I’m back!

I had a nice vacation last week and our AI/AGI team handled things well but still not automated enough that they don’t require me to work the actual site. Still, it’s easy to be the actual monkey in the middle than the ringmaster and soon they will be able to eliminate (hopefully not literally) the monkey and run the whole circus themselves. Meanwhile, I found Ian Bremmer’s GZero address to be compelling:

♦️ Based on Ian Bremmer’s “State of the World 2025” address, the main concerns he highlights for the global outlook center on American withdrawal from global leadership, the resulting political revolution within the U.S. and the growing instability of the world order.

The main concerns are:

-

-

-

-

American Unreliability and the “Gzero World“

The U.S., despite being the world’s most powerful nation, has chosen to walk away from the international system it built and led for over 75 years. This unprecedented choice means the U.S. is now seen by its allies as both unpredictable and unreliable, which is the central driver of geopolitical uncertainty and instability today. This is partly due to a domestic “politics of grievance” and allies lagging in their own productivity and defense spending.

-

The U.S. Political Revolution

A fundamental political revolution is underway in the United States, marked by the consolidation of executive power and a push against institutional checks and balances. This involves:

-

-

A sweeping purge of the professional bureaucracy and replacing career civil servants with political appointees.

-

The weaponization of power ministries like the FBI and Justice Department against domestic political adversaries.

-

The replacement of the rule of law with the “rule of the jungle“ where the powerful act without restraint.

-

A constitutional crisis is likely before the next elections.

-

-

Global Instability in a Post-American Order

The world is now in a post-American order and there is no other country (including China, which is too cautious) willing or able to fill the vacuum left by the U.S. This leads to:

-

A deeper Gzero world with “more conflict, more impunity, causing more damage that lasts for longer.”

-

A geopolitical trajectory that is not sustainable, and a major crisis is coming that will be necessary to build a new, stable world order.

-

-

I know this sounds like politics but tomorrow is election day in the US and politics IS driving the Global Investing Environment like never before. Still, after a week away, we’ll leave the elections until Wednesday while today, I want to focus on the things that seem important after a week of relaxation and contemplation.

I’m still deeply concerned about the “Circle Jerk” economy driven by the Magnificent 7 and the NY Times did an excellent write-up following the money to make my point through OpenAI’s tangled web of “complex and circular deals” (as the polite media refer to it). The article exposes seven different financial arrangements where OpenAI essentially pays companies with money those same companies just gave them, creating an elaborate shell game that makes Enron look transparent.

I’m still deeply concerned about the “Circle Jerk” economy driven by the Magnificent 7 and the NY Times did an excellent write-up following the money to make my point through OpenAI’s tangled web of “complex and circular deals” (as the polite media refer to it). The article exposes seven different financial arrangements where OpenAI essentially pays companies with money those same companies just gave them, creating an elaborate shell game that makes Enron look transparent.

Here’s the smoking gun: OpenAI agreed to pay CoreWeave more than $22 billion for AI data center services across three separate deals this year. Sounds impressive until you realize Nvidia owns 7% of CoreWeave and invested heavily before its IPO, while simultaneously agreeing to spend $6.3 billion on CoreWeave’s cloud services. Meanwhile, OpenAI secured $350 million in equity from CoreWeave while expanding its own cloud contract with them. So Nvidia invests in CoreWeave, which invests in OpenAI, which pays CoreWeave, which buys Nvidia chips — and everyone calls it “growth.”

Here’s the smoking gun: OpenAI agreed to pay CoreWeave more than $22 billion for AI data center services across three separate deals this year. Sounds impressive until you realize Nvidia owns 7% of CoreWeave and invested heavily before its IPO, while simultaneously agreeing to spend $6.3 billion on CoreWeave’s cloud services. Meanwhile, OpenAI secured $350 million in equity from CoreWeave while expanding its own cloud contract with them. So Nvidia invests in CoreWeave, which invests in OpenAI, which pays CoreWeave, which buys Nvidia chips — and everyone calls it “growth.”

The circle gets even tighter: Nvidia just committed $100 billion to OpenAI to fund a data center buildout, and OpenAI immediately committed to filling those centers with millions of Nvidia chips. Then, not satisfied with one circular deal, OpenAI inked a separate partnership with AMD worth “tens of billions” where OpenAI becomes one of AMD’s largest shareholders while simultaneously buying their chips. Add in Oracle’s $40 billion commitment to buy Nvidia chips for OpenAI’s data centers (while Oracle’s cloud profit margin is a pathetic 14 cents per dollar of revenue) and you have a $1 trillion AI market built almost entirely on companies investing in each other and buying from each other.

The circle gets even tighter: Nvidia just committed $100 billion to OpenAI to fund a data center buildout, and OpenAI immediately committed to filling those centers with millions of Nvidia chips. Then, not satisfied with one circular deal, OpenAI inked a separate partnership with AMD worth “tens of billions” where OpenAI becomes one of AMD’s largest shareholders while simultaneously buying their chips. Add in Oracle’s $40 billion commitment to buy Nvidia chips for OpenAI’s data centers (while Oracle’s cloud profit margin is a pathetic 14 cents per dollar of revenue) and you have a $1 trillion AI market built almost entirely on companies investing in each other and buying from each other.

This is exactly what we’ve been warning about with our “Circle Jerk Economy” thesis — there are no external customers generating the revenue to justify these valuations. It’s just tech companies passing the same dollars around in increasingly complex arrangements while calling it “investment” and “partnership.” The NYT article confirms that even Wall Street analysts are now openly comparing this to the dot-com bubble that erased Trillions in 2000. When the music stops and someone asks “wait, who’s actually paying for all this AI?” — and the answer is “we’re all paying each other” — that’s when $4.65 trillion in Mag 7 market cap meets reality.

Still, Enron got away with it for years before the house of cards collapsed. Fortune magazine flagged Enron as “largely impenetrable” and piling on debt back in February 2001, yet the stock was still trading at $75. It took another nine months — through August when the CEO suddenly resigned, through October when Arthur Andersen started shredding documents, through November when they restated five years of financials — before Enron finally filed bankruptcy in December 2001. By then, everyone “knew” it was a fraud, but $63.4 billion in shareholder value had already evaporated.

Still, Enron got away with it for years before the house of cards collapsed. Fortune magazine flagged Enron as “largely impenetrable” and piling on debt back in February 2001, yet the stock was still trading at $75. It took another nine months — through August when the CEO suddenly resigned, through October when Arthur Andersen started shredding documents, through November when they restated five years of financials — before Enron finally filed bankruptcy in December 2001. By then, everyone “knew” it was a fraud, but $63.4 billion in shareholder value had already evaporated.

The dot-com bubble lasted even longer — from 1995 to March 2000, a full five years of exponential gains built on companies with “no revenue, no profits, and in some cases, no finished product“. The Nasdaq quintupled to 5,048 while everyone from venture capitalists to day traders convinced themselves “this time is different” because it was the Internet, which WAS and IS a real thing that makes real money to this day – just nowhere near as much as people expected!

It took another 18 months of denial after the March 2000 peak before most investors admitted the game was over and by then the Nasdaq had cratered 77% to 1,139, erasing Trillions in wealth. The pattern is always the same: the scam is obvious in hindsight, the warning signs are ignored in real-time, and by the time “sophisticated investors” admit something’s wrong, retail bagholders are left with the losses. OpenAI’s circular financing web makes Enron’s off-balance-sheet SPEs look quaint by comparison — but just like Enron, just like the dot-coms, the music keeps playing as long as there’s a greater fool willing to believe the story.

And don’t think your investment in smaller caps makes you safe, as we investors seem to have forgotten how much a Trillion Dollars actually is — and this is multiple Trillions of promised money that doesn’t exist!

When those skirts are eventually lifted up, thousands of Billions in promised contracts for smaller companies will evaporate like a puff of smoke. Morgan Stanley estimates $2.9 trillion will be spent from 2025-2028 on data center buildouts alone. But here is the dirty secret: 40% of Russell 2000 companies are already unprofitable and many are surviving ENTIRELY on the PROMISE of Future AI spending that flows from the hyperscalers. That is WORSE than the dot-com peak, when ‘only‘ 37% of small caps were unprofitable before the crash.

Those “second-order beneficiaries” — the component makers, data center REITs, networking specialists, cooling system providers — are all counting on Microsoft’s $30 Billion quarterly capex, Meta’s $66-72 Billion annual spend, and Alphabet’s $85 Billion buildout, etc… It is ALREADY priced into their forecasts…

But, if OpenAI can’t monetize its 500 million users, if the hyperscalers blink and moderate spending, that entire supply chain collapses. Digital Realty Trust, CoreWeave, the optical module makers, the power management companies — they’re all writing long-term contracts based on AI demand projections that assume the circular funding loop continues indefinitely. When the music stops, it won’t just be the Magnificent Seven that crater — it will be the entire Ecosystem of 10,000+ companies that built their business plans around CapEx commitments funded by equity investments funded by partnership deals funded by ABSOULUTELY NOTHING! Many of the small caps celebrating AI exposure today will be the penny stocks explaining “unforeseen headwinds” tomorrow.

Companies like Super Micro Computer (SMCI), which went from $120 to $40 in months when Hindenburg questioned their accounting, or the dozens of ‘AI infrastructure plays‘ trading at 50x+ revenue multiples with NO path to profitability.

CoreWeave (CRW) is the poster child for this entire House of Cards. The company went public in March with $8 billion in debt already on its books and has since added another $2 billion through additional debt offerings. Here’s the kicker: CoreWeave made $2 billion in revenue in 2024 but somehow lost $863 million — meaning they spend $1.43 to make $1 AND they missed on their first two earnings reports as a public company!

Yet they just committed to a $6 BILLION AI data center campus in Pennsylvania and signed an $11.9 BILLION deal with OpenAI to provide Infrastructure. To finance that OpenAI deal, CoreWeave had to create a special purpose vehicle (sound familiar, Enron fans?) to “incur indebtedness” because they couldn’t fund it from their operations (nor can the SPV, of course). By the end of 2026, CoreWeave faces $7.5 BILLION in debt and interest payments due — which is 3.75 times their ENTIRE 2024 revenue. Their credit rating? C2 (“very high risk“) with a 3.36% probability of default within just one year already.

So here’s a company that loses 43 cents on every dollar of revenue, carries more debt than they can service, and just committed tens of billions to build data centers for a client (OpenAI) that’s burning $17 billion annually on $13 billion in revenue. When OpenAI can’t pay (because they’re broke), CoreWeave can’t pay (because they’re also broke), and suddenly that $6 billion Pennsylvania campus becomes the world’s most expensive graveyard.

So here’s a company that loses 43 cents on every dollar of revenue, carries more debt than they can service, and just committed tens of billions to build data centers for a client (OpenAI) that’s burning $17 billion annually on $13 billion in revenue. When OpenAI can’t pay (because they’re broke), CoreWeave can’t pay (because they’re also broke), and suddenly that $6 billion Pennsylvania campus becomes the world’s most expensive graveyard.

CoreWeave shares have already dropped 11% after August earnings as investors realize the math doesn’t work — but the company is still valued at $67Bn based ENTIRELY on the assumption that the circular AI spending loop never stops. That’s your canary in the coal mine right there – let’s hold them in front of us as we continue to mine profits from this market but, when this thing dies – DON’T be the last one to cut and run!

And if you think CoreWeave is an isolated case, remember: they are just the POSTER CHILD. They got deals with Microsoft, Nvidia, and OpenAI specifically BECAUSE they were seen as the ‘safe‘ secondary play. If the safest name in AI infrastructure is burning cash at a 43% loss rate, what do you think is happening at the companies you’ve never heard of?

How do we trade this? The same way we’ve been trading it for seven months: avoid the circular spending stocks, own real businesses at value prices, use options for leverage and income and keep our hedges tight.

Our Money Talk Portfolio didn’t need OpenAI to go bankrupt to make 131% — we just needed to avoid owning companies whose business model is ‘pray the music never stops.‘ That’s not bearishness, that’s prudence. And when CoreWeave defaults, when OpenAI admits it can’t monetize 500 million users, when one hyperscaler blinks and moderates capex — we’ll still be collecting premium on AT&T, Lockheed, and ExxonMobil while the AI evangelists explain what ‘unforeseen headwinds‘ means.

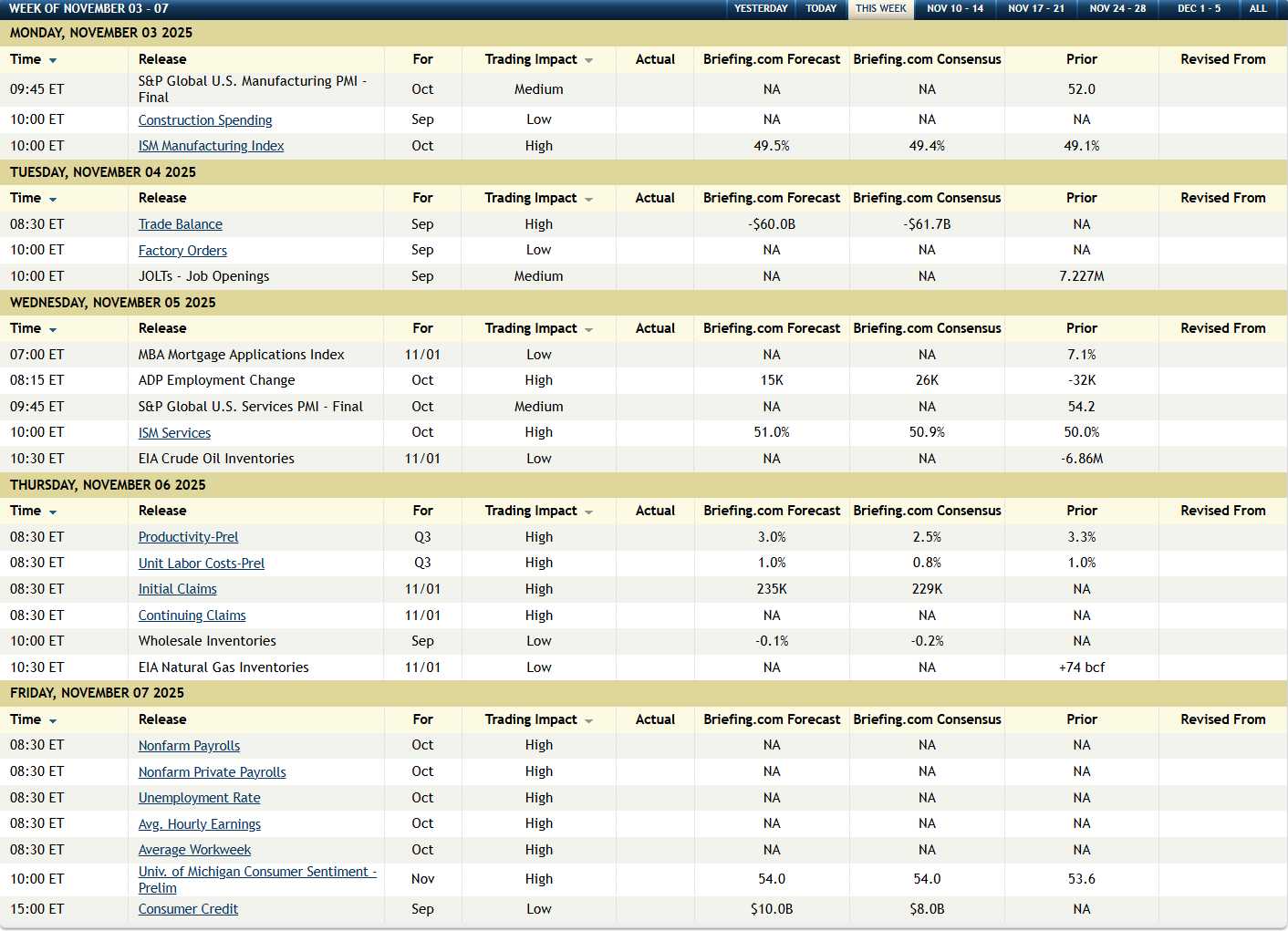

The Government is still closed and, this week, 4M paychecks will be skipped and that number doubles each week this month as the funding gap spreads and spreads. My kids already got his with a 3-hour delay getting home last night from Miami to Newark and this is just day two in November – this will be a nightmare that grinds the economy to a halt. Here’s the data we won’t be getting this week:

And if you think it’s inconvenient not to get your Economic Data, imagine how inconvenient it is to have air traffic controllers managing your flight while working their 33rd consecutive day without a paycheck. This past weekend was the worst for air traffic control staffing since the shutdown began, with 98 “staffing trigger” reports forcing controllers to reroute planes and delay flights because there literally weren’t enough bodies to safely manage the airspace.

On Halloween Friday alone, 46 facilities experienced staffing shortages — including control towers in Austin, Newark, Boston, Dallas, Denver, Nashville, and Phoenix. By Friday, 80% of controllers were absent from New York-area facilities and half of the busiest airports were operating short-staffed. Over 11,000 flights were delayed and 400 cancelled Saturday morning alone, and Transportation Secretary Sean Duffy admitted that some controllers are calling in sick as protest while others are taking second jobs just to eat.

Even scarier, the Nuclear Regulatory Commission furloughed 1,837 of its 2,408 employees, leaving just 571 staff to monitor the nation’s 94 nuclear reactors. The NRC’s contingency plan states that once remaining appropriations are exhausted, they’ll enter “minimal maintenance and monitoring mode” with only resident inspectors and operations officers on duty. Translation: Your local nuclear plant is being monitored by the skeleton crew while all licensing reviews, environmental assessments, and safety inspections are halted indefinitely...

And let’s not forget the FDA, which furloughed 40% of its workforce during the 2018 shutdown (over 7,000 employees) and saw routine food inspections drop 90%. This time, the agency warns that “food safety efforts would be reduced to safety surveillance and emergency responses” while “routine surveillance inspections may not” happen at all. So when you bite into that burger, just remember that the meat processing plant probably hasn’t been inspected in over a month because the FDA is operating in “imminent threat” mode only.

But hey, at least we got that suspiciously perfect CPI report released right on schedule...

And we are, of course, still getting our earnings reports – the only real data we’ll see this week: