The Futures are FLYING higher!

The Futures are FLYING higher!

Aside from the usual low-volume Monday BS, this particular idiocy is based on Scott “BS” Bessent, who said this morning: “We have a substantial framework for the leaders” while China’s Vice Minister Li said we have “Preliminary consensus requiring internal review“, which translates to “They agreed to keep talking and not blow each other up before Thursday’s photo-op.” We have seen this movie before:

We play these games with China ALL THE TIME yet “this time is different” is a game for fools and this time it looks like the fools are running the White House but the bigger fools are running the markets – willing to pay any amount for any stock any time they are told a new fairy tale…

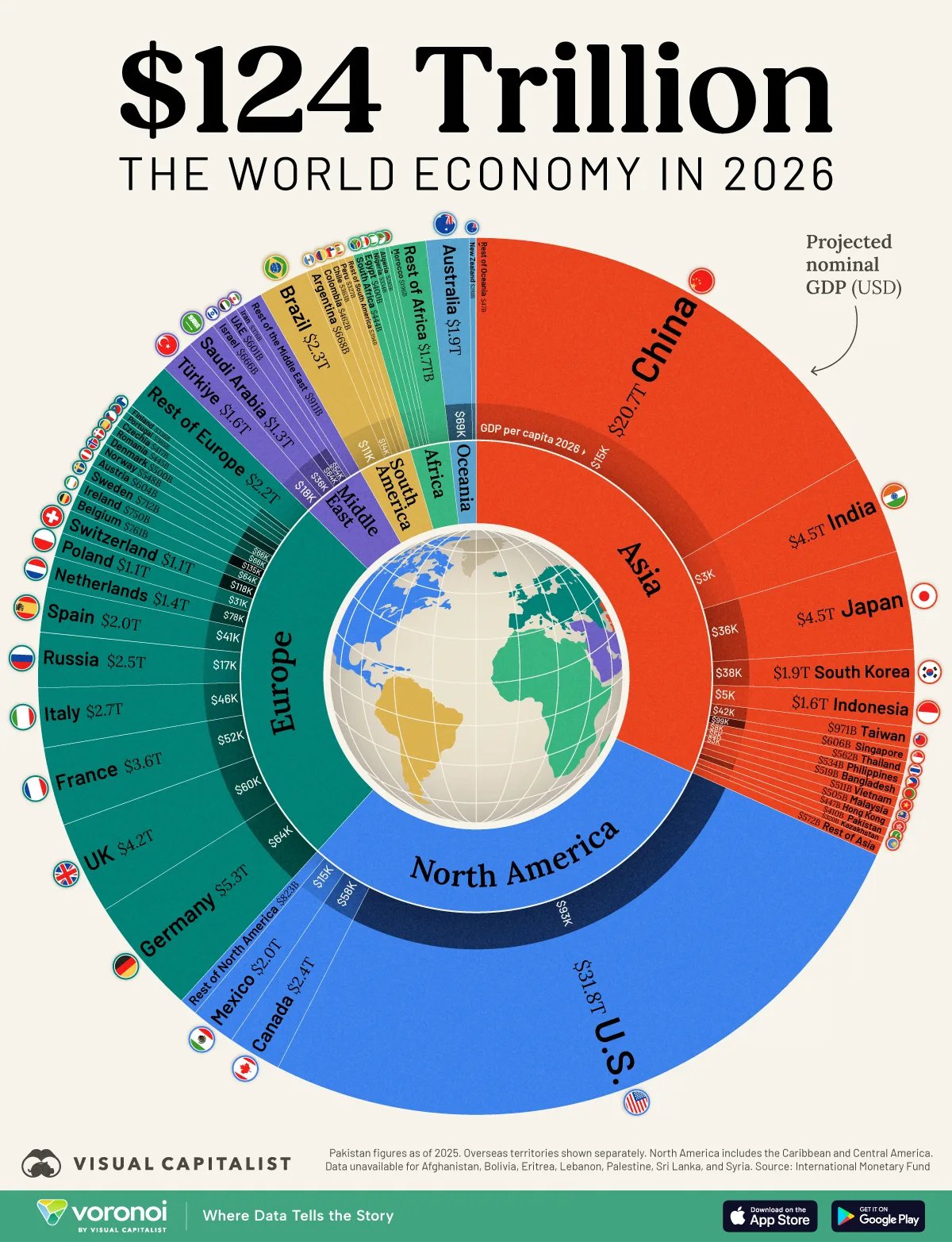

Not that a market rally fixes anything for anyone – other than the Top 10%, who now own 87.2% of the stocks and 62.3% of the TOTAL WEALTH in this country. They even own half the land, squishing the other 90% into the other half (and no, it’s NOT Waterfront, Lakefront or Penthouse).

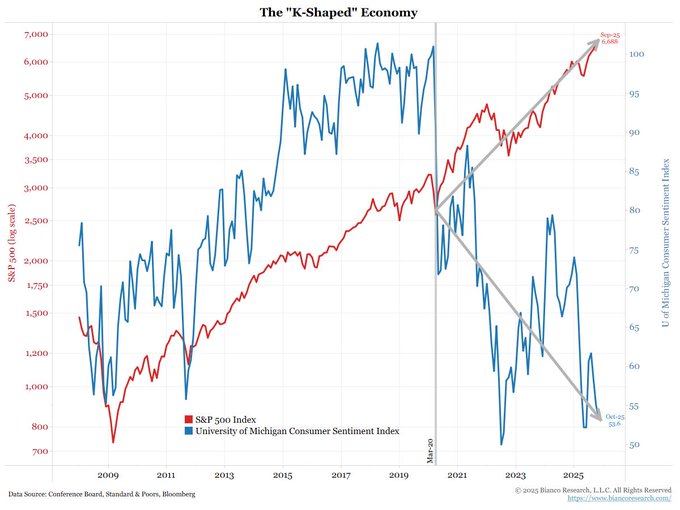

This is leading to an EXTREME disconnect between record-high market returns and Consumer Sentiment – which has only been lower in America when we were all locked in our homes praying we didn’t die from an infectious disease. You know – Trump’s last Administration when the Top 10% got $9Tn worth of bailouts and the Bottom 90% got $3,000. God bless us, everyone…

What has China ACTUALLY confirmed?

-

-

“Progress” was made in Malaysia talks

-

“Basic consensus on arrangements” for Trump-Xi meeting

-

Will review “framework” internally

-

What has NOT been confirmed?

-

-

Specific tariff rollbacks

-

Soybean purchase amounts

-

Rare earth export restriction delay

-

Any dollar figures or timelines

-

China State Media this morning said: “”Win-win cooperation between China and the US is the right path; suppression and containment will lead nowhere” which is diplomatic speak for: “We’re not agreeing to anything substantive, just smiling for cameras.” For President Trump, that translates to him saying on AF-1: “I have great respect for President Xi, and we’re going to finalize the deal.“

BS Bessent says:

-

- 100% tariffs “effectively off the table” for Nov 1st

- China will buy “substantial” US soybeans

- Rare earth export controls delayed “one year“

- Fentanyl precursor chemicals stopped

Like Canada, if nothing actually materializes, they can always claim China “blew up” the deal. Keep in mind that neither Trump nor Bessent have ever understood a single word that President Xi has actually said. Not that it’s impossible – but do you really think Trump as formed a warm and fuzzy relationship with the Communist leader whose peasant father was purged in the Cultural Revolution and is known as a “worker-peasant-soldier-student” among his people. What exactly do they have in common? Cleary it’s not office decorating…

Like Canada, if nothing actually materializes, they can always claim China “blew up” the deal. Keep in mind that neither Trump nor Bessent have ever understood a single word that President Xi has actually said. Not that it’s impossible – but do you really think Trump as formed a warm and fuzzy relationship with the Communist leader whose peasant father was purged in the Cultural Revolution and is known as a “worker-peasant-soldier-student” among his people. What exactly do they have in common? Cleary it’s not office decorating…

In truth (what’s that?) even these hints of a deal are merely kicking the can (again) down the road. As Bloomberg notes: “Those easy hits are pleasing investors, but leave deeper core conflicts unresolved.” Things that still need resolving include:

-

-

Semiconductor export controls (US still blocking chips to China)

-

TikTok forced sale (China opposes, US demands- the fakely announced this done a month ago – it wasn’t)

-

Intellectual property theft (US core complaint)

-

Forced technology transfer (US core complaint)

-

Manufacturing subsidies (China’s industrial policy)

-

Time Magazine notes: “Even if a deal is reached between Trump and Xi on Thursday, it’s unlikely to provide lasting relief… Trump has ripped up negotiations and deals on a whim—even with allies.”

Even if they announce a deal – what will it actually mean? In 2020, Trump announced a deal in which China promised $200Bn in purchases yet less than $100Bn actually came to pass. We are currently operating under the May-Aug extension of the April “no exceptions” deadline, which has been extended in September and October. This “framework” is the same playbook – with vague promises of cooperation, photo-ops and a return to status quo.

Even if they announce a deal – what will it actually mean? In 2020, Trump announced a deal in which China promised $200Bn in purchases yet less than $100Bn actually came to pass. We are currently operating under the May-Aug extension of the April “no exceptions” deadline, which has been extended in September and October. This “framework” is the same playbook – with vague promises of cooperation, photo-ops and a return to status quo.

China usually doesn’t comment so Trump’s team could be making it all up – it’s like when people spread Apple rumors that gain traction because they refuse to comment. China’s playbook is to never confirm specifics until AFTER the signing ceremony (it maintains their leverage until the last second) while Trump’s playbook is to announce the “Biggest Deal EVER” to try to pressure the other side to agree with him – only to walk back most of the “terms” into the signing.

This trade deal was announced yesterday – before the markets re-opened, causing them to get squeezed 1% higher as Bessent was on every Sunday morning show (and NOT in China) claiming victory. By the time people realize Trump once again traded his cow for magic beans – the Nov tariff deadline will be extended and the cycle repeats yet again. It lifts the market EVERY time – so why not?

Assuming a 90-day extension, we’ll be into February and all of 2025 will be saved for China-US Importers and think what fantastic inside information that has been this year! China will buy some soybeans (edamame), which they love and HOPEFULLY Rare Earth restrictions will be delayed (but always a sword to our throat).

There will NOT be any structural reforms on IP, Subsidies or Tech Transfers nor will there be a resolution of the Semiconductor restrictions that could be a problem for Big Tech (who ARE the Economy) and it will be very surprising if China agrees to a TikTok deal and, of course, Taiwan is still in a precarious position but look at how Trump treats Ukraine – do you really think he’ll do anything for Taiwan?

This “framework” language has preceded every failed negotiation since 2020 (and that one was FAKE) yet it’s “Fool me once, shame on you – fool me 127 times – I’ll take a MAGA hat, Trump Coins AND the watch, please.” The algos are lazy because lazy is winning for the Top 10% and then retail traders develop FOMO and follow the “trend.” 90 days later – we’ll do it again…

We already have SPY 2028 $640 puts in our Short-Term Portfolio (STP) and SPY should be opening at $683 so perhaps we’ll take advantage and roll them to a higher strike like the $670 puts for +$10. That spends a little bit of money to lock in the gains our Long-Term Portfolio (LTP) will be making off of this morning’s rally-booster. If there is an actual deal with China – it will most likely come at the expense of Taiwan and Taiwan Semiconductor (TSM) JUST demonstrated how vital they are to our Economy – it’s another chess piece Trump is giving away because he doesn’t understand how devastating it can be if used against us.

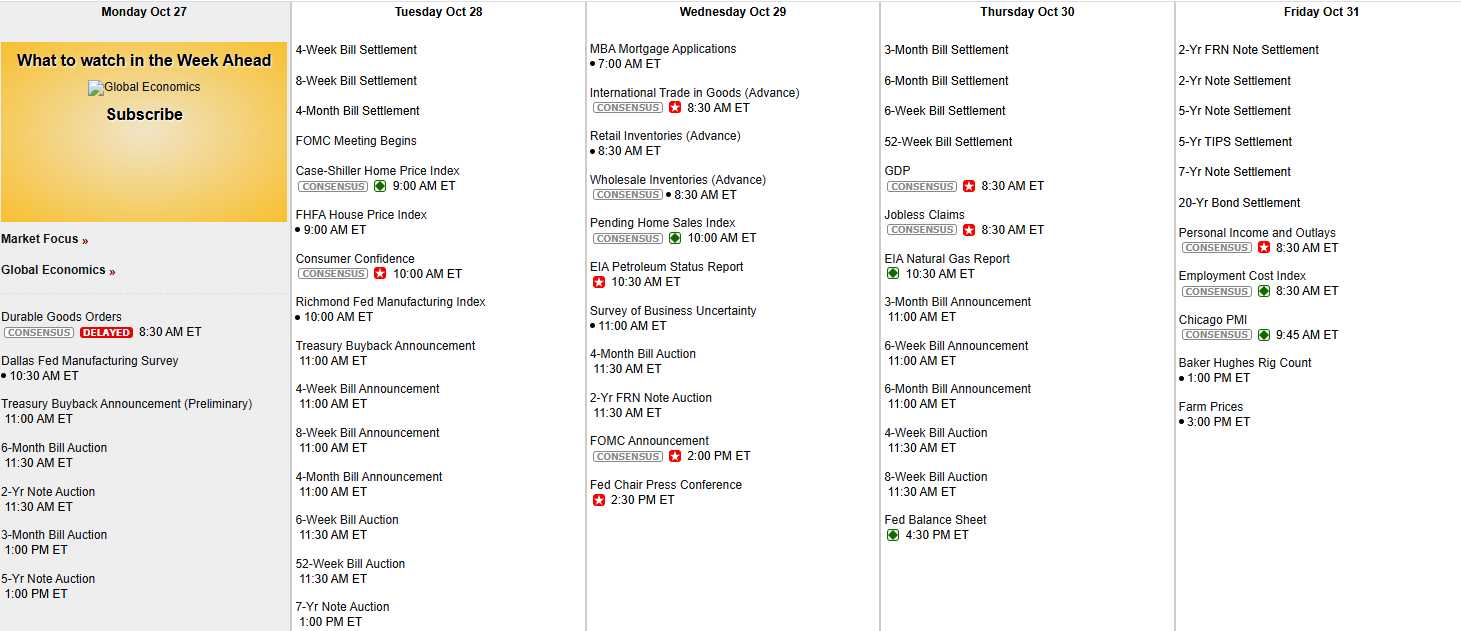

Meanwhile, in other news: Earnings Season bangs along with LOTS of big names stepping up to the plate including 4 of the Magnificent 7 so it will be a fun week for reading tea leaves in absence of data AND an absence of Fed Speak – other than Powell – after Wednesday FOMC Announcement.

Durable Goods are cancelled, Case-Shiller can’t get their base data, FHFA is closed, International Trade Goods come from Census – they are closed. Retail & Wholesale Inventories also Census (closed) and Pending Home Sales relies on Census data so – not happening. GDP comes from the Bureau of Economic Analysis and they are ALSO furloughed and Personal Income and Outlays is BEA (closed), Employment Cost Index is BLS (back on furlough now that they’ve delivered their “special” CPI Report) but Chicago PMI is private and MAY rely on Census data but may “guesstimate” their report for shits and giggles.

So while all this (or NONE of this) is going on, we are trying to sell $100Bn+ worth of notes this week. For bidders, this is like when you have to walk through a very-depressing dead mall to get to a sad little movie theater which only employs one ticket guy who also runs the projector and one high-school girl behind the counter who doesn’t seem to know how things work – but you give her your money anyway.

That’s what the US is like now…