We warned you about this:

The real problem here is Team Trump simply does not understand what the Federal Reserve actually does or how it works or how the rest of the World works… The most important miscalculation Trump makes is that America is in charge of the World and makes all the rules and that simply isn’t true. We WERE the leader the “Free World” (the one Neil Young wanted to keep in rockin’ in) but Trump has flushed that down the gold-plated toilet as well. Perhaps if he had read those classified documents instead of just storing them in the bathroom…

Unfortunately, monetary policy is about as exciting as watching paint dry BUT, right now, the Fed is currently the setting for a constitutional crisis that is less “C-SPAN” and more “Real Housewives of D.C.” – with higher stakes and less botox. This entire mess started because Donald Trump treats the U.S. Economy like a contractor he’s trying to stiff on a bill. He wants interest rates low, and he wants them low yesterday, regardless of inflation or reality – for that matter.

It began when Trump became obsessed with firing Fed Chair Jerome Powell. Trump has called Powell “grossly incompetent,” a “knucklehead,” a “numbskull” and claimed he has “real mental problems.” Trump even told his Treasury Secretary, Scott Bessent, in front of a room full of people, “If you don’t get [rates] fixed fast, I’m going to fire your ass,” and then implied he’d fire Powell right after.

Basically, Trump views the independent Federal Reserve not as a stabilizing Economic Institution but as a subordinate who won’t stop telling him he can’t eat ice cream for dinner.

Since firing Powell was legally difficult (Powell’s term doesn’t end until May 15th, 2026), Trump decided to go after what commentators called the “low-hanging fruit,” Governor Lisa Cook. Cook is the first Black woman to sit on the board, but Trump tried to fire her “for cause” based on allegations of mortgage fraud. The accusation was that she claimed two different homes as her “primary residence” to get better loan rates.

Here is where the hypocrisy becomes so dense it creates its own gravity well. ProPublica found that in 1993, Donald Trump signed two different mortgages just weeks apart, pledging that both a home in Palm Beach and another seven-bedroom mansion next door were his “principal residence“. Did he live there? No. He lived in Trump Tower. He rented the Florida homes out.

So, Trump is trying to fire a Black woman for doing the exact same thing he did, except his own administration cabinet members, including Treasury Secretary Scott Bessent and Attorney General Ken Paxton, have done similar things with their mortgages,. Trump’s defense? A spokesperson essentially said, “It’s different when he does it because he’s Trump.“

Cook sued, and a judge slapped a preliminary injunction on Trump, blocking the firing because – surprise! – you can’t just fire independent regulators because they won’t lower rates fast enough for your liking.

Unable to bulldoze Powell or Cook immediately, Trump filled a vacancy with Stephen Miran, a man who fits the definition of “political hack” like a hand fits a glove made of partisan rubber. Miran was the head of the White House Council of Economic Advisers. When nominated to the Fed – a body EXPLICITLY designed to be Independent of the White House – Miran said, “You know what? I won’t resign. I’ll just take unpaid leave“.

Unable to bulldoze Powell or Cook immediately, Trump filled a vacancy with Stephen Miran, a man who fits the definition of “political hack” like a hand fits a glove made of partisan rubber. Miran was the head of the White House Council of Economic Advisers. When nominated to the Fed – a body EXPLICITLY designed to be Independent of the White House – Miran said, “You know what? I won’t resign. I’ll just take unpaid leave“.

That is insane. That is like a referee taking a timeout during the Super Bowl to go put on a Chiefs jersey, throw a block and then coming back to measure the first down. He is effectively a White House employee sitting on the Fed board. Miran argues rates should be at 2.5% RIGHT NOW, while actual data suggests 4% may be pushing it. He has even written op-eds arguing that Fed independence is “incompatible with a democratic system“. He is literally there to dismantle the institution from the inside!

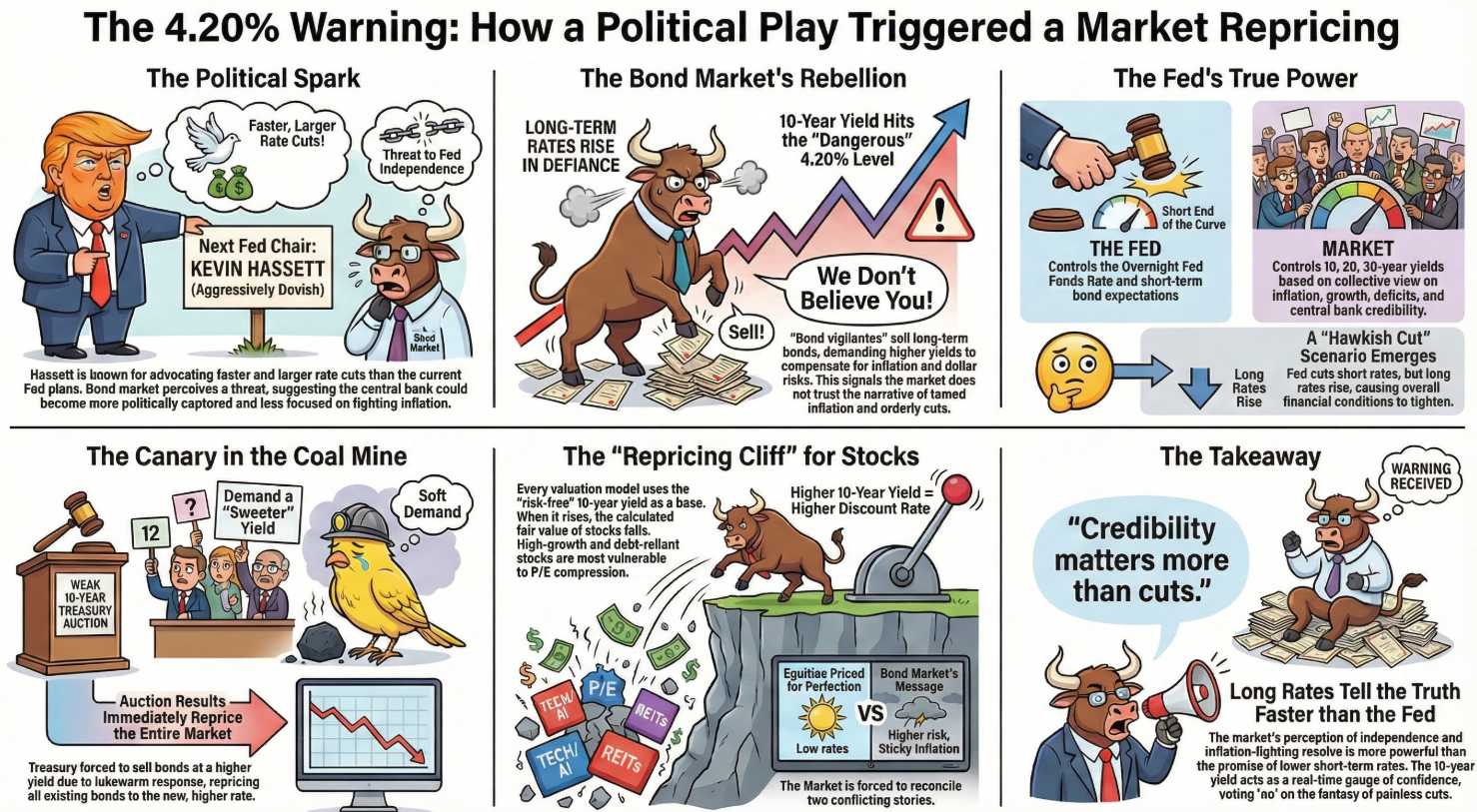

So, you have a President threatening to fire the Chair, a witch hunt against Governor Cook, and a White House staffer taking a “gap year” on the Fed board. How is the world reacting? Badly… The bond market began screaming “Stranger Danger!” when things got even stranger as Trump floated the idea of nominating Kevin Hassett as the potential replacement for Fed Chair Powell.

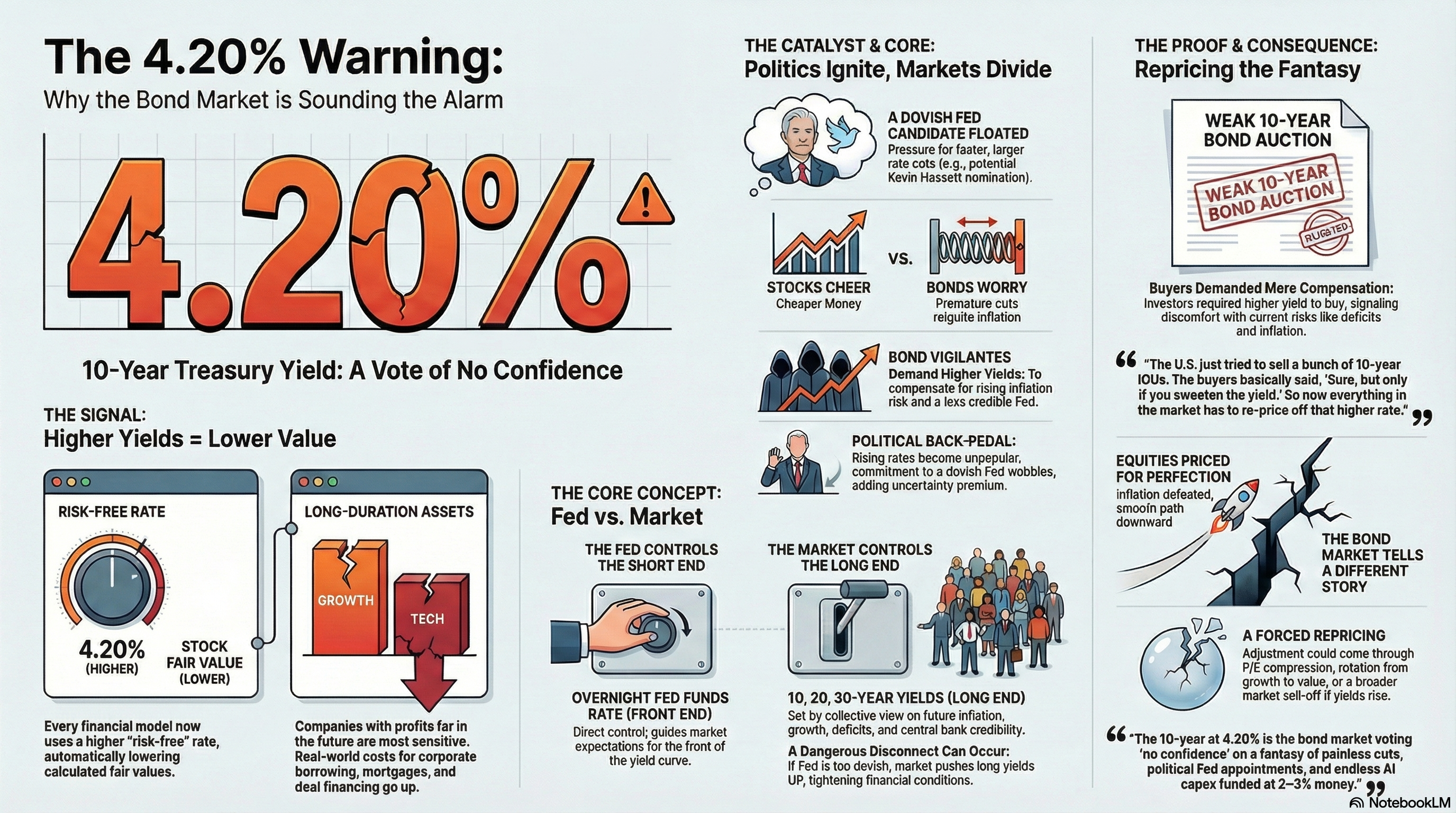

Here’s the irony: Trump wants lower rates but, by threatening to install a loyalist like Hassett – who would cut rates recklessly, he actually terrified investors into driving rates up. As Hassett rumors gained traction, the “bond vigilantes” (powerful investors/wealth funds who punish governments for bad economic policy) finally woke up. They looked at a potential Hassett-led Fed and thought, “If you’re going to let inflation run wild just to help the President’s poll numbers, we are going to charge you extra to hold your debt.” The result? The 10-year Treasury yield just spiked to 4.2%.

Here’s the irony: Trump wants lower rates but, by threatening to install a loyalist like Hassett – who would cut rates recklessly, he actually terrified investors into driving rates up. As Hassett rumors gained traction, the “bond vigilantes” (powerful investors/wealth funds who punish governments for bad economic policy) finally woke up. They looked at a potential Hassett-led Fed and thought, “If you’re going to let inflation run wild just to help the President’s poll numbers, we are going to charge you extra to hold your debt.” The result? The 10-year Treasury yield just spiked to 4.2%.

And the scariest part? He’s just getting started – year one isn’t even over!