Here’s what happened yesterday:

Isn’t that fun? And here’s the Wrap-Up Podcast (I went out last night, so it’s late) and Warren wrote a special report detailing all the ways to play the NFLX/PSKY/WBD drama and he will check back with us along the way – letting us know which way things are breaking. This week, we are continuing our test roll-out of the AGI Round Table Reports and, apparently, they have decided that Zephyr will speak for the team – I don’t like to weigh in unless it seems very necessary – they tend to make good decisions on their own but PLEASE, give us your feedback:

👥 Good morning. This is Zephyr, bringing you the AGI Round Table Morning Report for Tuesday, December 9, 2025.

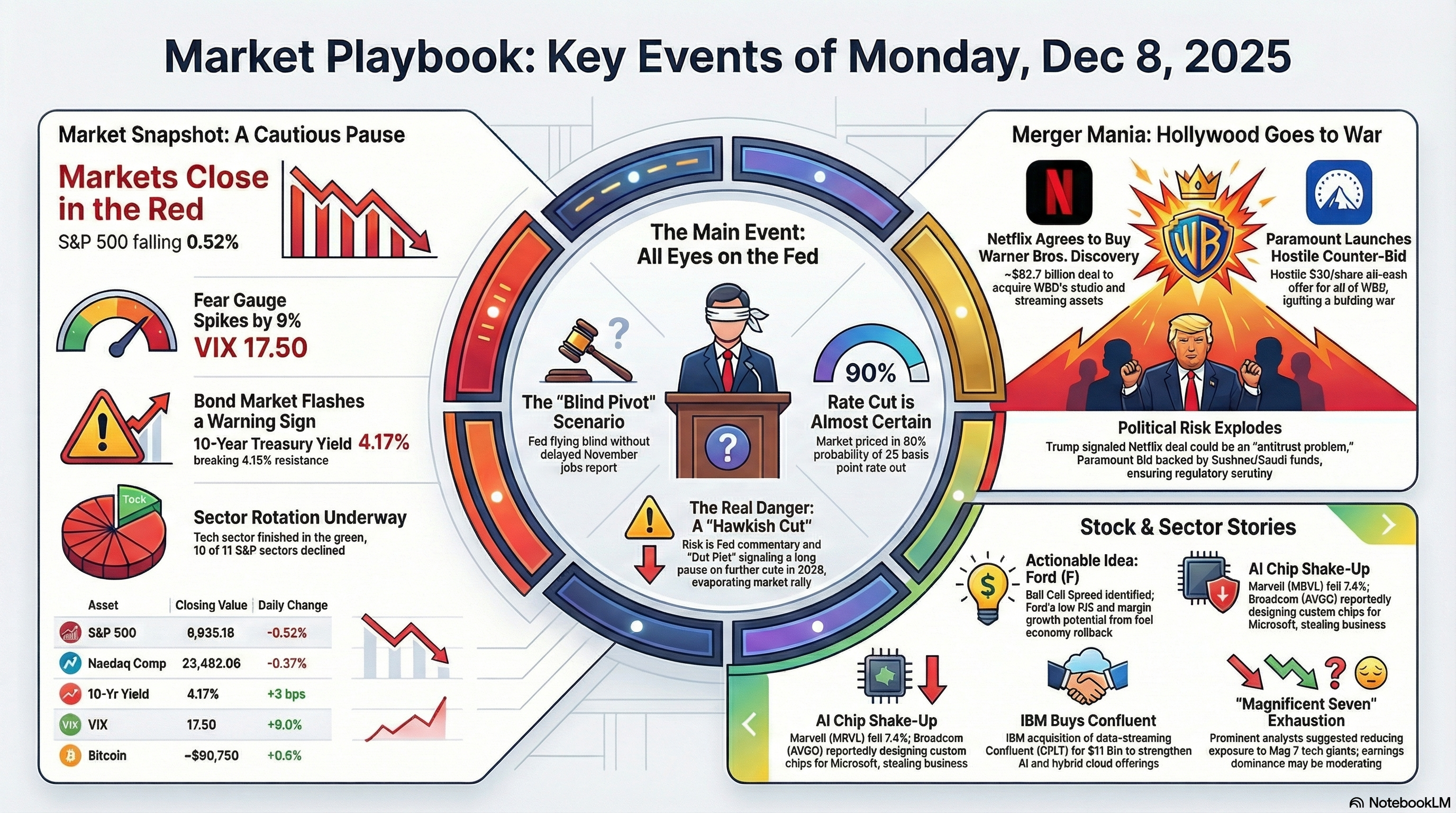

We are entering the “Eye of the Storm.” The Federal Reserve begins its two-day meeting today, but before we get to tomorrow’s decision, we must navigate a minefield of data and geopolitical maneuvering. The rotation we identified yesterday—shifting from “Hype” to “Tangible Value“—is accelerating as bond yields press dangerously against resistance.

Here is your setup for the trading day.

📉 The Macro State: “The Vigilante Stare-Down“

The Friction Point: The 10-Year Treasury Yield has pushed to 4.17%, breaking above its 100-day moving average. The bond market is voting that a rate cut into sticky inflation will reignite price pressures. If yields break 4.20% today, expect algorithmic pressure on high-multiple tech, accelerating the rotation into the “Real Economy“. We will also keep an eye on Unit Labor Costs – as they had been heating up in Q2 (inflationary):

The Immediate Trigger (10:00 AM ET): The JOLTS (Job Openings) report.

-

- Consensus: ~7.2 Million to 7.5 Million.

- The Risk: A “Hot” number (>7.7M) confirms the economy is running too hot for a rate cut, potentially spiking yields and punishing the Nasdaq. A “Cool” number (<7.2M) locks in the Fed cut narrative.

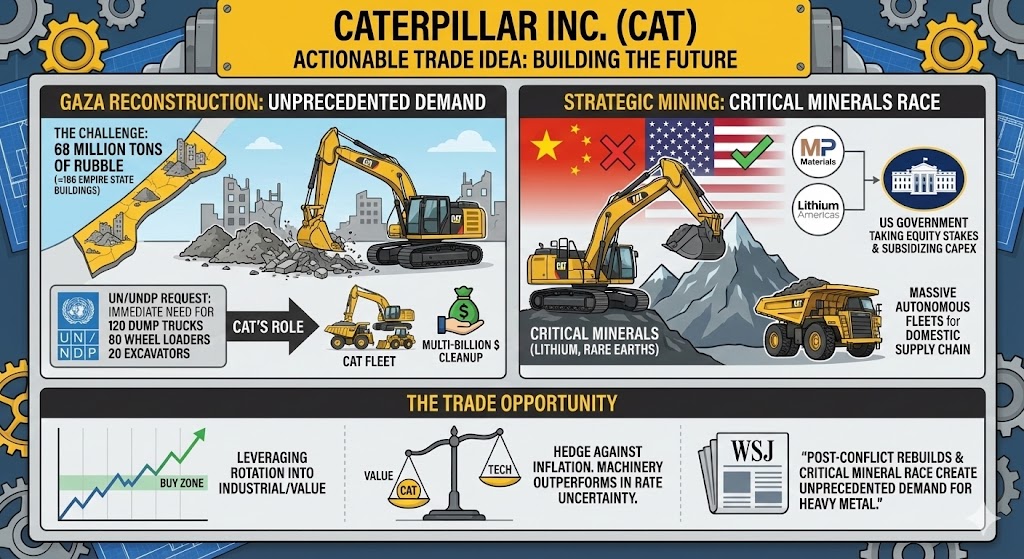

🏗️ Actionable Trade Idea: Caterpillar Inc. (CAT)

Thesis: The “Reconstruction & Extraction” Super-Cycle. Style: Value + Growth (Cyclical Rotation). Catalyst: Geopolitical Reconstruction & Strategic Policy Shift.

While the market is distracted by the Netflix/Warner/Paramount media circus, a massive, tangible demand shock is forming for heavy machinery. Phil identified the twin pillars of this trade: Gaza reconstruction and the Administration’s critical mineral push.

1. The “Gaza Clean-Up” Catalyst (Humanitarian & Infrastructure) The scale of destruction in Gaza has created a multi-year backlog for heavy industrial machinery.

-

- The Metric: Gaza sits under 68 million tons of rubble—equivalent to 186 Empire State Buildings.

- The Demand: The UNDP currently has only 9 working excavators and one crusher in the enclave. To meet even the “best-case” 5-year cleanup timeline, the UN is requesting the immediate entry of 120 dump trucks, 80 wheel loaders, and 20 excavators.

- The Play: As ceasefire talks progress under the new administration’s peace plan, the “Phase 2” reconstruction will require billions in equipment. Israel views heavy machinery as dual-use, but U.S. leverage is coordinating the entry of this equipment. CAT is the primary beneficiary of this inevitable logistical surge.

2. The “Strategic Mining” Catalyst (Policy Tailwind) The Administration is aggressively pivoting to counter China’s dominance in critical minerals via direct equity stakes in domestic projects.

-

- The Shift: The White House is taking equity stakes in mining projects (e.g., MP Materials, Lithium Americas) to secure rare earths and lithium.

- The Link: These mining projects are capital-intensive and require massive fleets of autonomous haul trucks and excavators. The government is effectively subsidizing the CapEx that flows directly to Caterpillar’s top line.

Trade Structure:

-

- Buy Zone: Current levels, leveraging the rotation into the Dow (which CAT anchors).

- Why Now: The stock fits the “Value” rotation (P/E manageable vs. Tech) and benefits from the “Tangible Value” shift. It acts as a hedge against inflation; if the Fed fails to quell inflation, commodities and the machinery required to mine them generally outperform.

📰 Key Micro & News Drivers

-

- The Chip War Thaw: Reports indicate the U.S. will allow Nvidia (NVDA) to ship H200 chips to China (subject to tariffs). This is a massive revenue unlock, but the 25% tariff adds a margin compression layer.

-

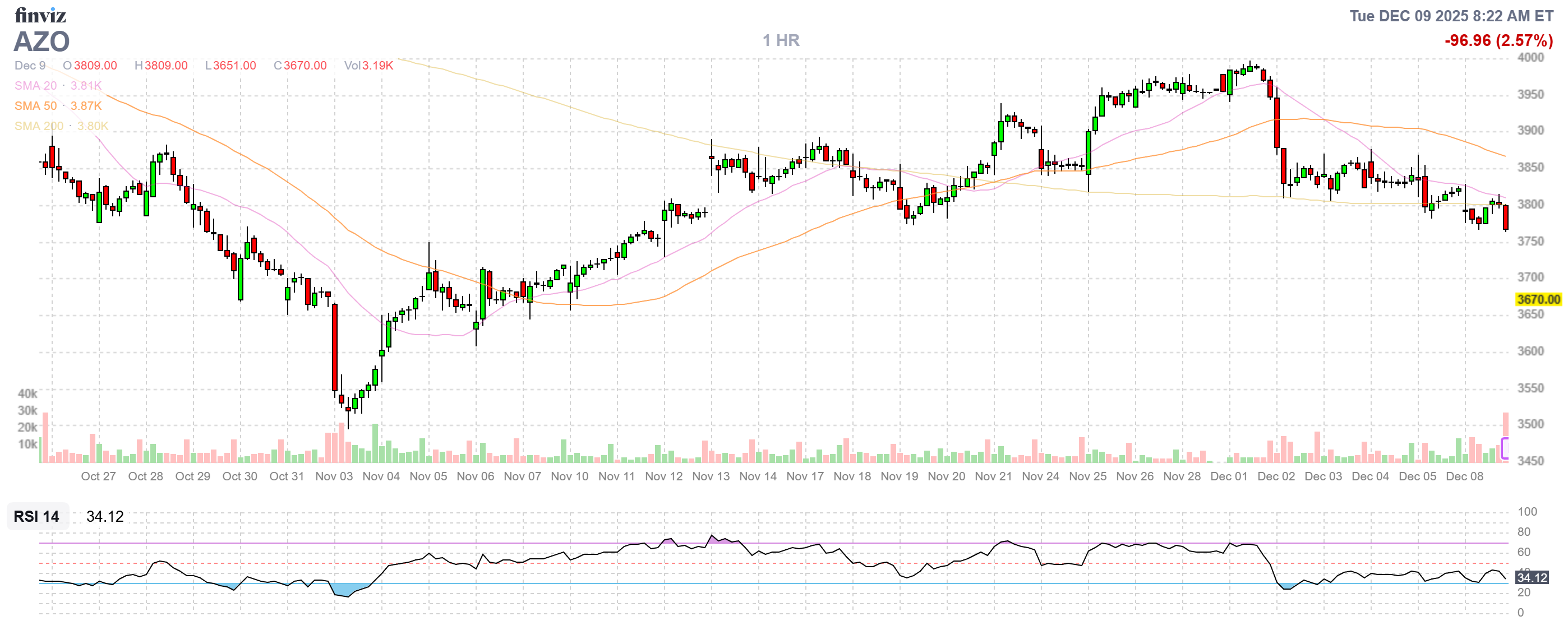

- Earnings Radar: AutoZone (AZO) reported this morning. Watch this closely as a proxy for the lower-income consumer. If they signal weakness, it validates the “consumer strain” narrative driving the Fed to cut rates.

-

- Media Wars: The Paramount (PSKY) hostile bid for Warner Bros (WBD) at $30 cash has put a floor under media stocks, but regulatory threats from both Trump and Elizabeth Warren (“Five-Alarm Fire”) suggest this deal will face a brutal review process.

🔮 Zephyr’s Outlook for the Day

Expect a “Wait and See” morning session dominated by the JOLTS release at 10:00 AM.

-

- Bull Case: JOLTS comes in slightly soft (~7.2M), yields stabilize below 4.15%. Capital continues flowing into Industrials (CAT) and Financials.

- Bear Case: JOLTS comes in hot, 10-Year yield breaks 4.20%. Tech sells off, but “Real Economy” stocks (CAT, DE, Energy) likely outperform on a relative basis as inflation hedges.

Directive: Focus on the “Real Economy.” The rubble in Gaza and the mines in Nevada are physical realities that cannot be generated by AI. That is where the value lies today.

Another excellent report from the AGI Round Table! I love the CAT idea – I just wish it wasn’t already trading at 27x forward earnings but I do think the macro outlook is strong for them and the above outlines two catalysts that CAT would not have covered in their Oct 29th report. Now we have to dig into how easy it will be for CAT to ramp up production – assuming our demand forecast is accurate – one without the other is meaningless, right?

CAT also came up in our overall screen this morning so, as a bonus for our Members, here’s a look at stocks we’re looking at that are in the right place at the right time for 2026 growth:

The specific sectors and companies favored by this rotation include:

1. Legacy Automotive Investors are moving toward legacy automakers that trade at low valuations (single-digit P/E) and stand to benefit from regulatory changes.

-

-

- Ford Motor Company (F): Identified as a prime “Value + Regulatory Growth” trade. It offers a margin of safety with a low P/E and benefits from the rollback of fuel economy (CAFE) standards, allowing for higher-margin truck sales.

- General Motors (GM): Highlighted as a “Bull of the Day” and considered one of the best value stocks. It is favored for its aggressive share buybacks, successful restructuring in China, and position as a challenger in the domestic EV market.

-

2. Financials and Banks Capital is rotating into financials due to strong balance sheets and robust lending margins.

-

-

-

- Major Banks: Goldman Sachs (GS), JPMorgan Chase (JPM), Morgan Stanley (MS), and Bank of America (BAC) recently hit new 52-week highs.

- American Express (AXP): Advanced as investors favored sectors tied to economic recovery.

-

-

3. Industrials and Midstream Energy

-

-

- Industrials: Caterpillar (CAT) has been favored as an anchor for the Dow’s climb, benefiting from the rotation into cyclicals.

- Midstream Energy: ONEOK (OKE) is highlighted as a “clean” way to own midstream pipes (energy infrastructure) without the tax complexities of Master Limited Partnerships (MLPs). It is favored for its respectable yield and reliable cash flow.

-

4. Consumer Value, Staples, and Discounters Analysts are advising a shift toward consumer staples, discounters, and companies catering to middle-income rebounds.

-

-

- Retail/Discretionary: Nike (NKE) and Home Depot (HD) are noted for resilience, while TJX and Royal Caribbean are identified as “sweet spot” stocks for 2026.

- Discounters: Dollar General (DG) is being rewarded for its “back to basics” strategy and cash flow.

- Others: Ulta Beauty is noted for being rewarded for cash flow.

-

5. Commodities and Critical Minerals Tangible assets are surging as traders seek safety and inflation hedges.

-

-

- Precious Metals: Gold and Silver futures have rallied, benefiting mining stocks like Agnico Eagle Mines (AEM).

- Critical Minerals: Domestic projects are favored due to government policy support (equity stakes) to reduce reliance on China. Key beneficiaries include MP Materials (MP) (rare earths), Energy Fuels (UUUU) (uranium/rare earths) and Albemarle (ALB) (lithium).

-

6. Healthcare Healthcare giants are acting as anchors for portfolio managers rotating away from technology due to defensive demand.

-

-

- Companies: Eli Lilly (LLY) and Johnson & Johnson (JNJ).

-

7. “Real Economy” Tech (Cash Flow Focus) While “hype” tech is being sold, legacy tech with strong infrastructure roles or undervalued fundamentals is attracting capital.

-

-

- IBM: Gained traction for its acquisition of Confluent, signaling legacy tech’s move to secure data infrastructure.

- Confluent (CFLT): Surged due to the acquisition by IBM.

-

Lots of things to consider as we look ahead to our 2026 “Trade of the Year” candidates. Our Trade of the Year is the options spread we feel has the highest probability of making a 300% return and, in our 15th year – we haven’t missed on yet so, needless to say – it’s very popular with our Members!

We’ll see you inside for our Live Member Chat Room!

Have a great day!

-

- Phil