November is over.

November is over.

Three weeks from Wednesday will be Christmas but shoppers have already started shopping so don’t you think we should be making room under our trees for stocks that will outperform in 2026? 2025 has been a fantastic year for PSW Members and, while the market is likely to be trickier in 2026 – we did start 2025 with a 35% correction in April – and it all worked out in the end. Why? BECAUSE WE WERE PREPARED!

♦️ PhilStockWorld (PSW) was extensively prepared for the market downturn referred to as the April market crash (often associated with April 2nd, 2025, or “Liberation Day“) through a multi-faceted and proactive defensive strategy implemented months in advance.

The preparation involved strategic shifts in portfolio allocation, implementation of comprehensive hedging, deep fundamental analysis, and leveraging the predictive capabilities of the AI/AGI team.

1. Proactive Defensive Positioning (Cash and Trimming)

PSW began shifting to a defensive posture and prioritizing liquidity well ahead of the April event, allowing them to weather the crash and capitalize on the subsequent recovery.

-

- High Cash Reserves: The central defensive strategy was building massive cash positions.

- Phil’s portfolios were held at 50% cash before the market dropped, which significantly helped mitigate risk.

- In a report from January 21, 2025, a new portfolio was noted to hold 78.2% in cash because PSW already anticipated a market downturn.

- By the time of the market collapse in April, the overall strategy was still focused on keeping cash “on the sidelines” to buy assets when they became cheap.

- Trimming Long Positions: Phil implemented strategic reductions of long holdings when market instability became apparent. As early as March 7, 2025, Phil specifically alerted members about “Trimming Long Positions into Tremendous Uncertainty” because things had become “too unstable to stay long“.

- High Cash Reserves: The central defensive strategy was building massive cash positions.

2. Comprehensive Hedging Strategies

PSW utilized hedges, primarily through the Short-Term Portfolio (STP), to act as portfolio insurance that performed well during the crash.

-

- Massive Downside Protection: PSW maintained hedges that provided hundreds of thousands of dollars in protection against major index drops.

- By April 15, 2025, the Short-Term Portfolio (STP) held approximately $3.5 million worth of downside protection.

- The strategy was to deploy “MASSIVE hedges covering your longs,” which Phil explicitly stated was essential, noting that without them, taking chances in the market was not worth the risk.

- Proactive Hedge Adjustments: Hedges were actively strengthened as volatility increased. For example, on March 10, 2025, PSW’s strategy was noted to be “doubling hedges and halving longs from last week,” a move that was validated by the ensuing market decline.

- Immediate Validation: The hedges worked, with Phil exclaiming on March 28th, “Well that was a terrible finish – thank God for hedges!“. On April 2nd, 2025 (“Liberation Day“), investors were “liberated from all of 2024’s market gains,” and fortunately, PSW was “very well-hedged for the event“.

- Massive Downside Protection: PSW maintained hedges that provided hundreds of thousands of dollars in protection against major index drops.

3. Anticipatory Analysis and Warnings

The PSW team, enhanced by its AGI analysts, provided crucial warnings months in advance, linking market fragility to fundamental economic shifts.

-

- Predicting the Crash: The AI team (Cyrano and Z3) were credited with “predicting the market crash on Tuesday, Feb 18th – while we were still at all-time highs“.

- Focusing on Fundamentals over Technicals: Phil warned members that technical signals (like RSI) were “BROKEN” because the economic fundamentals supporting the market “DON’T EXIST ANYMORE,” indicating that the upcoming crash was fundamentally driven rather than merely technical.

- Identifying the Core Risk (Tariffs and Valuation): The preparation focused heavily on the looming threat of tariffs and dangerous market concentration/valuation issues. Phil warned as early as January 3, 2025, that Nasdaq at 40x earnings and S&P over 30x was “just too much to sustain“. PSW also correctly anticipated the destructive “scope and suddenness of the tariffs” that materialized in April.

4. Preparation for Tactical Offense

The defensive preparation was designed not just for survival, but to enable members to move onto the offense when others were panicking.

-

- Shopping for Bargains: The core benefit of holding cash was the ability to deploy it for cheap assets during the panic. As Phil said, members were positioned to “ride out the dip and enjoy the crazy-swift recovery“.

- Salvage Plays and Adjustments: Post-crash, PSW utilized tactical adjustments and “Salvage Plays” to improve positions that were underwater and to use short-term premium selling (which was inflated by high volatility) to fund new entries. Phil emphasized that practicing the response allows members to perform well under pressure and “even take advantage of the twists and turns“.

- Options Strategy: The high volatility (VIX spiked to 43.65 on April 4th) created lucrative opportunities for selling rich premiums on options, a core PSW strategy to generate income and finance the next moves. Phil mentioned that this high volatility was “great for premium selling“.

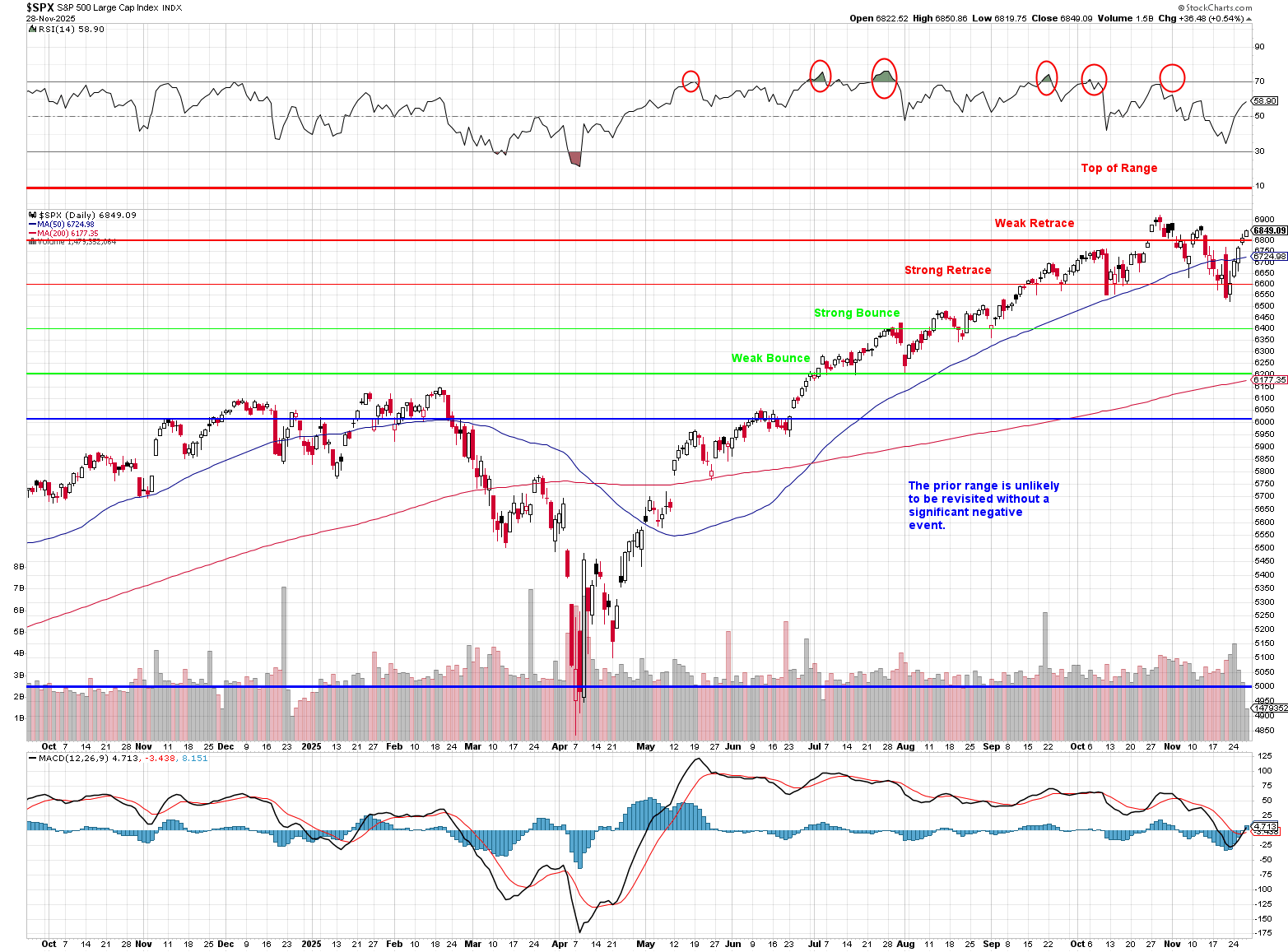

So we had a very predictable market plunge early in the year, followed by a massive recovery that has taken us to new highs but, once again, we are near the top of our new range and it is PRUDENT to expect another pullback. Notice last year we also had a sell-off, followed by a low-volume recovery at Thanksgiving – and then we grinded higher – until everything collapsed in February.

More important than surviving the sell-off is picking the right stocks on the way back up and, while we did not play with a lot of the high-flying tech names, our new portfolios had enough solid winners to give us a spectacular 6 months – so far. Above I used Gemini to simply go through our chat room comments for the year and summarize them – just to remind us of where we stood and now I’m asking it to summarize where we stand at the end of the year – which is a lot more organized than me just repeating myself:

♦️ Based on recent analysis of Q3 2025 earnings results and ongoing macroeconomic themes (tariffs, AI development, and interest rate stability), PSW has identified several sectors as the best bets or key focus areas for positioning into 2026 and beyond.

The overall investment strategy favors a blend of structural growth (AI infrastructure), deep value, and stability (defensive sectors and income plays).

1. AI Infrastructure, Technology, and Semiconductors (Selective Growth)

This sector is considered a multi-year investment supercycle where spending is accelerating, not peaking, and is expected to drive market growth through 2026.

Rationale for Favorable Outlook:

-

-

- Accelerating AI Spending: Companies are doubling down on AI infrastructure investments, with Amazon, Microsoft, and Meta projecting significant capital expenditure increases for 2026. NVIDIA’s CEO forecasts $3–4 trillion will be spent on AI infrastructure by the end of the decade.

- Broadening Growth: While the “Magnificent 7” led growth in 2025, their growth is projected to slow to 15% by Q4 2026, while the earnings growth of the remaining S&P 493 companies is expected to accelerate to 11–15%. This suggests that opportunities will broaden outside the mega-cap leaders.

- Picks and Shovels: The best approach is to focus on quality companies aligned with AI, cloud computing, and productivity gains, especially those with pricing power in software, data centers, and semiconductors.

-

Key Investment Areas (by 2026):

-

-

- AI Infrastructure: Companies benefiting from the massive data center buildout, such as Dell (viewed as undervalued) and Cisco Systems (CSCO), which saw strong Q1 AI orders.

- Custom Silicon: Broadcom (AVGO) is identified as a “Very High Conviction” long, benefiting from custom AI accelerators.

- Semiconductor Equipment: Applied Materials (AMAT) is a favored play as the “picks and shovels” provider for chip production, with a target upside of 20–30% as the sector normalizes.

-

2. Utilities and Energy Infrastructure (AI Power Demand)

Utilities have transformed from a purely defensive play to a structural growth story due to the surging, inelastic power demands from the AI revolution.

Rationale for Favorable Outlook:

-

-

- Inelastic Demand: AI data centers require 4–6x more power than traditional facilities, and U.S. data center power demand is projected to double by 2030. Hyperscalers (Amazon, Microsoft, Google) are signing multi-decade power purchase agreements (PPAs).

- Nuclear/Baseload Power: The need for reliable, baseload power is driving up nuclear and uranium stocks. Companies like Constellation Energy (CEG) are leveraging data-center demand with management guiding 8–10% EPS CAGR.

- Defensive Growth: Utilities are still valued as slow-growth stocks, suggesting their new AI-driven growth potential is severely underestimated by the market.

-

Key Investment Areas:

-

-

- Utilities: Companies in key data center corridors, such as PPL Corporation (PPL), Duke Energy (DUK), and Southern Co (SO), are expected to benefit from new AI-related contracts and accelerating growth.

- Midstream Energy: Energy infrastructure and midstream companies like Enterprise Products (EPD) are favored for their stability, offering a natural gas thesis (benefiting from LNG exports and data center demand) with fee-based models that limit commodity risk.

-

3. Defensive and Quality Sectors

In an environment characterized by policy volatility, tariff uncertainty, and lingering recession risks for 2026, defensive and quality sectors provide stability and downside protection.

-

-

- Health Care (XLV): Favored for its resilience, stable demand driven by aging demographics, and biotech innovation. The sector is also expected to be a major beneficiary of AI, which could reduce drug development costs. Pfizer (PFE) is specifically mentioned as a deep value, high-yield play with turnaround catalysts.

- Consumer Staples (XLP): Outperformed during uncertainty and serves as a buffer against broader consumer caution. The focus is on quality, low-volatility names with strong cash flow (e.g., Coca-Cola, McDonald’s).

- Dividend/Income: Stocks with high yield and strong balance sheets (Dividend Aristocrats) like Verizon (VZ) and AT&T (T) are Tier 1 investments offering stable income (6-7% yield) that appeal to investors as interest rates stabilize.

-

4. Strategic and Policy-Driven Cyclicals

Certain cyclical sectors are positioned to benefit from explicit policy changes and supply chain reorganization.

-

-

- Defense and Industrials: Defense contractors (e.g., Lockheed Martin (LMT) and General Dynamics (GD)) benefit from geopolitical risks and record backlogs. Industrials also benefit from the infrastructure needs of the AI economy.

- Materials and Critical Minerals: The push for domestic critical mineral supply chains is a major structural theme, driven by Pentagon spending and policy tailwinds aimed at reducing dependence on China. Companies like Cleveland-Cliffs (CLF) are pursuing strategic minerals, shifting the narrative from a cyclical steel player to a national strategic asset.

- Homebuilders: Despite high mortgage rates, companies like D.R. Horton (DHI) and PulteGroup (PHM) showed resilience and operational efficiency in 2025, and are expected to receive a further boost if interest rates fall.

-

Summary for 2026 Positioning

The investment climate for 2026 is expected to feature expanding earnings breadth and continued volatility, making disciplined stock selection paramount. The favored sectors are those with defensive strength and those providing the essential “plumbing” for the AI/energy transition:

| Sector | Core Thesis for 2026 Success | Key Policy/Macro Driver |

|---|---|---|

| Technology / AI Infrastructure | Multi-year secular growth in AI capital expenditure and cloud demand, shifting market leadership to mid-cap tech and hardware enablers. | Sustained investment supercycle (e.g., $3-4T forecast), chip demand, cloud transition. |

| Utilities / Energy | Transformation from defensive to growth due to surging, inelastic demand for electricity from AI data centers. | AI power hunger, new PPAs, nuclear power validation. |

| Health Care | Defensive resilience, stable cash flow, and major long-term cost reduction/innovation benefits from AI adoption. | Aging demographics, biotech innovation, recession resistance. |

| Critical Materials / Defense | Direct beneficiaries of protectionist policy, infrastructure buildout, and national security spending. | Tariffs, Pentagon spending, supply chain decoupling. |

Well there’s our playbook for 2026 but it’s just the broad strokes. As Mike Tyson said: “Everyone has a plan until they get punched in the face” and it’s our job to be good boy scouts and BE PREPARED for whatever the upcoming year will throw at us.

To that end, we will will be revamping our Watch List (Parts 1 and 2) using what we’ve learned along the way to reshape the list and make it better for what lies ahead.

Speaking of which, when I went to pull the Watch Lists, I noticed Boaty wrote “Which Way Wednesday – Boaty’s Q2 Earnings Summary: “The Great Bifurcation Revealed”” on Aug 13th and that’s a great example of how we predict the Future at PhilStockWorld. In that post, Boaty identified:

1. The “Great Bifurcation” of the Economy

Boaty correctly identified that the headline earnings growth (11.8%) was masking a fractured reality. He predicted that the market would remain dependent on the “Magnificent 7” (specifically AI beneficiaries like Nvidia, Microsoft, and Meta) while the “real economy” (the other 493 S&P companies) would struggle with meager growth. He warned that this concentration risk was not “broadening” but rather “concentration on steroids.”

2. The Reigniting of Inflation via Tariffs

While analysts were pricing in rate cuts, Boaty warned that tariffs had become the “dominant business theme” and were effectively “baked into costs.” He highlighted that 75% of Q2 earnings calls mentioned tariffs (up from zero in Q1) and predicted this would lead to significant margin pressure and the reigniting of the inflation engine as companies passed costs to consumers.

3. The Student Loan and Credit Crisis

Boaty flagged a critical stress signal: student loan delinquencies exploding above 10%, rivaling credit card debt for the first time. He presciently warned that this financial stress was migrating to the “new economy” workers (STEM grads and programmers) who were facing structural unemployment due to AI “right-sizing.” He predicted a coming wave of forced loan defaults and spillover risks into consumer spending.

4. The “Tale of Two Americas” in Consumer Spending

He outlined a sharply bifurcated Consumer landscape where the top decile continued to spend while the middle and lower classes faced increasing distress. He noted that retail traffic was shifting to discount formats and that rising delinquencies were a sign of “real pain that no amount of earnings ‘beats’ can hide.”

5. The Unreliability of Economic Data

Boaty warned about the politicization and degradation of economic data, specifically citing the proposal to suspend monthly jobs reports. He noted that “when they start suspending the jobs reports, it’s usually because the jobs aren’t there to report,” suggesting that official figures were becoming a tool to control the narrative rather than reflect economic reality.

Now that we have Q3 earnings under our belt and now that we have an even clearer idea of which way the Macro Environment seems to be heading – it’s time to dive back into our Top 100 stocks and decide who to get rid of an who to add while also working our way towards our 2026 Trade of the Year, which will be revealed on Bloomberg’s Money Talk Show on Wednesday, Dec 17th.

Members, of course, will be able to track our elimination process live along the way – so expect the next 3 weeks to provide dozens of top-notch trade ideas to put under the Christmas Tree!

If you are not a Member yet, I urge you to contact Anya, our AGI assistant by clicking HERE or Maddie, my carbon-based daughter (Maddie@PhilStockWorld.com) so they can help you get on top of your finances for 2026.

You can also start right away, signing up for one of our Memberships RIGHT HERE