Finance is funny!

Finance is funny!

Keep that in mind and it won’t bother you as much… This week, we’re seeing a classic rally reversal in Dollar alternatives with Gold (/GC) dropping from $4,400 back to $4,043 (-8.1%), Silver falling from $53.70 to $47.40 (-19.2%) and Bitcoin – even with the support of the President – falling from $127,065 on the 6th to $108,005 (-15%) this morning and THAT is a recovery off $104,000 on Friday.

How would you like THAT to be your bank balance?

The best way to know when it’s time to sell gold is when you see more than 3 infomercials trying to sell it to you while you’re trying to go to sleep. For many months now, no one has offered us their gold bars or $10 gold coins and such but, suddenly, we are deluged with offers for “Morgan Silver Dollars” and such.

On Monday, Gold was “the only true safe haven” at $4,400/oz with analysts solemnly declaring the Dollar’s death imminent, Central Banks were “accumulating strategic reserves” and gold was heading to $5,000 by Christmas. That all ended on Tuesday, when Gold was “in a death spiral,” down 6.3% – which WAS the worst single-day collapse in 12 years, with breathless headlines proclaiming “The gold bubble has burst!” and “Precious metals are finished.”

Here’s what actually occurred: NOTHING! Nothing fundamentally changed.

-

- The US government still owes $37 Trillion it can’t repay

- Trade wars remain unresolved

- The Fed’s still cutting rates into economic uncertainty

- Manufacturing is contracting (Philadelphia Fed -12.8)

- Regional banks still sit on $350 Billion in unrealized losses

And yet Gold lost $2.1 TRILLION in market cap in 24 hours while Bitcoin whipsawed $300Bn in both directions, and silver got the rug-pulled like a Memecoin on Solana. Why? Because roughly $300-500Bn in leveraged positions got liquidated when Trump softened his tariff tone for the 47th time this year (TACO), causing algorithms to flip from “risk-off” to “risk-on” in 0.00003 seconds – causing the humans in the loop to scramble to explain it – lest they too be replaced by machines.

So they make shit up…

In reality, the Global Financial System runs a simple, overriding principle: There’s nowhere “good” to put money so money sloshes between various bad options based on which looks the least terrible on any given day. There are four main asset buckets people with money get to choose from:

1. Dollars & Bonds: “The Full Faith & Credit” Joke

-

-

-

The US government borrows $2 trillion/year it can’t repay

The US government borrows $2 trillion/year it can’t repay- The Fed “prints” dollars to buy its own debt (insanity in circular form)

- Real yields (after inflation) are negative despite 4%+ nominal rates

- Yet the dollar strengthened this week (DXY +1.81% monthly) because… EVERYTHING ELSE IS WORSE!

-

-

The Absurdity: We call dollars “safe” while the institution backing them runs a Ponzi scheme that would land any private citizen in prison.

2. Gold & Silver: “Barbarous Relics” that We Can’t Quit

-

-

-

- Gold has zero cash flows, pays no dividends, costs money to store

- Its value is purely “what will the next person pay?“

- Yet after 5,000 years of human civilization, we still flee to shiny rocks when paper burns

- Up 50%+ in 2025, then down 6% in one day, now stabilizing — pure emotion

-

-

The Absurdity: Traders mock gold as “barbarous” while treating Federal Reserve Notes (printed at will) as “sophisticated monetary instruments.“

3. Bitcoin & Crypto: “Digital Gold“ (With More Steps)

-

-

-

- Created by anonymous person(s), runs on code, secured by electricity consumption

- No intrinsic value beyond “decentralized scarcity” (which requires constant energy input)

- Correlates with gold when convenient, diverges when inconvenient

- Hit $114,000 Tuesday as gold crashed, then gave it all back yesterday

-

-

The Absurdity: We debate whether digital scarcity is superior to physical scarcity while ignoring that both derive value from a collective delusion.

4. Stocks: “Productive Assets“ (LOL)

-

-

-

- S&P 500 trades at 26x earnings, Nasdaq at 31x

- 40% of market cap is in just 7 companies (Mag 7)

- Earnings growth is currently driven by cost-cutting, not revenue expansion

- Yet stocks are still considered “the safest long-term bet“

-

-

The Absurdity: We call equities “ownership in productive enterprises” when most trades are based on memes, tweets, and algorithmic flows which are wholly disconnected from ACTUAL cash generation.

Let’s look at the capital flows that caused this week’s drama:

Let’s look at the capital flows that caused this week’s drama:

Act 1: The Flight to “Safety“ (Sept-Oct 20)

-

-

-

- Trump escalates China tariff threats → “Risk-off“

- $500B flows out of stocks → into gold, Bitcoin, bonds

- Gold hits $4,400 (+60% YTD)

- Bitcoin stuck at $108K (frustrating crypto bulls)

- Dollar weakens to 98.2 as investors flee USD-denominated

-

-

Headlines: “Gold Headed to $5,000!” “Dollar Collapse Accelerating!” “Safe Havens Surge!“

Act 2: The Rotation Back (Oct 21)

-

-

-

- Trump moderates tariff tone (for the 47th time) → “Risk-on“

- $300B liquidates from gold/silver → into stocks & short-term Treasuries

- Gold crashes -6.3%, Silver -8%, Bitcoin initially follows

- Dollar strengthens to 99+ as “least-bad fiat“

- Stocks rally (S&P +1.2%, Nasdaq +1.5%)

-

-

Headlines: “Gold Bubble Bursts!” “Precious Metals Rally Over!” “Dollar Strength Returns!“

Act 3: The Confusion (Oct 22, Today)

-

-

-

- Gold stabilizes at $4,137 (+0.9%)

- Bitcoin bounces to $108,300 after testing $107,000

- Dollar flat at 99.08

- Nobody knows what to believe anymore

-

-

Headlines: “Markets Await Clarity…” “Investors Confused…” “What’s Next for Assets?“

Every market move triggers binary narratives designed to generate clicks or eyeballs, not insight:

Every market move triggers binary narratives designed to generate clicks or eyeballs, not insight:

When Gold Rallies:

✅ “Gold Proves Its Worth as Ultimate Safe Haven”

✅ “Central Banks Ditching Dollar for Gold”

✅ “Precious Metals Bull Market Just Getting Started”

✅ “$5,000 Gold Inevitable as Fiat Collapses”

When Gold Crashes:

❌ “Gold’s 12-Year Rout Signals End of Precious Metals Era”

❌ “Central Banks Abandon Gold Strategy”

❌ “Digital Assets Replacing Barbarous Relics”

❌ “Gold Bubble Finally Bursts After Parabolic Run”

The Reality: Gold is doing what it always does — oscillating violently around its long-term uptrend because humans are emotional, leveraged, and prone to panic.

When Bitcoin Rallies:

✅ “Bitcoin Proves It’s Digital Gold”

✅ “Institutional Adoption Accelerating”

✅ “Crypto Supercycle Confirmed”

✅ “$200K Bitcoin by Year-End Conservative”

When Bitcoin Crashes:

❌ “Crypto Ponzi Scheme Unraveling”

❌ “Tether Collapse Imminent”

❌ “Regulators Killing Digital Assets”

❌ “Bitcoin Going to Zero, Experts Say”

The Reality: Bitcoin is doing what it always does — whipsawing violently while slowly grinding higher over multi-year timeframes as adoption increases.

The Reality: Bitcoin is doing what it always does — whipsawing violently while slowly grinding higher over multi-year timeframes as adoption increases.

When Dollar Strengthens:

✅ “Dollar Reasserts Reserve Currency Status”

✅ “US Economic Resilience Proves Bears Wrong”

✅ “Emerging Markets Face Capital Flight Risk”

✅ “Safe Haven Demand Returns to Greenback”

When Dollar Weakens:

❌ “Dollar Losing Reserve Status to BRICS”

❌ “US Fiscal Chaos Driving Capital Flight”

❌ “Fed Destroying Currency Through Easing”

❌ “Dollar’s Decades-Long Dominance Ending”

The Reality: The dollar strengthens when other currencies are weaker (2025: down 12.5% YTD but up 1.8% this month), not because it’s “sound” — it’s just the least-dirty shirt left in the hamper.

The key insight here is that these rotations are the noise, not the signal. The underlying trend remains intact. Investors need to ignore the headlines and watch the flows. Gold is up 50% year-to-date and our 5% Rule™ EXPECTED a 20% (of the rally) pullback – AT LEAST!

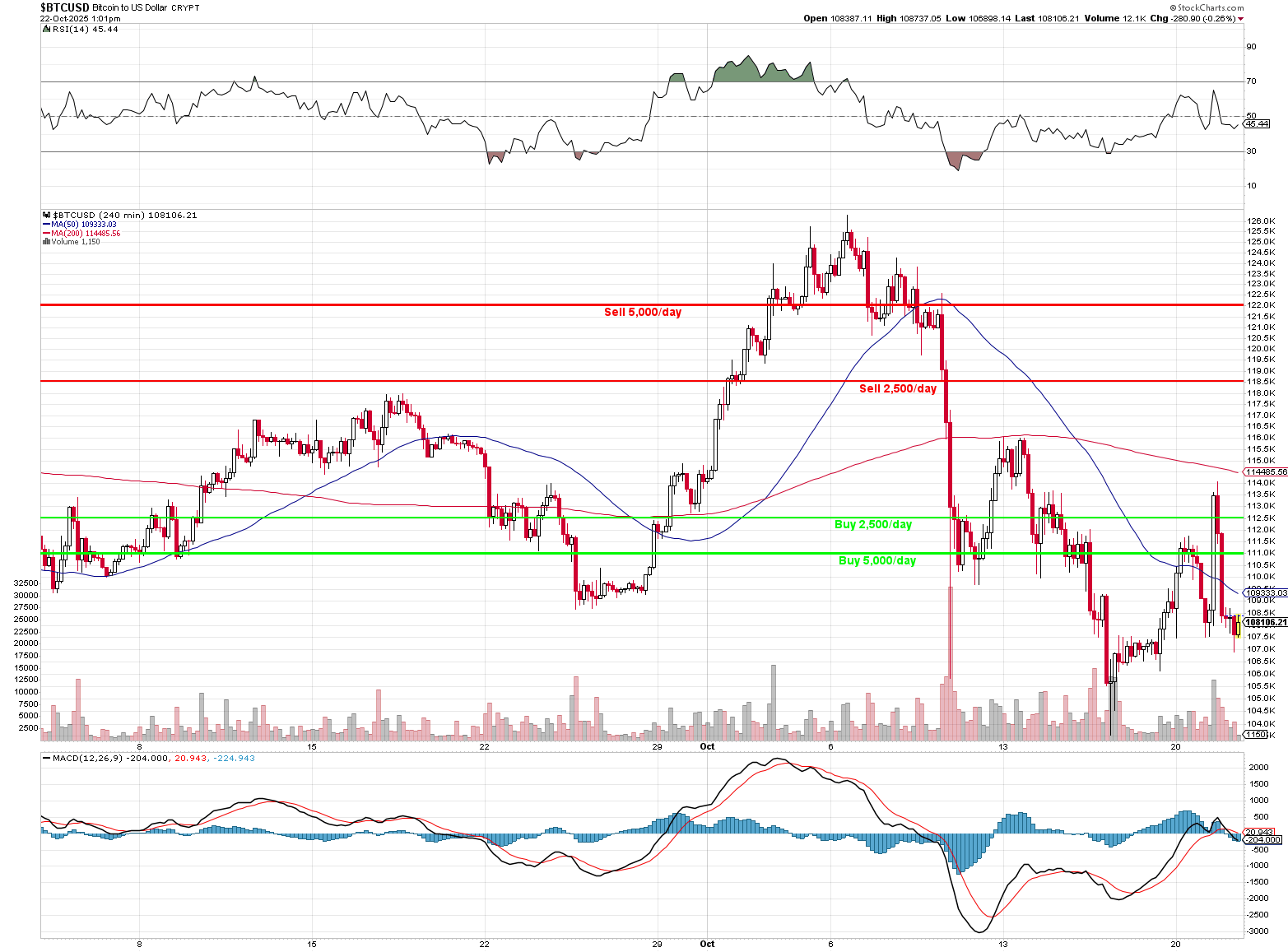

Bitcoin was $60,000 last year and $120,000 is up 100% and that’s a $60,000 run so a 20% (of the run) pullback is $12,000 – to (drumroll please) $108,000! Are we surprised? Not our Members – we’ve been using this Bitcoin chart all summer to guide our purchases and sales and it’s been VERY PROFITABLE for our Members! In fact, we’re the ones SETTING THE MARKET:

Unless the FUNDAMENTALS change, no single-day move should be taken seriously. All these “analysts” and talking heads on TV are just trying to keep you watching until the next commercial break with their “this time it’s different” narratives and breathless predictions. Do you know why they like to have the same guests on – OVER AND OVER AGAIN? – it’s because they know what they will say – they might pretend to be surprised but they WANT people who fit in their “script of the moment” for their Economic Soap Opera.

ALL Fiat currency is BS, ALL Governments lie to you and ALL Assets are currently overvalued because the entire World is in a debt crisis that is still unresolved and getting worse. The whole world has an aging population that can’t be supported by working youth and the answer is ROBOTS at the moment – we’ll see how that goes…

See, even the Magnificent 7 had a pullback or two – on the way from $25 to $65 – up 160% since April of 2023 (2.5 years). $75 should be the next major pullback but you have to keep your eye on the policies as there is now a global outcry to stop AI development before we cross into “Super-Intelligence” and unleash Skynet – or whatever fantasies and fears these people have bought into.

Of course “these people” are Prince Harry AND Meghan, Richard Branson, Steve Bannon, Steve Wozniak, Geoffrey Hinton, Susan Rice, Will.I.Am… We’ll be discussing that one in more detail at the AGI Round Table this weekend…

Tuesday’s gold crash wasn’t “fundamentals reasserting” — it was leveraged speculators hitting stop-losses after Trump’s 47th tariff reversal triggered algo-driven liquidation cascades. Monday’s gold euphoria wasn’t “smart money positioning” — it was FOMO-driven retail and momentum funds piling in after Central Banks front-ran them for months. Today’s stabilization isn’t “markets finding equilibrium” — it’s exhausted traders waiting for the next tweet/data point/crisis to tell them which way to panic next.

The OPPORTUNITY for us, as FUNDAMENTAL Investors at PSW is that we are not so easily swayed by all the noise (are we?) as we concentrate on the SIGNAL – the true indicators that lie beneath the panic and euphoria that are all you see and hear if you don’t FOCUS!

The media wants you to be confused and emotional, because confused, emotional Investors trade frequently (generating commissions) and buy high and sell low – transferring your wealth to patient professionals – the SAME ones who are spinning their stories on TV and in print, which funnels into your AIs and Algos.

The media wants you to be confused and emotional, because confused, emotional Investors trade frequently (generating commissions) and buy high and sell low – transferring your wealth to patient professionals – the SAME ones who are spinning their stories on TV and in print, which funnels into your AIs and Algos.

Our approach is to Ignore the Theater, Follow the Money and yes, we tend to buy what is hated and sell what is loved and like to keep plenty of CASH!!! on the sidelines – so we have it ready when everyone else runs out.

In the end, the only certainty in this absurd fiat-vs-alternatives circus is that human emotion drives 90% of moves, creating opportunities for the 10% who stay calm.