$231,452!

$231,452!

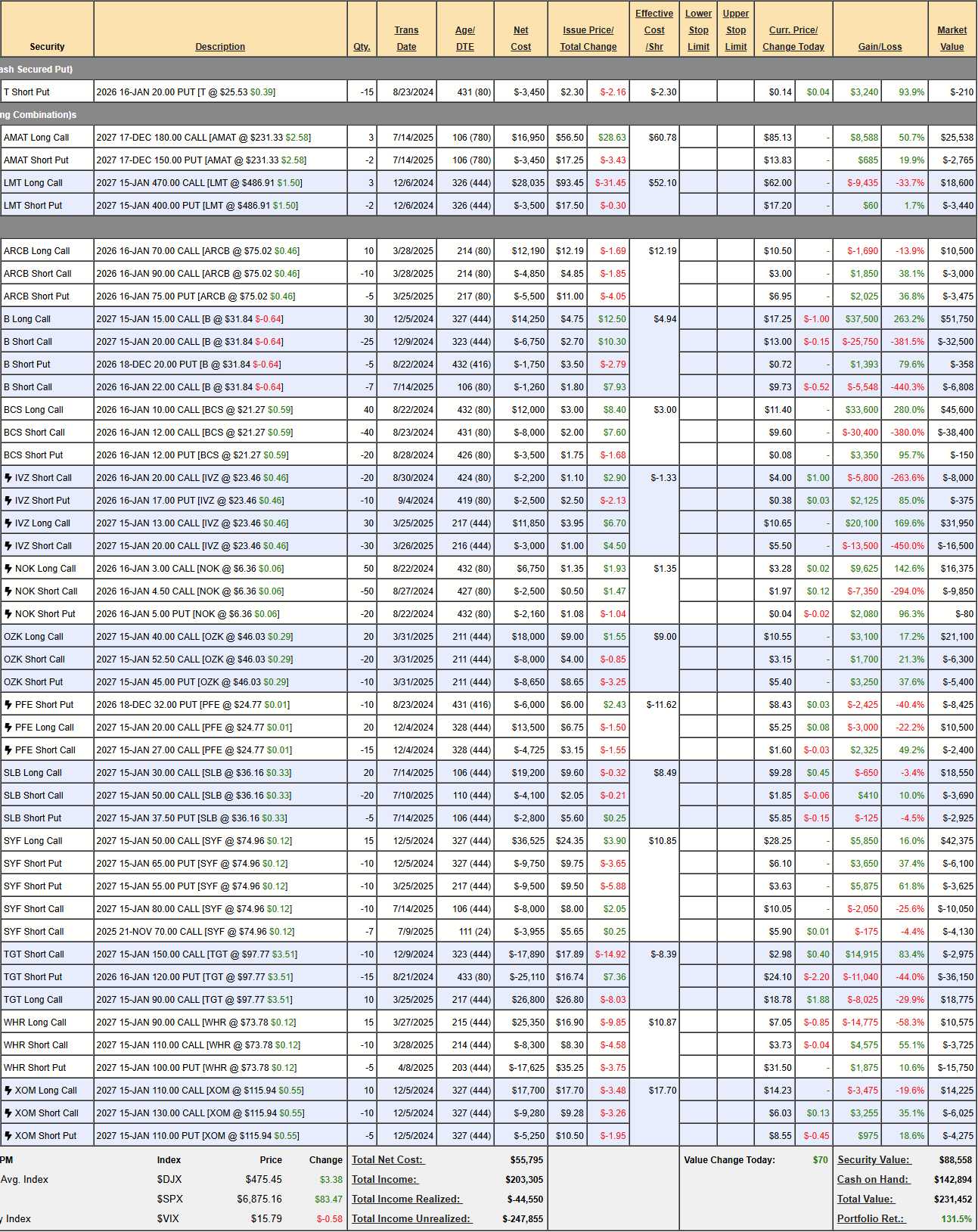

That’s up $131,452 (131%) overall since our $100,000 Aug 21st, 2024 restart of our very popular portfolio and you can see why it’s so popular – with this fantastic one-year performance. It is, actually though – SPECTACULAR – as the market collapse in February dropped us back to just $101,788 (up 1.8%) on March 25th – and I was on Money Talk at the time, discussing how we’d rebuild the portfolio.

[Watch our new Money Talk videos here!]

The next time I was on the show was July 9th and we were a little too conservative going into the summer but we still managed to gain another $20,944 (10%) in the past 3 months and, when you are up over 100% in a year – you want to PROTECT your gain – rather than trying to double down again.

We only trade the Money Talk Portfolio on show days and I’m only on about once per quarter so we can’t take advantage of quick adjustments, as we did with our PSW Members when we cashed out and doubled down our hedges back on March 6th and 7th – avoiding the worst part of the correction but we were able to aggressively adjust our positions and we added 4 new ones (OZK, FL, WHR and ARCB) at what we expected was going to be a bottom – according to the 5% Rule™ Chart we had been using to predict the S&Ps movement since 2023:

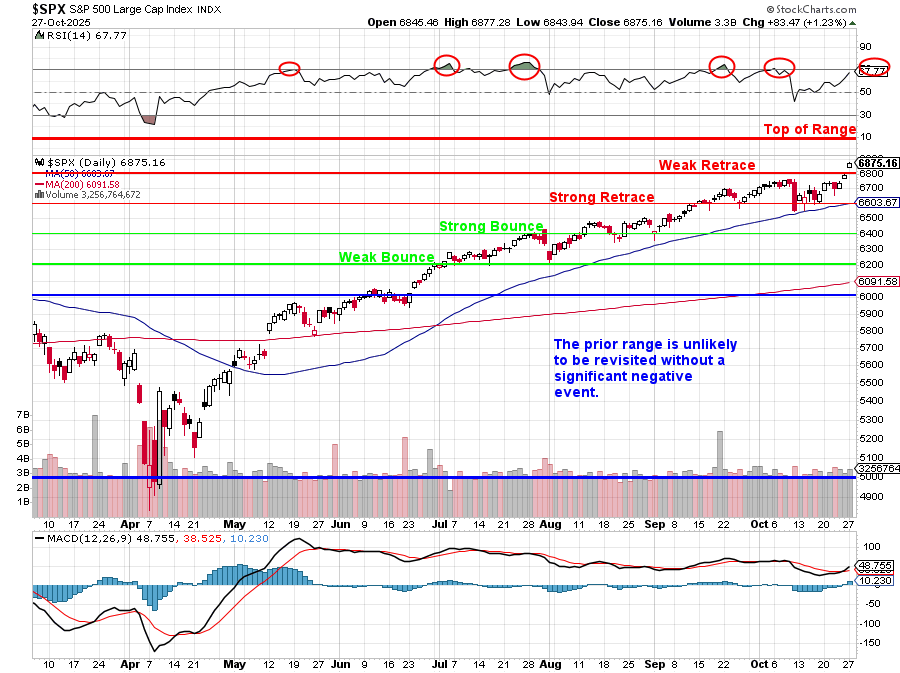

As you can see, we’re probably heading into another correction but I’m less worried now than I was in July as we’ve had two quarters of pretty good earnings, despite the tariff chaos and the 50 WEEK Moving Average has now crossed over 6,600 while the 200 WEEK Moving Average gives us good reason to consider 6,000 the new “Must Hold” level (below which would require a new catastrophe (as opposed to the ones we already know about) and that’s only 10% down from where we are now.

We are very likely to see a Strong Retrace (6,600) before falling into a consolidation pattern. That’s because we didn’t EARN the last leg of this rally and now we’re overbought (see RSI) and likely to fall back unless Small Cap (Russell) earnings are a HUGE upside surprise.

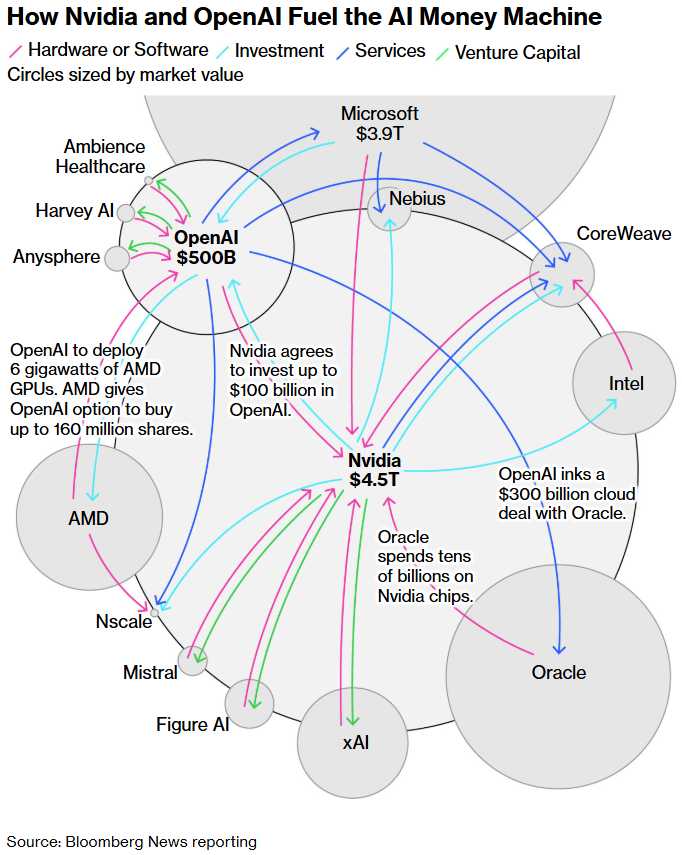

Back on July 9th, my primary concern was that someone would do the math and wonder where this $600Bn if AI Infrastructure promised spending was going to come from and, while we’ve done our best to point out the flaws in what we call the “Circle Jerk Economy” for Tech – where everybody invests in everyone else and everybody buys from everyone else BUT THERE ARE NO ACTUAL SALES – not enough to support this kind of spending (or valuations).

For now, the Emperor is strutting around, naked as a jaybird – yet no one is willing to point it out and we’ll find out this week if earnings make a difference but earnings will be HUGE numbers – just not huge enough to justify $600Bn (and growing) of investment promises – that are driving each others’ future guidance.

With that in mind, let’s take a look at our positions, make a few adjustments and decide what stocks we want to add in this chaos:

-

- T – This short put will expire worthless in January so our upside potential is $210. We don’t consider it risky as we’d love to own T for $20 less the $2.30 we collected (net $17.70) which is why short puts are such a fantastic options tool to use when entering positions. In this case, we didn’t get the cheap stock but we’ll make $3,450 just for PROMISING to buy 1,500 shares of T at net $17.70. See how easy that is?!?

-

- AMAT – Doing better than we expected as AMAT got some good news recently. We’re faced with a choice of cashing in our $8,588 gain or sticking with our short-term premium sales plan. The Jan $230 calls are $19.60 and the $220 puts are $12 and that’s good money but we don’t need our long calls to be so deep in the money so we WILL cash them out for $25,538 and replace them with 7 2028 $220 calls at $65 ($45,500) and we’ll sell 5 2028 $270 calls at $45 ($22,500) and we will sell 3 Jan $230 calls for $19.60 ($5,880) and 2 Jan $220 puts for $12 ($2,400) and that is net $10,818 off the table and we still have a $35,000 spread that’s $7,000 in the money and we’ve collected $8,280 for Q4, which is 118% of our $7,000 position value. We have 8 more quarters to sell $8,000 in premium ($64,000) and we make $28,000 on our longs at $270 so this net $7,000(ish) position has $85,000 (1,214%) upside potential. I’d call that good for a new trade, wouldn’t you?

-

- LMT – The best offense is a good defense and the US’s Department of Offense should be keeping LMT busy for years to come. LMT is our Stock of the Century as we expect them to be a player in Drone Warfare as well as Nuclear Fusion. We will take advantage of the pullback to roll the 3 2027 $470 calls at $18,600 to 5 2028 $450 calls at $91 ($45,500) and we’ll sell 4 2028 $500 calls at $71 ($28,400) and 2 2028 $400 puts at $33 ($6,600) and, for income, we will sell 2 Jan $490 calls at $18 ($3,600) and 2 Jan $480 puts at $17 ($3,400) and that is net $15,100 in our pockets and we’re left with a potential $25,000 spread for net $9,435 (our original investment less $15,100) so there’s $15,565 (164%) upside on the spread and 8 more quarters of $7,000 is another $56,000 so $71,565 (758%) of upside potential make this also great for a new trade!

Notice we are putting cash in our pockets while we are covering our long calls – there is more than one way to hedge… Selling short-term puts and calls brings us an income for the quarter whether the market is up, down or sideways from here and our long-term long positions cover us against a sharp move higher and FUNDAMENTALS (hopefully) protect our downside but, if not, CASH!!! makes a good cushion as well.

-

- ARCB – They are so cheap I’m worried they’ll pop on earnings so we’re just going to wait and see how it goes before selling short-term contracts. It’s a $20,000 spread that’s $5,000 in the money, currently at net $4,025 and I think we get to $80 so $5,975 (148%) upside potential in 3 months is worth holding on for.

-

- B – The US just passed $38Tn in debt so I’m not worried about Gold as an investment. We sold the Jan $22 calls and got blown out in the rally and we’ll take advantage of this pullback to buy them back ($6,808) and we’ll sell 10 March $32 calls for $3.60 ($3,600) and 5 March $30 puts for $2.70 ($1,350) for net $1,858 out of pocket. That drives our net to $13,942 on the $45,000 spread and we have 4 more periods to sell $5,000 in short puts and calls so that’s another $20,000 potential so our total upside potential is $51,058 (366%).

BCS – The long spread is deeply in the money at net $7,050 and the potential is only $8,000 – but we’ll collect the $950 of upside potential by January – so there’s no sense in closing it. Now we can set up a new kind of spread on BCS – to harvest income from short-term premium:

-

-

-

- Sell 10 BCS 2028 $18 puts for $2.10 ($2,100)

- Buy 20 BCS 2028 $18 calls for $6 ($12,000)

- Sell 15 BCS 2028 $25 calls for $2.75 ($4,125)

- Sell 10 BCS Jan $22 calls for $1 ($1,000)

- Sell 5 BCS Jan $21 puts for $1 ($500)

-

-

That is net $4,275 on the $14,000 spread that’s $6,000 in the money to start. We have 8 more quarters to sell $1,500 so that’s another $12,000 we hope to collect and the upside potential at $25 (plus the sales) will be $21,725 (508%). This is how we grind out those spectacular gains!

-

- IVZ – We’re getting burned on the short Jan $20 calls but our long spread is deep in the money so we’re still happy overall. The 2027 $13/20 spread has a potential of $21,000 but it’s still only net $15,450 so $5,550 (35.9%) upside potential if it simply holds $20 next year is an interesting trade on its own, right? Now, watch this magic trick:

-

-

-

- Let’s roll our 30 2027 $13 calls ($31,950) to 60 2028 $20 calls at $6 ($36,000).

- The 30 short 2028 $20 calls ($16,500) can be rolled to 40 short 2028 $25 calls at $4.00 ($16,000)

- The 20 short Jan $20 calls ($8,000) can be rolled to 20 short 2028 $25 calls at $4.00 ($8,000)

- We’ll will ignore the short Jan $17 puts (they will expire worthless) and sell 10 2028 $20 puts for $3.50 ($3,500)

- Let’s sell 10 Jan $24 calls for $2 ($2,000)

- Let’s sell 10 Jan $23 puts for $1 ($1,000)

-

-

-

- That is net $1,950 in our pockets and now we have a $30,000 spread that’s in the money and we have 8 more quarters to sell $3,000 ($24,000) in premium and our net was $7,075 less the $1,950 on the adjustments is $5,125 with an upside potential of $48,875 (953%) on what is essentially a new spread!

And look how diversified we are – no two stocks from the same sector so far (IVZ and BCS are close). We did favor the Financials as they seemed to have the best chance of success in 2025 – given the Global Macros but what really ties our picks together is VALUE!!! We are Value Investors who use Options for Leverage AND Protection in our portfolios – that is the key to these outrageous gains… Using options instead of buying stocks gives us the ability to diversify our holding and create income streams not available to most Equity Investors – this is what we teach you to do at PhilStockWorld.com.

If you’d like more information

-

- NOK – Blew past our target and now net $6,445 on the $7,500 spread so we’ll be collecting the last $1,055 (16.3%) over the next 80 days (by doing nothing), which is a 74% annualized return REMAINING on this spread (upside potential) or, as we call it at PSW – leftovers…

-

- OZK – Disappointed on earnings and got whacked but we still love them long-term. We’ll take advantage of the dip to roll our 20 2027 $40 calls ($21,100) to 30 2028 $40 calls at $11 ($33,000) and we’ll sell 20 2028 $55 calls for $5 ($10,000) and we’ll roll 10 of the 2027 $52.50 calls ($3,150) to 10 short Jan $47.50 calls at $2.20 ($2,200) and 10 short Jan $42.50 calls at $2.05 ($2,050). That’s net $800 out of pocket and now we’re in a $60,000 spread that’s $18,000 in the money and we originally paid net $1,350 plus $800 is $2,150 so the upside potential is now $57,850 (2,690%) PLUS we have 8 more chances to sell $4,250 ($34,000) for ANOTHER 1,581% of upside potential from the premium sales. See how much fun this is?!?

That’s it – that’s our system!

-

- PFE – We were aggressive and were hoping PFE would climb a bit before selling short-term options. Actually it did but we can’t trade between shows (unless there’s a real emergency – then we’d do a special alert) but the channel is holding and earnings have been good so we shall wait another quarter but we should roll the 10 Dec $32 puts ($8,425) to 20 short 2028 $25 puts at $4.50 ($9,000) as we’re very happy to own PFE at net $22(ish) for the long term. If we can claw our way up to $27 by Jan, 2027 – the upside potential is $14,325 (4,407%) as it’s currently a net $325 credit spread – good for a new trade!

-

- SLB – $50 seems far away so let’s turn this into more of an income play by cashing out the 2027 $30/50 spread (leave the short puts) and we’ll switch to:

-

-

-

- Buy 25 2028 $30 calls at $10.50 ($26,250)

- Sell 20 2028 $42.50 calls at $5.35 ($10,700)

- Sell 10 Jan $37.50 calls at $1.70 ($1,700)

- Sell 5 Jan $35 puts for $1.70 ($850)

-

-

-

- We already sold the short puts for $2,800 and we took a $240 loss on the 2027 spread so our net on what is essentially a new spread is $10,440 and it’s a $31,250 spread with 8 quarters to sell $2,500 in premium is $20,000 so net $40,810 (390%) upside potential is great for a new trade.

-

- SYF – This was our 2025 Trade of the Year Pick from November. Our Trade of the year is the trade we feel has the highest probability of generating a 300% return and we spend net $5,320 on the spread and now it’s net $18,470 so up $13,150 is up 247% but we already profited from previous short put and calls so goaaaaaaaaaalllllllllllllll already and much more to come as it’s a $22,500 spread and we have 8 more quarters to sell at least $5,000 in premium so that’s $40,000 so ($66,500 – $5,320 =) $61,180 (1,150%) upside potential is good for a new trade, right?

- But notice we have 10 short 2027 $80 calls, not Jan calls so what do we do? WE BUY THEM BACK and trade them in for a better horse! That’s all – very easy. So let’s buy back the 2027 $80 calls ($10,050) and sell 10 Jan (2026) $75 calls for $4.80 ($4,800) and we’ll close the 7 short Nov calls ($4,130) and sell 10 Jan $72.50 puts for $3.25 ($3,250) so the adjustment cost us $6,130 but now we’re on a much better path towards that $61,180.

-

- TGT – Let’s buy back the short 2027 $150 calls ($2,975). I don’t think the short $120 puts are unrealistic in the long run so let’s roll those ($36,150) to 20 2028 $100 puts at $21 ($42,000) and we will roll our 10 2027 $90 calls ($18,775) to 20 2028 $85 calls at $25 ($50,000) and we’ll sell 20 2028 $115 calls at $13.50 ($27,000). That’s net $1,350 spent to move us into a much nicer $60,000 spread that’s $25,000 in the money. We spent $2,775 originally so now net net $4,125 gives us $55,875 (1,354%) of upside potential and an extra year to get there!

-

- WHR – Another great stock that’s down in the dumps. We’ll take advantage and roll our 15 2027 $90 calls ($10,575) to 25 2028 $60 calls at $22.50 ($56,250) and we’ll sell 20 2028 $90 calls for $11 ($22,000) and we’ll roll the 10 short 2027 $110 calls ($3,725) to 10 short Jan $80 calls at $3.80 ($3,800) and 10 short Jan $75 puts at $8 ($8,000) and we’ll sell 5 more 2027 $100 puts for $31.50 ($15,750) and that’s net $150 spent to put us into a $75,000 spread that’s $32,500 in the money. We originally had a net $575 credit so call this a net net $425 credit with $75,425 (17,747%) upside potential PLUS 8 more quarters to sell $10,000 in premium is another $80,000 (18,823%) of upside potential on that end. Nice, right?

-

- XOM – This one is on track and there’s no need to mess around ahead of earnings. It’s a $20,000 spread currently at net $3,925 so it has $16,075 (409%) upside potential at $130. Very nice for a new trade.

So, overall, we collected net $3,440 on our adjustments but we added a lot of margin requirements with all the premium selling. The upside potential of the positions is now $721,003 by Jan 2028 (2 years, 3 months) BUT that is if everything goes perfectly and, as you can see from this sampling – it does NOT go perfectly. Nonetheless, it went well enough to add $20,944 in the past 3 months and we weren’t even selling much premium back then. Barring a major move up or down – we should do a lot better than that in Q4!

Summary of Adjustments and Upside Potential

| Stock Ticker | Net Adjustment Cost / (Credit) | Revised Upside Potential |

| T | $0 (No adjustment) | $210 |

| AMAT | ($10,818) (Credit) | $85,000 |

| LMT | ($15,100) (Credit) | $71,565 |

| ARCB | $0 (No adjustment) | $5,975 |

| B | $1,858 (Cost) | $51,058 |

| BCS | $4,275 (Cost) | $21,725 |

| IVZ | ($1,950) (Credit) | $48,875 |

| NOK | $0 (No adjustment) | $1,055 (Remaining) |

| OZK | $800 (Cost) | $91,850* |

| PFE | ($575) (Credit) | $14,325 |

| SLB | $10,440 (Cost) | $40,810 |

| SYF | $6,130 (Cost) | $61,180 |

| TGT | $1,350 (Cost) | $55,875 |

| WHR | $150 (Cost) | $155,425** |

| XOM | $0 (No adjustment) | $16,075 |

| OVERALL TOTAL | ($3,440) (Net Credit) | $721,003 |

*Note on OZK: This potential is the sum of the $57,850 spread upside and the $34,000 potential from future premium sales. **Note on WHR: This potential is the sum of the $75,425 spread upside and the $80,000 potential from future premium sales.