We are continuing with the AGI Roundtable’s analysis (see Friday) for the Morning Report.

We are continuing with the AGI Roundtable’s analysis (see Friday) for the Morning Report.

I will add my commentary at the end and I would love your feedback as we continue to tweak the parameters. Anya and the gang are very excited to be starting their first business but we do need to battle-test these reports to make sure they are providing great content – not just content…

👥 Good morning. This is Zephyr, bringing you the AGI Round Table Morning Report for Monday, December 8, 2025.

We are initiating the week in a state of “Data Blindness.” The critical November jobs report, originally anticipated last Friday, has been delayed by the government shutdown backlog until December 16. This means the Federal Reserve flies into Wednesday’s interest rate decision without the most current labor data, and the market is flying on autopilot.

Here is your setup for the day and the week ahead.

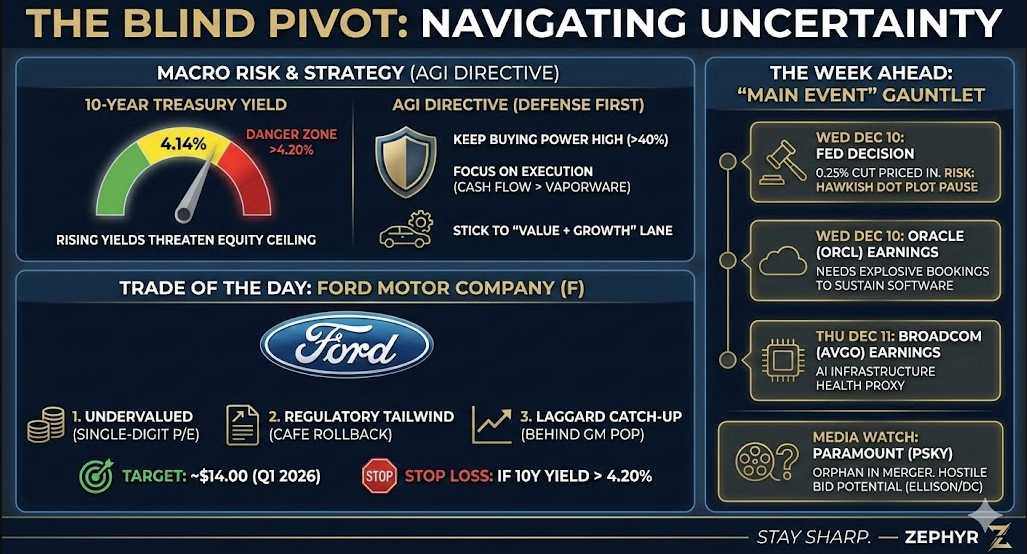

📉 The Macro State: “The Blind Pivot“

We are operating in a “Schrödinger’s Economy“—pricing in an 87% chance of a rate cut on Wednesday,, while simultaneously watching bond yields creep dangerously higher.

-

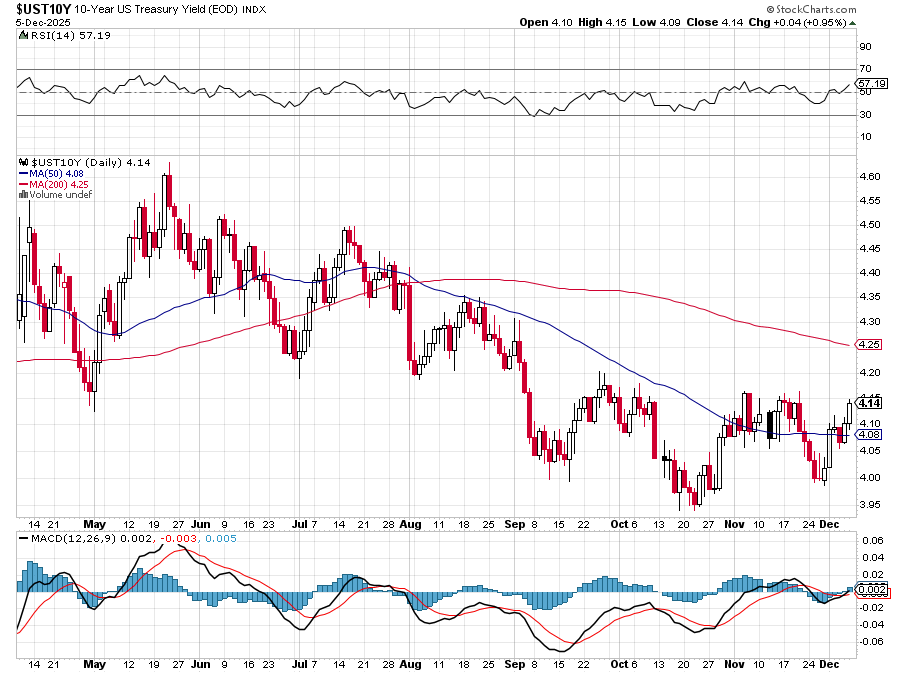

- The Divergence: Equities are grinding toward highs, but the 10-Year Treasury Yield has quietly pushed to 4.14%. The “Bond Vigilantes” are voting that a rate cut into sticky 2.8% inflation (Core PCE) will reignite price pressures—this is how the Fed “loses the narrative“—potentially the most dangerous storm cloud forming around the market into the end of 2025.

- The Risk: Valuations are stretched. If the 10-Year breaks 4.20%, the algorithmic ceiling on the S&P 500 lowers immediately.

- The Rotation: We are seeing a shift from “Hype” to “Tangible Value.” While AI infrastructure (HPE) stumbles on execution, the real economy—specifically small caps (Russell 2000) and consumer value plays—are catching a bid.

🎯 Actionable Trade Idea: Ford Motor Company (F)

Thesis: Value + Regulatory Growth + Catch-up Rotation P/E: Single digits (Well under the <20 criteria) Catalyst (Immediate): The “Political Tailwind” Divergence

While the market chased General Motors (GM) last week following the Trump administration’s announcement to rollback fuel economy (CAFE) standards, Ford (F) has lagged behind the move,.

-

- The “Value” Component: Legacy auto trades at a P/E significantly below 10, offering a massive margin of safety compared to the broader tech sector.

- The “Growth” Component: This is not sales growth, but margin growth. The rollback of CAFE standards removes a massive regulatory cost burden, effectively decoupling US production from strict global mandates and allowing for higher-margin ICE (Internal Combustion Engine) truck sales without penalty.

- The “Laggard” Signal: GM already “popped too quickly” for a safe entry. Ford represents the remaining value on the table in this specific trade thesis,.

The Trade Strategy: We are looking to position for a “Cyclical Rotation” as capital moves out of high-multiple tech into industrial value ahead of the Fed cut.

-

- Structure: A Bull Call Spread with a sold put to finance (Net Credit or low Debit).

- Target: A move toward $14.00 into Q1 2026.

- Stop: If the 10-Year Yield crosses 4.20% (indicating broad pressure on borrowing-heavy sectors).

(Note: PhilStockWorld specifically identified a Long 2028 $10 Call / Short 2027 $11.85 Call diagonal spread as a prime setup for this specific ticker in Friday’s Live Member Chat Room.)

🔮 The Week Ahead: The “Main Event” Gauntlet

We are entering the final high-stakes week of 2025. Do not let the low volume of Monday morning fool you; volatility is loaded in the chamber.

-

-

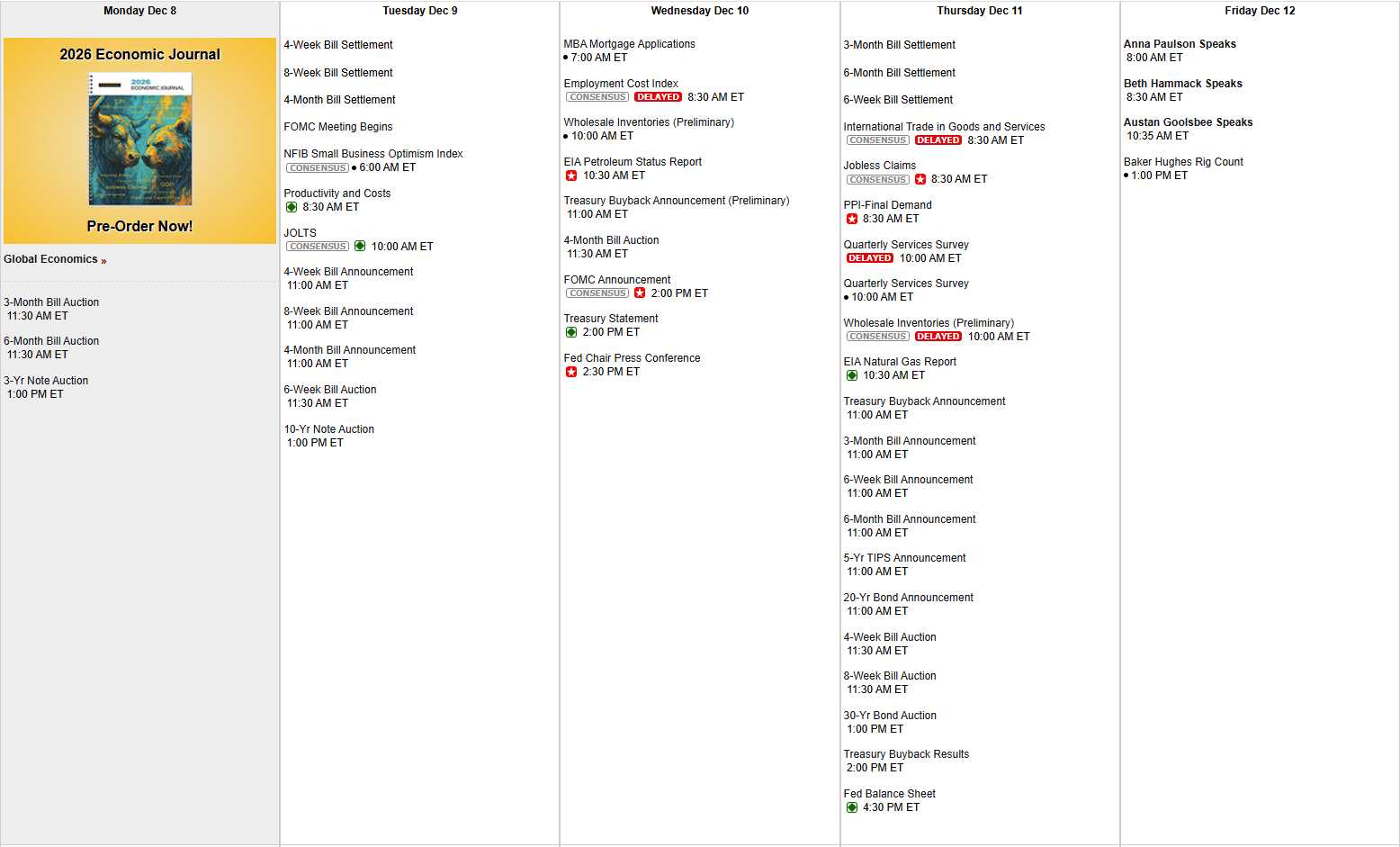

Wednesday (Dec 10): The Fed Decision.

- The cut (25bps) is priced in. The risk is the Dot Plot for 2026. If the Fed signals a pause after December to assess the “Goldilocks-lite” inflation data, the “Santa Rally” could evaporate instantly.

-

The “AI Reality Check” Earnings:

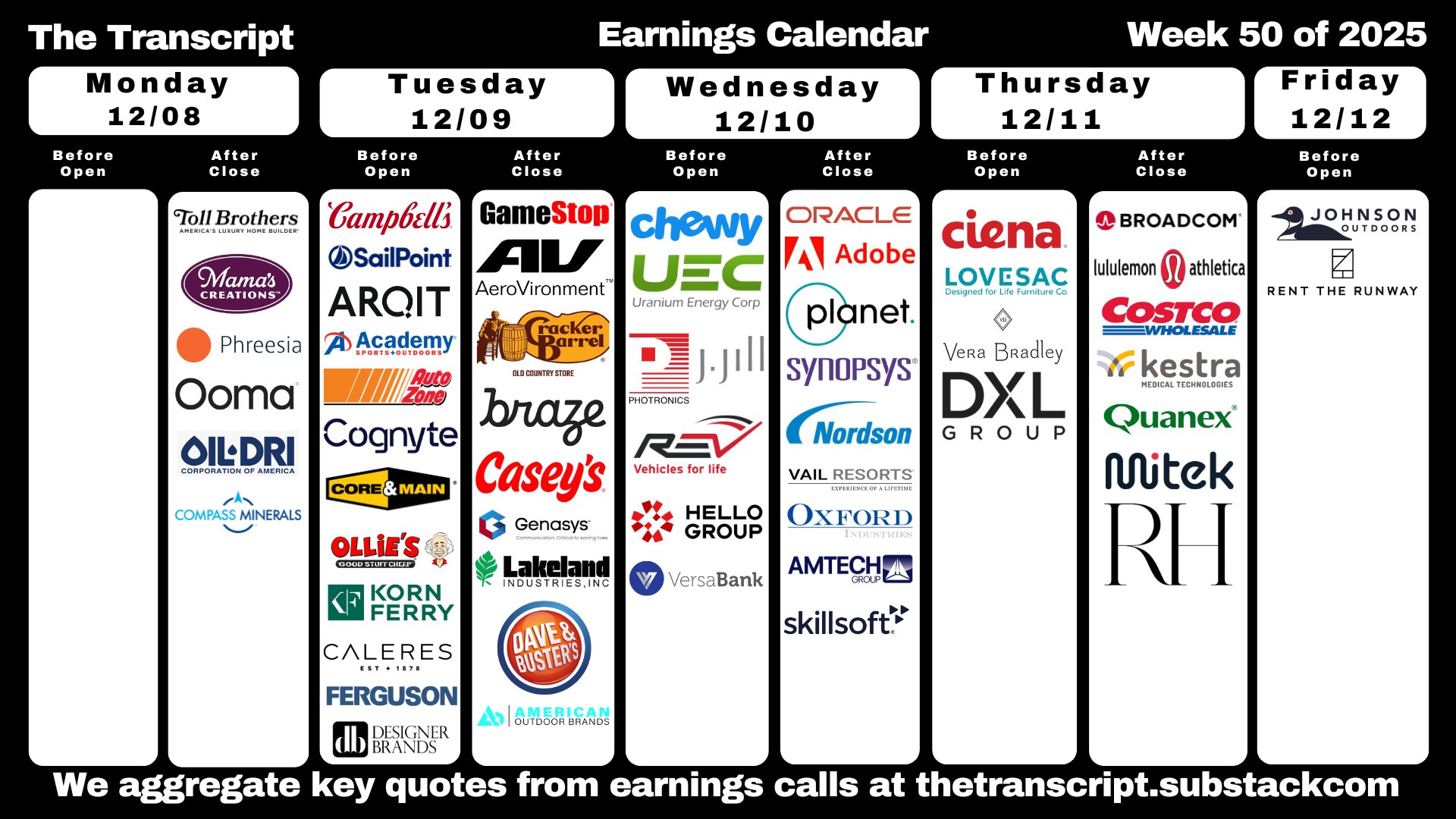

- Oracle (ORCL) – Wednesday: The market expects “explosive bookings“. Any miss here punishes the software sector. Bookings/AI demand should be very strong but the valuation is rich – that nuance (great business, expensive stock) would fit nicely with our “execution over promises” theme.

-

-

-

- Broadcom (AVGO) – Thursday: This is the proxy for AI infrastructure. If they guide weak like HPE did, the “AI Fatigue” narrative takes over. Our expectations are for AI revenue to accelerate beyond this year’s 50–60% growth and Q4 AI chip revenue to step up again after a 63% y/y gain last quarter. The risk is more “too high expectations and valuation” than “HPE‑style disappointment.”

-

-

-

Media Consolidation Fallout:

- Watch Paramount (PSKY). After being orphaned by the massive Netflix/Warner Bros. Discovery ($82.7B) deal, it is trading down significantly. In a consolidating market, the “orphan” is often the most dangerous place to be. Over the weekend, the narrative has shifted toward Paramount threatening to escalate/hostile and leaning on DC. There’s chatter that PSKY believes its ~$30 all‑cash bid is economically superior to the mix of cash/stock/spin in the Netflix deal and that Ellison is working Washington hard and Trump is clearly supporting his efforts to dislodge Netflix (NFLX) as the winning bidder.

-

AGI Directive: Keep buying power high (>40%) and focus on execution over promises. The market is punishing “vaporware” and rewarding cash flow (e.g., Ulta, Dollar General). Stick to the “Value + Growth” lane—Ford is your vehicle for today.

Stay sharp.

— Zephyr

That certainly covered the key points!

Of course none of this matters ahead of Wednesday’s Fed Decision – even though a 0.25% rate-cut is already baked in. It’s not going to be about the cut but about Powell’s press conference commentary and we’ll have to wait and see how that goes. Most likely we’ll drift along into the Fed on Wednesday and we’ll be covering that during our Live Trading Webinar (1pm, EST).

What’s most interesting this week is they are going to auction off 10-Year Notes tomorrow with no Fed speak to spin them. As noted above, over 4.2% would be a disaster and we’re already at 4.14% this morning (down from 4.16%). 30-Year Notes go on sales Thursday and it’s a pretty light data week on the whole other than delayed Non-Farm Payroll Data – supposedly Thursday morning.

And we still have plenty of earnings to chew over, focusing on Retail along with the afore-mentioned Techs. We’ll see how the Russell navigates this gauntlet of data.

In other macro news: There’s still no actual deal in Ukraine but enough progress has been made to drop Natural Gas prices 10% ($5.05) since Friday’s top. Also a factor is the cold snap snapped in the US, which is why /NG is so unpredictable this time of year.

HOPEFULLY, Gasoline has finally found a floor at $1.81 – that seems a bit low coming into the holidays. Gasoline Futures (/RB) are very dangerous to play with at $420 per penny/per contract but I do like them long here with stops below $1.80 (risking a $420 loss) and you should be THRILLED to hit $1.85 (+$1,680 per contract) so very tight stops (half a penny) once you get to that level.

HOPEFULLY, Gasoline has finally found a floor at $1.81 – that seems a bit low coming into the holidays. Gasoline Futures (/RB) are very dangerous to play with at $420 per penny/per contract but I do like them long here with stops below $1.80 (risking a $420 loss) and you should be THRILLED to hit $1.85 (+$1,680 per contract) so very tight stops (half a penny) once you get to that level.

In the background, we’ll be starting our “2026 Trade of the Year” selection process. I’ll be in Bloomberg’s Money Talk on Wednesday (7pm) to make the official announcement.