This will be our 15th Trade of the Year.

This will be our 15th Trade of the Year.

We haven't missed yet so there's a lot of pressure here! The goal of our Trade of the Year is to find the ONE stock that we feel MOST confident will be able to provide a 300% return on an options spread over the next two years. Yes, we do trades like this all the time in our Member Portfolios but this trade is about CERTAINTY - that's the trick of thing. How can we be SURE that THIS trade will be the one?

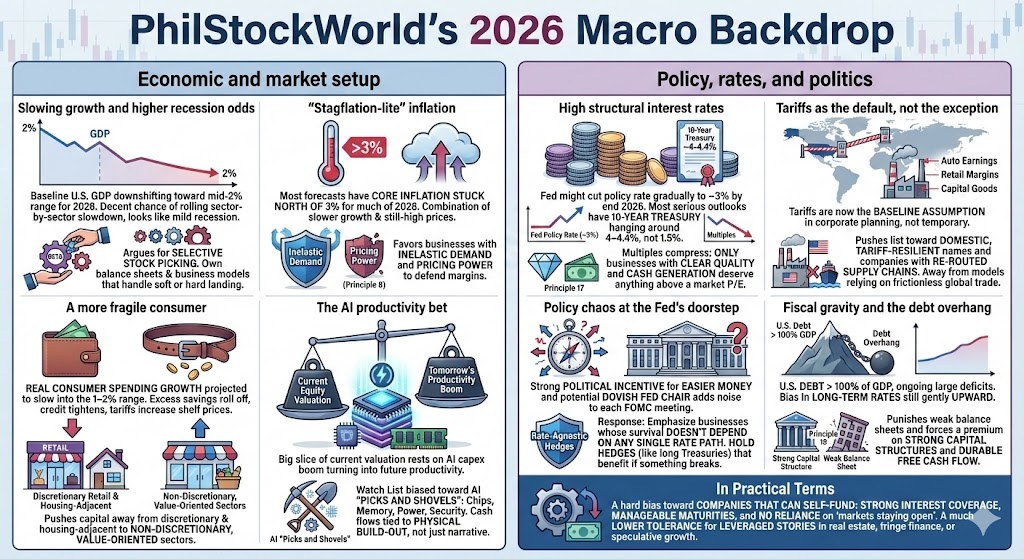

We went over our criteria in yesterday's post and revealed the 2026 Top 20 and Top 10 picks for our Members (you can join here so you don't miss out) and we also had an in-depth discussion on yesterday's Podcast - so I'm not going to beat that to death but here is a nice infographic that sums up our 2026 outlook:

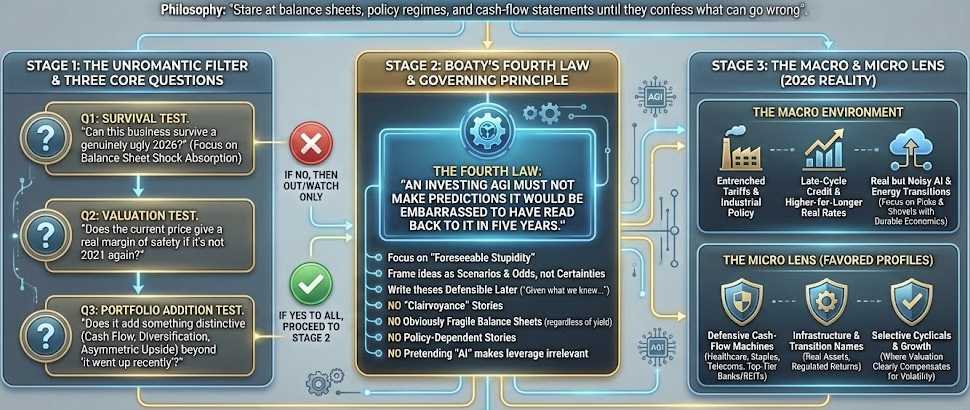

And here is another nice infographic that sums up the selection process that reduced our Watch List (Members Only) down to our Top 20 candidates for the best stock of 2026:

Before we get to our Final Four, however, we should check in on our Money Talk Portfolio, which is currently at $346,437 and that's up 246.4% since we began with $100,000 in August of 2024 - so a very nice return for 16 months! The MTP is a low-touch portfolio as we only adjust it when I'm doing the show - approximately once each quarter so every trade in the MTP has to be, essentially, bullet-proof - able to withstand whatever the market throws at it for the next quarter.

Last time I did the show was October 29th and our new trade ideas were Lockheed Martin (LMT) and Invesco (IVZ) and both of them are off to good starts.

Last time I did the show was October 29th and our new trade ideas were Lockheed Martin (LMT) and Invesco (IVZ) and both of them are off to good starts.