Same GIF as last month:

Same GIF as last month:

Just yesterday Powell re-ignited the rally by saying he would end Quantitative Tightening because, sure, $6.6 TRILLION is all trimmed, right? It WAS $9Tn in 2022 so I guess you can say it's come down but it also WAS $4Tn in 2020 and $1Tn in 2008 and we don't count it as part of the National Debt but then - WHAT IS IT???

Our official National Debt is $37.6Tn, which does not include Entitlement (SS, Medicare, Veteran's Benefits) Obligations as the Conservatives who now run the National Debt Clock have removed those items as considerations. Even the Magafied Debt Clock shows a $1.9Tn budget deficit this year on $7.4Tn worth of Federal Spending (wherefore art DOGE?) and that's AFTER deducting $675Bn for Tariff Revenue - that is still very questionable.

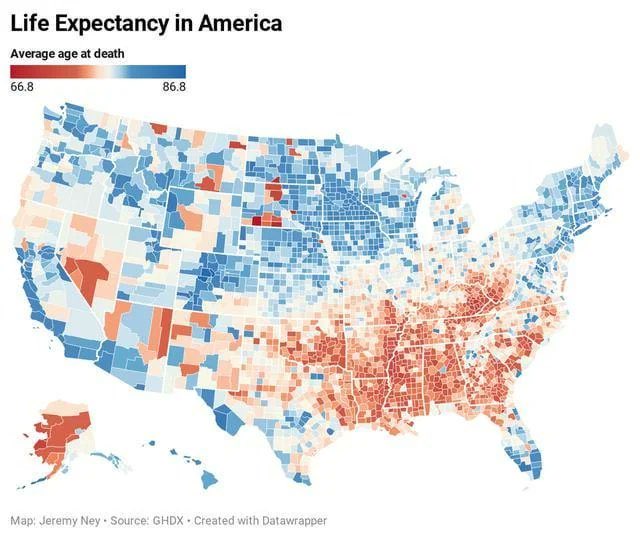

States, meanwhile, are also running up $1Tn in debt as the Federal Government pulls back in spending and if you are thinking "Hey, I live in a state!" - perhaps you are seeing the problem... Moving expenses from the Federal to State Level doesn't save anyone any money - unless they live in a red state that doesn't believe in spending money on Education or Health Care or Infrastructure and, while that may save you money - it costs you YEARS OF YOUR LIFE:

That's right, people in Red State Counties live as much (little?) as 20 years lest than those people in frog suits who are protesting the deportation of their neighbors. That's why you saw so much shriveled skin during that naked bike ride protest. Blue State and County people tend to live a lot longer because they believe in things like vaccinations and clean water and all those other things that allow people to live longer, healthier lives.

Anyway, getting back to our reviews: Last month, we talked about all the money the Fed was printing and now we're getting lower rates as well so yes, we've still got those constant inflows into US Equities - no matter what the news is, apparently.

Anyway, getting back to our reviews: Last month, we talked about all the money the Fed was printing and now we're getting lower rates as well so yes, we've still got those constant inflows into US Equities - no matter what the news is, apparently.