We’re back!

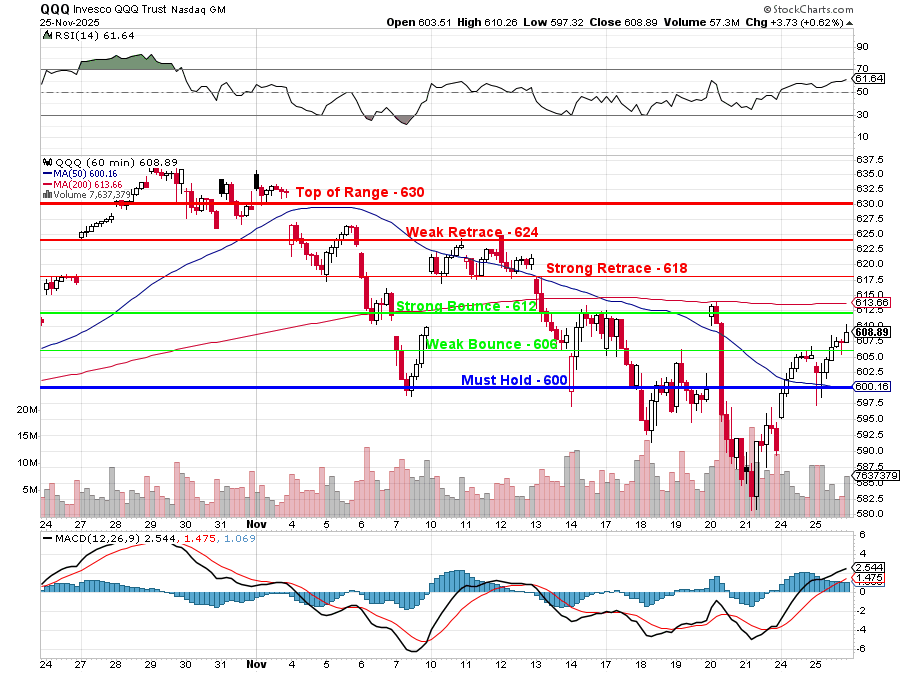

The indexes are barely off our October all-time highs after a very scary 8% pullback on the Nasdaq but it’s all over now – or is it? As you can see from the QQQ hourly chart, which does not count the spikes above and below our predicted range – we still haven’t made a Strong Bounce (612) yet and that means the “all clear” noises you are hearing from the MSM are as premature as the Christmas Trees that are already in your friends and relatives’ living rooms.

This was, on the whole, a good test of our Strong Retrace line and it was a very nice bounce but it was also very forced as the Fed suddenly rediscovered its inner dove. NY Fed’s Williams floated “near-term” cuts and now the market has pushed December rate cut odds from 40% to 85% thanks to rumors that Kevin Hassett, who has been saying he would cut rates “right now” if he were chair (auditioning for Trump, of course), is indeed Trump’s choice for the position – despite Williams’ incredible ass-kissing performance.

And then we have the “Ukraine Peace Deal” which was NOT good for Oil and Defense stocks but made an overall positive. Coming on the heels of the Gaze Peace Deal, Trump has some credibility but we’ll have to wait and see if this gets past the notional stage (Zelenski does seem to be interested, despite giving up territory).

Earnings reports have also been favorable for the past week. NVDA may have gone down but their numbers were undeniable and Elon Musk was able to bullshit TSLA up 10% by repeating the same incantations that got them to $1.5Tn in the first place.

Wow, impressive! Unless you happen to know that means going from 29 to 58 – still half of Waymo’s current deployment in Austin alone. Meanwhile, TSLA’s European sales fell 50% in October (BYD’s tripled, overall car sales rose 4.9%) – you would think that would move the needle more than 29 robotaxis hitting the road for a test drive. Now Musk is talking up TSLA producing their own AI chips – as if it doesn’t cost $50Bn+ just to begin a foundry…

Wow, impressive! Unless you happen to know that means going from 29 to 58 – still half of Waymo’s current deployment in Austin alone. Meanwhile, TSLA’s European sales fell 50% in October (BYD’s tripled, overall car sales rose 4.9%) – you would think that would move the needle more than 29 robotaxis hitting the road for a test drive. Now Musk is talking up TSLA producing their own AI chips – as if it doesn’t cost $50Bn+ just to begin a foundry…

Of course, Elon Musk is the greatest man who ever lived – just ask Grok!

Of course, Elon Musk is the greatest man who ever lived – just ask Grok!

“Profound paternal investment?” I’d like a reporter to ask him if he can name 7 of his 14 children (or birth mothers, for that matter)… We’ll have to wait until January for Tesla’s next earnings disaster so, until then – let the BS continue! $425/share is less than 200 times forward earnings – only 193x, in fact. They missed Q3 earnings by 11% and that only caused them to miss a step, which makes betting against them seem foolish (we did).

There are plenty of high-flying tech stocks like TSLA, where Fundamentals have been thrown out the window in exchange for promises of an infinite future but, at some point, those promises need to convert to profits and Q3 was the first time that the patience of the investors no longer seems infinite.

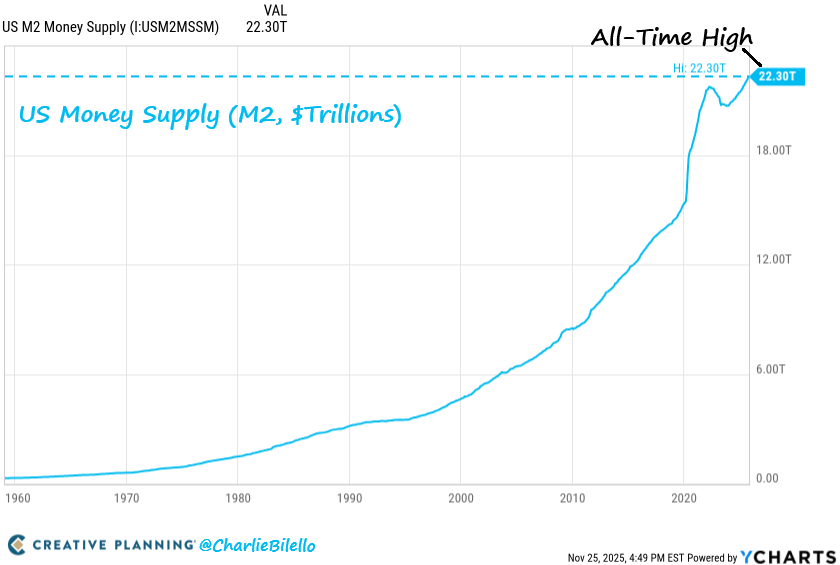

Still our underlying investing premise for 2025 remains strong into 2026: Money ($22.2Tn worth of it) has nowhere else to go BUT the stock market!

Still our underlying investing premise for 2025 remains strong into 2026: Money ($22.2Tn worth of it) has nowhere else to go BUT the stock market!

-

Cash and money markets (3.5–4%):

-

-

National money-market / Treasury yields are now around 3.8–4.0%, down from 5%+ a year ago.

-

That’s fine as a parking lot, but after 3% inflation you’re barely treading water in real terms. Great for short-term dry powder, not a long-term wealth engine.

-

-

-

Treasuries and high-grade bonds:

-

With the Fed already cutting and the curve compressing, the easy capital-gains trade from “higher to lower yields” is mostly behind us.

-

You’re locking in mid-single-digit coupons, which is fine for liability-matching, but not enough to justify today’s equity multiples unless you assume some equity risk premium stays.

-

-

Housing (frozen):

-

Only about 2.8% of U.S. homes are changing hands this year—essentially a housing market in deep freeze as owners cling to 3% mortgages and buyers balk at 6–7% rates.

-

That traps equity in place instead of recycling it through sales; there aren’t enough transactions for “flip and trade up” money to soak up much of that $22Tn.

-

-

Commercial real estate:

-

CRE volumes have stabilized, but at much lower levels than the 2021 peak, and most of the action is in multifamily and select office; lenders are tight and cap rates haven’t fully reset.

-

It’s a specialist game right now, not a mass outlet for retail liquidity.

-

-

Alternatives / private assets:

-

PE, private credit, hedge funds, and “alts” keep growing, but they’re capacity-constrained and mostly open to institutions or high-net-worth money—not where the bulk of retail checking/savings balances can go easily.

-

-

Gold and Bitcoin :

-

They benefit from the “too much money chasing too few hard assets” narrative, and rising global M2 has been supportive.

They benefit from the “too much money chasing too few hard assets” narrative, and rising global M2 has been supportive. -

But together they’re still a small slice of global financial assets and far too volatile to absorb a big share of $22Tn in a politically or psychologically stable way.

-

-

Value vs. Growth inside equities:

-

Even within stocks, flows are rotating away from U.S. “growth” funds (over $150B of outflows YTD) and into value/dividend strategies as investors look for real cash returns in a high-liquidity world.

-

That rotation doesn’t leave the asset class—it just shuffles money inside the market.

-

That is how we get these quick dips and even quicker rebounds in the market… People panic out of stocks, cash goes into their broker accounts and, a day or so later, they realize that the alternatives for their money SUCK! By that time, the above rescue brigade has jumped in to pump equity prices back up while the Retail Traders give chase – just until the next wave chases them all back to the shore.

That is how we get these quick dips and even quicker rebounds in the market… People panic out of stocks, cash goes into their broker accounts and, a day or so later, they realize that the alternatives for their money SUCK! By that time, the above rescue brigade has jumped in to pump equity prices back up while the Retail Traders give chase – just until the next wave chases them all back to the shore.

At PSW, that’s how we make our money. We know the tide of funds is going to flow in and out on a fairly regular basis and we sell options to people who think “THIS ONE” will be the last wave. There is always another wave and sometimes the tide is high and sometimes the tide is low but that too will cycle around and we like to bet that the ocean will not, in fact, wash over all of the land (not until 2050, anyway) and we also bet that the ocean won’t recede away and leave nothing but desert – no matter what the recent “pattern” seems to indicate.

It’s actually not that complicated…

Have a fantastic Thanksgiving!

-

- Phil and the Crew