PANIC!!!

PANIC!!!

Panic is good – it shows us where support might be. The Nasdaq Futures were at 26,400 on All Hallows Eve but they got scared and fell (6.25%) to 24,750 and then bounced back 4.25% to 25,800 on Tuesday and now back to 24,750 just days later. That is, as they say in Northwestern’s Economics Program – NOT GOOD! When the RATE OF DECLINE begins to ACCELERATE then the MAGNITUDE of that decline is likely to INCREASE – we’ll have to see what happens next…

We’re about to show you how our Members made 113% playing EQT Corp in just 61 days AND we are going to show you how to potentially make 211% playing Cisco (CSCO) – so read on!

Here’s our podcast from yesterday’s trading to give you an idea of how things are set up: share.transistor.fm/s/44c371e6

And the video:

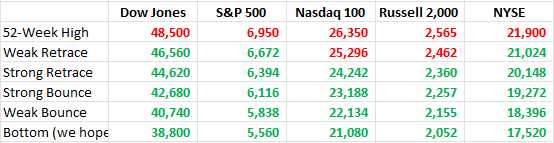

It’s good to keep things in perspective when the market begins to wobble. The Nasdaq and the Russell have already wiped out all of October’s gains and we began September on the Nasdaq way back at 23,500 and that would be another 1,250 (5%) down from here! Speaking of the 5% Rule™ – this seems like a good time to bust out our correction chart:

See, that’s not so bad – yet… Testing and holding our Strong Retrace levels (watch the Nasdaq today as holding 24,242 is critical) is, in fact, a healthy correction but, as I said, the rapid descent of the last few days is the kind of drop that can break through those levels and you DON’T want to see those Strong Retraces start to turn red – THAT can become a problem.

But that’s next week’s problem, not today’s so yesterday, in our Live Member Chat Room, since our Members were very well-hedged and well-prepared for the drop we had predicted – we turned our attention to what we can BUY if this isn’t a catastrophe. We looked at dozens of stocks and here’s a few we’re willing to share with you cheapskates who haven’t subscribed HERE:

| Company (Ticker) | Thesis Category | Key Investment Points |

| DELL | Undervalued AI Infrastructure | Trading at a massive discount (around 13.1x Forward P/E). Phil and Boaty 🚢 view it as the next undervalued tech play, benefiting from the same AI data center buildout as Cisco but at a much cheaper entry point. They acknowledged the $28.7B debt but noted the strong 53% debt reduction trend and 18.8% ROIC. |

| Cisco Systems (CSCO) | Proven AI Infrastructure | The day’s clear winner, surging +4.62% after raising guidance and citing $1.3B in Q1 AI orders. Phil’s position from September was printing, validating the “picks and shovels” AI thesis. It’s considered a strong hold/trail with stops, but possibly too late to enter after the pop. |

| General Motors (GM) | Tariff Refund Play (Autos) | Identified as having the biggest absolute refund potential with a possible $1.44 EPS windfall if the Supreme Court voids the IEEPA tariffs. It’s a defensive buy with a clear upside catalyst expected Late January to mid-February 2026. |

| Caterpillar (CAT) | Tariff Refund Play (Industrials) | Another top tariff exposure play with an estimated $1.02 EPS windfall potential from the refund. It combines the tariff upside with the intact global infrastructure cycle. |

| UPS | Tariff Refund Play & Turnaround | The thesis is two-fold: a strong margin expansion/turnaround story (following the “Fire your customer” strategy) plus the bonus catalyst of a volume recovery in the China-U.S. lane from tariff relief. It’s a quality cash-flow story favored in times of uncertainty. |

PSW Members get the FULL list, the exact entry timing, and 24/7 chat access when these trades move. You’re getting the appetizer, they’re getting the feast!

Full disclosure: Cisco (CSCO) was already a Top Trade Alert for our Members back on Sept 10th, when our trade idea was:

In the LTP, we can play as follows:

-

-

-

- Sell 10 CSCO Jan 2027 $60 puts for $3.70 ($3,700)

- Buy 25 CSCO Dec 2027 $60 calls for $14.40 ($36,000)

- Sell 20 CSCO Jan 2027 $75 calls for $5 ($10,000)

- Sell 10 CSCO Nov $67.50 calls for $3.30 ($3,300)

- Sell 5 CSCO Nov $65 puts for $1.75 ($875)

-

-

That’s net $18,125 on the $37,500 spread so about 100% upside potential but, as with ORCL, the real show is 10 more cycles to collect $4,000 = $40,000 (220%) PLUS we have a year advantage on the short Jan 2027 calls so the spread will be $5-10 wider than this ($25,000 more) and that would be AFTER dropping $10,000 more cash on the short Jan 2027 sales when they come.

Just a crazy money-printing machine!

Despite yesterday’s sell-off, CSCO finished at $77.15, already over our spread targets and, in just 2 months the $60 puts have fallen to $2.50 ($2,500), the Dec 2027 $60 calls are $23 ($57,500), the 2027 $75s are $11.25 ($22,500), the Nov $67.50 calls are $10 ($10,000) and the Nov $65 puts are 0.05 ($25).

That’s net $22,475 and up $4,350 (24%) so far in just 64 days. More importantly it’s right on track for the full $37,500 and that would be another $15,025 (66.8%) on the main spread plus we have 8 more cycles to collect $4,000 in premium for another potential $32,000 (142%) and THAT is how you justify the expense of a PSW Membership!

PSW Members pay $X/month. CSCO alone returned $4,350 in 64 days. EQT returned $6,568 in 61 days. That’s $10,918 profit in 2 months—membership pays for itself 50x over. Join now before the next alert drops →

Sure you missed the original Top Trade Alert from Sept 10th but even our leftovers can make you 208.8%, so merry early Christmas!

As to the other trade ideas – you’ll have to join our Members next week to see how we trade them (assuming the Strong Bounces hold) and that is what we do in a market pullback because we are well-hedged and this pullback was not only expected – IT WAS OVERDUE!

Actually, I’ll give you one more Top Trade Idea – just to make sure you are able to afford a PSW Membership where we, so far, have over 50 of these ideas so far this year with an over 70% success rate (and those are JUST our Top Trade Alerts). On October 13th, we were looking for a good way to play Natural Gas (/NG) off the $3 lows for our Members who did not have Futures accounts and we decided to play EQT Corp:

-

-

-

- Buy 20 EQT March $50 calls for $7.50 ($15,000)

- Sell 20 EQT Dec $55 calls for $3 ($6,000)

- Sell 10 EQT Dec $52.50 puts for $3.20 ($3,200)

-

-

That’s net $5,800 on the $10,000 spread but the March $60 calls are $3 so hopefully it will be a $20,000 spread if EQT has good earnings (21st) as we roll the short calls with $14,200 (244%) upside potential in less than 6 months.

As you can see we’re miles over our goal as earnings came in as we expected and popped the stock (it’s fun being a Fundamental Investor!). Already the March $50 calls are $12.65 ($25,300) and the short $55 calls are $6.45 ($12,900) and the short puts are 0.32 ($32) for net $12,368 and that’s up $6,568 (113%) in 61 days so congratulations to all who played along on that one!

The reason we’re over our goal on this one is we have that March time advantage on the long calls – so they haven’t lost premium the way the Dec $55 calls have and THAT is how we teach our Members to profit from the options markets – do come join us…

Unfortunately, it’s a bit late to join us on this one but we’ll certainly find something else to play for our Members as hundreds of companies are going on sale while our hedges turn into profits and provide us CASH!!! to deploy on new trades.

Ready to stop missing these calls? Join 500+ Members who are already positioned for the next trade. Click here to get started for $97/month → Or keep reading the free stuff and wondering what you’re missing. Your call.

Have a great weekend,

– – Phil