Finally some clarity!

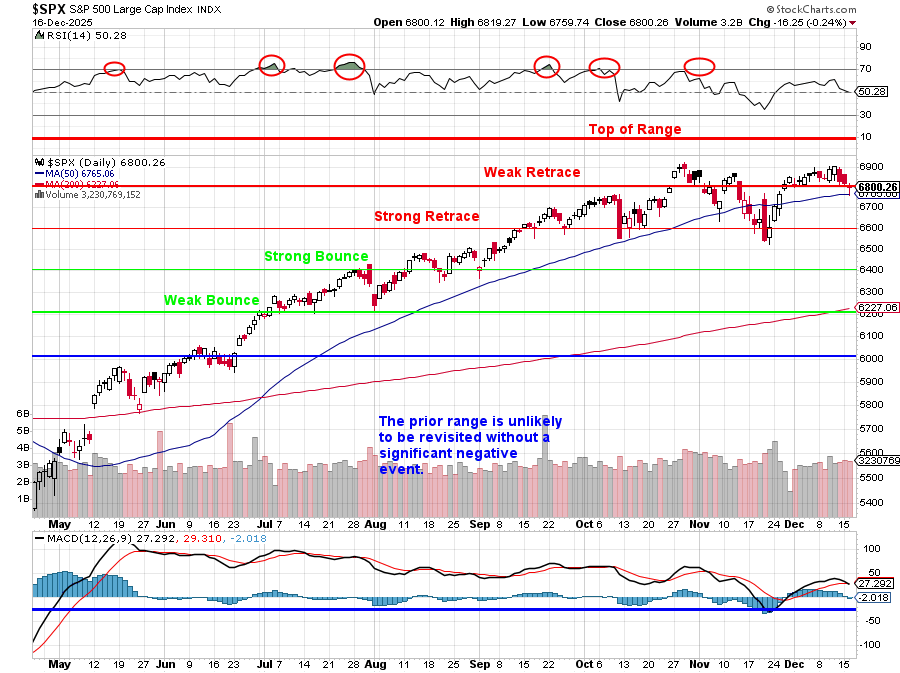

In the last month we finally got a “test” (perfectly along our 5% lines) as the indexes pulled back 5% and reminded everyone that trees do not grow to the sky. This month the S&P has lurched right back to the highs, but if you look past the index line and into the Heat Map, it’s obvious this is not the same broad, easy rally we enjoyed off the June lows.

Under the surface, leadership has narrowed and rotated. Mega-cap tech and a handful of AI darlings are still doing the heavy lifting while whole sectors – especially energy and parts of healthcare – have quietly gone on sale. That’s exactly what long-term fundamental investors should want to see from an “overbought” market: dispersion, not disaster...

Since our last check-in, the S&P 500 has continued its "melt-up," back to 6,800 BUT beneath the surface, the rotation is violent. We've seen a sharp pullback in some of our favorite sectors (Pharma, Energy) - which is EXACTLY what we had cash waiting for!

Pfizer just guided lower for 2026, and the stock barely budged, cementing it as our Trade of the Year. Energy prices have softened, bringing our favorite pipelines (ET) back into the "buy zone." This is the accumulation window for 2026. We are using this December volatility to deploy some of that massive cash pile into our "Final 4" conviction trades for the coming year.

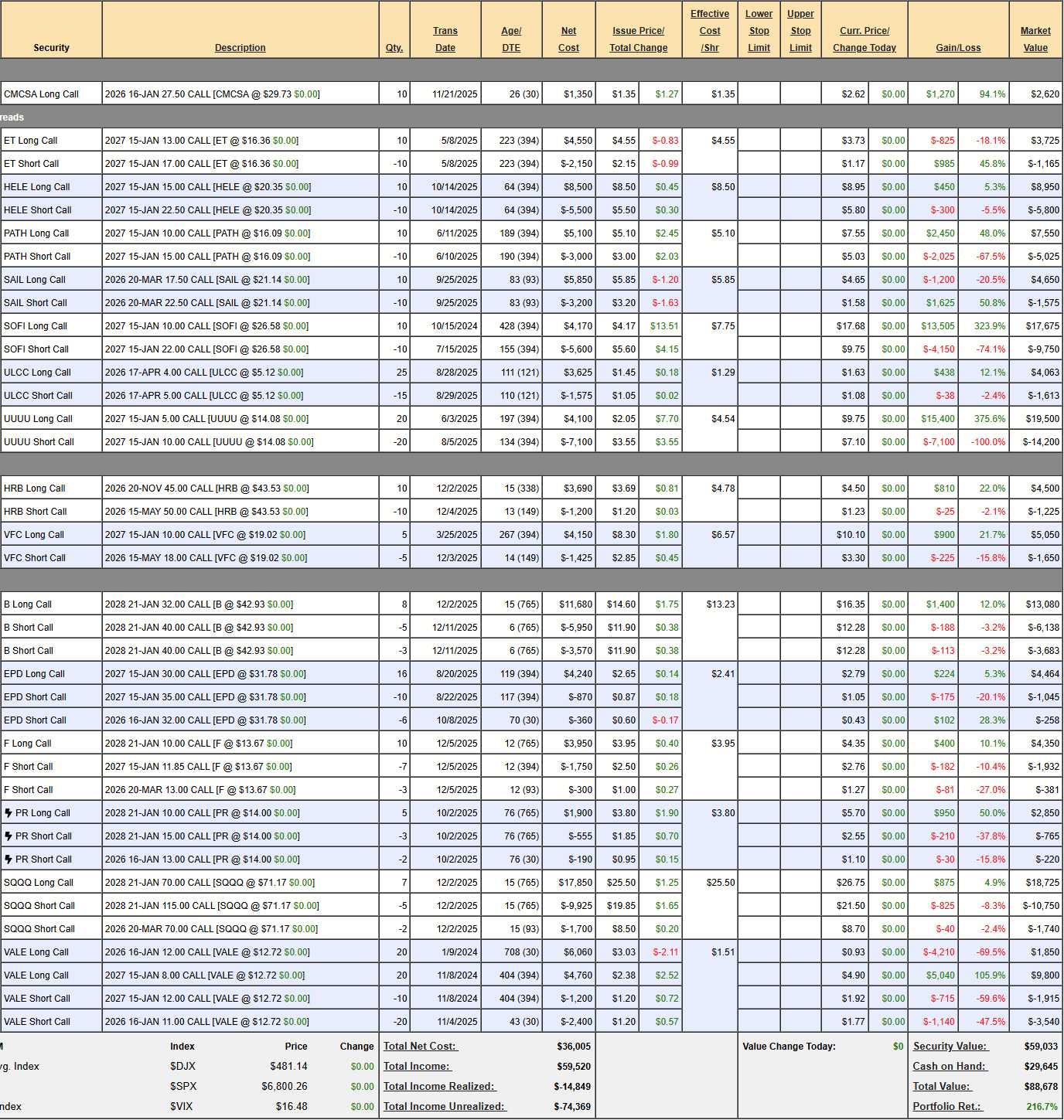

Remember where we came from this year: We cashed out before the Q1 crash, restarted the main portfolios on June 4th around S&P 6,000, and rode the market as it sprinted to 6,900 before that first real shakeout. Even after all the drama, we’re still sitting on triple‑digit gains for the year and, more importantly, a very healthy CASH!!!