The VIX hit 28 this morning.

The VIX hit 28 this morning.

It’s 7:30 now and we’re already back to 23, where we closed yesterday but that too is a warning to be taken seriously – especially on options expiration day – the first one for Q4. All of sudden, this morning, reports from JEF, ZION and WAL triggered a panic about the quality of loans and investments held at Regional Banks. Zions made a $50M charge-off while Western Alliance said it suffered from fraud losses but did not specify (that’s never good!). As we’ve noted, US Banks are already sitting on $350 BILLION in unrealized losses and REALIZING they have even more than that is no helpful.

Nonetheless, the Buybots kicked in as the S&P tested 6,550 and now we’re back to 6,666, which is Peter Theil’s favorite number (according to South Park last night).

Of course, nothing that happens in the low-volume Futures Market really matters but it is an indicator of how thin the ice is that investors are skating on and the elevated VIX indicates that some people are starting to panic about the cracks – which are becoming more and more obvious every day. As we noted in Wednesday’s Long-Term Portfolio (LTP) Review, we were up $60,665 (8% – and almost 666 Peter!) since September and that was up $79,235 (11.7%) since August so we have a huge cash buffer in addition to the hedges in our Short-Term Portfolio (STP) – otherwise I would have cashed out and walked away from this nonsense by now.

Like 1999 and 2007 – we MIGHT have a bit more gas in the tank to take this rally higher but there is also a VERY SERIOUS RISK of a 20-30% correction and Trump has been busy bringing peace to the Middle East (THIS time it will last, right?) and now he’s bringing peace to Ukraine but then he’ll be back in Washington with no Federal money to spend and he’ll get angry and start rage-tweeting again – it’s a bad combination as we head into November – including the mid-term elections!

Like 1999 and 2007 – we MIGHT have a bit more gas in the tank to take this rally higher but there is also a VERY SERIOUS RISK of a 20-30% correction and Trump has been busy bringing peace to the Middle East (THIS time it will last, right?) and now he’s bringing peace to Ukraine but then he’ll be back in Washington with no Federal money to spend and he’ll get angry and start rage-tweeting again – it’s a bad combination as we head into November – including the mid-term elections!

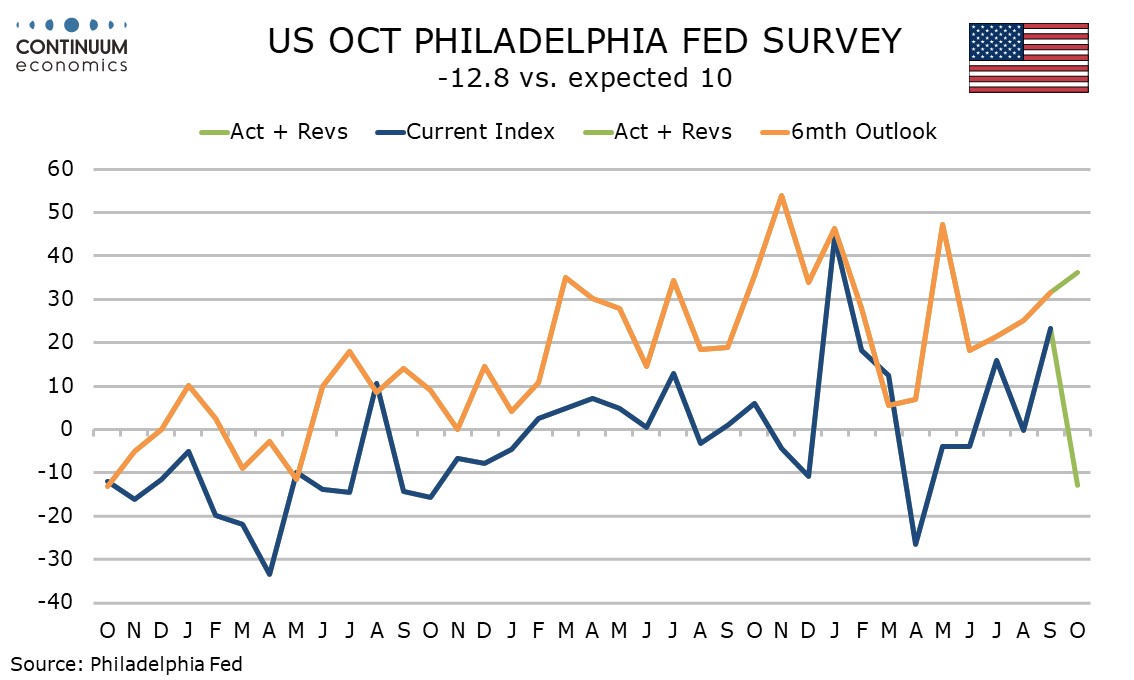

And while this is going on we’ve got no data to guide us. We did get the Philly Fed Report yesterday and that was a total disaster – falling from 23.2 in September to NEGATIVE 12.8 with 25% of the firms reporting decreased activity and only 12% reporting increases. Shipments fell 20 points as well. NY had reported +10.7 on Wednesday (though NY’s year has been a disaster) and the big difference between Philadelphia and NY is Philly is hit harder by tariff costs as those charges begin to take effect.

Prices Paid (input costs) rose to 49.2 while Prices Received hovered at 26.8, which indicates the Manufacturers are unable to pass along their rising costs so, in the very least, their margins are getting squeezed and where are we going to see that? In the earnings reports!

NY State has those Finance, Tech and Professional Services that are doing so well while Philadelphia relies on a Heavy Industrial Manufacturing base – so they are suffering the tariffs and NY mostly is not. Philadelphia manufacturers are contracting despite rising orders because THEY CAN’T PROFITABLY FULFILL THEM. This is the definition of Stagflation: demand exists, but supply-side costs make production unprofitable.

There is a lot of cognitive dissonance in this chart. ACTUAL conditions are hitting them hard but they HOPE things are going to get better (like they did in April when Trump reversed on tariffs). Unless there is a miracle with China talks this month, nothing is going away and that forward sentiment will collapse hard and fast into the holidays as more and more tariffs kick in.

What’s happening here is AMZN, WMT, TGT, etc. are playing hard-ball trying to keep their costs down and that’s why the manufacturers can’t pass it along but, eventually, you get to the point where it’s not worth manufacturing at a loss and then we have another round of inflation as Retailers have to pass the costs on to the consumers, who then go back to the Manufacturers and Retailers and demand higher wages – it’s the same slow, repetitive cycle we’ve been in all year – Team Trump just declares victory on the retracements and ignores the up cycles.

When manufacturers contract DESPITE rising orders, that’s not a recession signal, it’s a margin collapse signal! Margin collapse leads to reduced hiring (employment +4.6 will go negative), Reduced CapEx (despite current optimism), reduced production and, finally, RECESSION!!!

If Philadelphia is right and this is structural (tariffs, cost pressures), we could be just 3-6 months from broad Manufacturing contraction. If New York is right and Philadelphia was an outlier, then next month’s surveys should show some convergence. Most likely Philadelphia is the future and New York just hasn’t felt the pain yet – due to their different (and unique in the USA) economic mix.

Have a great weekend,

— Phil