$82,818!

$82,818!

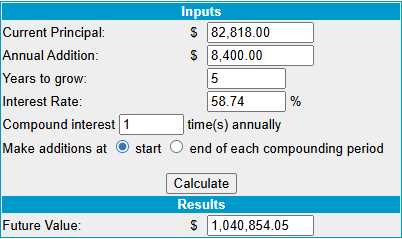

That’s up $2,370 ( since our Nov 4th Review) but $700 of that was our monthly deposit so we only gained net $1, 670 (2%) in the past month but I’ll take it given how choppy the market has been. We’re still on track to hit our $1M goal by the end of 2030 and, when I say “on track” I mean over 20 years ahead of our original 30-year goal!

We are now pacing at an annualized 57.84% and that’s dropped off from 59.9% last month and we know it’s an unsustainable pace but we still hate to see it go. Most of the damage that was done this month was due to the declining VIX, which devalued some of our long premiums. Either way, we still have $917,182 (1,107%) left to gain and we have $35,707 in CASH!!! in a portfolio that’s using NO margin – so it’s all ready to deploy…

If you are just coming in, we began on Aug 25th, 2022 ago with $700 and each month we added $700 ($28,000) so far and each month we find things to buy under NO MARGIN rules (for 401K/IRA players). This is, despite the huge gains, a fairly conservative portfolio and we are generally quick to take our profits and run – as we always seem to find new opportunities to make more. This year, our 10 prior Portfolio Reviews were:

- How to Become a Millionaire by Investing $700 per Month – Part 39/360

- How to Become a Millionaire by Investing $700 per Month – Part 38/360

-

How to Become a Millionaire by Investing $700 per Month – Part 37/360 – Year 4 Begins!

-

How to Become a Millionaire by Investing $700 per Month – Part 36/360 – 3 Years In!

- How to Become a Millionaire by Investing $700 per Month – Part 35/360

- How to Become a Millionaire by Investing $700 per Month – Part 34/360

- How to Become a Millionaire (EVEN in This Market) by Investing $700 per Month – Part 33/360

- How to Become a Millionaire – EVEN in a CRASH!!! by Investing $700 per Month – Part 32/360

- How to Become a Millionaire by Investing $700 per Month – Part 31/360

- How to Become a Millionaire by Investing $700 per Month – Part 30/360

- How to Become a Millionaire by Investing $700 per Month – Part 29/360

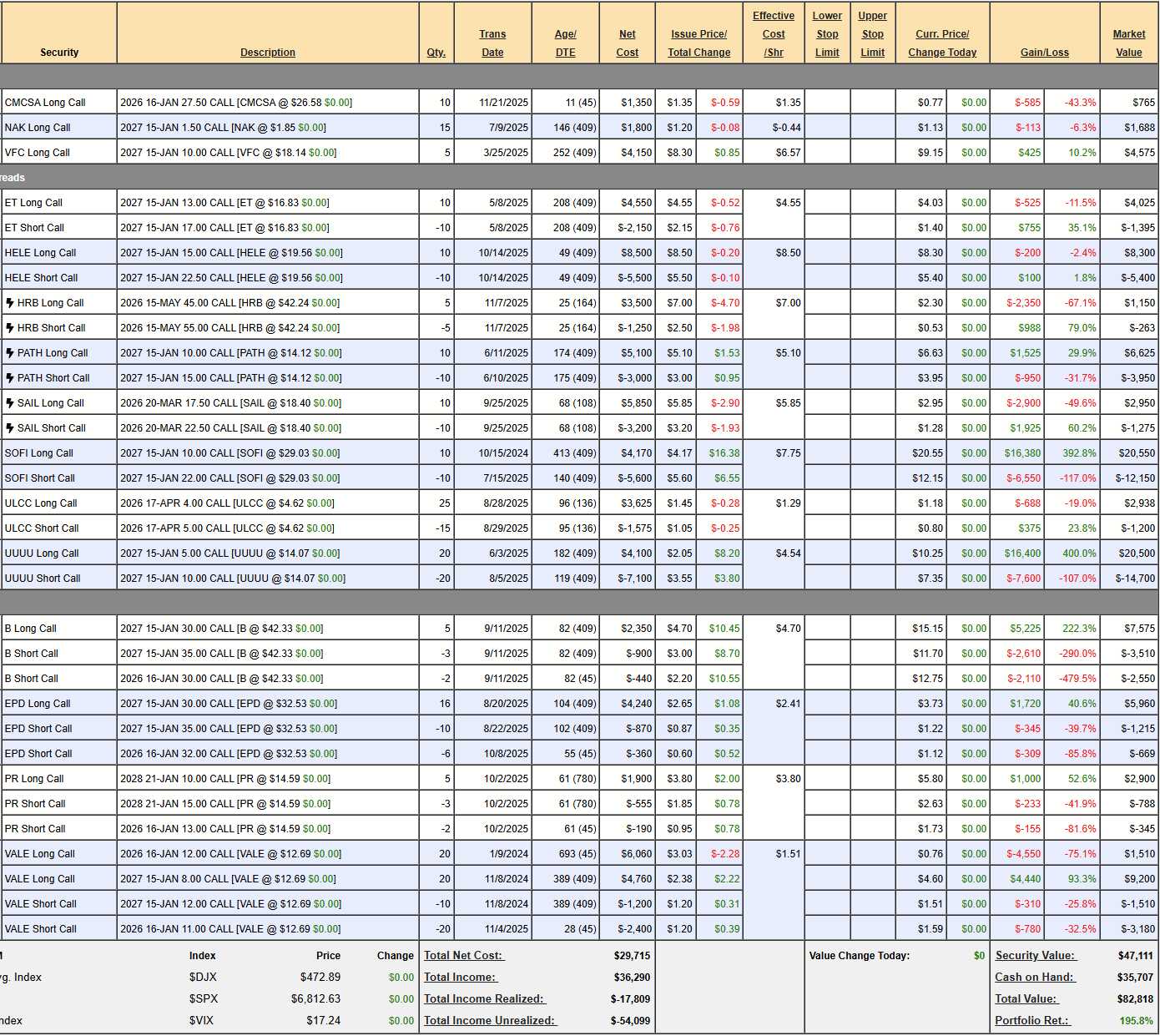

Now you are all caught up. We have just $47,111 in positions at the moment and the rest is CASH ($35,707) and we need to re-establish our SQQQ hedge and THEN we will certainly be looking for more things to buy – either here today or in our Live Member Chat Room in the month ahead.

As usual, before we consider adding positions, we first see if any of our current positions (15 now) need to be adjusted:

-

- CMCSA – This is new and not going well so far. The problem is they bid on WBA and the possibility of them overpaying that much is keeping the stock down. Last night, NFLX put in a cash offer so, hopefully, CMCSA is out. We need $28.85 by Jan to win this one so it’s a real gamble not to cover but there’s also no good way to “fix” it without potentially throwing good money after bad so we’ll watch it closely.

-

- NAK – We nailed it last month with the short puts and the short calls expiring worthless. We don’t believe in NAK AT ALL – this is just a trading vehicle to sell short-term premium. Way back in March, we had sold 10 Nov $1.50 calls for 0.50 ($500) and 10 Nov $1 puts for $1.20 ($1,200 – because nobody believes in them) and they both expired worthless for a $1,700 profit against what was an $1,800 position.

- We COULD cash out for $1,688 and that would be our profit or we could sell 10 2027 $1.50 puts for 0.75 ($750) and 10 2027 $2 calls for $1.10 ($1,100) and that’s more than we can sell for now and there’s a possibility (at $2+) of making another $750 and that SOUNDS good but it would require $1,500 in margin and I think we can do better with $1,500 than make $750 – especially as I don’t really think this is a $2 stock. So let’s cash it out.

-

- VFC – Took a while to get in gear but we’re on our way now. Last month I said “Risky, but I like it!” as we bought back the short calls and now we’re looking less risky at $4,575 and we can take $1,425 (31.1%) by selling 5 May $18 calls for $2.85, which leaves us in a net $4,500 spread at net $3,150 with $1,350 (42.8%) of upside potential PLUS another $1,425 (31.1%) sale along the way. Worth keeping!

-

- ET – Almost at our goal but only net $2,630 on the $4,000 spread so there’s $1,370 (52%) upside potential, which is actually good for a new trade – even if you missed our original net $2,400 entry.

-

- HELE – This is a $7,500 spread that is $4,560 in the money at net $2,900, which is $100 CHEAPER than our entry. There is $4,600 (158%) of upside potential and this is SO GOOD FOR A NEW TRADE that I have to restrain myself from doubling down – again!

-

- HRB – They screwed us by giving crappy guidance after beating on earnings but the IRS ended their automated filing assistance program and that HAS to drive more business to HRB, doesn’t it? I am very frustrated but the Nov $45 calls are $3.85 so let’s do that roll (and we should get $2.85 for the May $45s) for $500 and buy 5 more for $1,925 and sell 10 May $50 calls for $1.30 ($1,300) and buy back the 5 short May $55 calls ($263) to subsidize it.

- We were in for net $1,750 and we just spent $1,388 to double down and buy more time so that’s all in for net $3,138 now and if we hit $50 it’s $5,000 back so upside potential is $1,862 (59.3%) at a much lower strike than we began with. THAT is a Salvage Play!

-

- PATH – On track at net $2,675 on the $5,000 spread with $2,325 (86.9%) of upside potential so – good for a new trade!

-

- SAIL – Earnings next week, so we shall see. We’re down about $1,000 at the moment but prior earnings were beat, beat and beat so a beat and raise would be nice at this point. We only have until March so we’ll have to keep a close eye on them. At net $1,675 it’s a $5,000 spread that’s $1,000 in the money so $3,325 upside potential if we’re right about them.

-

- SOFI – We’re triple-dipping on this one! Miles over our goal at net $8,400 on the $12,000 spread so we still have $3,600 (42.8%) upside potential and it WOULD be good for a new trade but 42.8% drags us down at this point… NOT that I’d throw it away as we don’t need the cash at the moment and there’s a high degree of probability that offsets the “sub-par” returns.

-

- ULCC – We’re almost at goal but the spread is showing a net loss so far. We’re at net $1,738 and we’re $1,550 in the money on the $2,500 spread so there’s $762 (43.8%) of upside potential but here’s a magic trick – let’s sell 10 more April $5 calls for 0.80 ($800) and now we’re at net $938 with $1,562 (166%) left to gain and THAT is now good for a new trade!

- We took a risk by only partly covering, it didn’t go that well so NOW we’re fully covering and changing the dynamics of the trade (and taking half our risk off the table). It’s NOT because we’ve lost faith but because it’s a short time-frame and we had a weak month – so I’m being more conservative than I was last month – when we had gained 12% in the portfolio and were willing to take some chances.

-

- UUUU – Blew over our target and now net $5,800 on the $10,000 spread so a very healthy $4,200 (72.4%) upside potential if UUUU doesn’t drop $4 (28.5%) in 2026 makes this VERY GOOD for a new trade.

-

- B – Unfortunately, we got blown out by our short Jan calls as B shot up $10 since last month. Now what? The short $30 calls are $12.75 and the 2027 $35 calls are $11.70 so $1 ($500) can buy us $2,500 worth of additional headroom while still leaving us well-covered – problem solved!

Of course the 2028 $40s are $11.90 so problem even more solved there but let’s do a math trick with the following:

-

-

- Roll 5 B 2027 $30 calls at $15.15 ($7,575) to 8 B 2028 $32 calls at $15.50 ($12,400)

- Roll 3 B short 2028 $35 calls at $11.70 ($3,510) to 5 short 2028 $40 calls at $11.90 ($5,950)

- Roll 2 short Jan $30 calls at $12.75 ($2,550) to 3 short 2028 $40 calls at $11.90 ($3,570)

-

That set of rolls cost us net $1,365 and we originally spent net $1,010 so now we’re in what is now a $6,400 spread at net $2,375 with $4,025 (169%) upside potential over 2 years.

-

- Originally it was net $1,010 on the $2,500 spread with $1,490 (147%) upside potential so our Salvage Play has more than doubled our potential gains – not bad for something that “ran away” on us…

-

- EPD – We doubled down on this one last month and caught a nice pop! It’s at our Jan goal already so hopefully not much higher for now. We’re at net $4,076 on the $8,000 spread so there’s $3,924 (96.2%) upside potential and still good for a new trade.

-

- PR – One of our new trades! Up already and almost at goal at net $1,767 on the $2,500 spread with $733 (41.4%) left to gain. This one you missed!

-

- VALE – Wow, this is so confusing – they are actually going up… We gave up on our original position (the 20 Jan $12 calls) and they weren’t even worth selling so, instead, we used them as a buffer to sell 20 Jan $11s for $2,400 and now those are burning us – but we’re fine with that. I think we’ll have to wait and see how this plays out as it will be tricky to adjust but we made up most of the original loss – so I’m thrilled!

- If I were adjusting now I’d buy back the short 2027 $12 calls ($1,510), cash in the long Jan $12s ($1,510) and roll the short Jan $11s ($3,180) to the 2027 $12s ($3,800) and that would be net $620 in our pocket off our current net $6,020 so we’re leaving net $5,400 in play on the $8,000 spread with $2,600 (48%) upside potential – hopefully we can do better.

Overall, we managed to take $1,160 off the table on our adjustments, which leaves us with about $36,867 in CASH!!! to go shopping with and our overall upside potential is now $35,476 (42.8%) and that is well BELOW our 58.74% average annual gain – which means we need to get to work and find some new trade ideas!

| Position | Action Taken | Cost / (Income) | Upside Potential ($) | Upside Potential (%) | Notes |

| CMCSA | None | $0 | TBD | TBD | New position; watching closely |

| NAK | Cash Out | ($1,688) | N/A | N/A | Speculative trade closed for profit |

| VFC | Sell Calls | ($1,425) | $1,350 | 42.8% | Locking in gains; reducing risk |

| ET | None | $0 | $1,370 | 52% | Good for a new trade |

| HELE | None | $0 | $4,600 | 158% | SO GOOD for a new trade |

| HRB | Roll & Buy More | $1,388 | $1,862 | 59.3% | Salvage Play; doubled down |

| PATH | None | $0 | $2,325 | 86.9% | Good for a new trade |

| SAIL | None | $0 | $3,325 | ~198% | Earnings next week |

| SOFI | None | $0 | $3,600 | 42.8% | Triple-dipping; high probability |

| ULCC | Sell Calls | ($800) | $1,562 | 166% | Good for a new trade |

| UUUU | None | $0 | $4,200 | 72.4% | Very good for a new trade |

| B | Roll & Adjust | $1,365 | $4,025 | 169% | Salvage Play; extended to 2028 |

| EPD | None | $0 | $3,924 | 96.2% | Still good for a new trade |

| PR | None | $0 | $733 | 41.4% | Almost at goal |

| VALE | None | $0 | ~$1,980 | ~33% | Holding; tricky to adjust |

| TOTALS | Net Income Generated | ($1,160) | ~$35,476 | — | Est. Cash on Hand: ~$36,867 |

Key Takeaways:

-

Cash Generation: The portfolio adjustments this month (closing NAK, selling calls on VFC and ULCC) generated a net income of $1,160, adding to the existing cash pile.

-

Salvage Plays: Aggressive “Salvage Plays” were executed for HRB and B to recover positions and extend their duration, significantly increasing their upside potential.

-

New Opportunities: HELE, PATH, ULCC, and UUUU are explicitly highlighted as excellent entry points for new trades.

-

Hedge Pending: The SQQQ hedge needs to be re-established, which is a priority before adding new long positions.

Fortunately we have lots of CASH!!! so we just need to be mindful this month and do some serious bargain-shopping. As noted above – we NEED to put hedges back on so let’s add the following hedge:

-

-

- Buy 7 2028 $70 calls for $26 ($18,200)

- Sell 5 2028 $115 calls for $20 ($10,000)

- Sell 2 March $70 calls for $8.50 ($1,700)

-

That’s net $6,500 on the $31,500 spread so we have $25,000 worth of downside protection. Crazy, right?

Over time, we will sell 6 or 7 more short calls and hopefully draw an income in addition to covering the spread. Since the 2028 $115s are $20 and dwarf the price of the short calls ($8.50), we assume we can always roll out to 7/7 $45 spread in 2028 and, of course, it’s a 3x ultra-short ETF so a 20% drop in the Nasdaq is a 60% boost in SQQQ from $67.18 to $107.48 – hence our target.

If you want to learn to trade like this.

If you want to learn to hedge like this.

We’re happy to show you how…