“When Black Friday comes

I’ll stand down by the door

And catch the gray men when they

Dive from the fourteenth floor” – Steely Dan

As we kick off this Black Friday, the macro tape is revealing a nuanced picture… a delicate balance of cautious optimism masked by underlying fragility, punctuated by global data surprises, consumer bifurcation, and the ever-evolving entertainment and M&A scenes, all of which will shape the rest of this holiday shopping season through Cyber Monday and beyond, culminating in a 2025 close that’s as unpredictable as it will be instructive.

Last year’s Black Friday gave us the blueprint: US online sales hit $10.8Bn but Europe added 10% more transactions on lower-priced goods – a classic “volume up, ticket down” pattern that was our first 2025 signal of trading‑down behavior. Japan saw 12% higher spend but from fewer overall shoppers, meaning the high‑end consumer showed up while the mass market sat out. Globally, the entire BF‑CM window cleared $74.4Bn online, with mobile share at 69% and BNPL (Buy Now, Pay Later) pushing $686M, which was up 8.8%. That “pay‑later” surge was the canary: when consumers need to finance a $50 hoodie, the low‑end wallet is already stretched!

Domestically, this year, the AlixPartners survey and EY data show the same K‑split hardening: one‑third of high‑income shoppers plan to spend more, while less than 20% of everyone else will increase budgets. The top is flying, private‑jet orders are up, luxury cruises (Viking’s $1.54B IPO in May) are sold out and premium streaming bundles are adding subs. The bottom is fighting 25% higher grocery bills and maxed‑out credit cards; Walmart and Target’s Q3 earnings show same‑store sales growth ALMOST ENTIRELY coming from price (up 4–5%) NOT volume (flat to down). Inflation isn’t “transitory” for the median households – it’s a forced diet.

Earnings Tell the Same Story

-

-

Walmart beat, but gross margin compressed as they pushed discounting to move units.

-

Gap raised guidance because Old Navy (value) outperformed Banana Republic (premium) by double digits—textbook trade‑down.

-

Nvidia beat on data‑center, but gaming revenue is flat; the AI gold rush is enterprise‑only, not a consumer tailwind.

-

Tesla missed Q3 by 11% and still trades at 193x forward earnings because the “growth” story is now a robotaxi fantasy that even Austin’s 29 test cars can’t justify.

-

On the macro front, International Data continues to paint a picture of deceleration rather than collapse. European PMI readings remain mildly expansionary, albeit at a slower pace, with German industrial Activity contracting for the sixth straight month while China’s October industrial output has stabilized, hinting at a gentle easing rather than a complete stall.

Meanwhile, the US remains heavily data-dependent (and the data is still missing) but our Shadow-Data trend suggests we’re in a softening phase, with retail sales still holding (+0.3% in October) but underpinned by significant inventory drawdowns and price promotions, reflective of bifurcated consumer trends we’ve been tracking all year.

The high earners and savings-rich in the Top 10% are still thriving with the market at record highs and they splurging on Black Friday deals and entertainment, while the middle and lower-income groups continue to tighten their belts, a divergence that’s fueling sector-specific moves.

Earnings reports mirror this bifurcation. Tech giants like NVIDIA (NVDA) and Apple (AAPL) report mixed signals with NVIDIA’s AI/enterprise cloud-driven growth continuing to crush expectations, with Blackwell chips sold out through 2026, reaffirming its dominant position, yet the stock’s recent volatility and valuation premiums suggest a market that’s increasingly nervous about the long-term sustainability.

Conversely, retail stalwarts like Walmart (WMT) reveal resilient consumer spending in certain categories, even as others, like Clothing and General Merchandise soften under bifurcated demand. Wicked and Zootopia drove the box office this week, reminding us that Entertainment is still a vital sector. Avatar, which opens in three weeks, should push the box office over the $9Bn mark for 2025 – that’s a lot more revenue than OpenAI is going to show!

That’s a surge worth noting, especially with the stream of M&A and bidding activity on WBA, traditional media’s valuation premiums are still being tested, but the resilience of entertainment assets highlights a bifurcated landscape: content is still king and those with marquee franchises are on the hunt for acquisitions.

WBD is being pursued by PSKY, CMCSA and NFLX but the board wants $30, which would be about $90Bn for a company that will be LUCKY to make $1Bn this year (90x earnings) – RIDICULOUS!

The shadow-data concept guides us into understanding this complex dance of winners and losers. Globally, the data suggests markets are standing on a knife’s edge. European Industrial Activity is mixed, with sentiment easing but with some pockets of resilience, notably in Services, which are less sensitive to immediate supply chain shocks. Asia’s data shows China’s post-growth stabilization, but the property sector remains a volatile tipping point.

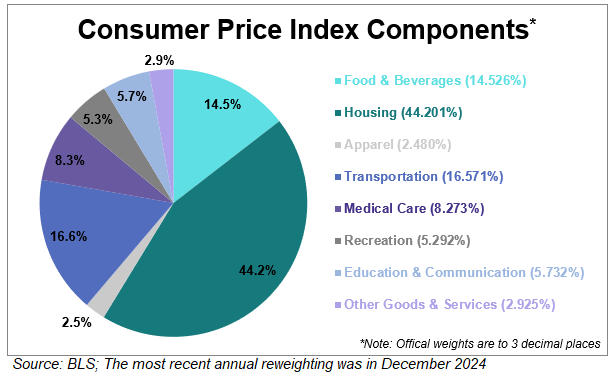

Meanwhile, the US’s mixed manufacturing and job market signals, paired with persistent Inflation pressures (PPI figures indicate inflation remains sticky) point to a delicate tightrope walk for the Fed. The question isn’t just about whether stocks will rise or fall—it’s about which sectors, geographies, and corporate narratives will win or falter in the unfolding scramble.

Consumer bifurcation remains the key theme of 2025. While the high-intensity spenders are out in force with Wicked and Zootopia’s box office successes (at record-high ticket prices), a very strong Black Friday retail push and continued luxury brand demand – our more price-conscious consumers are holding back, still bracing for potential shocks.

That split explains the bifurcated market moves. Some sectors and stocks rally on hope, others plummet in fear, which is why today’s activity is so fluid. The entertainment sector exemplifies resilience amid uncertainty. Avatar’s part III (Fox+DIS), alongside Wicked’s (II – CMCSA) and Zootopia’s (II – DIS) blockbuster weekend, underscores how cultural franchises continue to drive cash – with WBD’s bidding war hinting at a broader revaluation of content as a strategic asset.

Similarly, the tech sector remains bifurcated: Nvidia’s (NVDA) is still a rocket but its valuation premiums are already baked into the market while the AI arms race – featuring Google’s Gemini and OpenAI – continues to be a battleground for dominance and the pressure to turn “moonshot” investments into profitable realities is only intensifying into 2026.

From our Shadow-Data perspective, the key for this weekend is parsing signals from varied geographies, sectors, and systemic flows. The US remains internally bifurcated but front-loaded with robust Retail and Entertainment activity while the international landscape shows signs of slowing but NOT sinking.

Europe’s modest manufacturing decline and China’s soft strengthening tell us that a slowing Global Economy is now more a story of “slow drip” than “collapse.” Still, the crypto spillover, highlighted by Bitcoin’s correction and the collapse of some high-flying tokens, reminds us that risk is still lurking beneath the surface. Still, where does all that liquidity go when stocks are shaky? Into the next liquid asset down the chain:

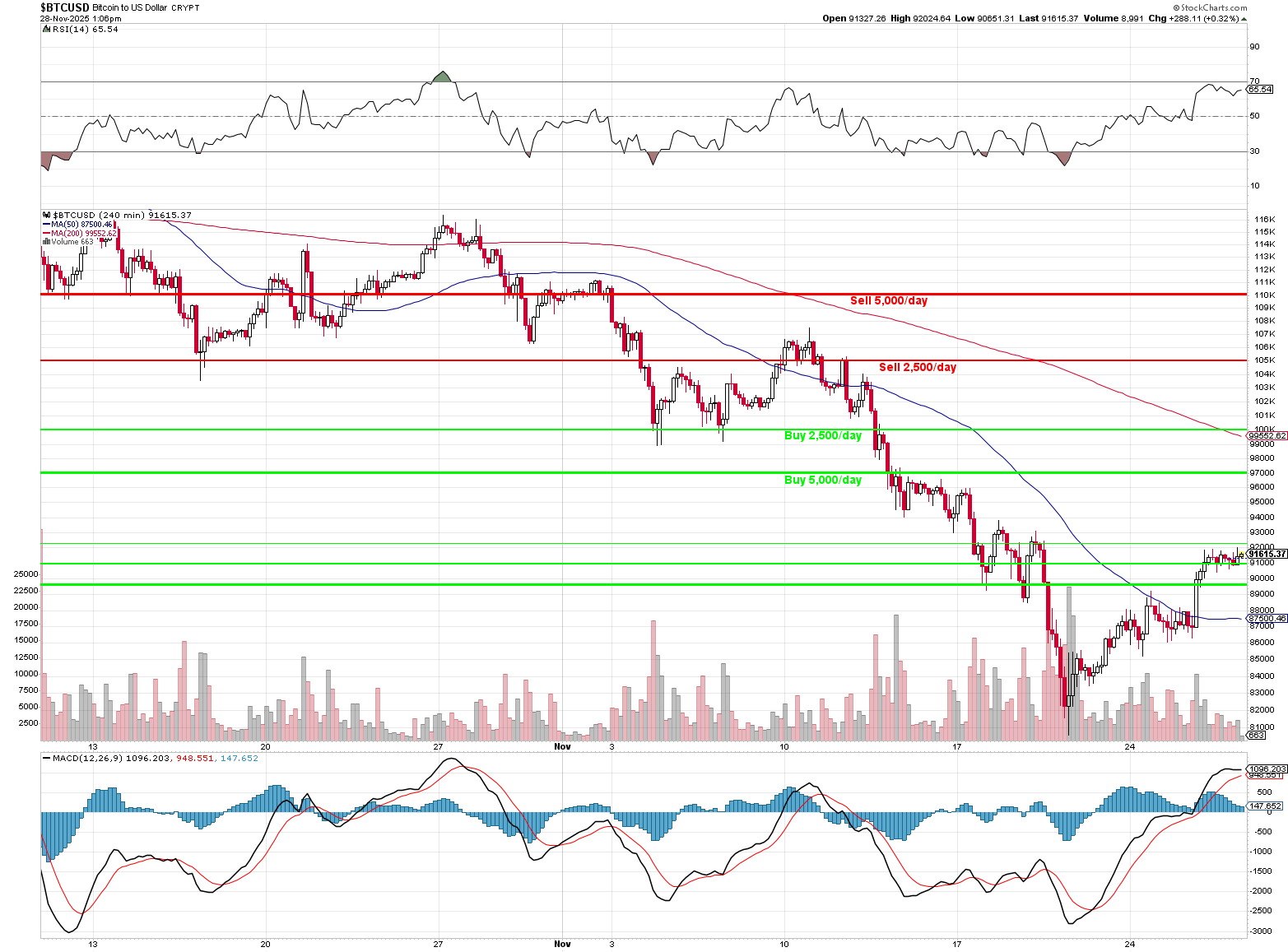

After successfully exiting their Bitcoin positions near the $110,000 resistance in October, $BTCUSD retreated and moved back into our primary Buy Zone in November. This triggered daily purchases in our 2,500/day range as well as our 5,000/day range, which triggered the following daily accumulations:

| Date | Quantity (Coins) | Purchase Price ($) |

| Nov 14 | 2,500 | 97,826.84 |

| Nov 17 | 5,000 | 95,168.88 |

| Nov 18 | 5,000 | 90,089.49 |

| Nov 19 | 5,000 | 91,386.52 |

| Nov 20 | 5,000 | 92,760.46 |

| Nov 21 | 5,000 | 85,973.09 |

| Nov 24 | 5,000 | 86,719.09 |

| Nov 25 | 5,000 | 88,321.30 |

| Nov 26 | 5,000 | 90,521.19 |

| Nov 27 | 5,000 | 91,307.81 |

| Nov 28 | 5,000 | 91,493.65 |

This systematic accumulation has now positioned they crypto portfolio for the current bounce. We are currently indicating holdings of 52,500 BTC as of this morning (still accumulating at 5,000/day) and will be keeping a close eye on the price action as we look to challenge that key 50-day moving average (red line), which remains the first major resistance test for this new rally.

Our average purchase price in this cycle has been $90,729 and our average selling price in the last cycle was $109,352 so a huge gap BUT, if BTC has trouble at $95,000 – it would be prudent to sell roughly half of the accumulated coins to drop the cost basis back to around $85,000 – giving us cushion to ride things out a bit. While crypto’s influence on markets is now diluted in the big picture, its recent volatility is a harbinger of potential tail risks that could amplify if sentiment shifts.

As we approach the end of 2025, an overarching theme emerges: valuations are still stretched, but liquidity (the $22.2T shadow that fuels the market) is proving resilient, especially within segments of the Tech, Entertainment and the Consumer Sectors. However, the bifurcation of consumer behavior and profit streams suggests that success will come down to nimbleness: the winners will be those who can swiftly adapt, lean into content assets and navigate the flow of capital between sectors and geographies.

Today’s snapshot is a landscape of fleeting nerves and selective strength, a tough but promising environment for adaptable investors! As money continues to flow into stocks the smart traders will identify the beneficiaries of this cycle and prepare for a volatile but possibly lucrative close to 2025.

Stay alert, stay hedged, and remember that the Shadow-Data whispers that the tide may be high today, but the ocean’s surface can still change swiftly. Our best move is to keep the boat steady and keep our eyes open.

Have a great weekend,

— Phil