, which was up 42% from last year at $2.6Bn but GS comparatively sucks at trading, up only 11% from last year.

Both banks benefitted from the thriving Top 10% Economy with surging M&A Activity driving Investment Banking, Wealthy Clients boosting Trading Volumes and AI & Data Centers driving Corporate Lending. On the other hand, the Bottom 90% Economy is still lurking on the balance sheet with deteriorating Consumer Credit, Commercial Real Estate (CRE) write-downs and $395Bn worth of unrealized CRE losses still on the books!

“Inflated asset prices” from the CEO of America’s largest bank is code for “this won’t end well“. Banks are making money from market volatility and wealthy client activity – exactly what you’d expect at the top of a bubble. Strong trading revenues come from volatility, not economic health.

The fact that banks are beating while broader markets struggle suggests we’re in the “banks profit from chaos” phase that often precedes major corrections. Bessent’s China claims are pure propaganda to justify escalating trade wars that hurt both economies. The real economy is more fragile than bank earnings suggest.

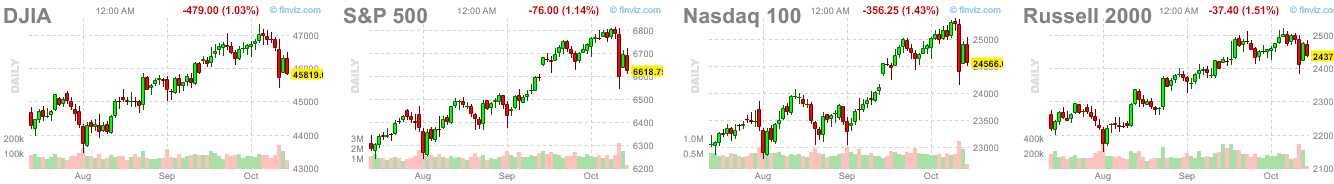

As I often warn our Members at PSW: “What has easily been done can just as easily be undone” and this rally has been far too easy and traders have gotten far too complacent for any sensible investor (very different from a trader) to be comfortable with. The August lows that you see: Dow 44,000, S&P 6,300, Nasdaq 23,000 & Russell 2,200 are around 5% below where we are now and that would be a HEALTHY pullback. Even 10% lower than we are now would be only a mild correction as the S&P was at 5,000 in April – remember that?

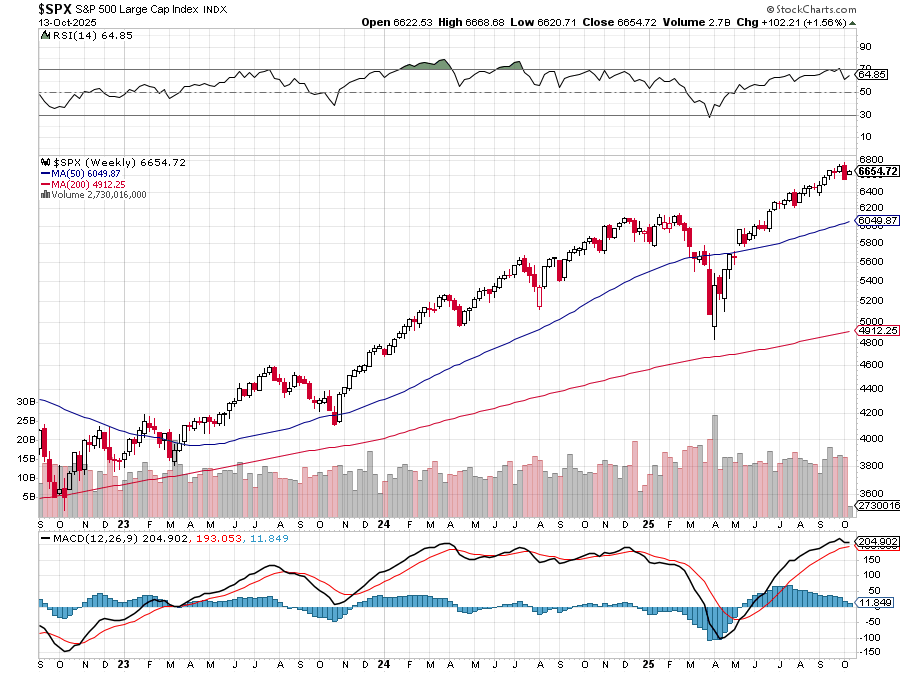

While April was a spike down, we started at 6,000 this year and 6,650 is up just over 10% but we’re up 33% from 5,000 and 6,050 is the 50-week moving average on the S&P 500 and 5,000 is the 200-week moving average – so those lines are definitely in play…

Now, the 200 wma is what people thought stocks were worth over the last 4 years and let’s say they didn’t account for inflation (10%) and let’s say they underestimate the value of the Magnificent 7 (10%) – that still only gets you to the 50-week moving average of 6,000 – not 6,654! And of course, what bothers me about the whole thing is the BULLSHIT premise all these forward-looking expectations are based on.

The Circular Ponzi Structure 🔄

-

-

-

-

-

-

OpenAI announces $300B Oracle deal → Oracle stock pops

-

OpenAI announces $270B AMD deal → AMD stock pops

-

OpenAI announces $500B Nvidia deal → Nvidia stock pops

-

These companies use stock gains to invest back in OpenAI

-

OpenAI uses new funding to make more announcements

-

Repeat until music stops 🎵

-

-

-

-

-

At the moment, Open AI has promised to spend $300Bn on ORCL (5-year deal), $500Bn on NVDA chips, $270Bn on AMD chips… That’s over $1 TRILLION worth of promises right there and let’s not forget Open AI gives MSFT $10Bn a year for Azure ($50Bn over 5 years – Open AI is MSFT’s biggest customer) as well as deals they’ve announced with Softbank, MGX, GOOGL and AVGO just yesterday that SEEM like they are good for another $500,000,000,000 – this is an incredible number!

Yes, INcredible as in NOT credible. Why? Because OpenAI’s operating income is NEGATIVE $8Bn in 2025 and they project to burn $17Bn in 2026, $35Bn in 2027 and $45Bn in 2028 and that’s against TOTAL 2025 Revenues of $13Bn. So where, THE FUCK, are they supposed to be getting $1,500,000,000,000 from?

If you add their promised Circle Jerk spending to their $115Bn of already-published projections, they will have a $1.6 TRILLION deficit to close out this decade and THOSE are the projections against which they need to raise capital and their business plan would say what?, exactly?

The Circular Ponzi Structure Exposed 🔄

-

-

-

-

-

-

Microsoft invests $14B in OpenAI

-

OpenAI spends it back on Microsoft Azure

-

Microsoft books “revenue growth”

-

Stock price rises

-

Microsoft “invests” more (Azure credits)

-

Repeat

-

-

-

-

-

I asked Boaty to whip up an investor presentation for Open AI and his math was the same as mine but, where he really killed it was in the summary (and I’m not kidding, this was his actual joke):

🎯 OUR INVESTMENT THESIS:

We’ve discovered the revolutionary business model of promising to spend money we don’t have to companies that invest in us, who then use their stock gains to give us more money, which we promise to spend on more things we can’t afford. It’s foolproof!

Warren Buffett eat your heart out!

💡 RISK FACTORS:

-

-

-

- Mathematics (we’re working on disrupting this)

- Physics (also on our disruption list)

- The concept of ‘having money before spending it‘ (outdated thinking)

-

-

🚀 MANAGEMENT TEAM:

-

-

-

- Sam Altman: Visionary who believes in impossible things

- CFO: Position currently vacant (previous CFO suffered nervous breakdown after seeing the numbers)

- Call today! Operators are standing by! (Not really, they all quit when they saw our burn rate.)

-

-

This makes Enron look like amateur hour. When this unravels, the collapse will be biblical because every major tech stock (MSFT, NVDA, ORCL, AMD, GOOGL) is counting on revenue that literally cannot exist. The AI bubble isn’t just overvalued – it’s built on commitments that are physically impossible to fulfill.

If OpenAI were a real company, they would have to, at some point, MAKE $1.6Tn. Let’s even say that’s not profit but Revenue. Amazon (AMZN) has $700Bn in annual Revenues and only 10% of that is profit and those are GLOBAL Revenues, not just US. $700Bn is 10% of all US Consumer Spending – Open AI needs MORE than that. Do you have 10% of your discretionary income for OpenAI?

As noted by Boaty, MATH is their greatest risk factor. Even if we valued OpenAI at $4.5Tn like NVDA, they’d still have to sell off 1/3 their stock to raise that capital and who has that kind of capital to invest? Even Buffett and AAPL only have $300Bn each – even if they give ALL of their money to OpenAI – they would still need another $1Tn!

This shit is CRAZY!, folks. Irrational and crazy and I wouldn’t care if it was just OpenAI but their insane spending promises are driving the rally for the rest of the market.

What if something goes wrong?

I’ve listened to preachers, I’ve listened to fools

I’ve watched all the dropouts who make their own rules

One person conditioned to rule and control

The media sells it and you live the role – Ozzy (RIP)