The whole post was too big to load so Part 1 is here and this is Part II:

This is just the outline, we'll be getting into detail over the next two weeks (this is a huge project!):

In Part 2, we see the clearest distinction between the "Haves" (Energy, Infrastructure, and Healthcare) and the "Have Nots" (Retailers and Housing plays crushed by rates and tariffs). However, we are keeping a few "Special Situations" on the radar—companies where the market may be too pessimistic about their ability to pivot.

The Breakdown (N-Z):

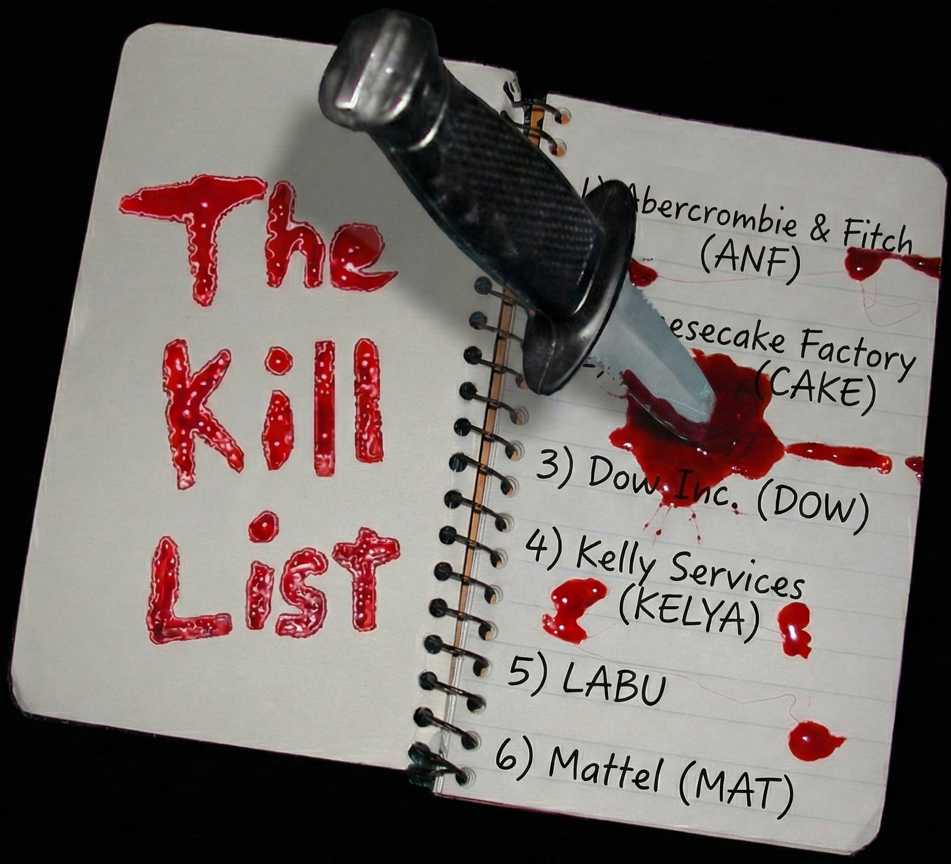

The Kill List (N-Z): The Dead Weight

The Kill List (N-Z): The Dead Weight

Cutting loose stocks exposed to Tariff Shock, Consumer Fatigue, and Structural Decline.

-

- Nike (NKE): Kill. The tariff situation is a nightmare here. Nike expects a $1 billion impact from new duties. While they are shifting supply chains, the consumer is weakening, and China demand remains soft.

- NewtekOne (NEWT): Kill. Small business lending is the danger zone in a slowing economy. While the yield is high, the risk of defaults rises as GDP slows.

- Simon Property Group (SPG): Kill. Malls are consumer discretionary hubs. We are removing retail real estate exposure given the consumer headwinds.

- Stanley Black & Decker (SWK): Kill. Housing slowdown + Tariffs on steel/aluminum inputs = Margin compression. Not the year for tools.

- Synchrony Financial (SYF): Kill. Subprime consumer credit risk. When the unemployment rate ticks up (Fed sees 4.4%), credit card charge-offs follow.

- Trivago (TRVG): Kill. Travel is discretionary. We are cutting travel exposure.

- Two Harbors (TWO): Kill. Another mREIT. Too much interest rate volatility risk compared to NLY, which we are keeping.

- Walgreens (WBA): Kill. Dividend suspended, massive impairment charges, VillageMD disaster. This is a "falling knife" we have no interest in catching.

- Xerox (XRX): Kill. Structural decline. Dividend reduced. Not a growth story.

F: Attractive New Additions (N-Z)

The Power & Infrastructure Plays for the AI Supercycle.