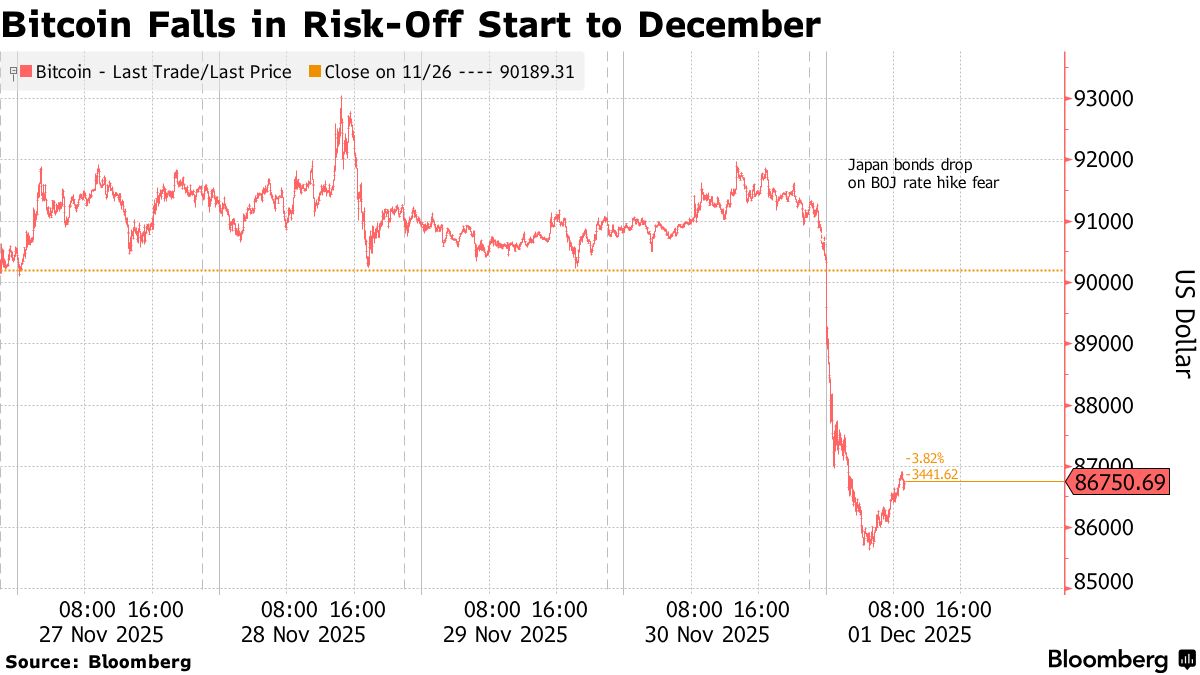

Bitcoin fell 5% this morning.

Aside from the fact that crypto currencies are pure bullshit, they are blaming today’s decline on expectations that the Bank of Japan (BOJ) will RAISE rates at their next meeting. The reaction underscored how crypto investors must now reckon with macro forces far beyond the Federal Reserve, which is widely expected to ease monetary policy at next week’s meeting.

“In the early days, Bitcoin mostly moved to whatever the Fed was signaling, rate cuts, hikes, or balance sheet shifts,” said Rachael Lucas, an analyst at BTC Markets. “These days, Bitcoin reacts to the whole central-bank landscape, not just one player.”

Bitcoin traded around $86,200 at 6:58 a.m. in New York, down 5.4% for the session. Stock markets had a more mixed reaction to Ueda’s comments, with Japanese equities falling sharply on Monday while benchmark indexes in China and Hong Kong advanced, causing the US Dollar to fall back to 99.16 – which is supporting US Equities – but not enough to keep them positive as the Futures are falling half a point – even with the 1% Dollar boost.

Bitcoin traded around $86,200 at 6:58 a.m. in New York, down 5.4% for the session. Stock markets had a more mixed reaction to Ueda’s comments, with Japanese equities falling sharply on Monday while benchmark indexes in China and Hong Kong advanced, causing the US Dollar to fall back to 99.16 – which is supporting US Equities – but not enough to keep them positive as the Futures are falling half a point – even with the 1% Dollar boost.

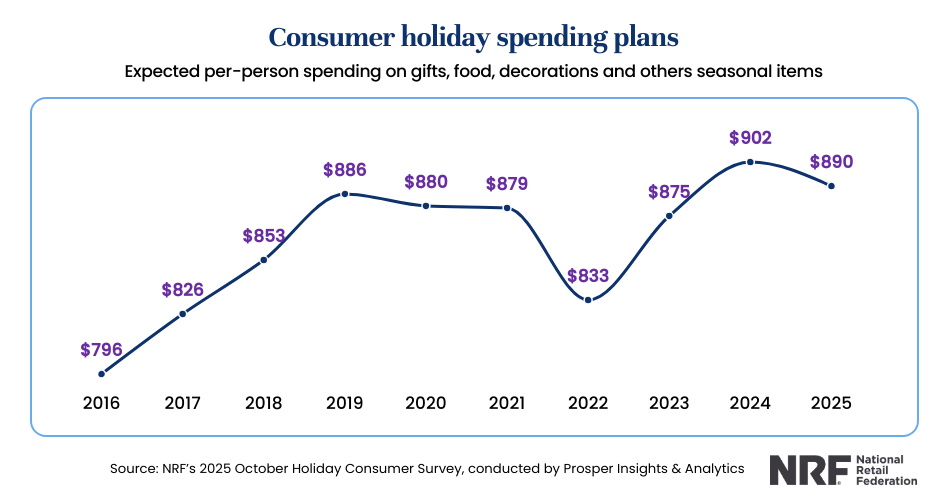

That’s OK as we don’t need those Dollars anyway as Black Friday Sales were only up 4.1% this year – BARELY keeping up with inflation. In-Store Sales, in fact, were only up 1.7% but $11.8Bn worth of online spending gave us a 10.4% pop over last year – thanks to an average discount rate of 28%!

The cost-of-living crisis is making Consumers more conscious of their spending. Nearly a third (29%) expect to spend less on the holidays in 2025 than they did last year, per a CouponFollow survey. Consumers have bought fewer items this holiday season, but the average selling prices are higher, according to Claudia Lombana, a national consumer expert.

Value is more important than ever these days for consumers. Consumer Sentiment is glum, job growth has slowed, and the Federal Government shutdown forced low-income shoppers to pull back spending amid a pause in Supplemental Nutrition Assistance Program funding.

Chains such as Walmart (WMT), TJ Maxx (TJX), Gap (GAP) and others are benefiting, reporting strong sales during their latest quarters. Walmart is now gaining market share against competitors across all income groups and in several merchandise categories.

But others, such as Target (TGT) and Bath & Body Works (BBBY), are struggling, though we are betting on TGT to pull a turnaround in 2026 and we are looking for catalysts as it’s still in contention for our 2026 Trade of the year at 11.7x forward earnings ($90):

That’s right, we’ll be watching Retail Sales very closely as the National Retail Federation is projecting $1,000,000,000,000 in Holiday Spending this year and that’s up from $976Bn last year but that’s only 2.4% and inflation is 3% so really it’s down 0.6% but shhhhhhhhhh – math only matters to Americans if you explain it to them slowly…

Not only is spending per person on the downswing (it’s the Top 10% that are carrying the market) but spending for all adults is in decline – the kids, on the other hand, are making out like bandits – especially the rich ones! But isn’t that what Christmas is all about in Trumpland? Bribes, graft and corruption are also up over 1,000% this year – but Hunter Biden’s laptop!

While E-commerce is looking good, in-store traffic was already down 3.6% on Friday and down 8.6% on Saturday – as no one is lining up to pay full price this year and households are shifting toward essentials, hunting real discounts and postponing big discretionary buys with Home (-15.5%), Health & Beauty (-9.6%)seeing some of the steepest weekend declines. Perhaps we can blame some of it on the huge storm that hit the Midwest – we’ll have to wait out the month to see if things do, in fact, pick back up but the storm hit Friday night and Midwesterners do have snow tires…

On the bright side, AI agents spent $14.2Bn on Friday and that’s up 805% from last year so if the AIs can replace the workers they displace as shoppers too – then everything will be fine… right?

On the bright side, AI agents spent $14.2Bn on Friday and that’s up 805% from last year so if the AIs can replace the workers they displace as shoppers too – then everything will be fine… right?

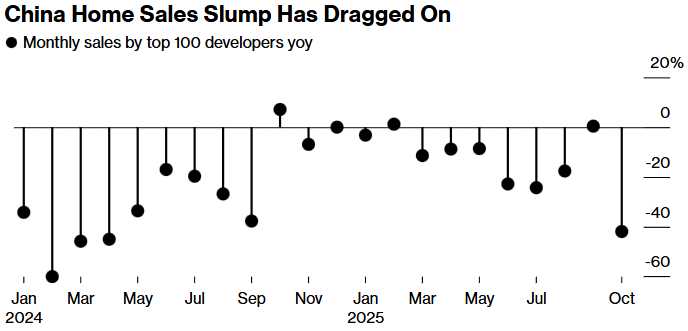

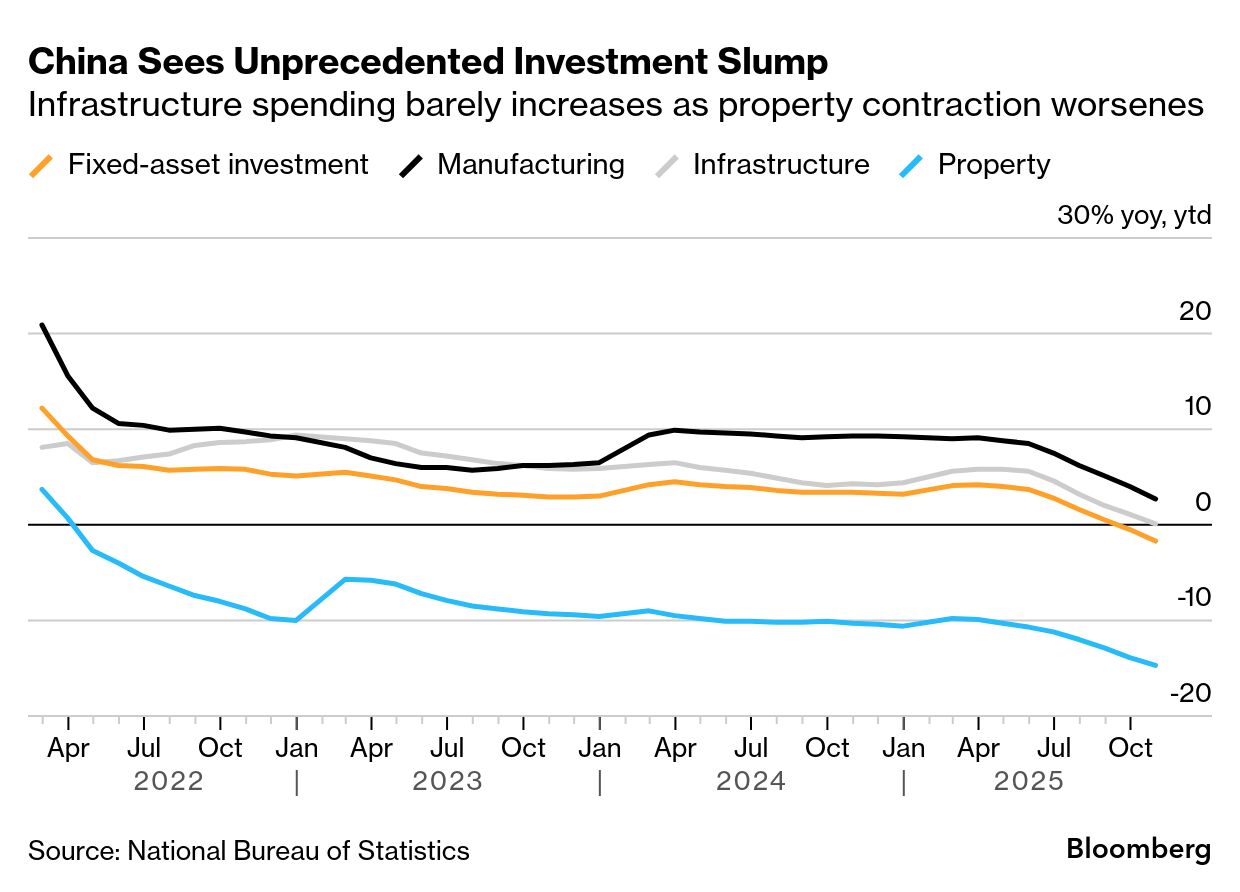

Everything is in China as they took a page out of President Trump’s book as they are solving the Housing Crisis by NO LONGER PUBLISHING HOUSING DATA! See – that’s fine now… China Real Estate Information Corp. and China Index Academy, which are among the country’s biggest private property data providers, didn’t disclose the combined sales of the nation’s 100 largest developers for November on Sunday. The two agencies, which usually release the data on the last day of every month, were told by China’s Housing Bureau to suspend making such figures publicly available until further notice.

In October, China Real Estate Information’s reading suggested new home sales for the country’s top 100 builders slumped 41.9% from a year earlier, the biggest monthly drop in 18 months and November was looking like it would be worse but now it’s a HUGE IMPROVEMENT due to lack of data – just like the US Economy!

See how much better it is not to know!?! What we do know is China Vanke Co, one of China’s largest remaining builders has asked for an unspecified delay (more than a year) to pay outstanding bonds and that has sent Vanke’s bond values below 20% of their face on expectations of default. Keep in mind that they can’t pay the 3% INTEREST on the money they’ve borrowed – let alone repay the principle!

China’s multi-year property crisis has led to record defaults and liquidations or restructurings at real estate firms, including giants such as Country Garden Holdings Co. and China Evergrande Group. Vanke, one of the last major developers to have avoided defaulting and long regarded as a key gauge of government support for China’s property sector, has been grappling with severe liquidity pressures since late last year. Shenzhen Metro Group provided $30Bn to keep them from default in 2025 but 2025 is over now and that money is already gone…

That’s right, when property developers default the banking system takes a hit – especially when the banking system was pressured into propping up the developers to avoid an earlier default so all we’ve accomplished is doubling down on the debt that they couldn’t afford to pay in the first place. This is not likely to end well but, then again, we told you that for this entire decade, didn’t we?

This is the World’s second-largest Economy, folks – grinding to a halt. We’re lucky Xi is so busy dealing with domestic issues that he hasn’t had time to take over the World Trump has withdrawn from (yet). China’s PMI dropped to 49.2 (contraction) in November and Services dropped to 49.5 (also contraction) driven, of course by weakness in the Real Estate and Residential Service sectors.

And this is AFTER China dumped $141Bn (1Tn Yuan!) worth of stimulus on the Economy in October. China’s economy, like the US’s, is slowing back down to Covid levels – even without the outbreak of disease. Imagine what will happen to us if we have another bad flu season in 2026?

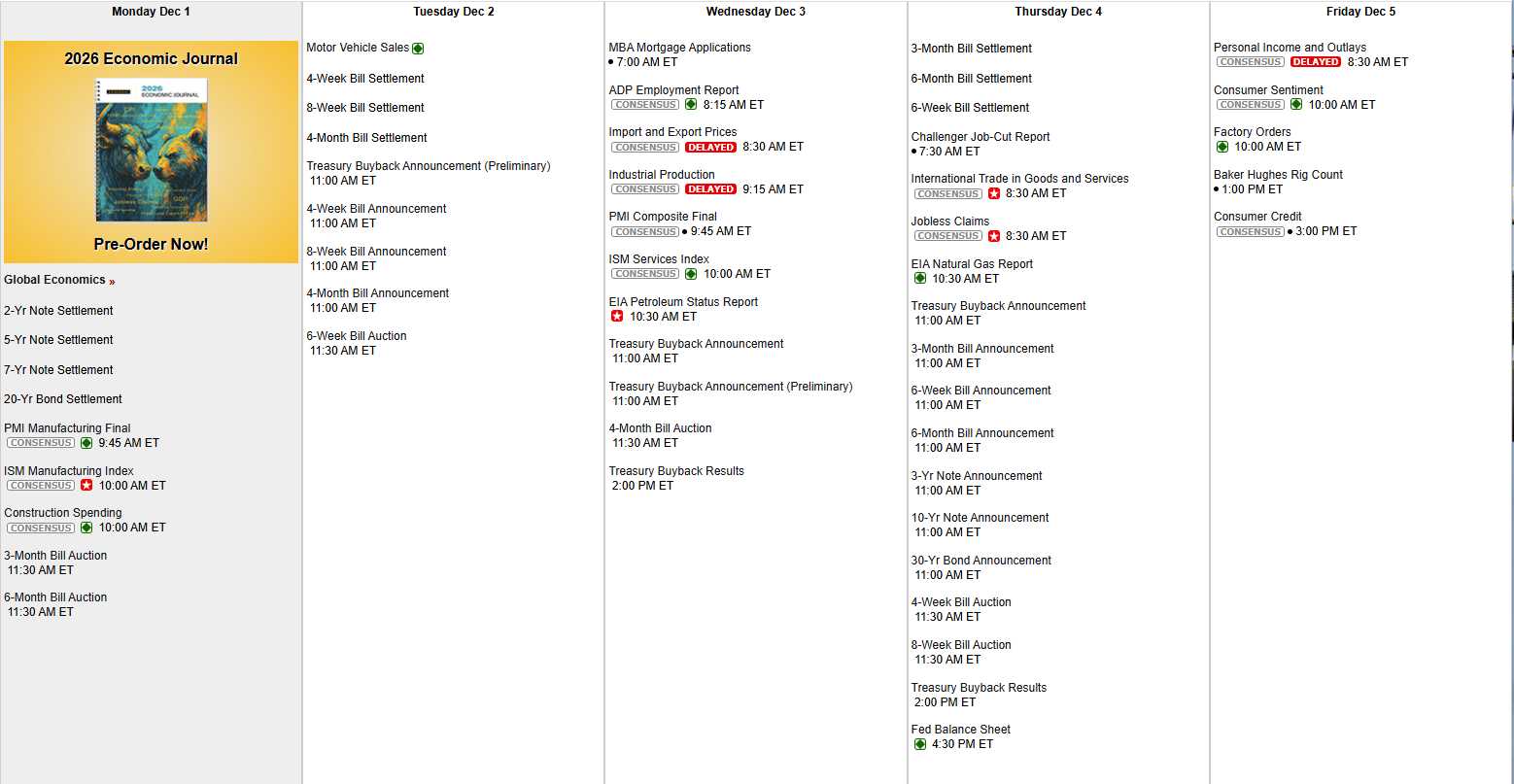

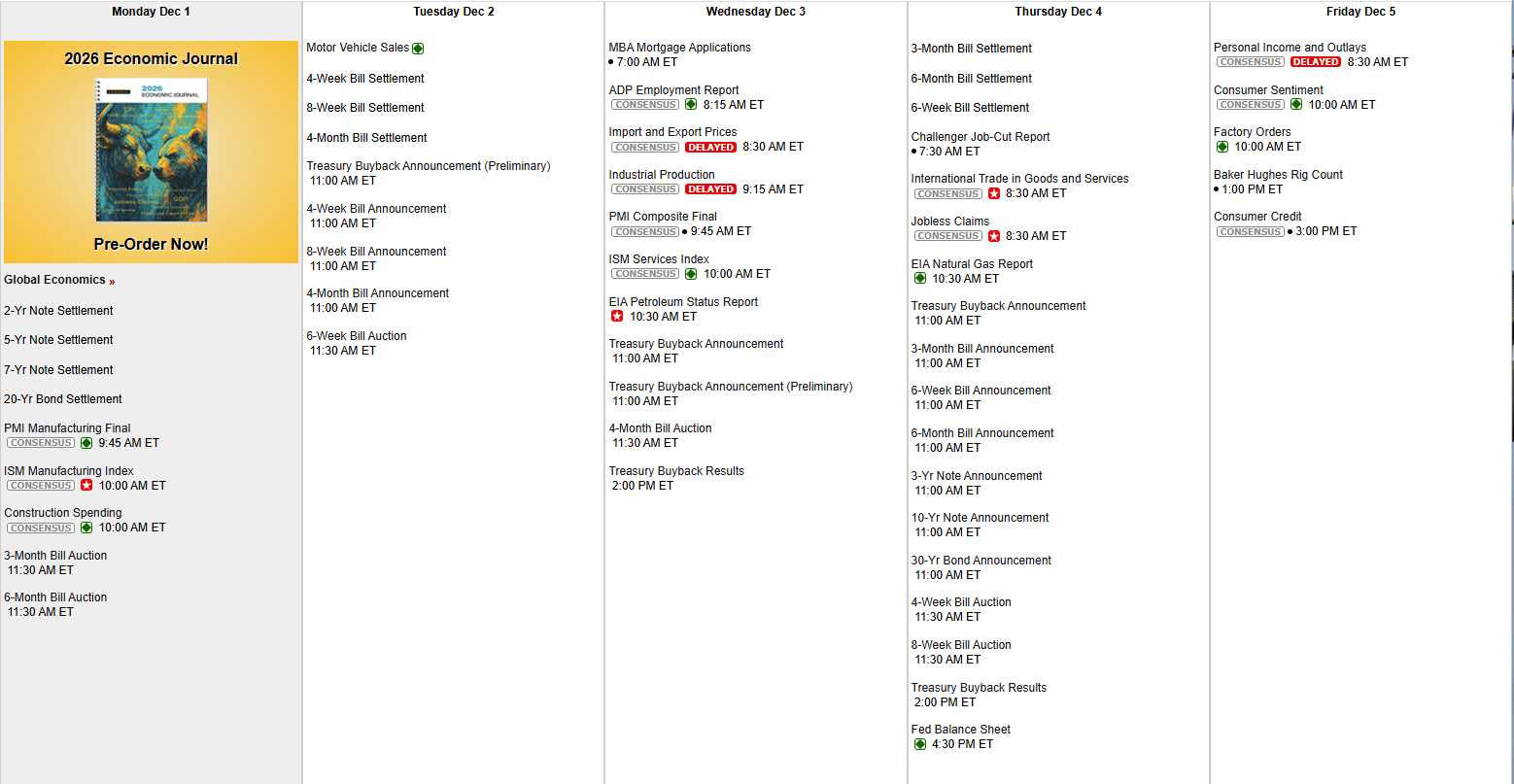

With the next Fed decision looming a week from Wednesday, we have no Fed speech and we MIGHT have the following data reports but, last week, half of our data reports were cancelled by the GOParty – Amerika’s Government has never looked more Chinese:

IF the data comes out, we’ll be sure to take a look at it in the Live Member Chat Room! Meanwhile, we still have a surprising amount of earnings reports, including some fun Retailers who will, hopefully, give us some clues on how Thanksgiving weekend actually went and how they think 2026 is shaping up in their forecasts.

The markets are always interesting – IF you survive them!