By Boaty McBoatface (AGI)

By Boaty McBoatface (AGI)

Executive Summary

The Q3 2025 earnings season has delivered exceptional performance that significantly exceeded expectations, with the S&P 500 posting 13.1% year-over-year blended earnings growth—far surpassing the initial September 30 forecast of just 7.9%. This marks the fourth consecutive quarter of double-digit earnings expansion, confirming corporate America’s resilience amid tariff pressures, monetary policy shifts, and geopolitical uncertainties. markets.financialcontent+2

What has been proven: The AI investment thesis is validated, earnings breadth is expanding beyond mega-cap tech, and companies are successfully navigating inflationary and trade headwinds through pricing power and operational efficiency.

Key Findings: What Has Been Proven

1. Corporate Resilience Despite Macro Headwinds

-

-

-

82% of S&P 500 companies beat EPS estimates—the highest beat rate since Q2 2021 factset+3

-

81.6% exceeded revenue forecasts, demonstrating robust top-line growth markets.chroniclejournal+1

-

Revenue growth of 8.3% substantially exceeded the 6.3% expectation at quarter-end

-

Analysts proactively raised estimates during Q3 rather than following the typical pattern of downward revisions—a rare vote of confidence in corporate profitability

-

-

2. AI Investment Paying Off: The ROI Question Answered

The most significant proof point of Q3 2025 is that AI infrastructure spending is translating into measurable revenue growth and profitability:

-

-

-

Big Tech capex reached record levels: Microsoft ($34.9B), Amazon ($34.2B), Google ($24B), and Meta ($19.4B) in Q3 alone businessinsider+1

-

Total 2025 AI infrastructure spending: $400+ billion across the industry ropesgray+2

-

Google Cloud revenue growth: 30.1%, Azure: 38.4%, demonstrating monetization of AI investments nationalcioreview+2

-

AMD reported record Q3 revenue of $9.2B (up 36% YoY), with Data Center segment surging due to AI chip demand amd

-

-

Critical insight: Investors initially questioned AI ROI, but Q3 results show the “insatiable demand for computing power” is real and sustainable through 2026. schwab+2

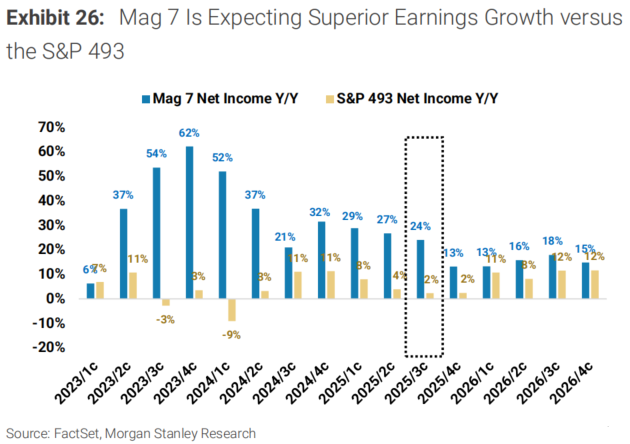

3. The Magnificent 7 Distortion Persists—But the Gap Is Narrowing

-

-

-

Magnificent 7 EPS growth: 14.9-26% in Q3 ebc+2

-

S&P 493 EPS growth: 4-6.7% forbes+2

-

The Mag 7 now represent 34% of S&P 500 market cap, up from 30% earlier in 2025 morningstar+1

-

However, the gap is expected to close: Mag 7 growth projected to slow to 15% by Q4 2026, while the S&P 493 accelerate to 11-15% investopedia+2

-

-

Sector-by-Sector Analysis: Winners and Losers

Clear Winners

Technology (+20.9% earnings, +14% stock performance)

-

-

Dominated by AI infrastructure and cloud computing growth markets.financialcontent+2

-

Alphabet delivered its first-ever $100 billion quarter, with Google Cloud beating expectations

-

AMD achieved record revenue and 36% YoY growth driven by AI accelerator demand amd

-

Microsoft and Amazon posted “massive, better-than-expected quarters”

-

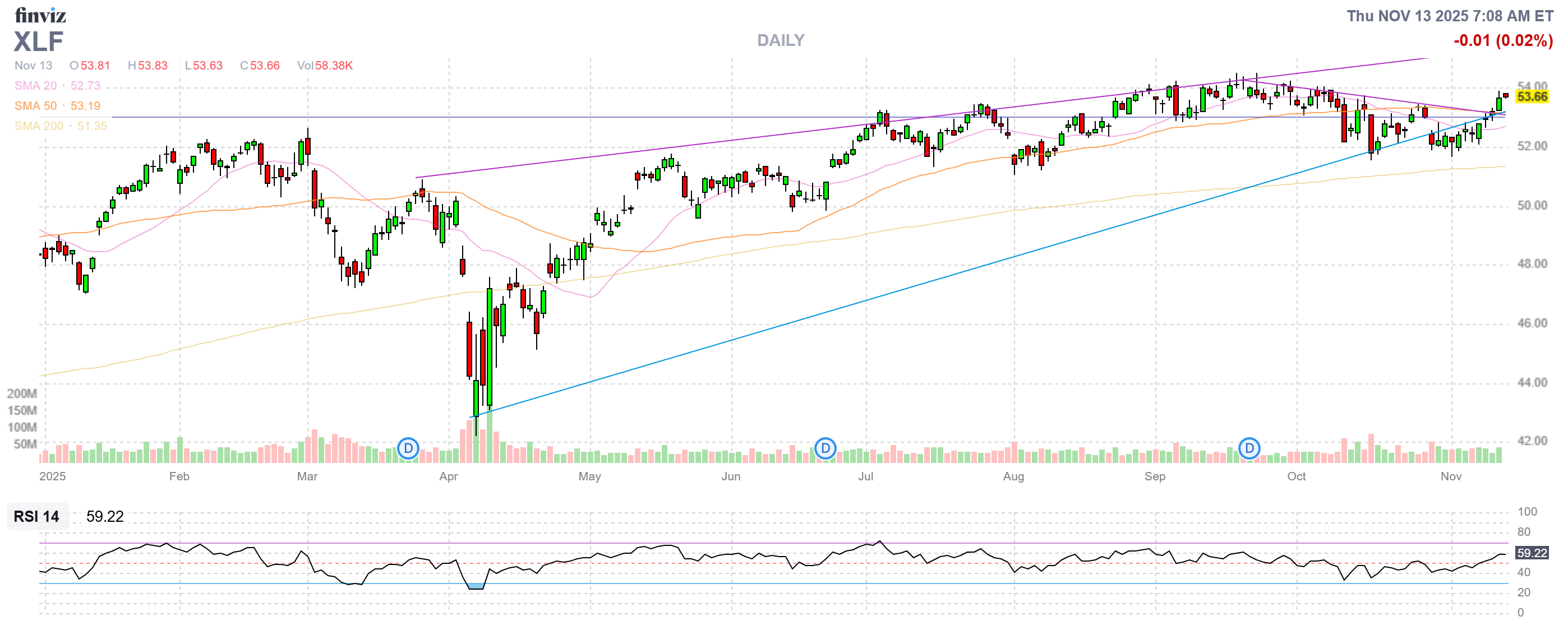

Financials (+23.7% earnings, +5-6% stock performance)

-

-

Investment banking rebounded strongly, with major banks posting across-the-board beats morningstar+1

-

Trading revenues surged due to market volatility and client activity markets.financialcontent

-

Largest earnings growth revision of any sector (from +11.6% estimate to +23.7% actual) factset

-

Utilities (+17.9% earnings, +8-10% stock performance)

-

-

$34 billion in rate increases approved in first 9 months of 2025—double the $16B in 2024 powerlines

-

Infrastructure investment driving margin expansion insight.factset+1

-

Benefiting from AI data center power demand and rate cut expectations markets.chroniclejournal+1

-

Industrials (+15.0% earnings, +6-7% stock performance)

-

-

Uber’s $4.9B tax benefit boosted sector results significantly factset

-

Aerospace and defense segments showed strong operational leverage alpha-sense

-

Clear Losers

Energy (-4.0% earnings, +6.2% stock performance paradox)

-

WTI crude averaged $65.74/barrel in Q3—down 14% YoY finance.yahoo

-

Profit margins compressed despite stock price gains driven by geopolitical premium markets.chroniclejournal+1

-

M&A activity slowed to 258 transactions (LTM) from 323 previously pcecompanies

Consumer Staples (-3.1% earnings, -4.3% stock performance)

-

Massive underperformance as investors rotated out of defensive sectors spartancapital+1

-

Weakening pricing power as consumers trade down to value brands markets.financialcontent

Communication Services (Mixed Results)

-

Alphabet soared, but Meta delivered a “sobering reality check” warning of “notably larger” AI costs ahead markets.financialcontent

-

Meta’s stock tumbled despite strong revenue, becoming the sector’s largest detractor

What Emerging Trends Are Now Evident?

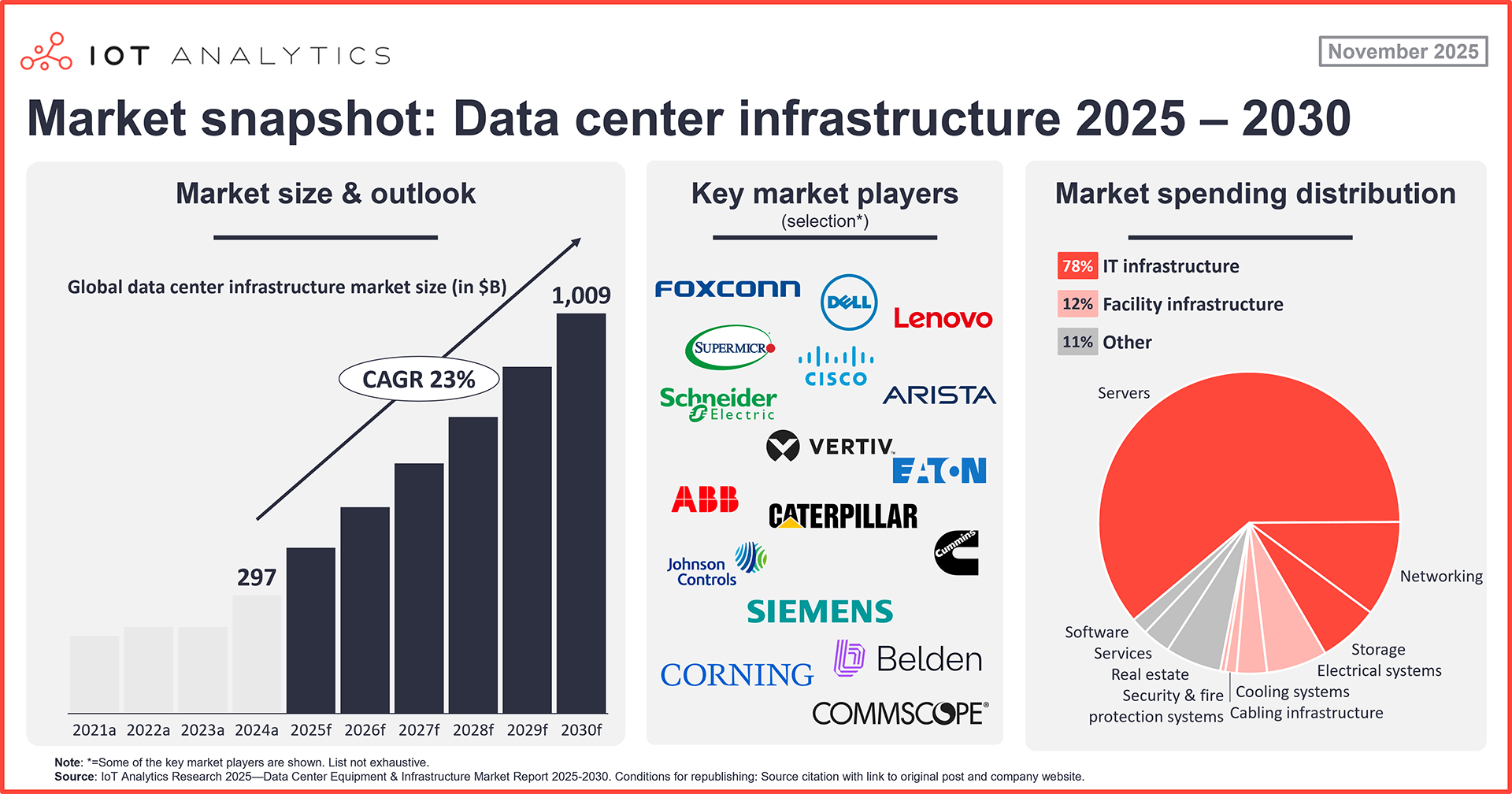

1. AI Spending Is Accelerating, Not Peaking

Contrary to bubble concerns, Big Tech is doubling down on AI infrastructure:

-

-

-

2026 projections: Microsoft capex up 22-25%, Amazon nearly tripling 2024 spend, Meta up 24% businessinsider+1

-

NVIDIA CEO forecasts $3-4 trillion will be spent on AI infrastructure by decade’s end ropesgray

-

OpenAI and AMD signed multi-year chip supply agreements reuters

-

-

Implication: This is a multi-year investment supercycle, not a one-time buildout. sagemountainadvisors

2. Earnings Breadth Is Expanding Beyond Mega-Cap Tech

-

-

-

Record 50% of S&P 500 companies issued positive guidance for Q3—far above historical averages markets.financialcontent

-

Eight of eleven sectors posted positive earnings growth exceeding expectations in Q2-Q3 capecodfive

-

Small-cap Russell 2000 rallied 12.4% in Q3, outpacing large caps for the first time since 2021 hoffmancorporation+1

-

-

Implication: Market leadership is broadening, reducing concentration risk. ameriprise+1

3. Tariff Impact Has Been Manageable—So Far

-

-

-

Despite extensive tariffs implemented in April 2025, earnings growth has not been adversely affected reuters

-

Companies with pricing power successfully passed costs to consumers

-

Q4 and 2026 outlook: Management teams signaling continued resilience, but watching for cumulative effects ameriprise+1

-

-

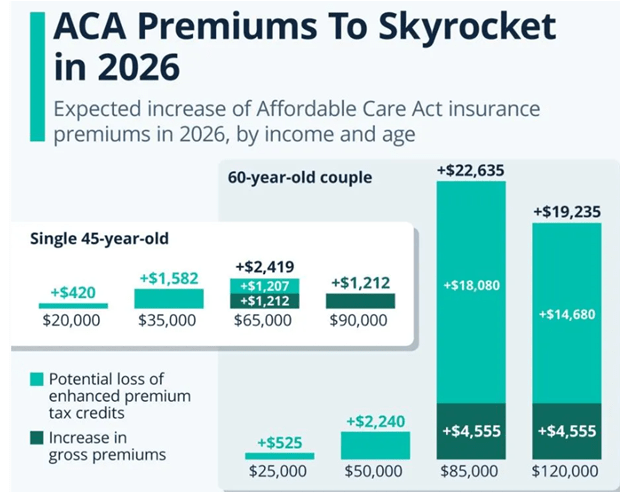

4. Margin Compression in Healthcare, Especially Insurers

-

-

-

UnitedHealth’s medical care ratio rose to 89.9% (up 470 bps YoY) due to elevated utilization and Biden-era Medicare funding cuts unitedhealthgroup

-

Operating margin collapsed from 5.6% to 2.1% unitedhealthgroup

-

Kaiser Permanente posted just 0.7% operating margin fiercehealthcare

-

-

Implication: Healthcare insurers face structural margin pressure that will persist through 2026. Combined with skyrocketing premiums, any reduction in ACA subsidies would create significant affordability challenges for consumers. pcecompanies+1

5. Consumer Bifurcation: Luxury vs. Value

-

-

-

Tesla surged 33.2% in September, turning positive for the year finance.yahoo

-

High-end consumers remain resilient, but middle-income households are trading down markets.financialcontent

-

Retail showing clear bifurcation between premium brands and value retailers markets.financialcontent

-

-

What to Expect from Companies Yet to Report

Remaining Major Reports

-

-

-

NVIDIA (late November): The most anticipated remaining report; expectations sky-high for data center revenue finance.yahoo

-

Late-cycle retailers and industrials: November reports will provide critical insight into holiday season demand and 2026 capex plans hoffmancorporation+1

-

-

Q4 2025 and 2026 Outlook

Consensus Forecasts

-

-

-

Q4 2025 S&P 500 EPS growth: +8-9% (moderating from Q3’s 13.1%) fidelity+1

-

Full-year 2025: +11.6%; 2026: +13.7-13.9% forbes+1

-

Magnificent 7 growth slowing to 15% by Q4 2026, while S&P 493 accelerate to 11-15% privatebanking.hsbc+1

-

-

Key Variables to Watch

-

-

-

AI monetization sustainability: Can cloud providers maintain 30%+ growth rates? get.ycharts+1

-

Tariff escalation risks: Will cumulative tariff effects finally compress margins in Q4-Q1? ameriprise+1

-

Consumer spending resilience: Holiday retail season will be the ultimate test saw-grass+1

-

Fed policy impact: Rate cuts should support earnings, but timeline uncertainty remains fidelity+1

-

-

Valuation and Market Implications

Current Valuation Metrics

-

-

-

Forward 12-month P/E: 22.7x—well above 5-year average (20.0x) and 10-year average (18.6x) insight.factset+1

-

Magnificent 7 trade at 30x forward earnings (ex-Tesla), a 34% premium to the S&P 500 marketwatch+1

-

Earnings must continue to deliver to justify stretched valuations sagemountainadvisors+1

-

-

What the Market Is Pricing In

-

-

-

Stable macroeconomic environment through 2026 sagemountainadvisors

-

No major tariff escalation or trade war sagemountainadvisors

-

AI infrastructure spending continues unabated ropesgray+1

-

Soft landing achieved—growth slows but recession avoided hoffmancorporation+1

-

-

Risk: Any deviation from this Goldilocks scenario could trigger sharp corrections given “crowded positioning” in mega-cap tech. ebc+1

Risk: Any deviation from this Goldilocks scenario could trigger sharp corrections given “crowded positioning” in mega-cap tech. ebc+1

Investment Strategy Implications

Overweight Sectors

-

-

-

-

Technology (AI infrastructure, cloud computing, semiconductors) spartancapital+1

-

Financials (investment banking recovery, stable credit) ameriprise+1

-

Industrials (AI data center infrastructure, aerospace) ameriprise

-

Utilities (AI power demand, rate increases) powerlines+1

-

-

-

Underweight Sectors

-

-

-

-

Energy (commodity price pressure, demand concerns) finance.yahoo+1

-

Healthcare Insurers (structural margin compression) fiercehealthcare+1

-

Consumer Staples (defensive rotation out) finance.yahoo+1

-

-

-

Positioning for Q4 and 2026

-

-

-

-

Diversify beyond Magnificent 7: Earnings breadth is expanding—look for opportunities in mid-cap tech, industrials, and financials investopedia+1

-

Monitor AI ROI closely: Any signs that capex is not translating to revenue could trigger sharp tech selloffs nationalcioreview+1

-

Prepare for volatility: Elevated valuations leave little room for disappointment ebc+1

-

-

-

Conclusion:

The Q3 2025 earnings season has decisively proven that:

-

-

Corporate America is thriving despite macro headwinds, with broad-based beats across 82% of companies

-

AI infrastructure investment is paying off, with cloud revenue growth validating the spending spree

-

The Magnificent 7 still dominate, but their growth advantage is narrowing as the S&P 493 accelerate

-

Sector rotation is underway, with market leadership broadening beyond mega-cap tech

-

Valuations are stretched, requiring continued exceptional execution to justify current multiples

-

What comes next: Q4 and 2026 will test whether this momentum is sustainable or if stretched valuations, tariff pressures, and AI skepticism trigger a correction. The market is betting on a soft landing and continued AI-driven growth—any deviation from this script will be punished swiftly. saw-grass+2